Enlarge image

Rev. 09-12

Schedule

West Virginia West Virginia

State Tax

Department

J Military Incentives Credit

Tax Year

Ending

Name(s) shown on tax return

Your social security number

Employer Name

Tax Identification Number

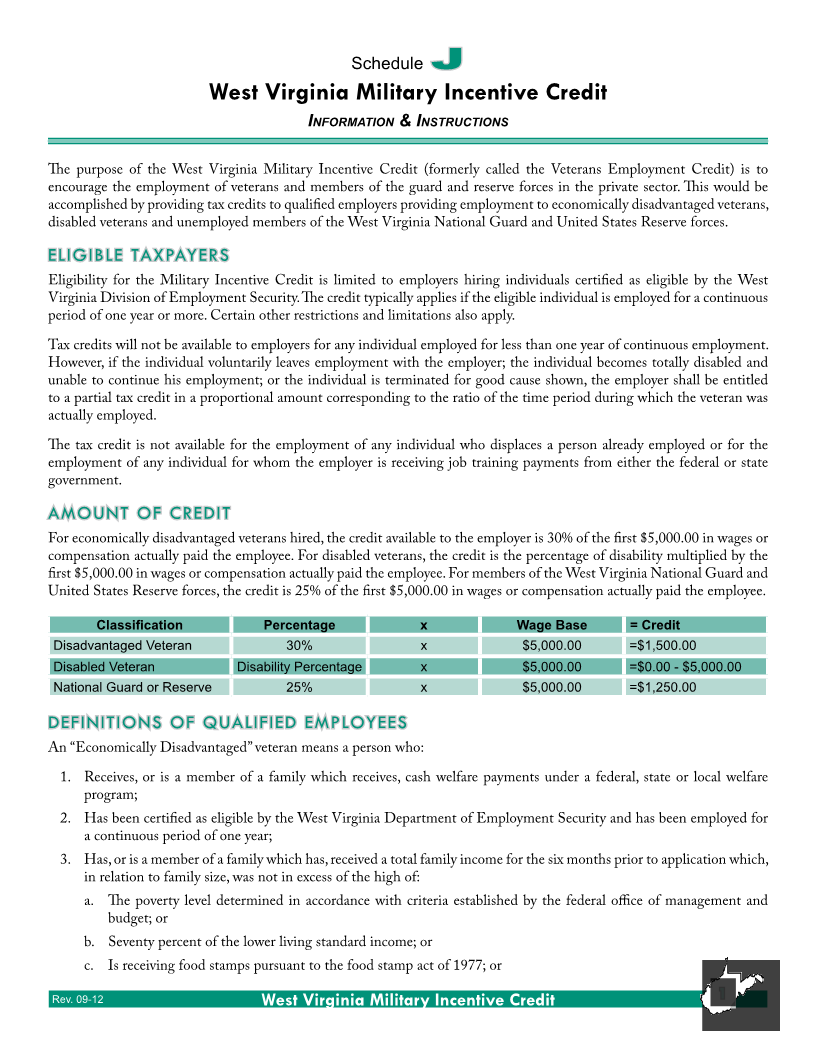

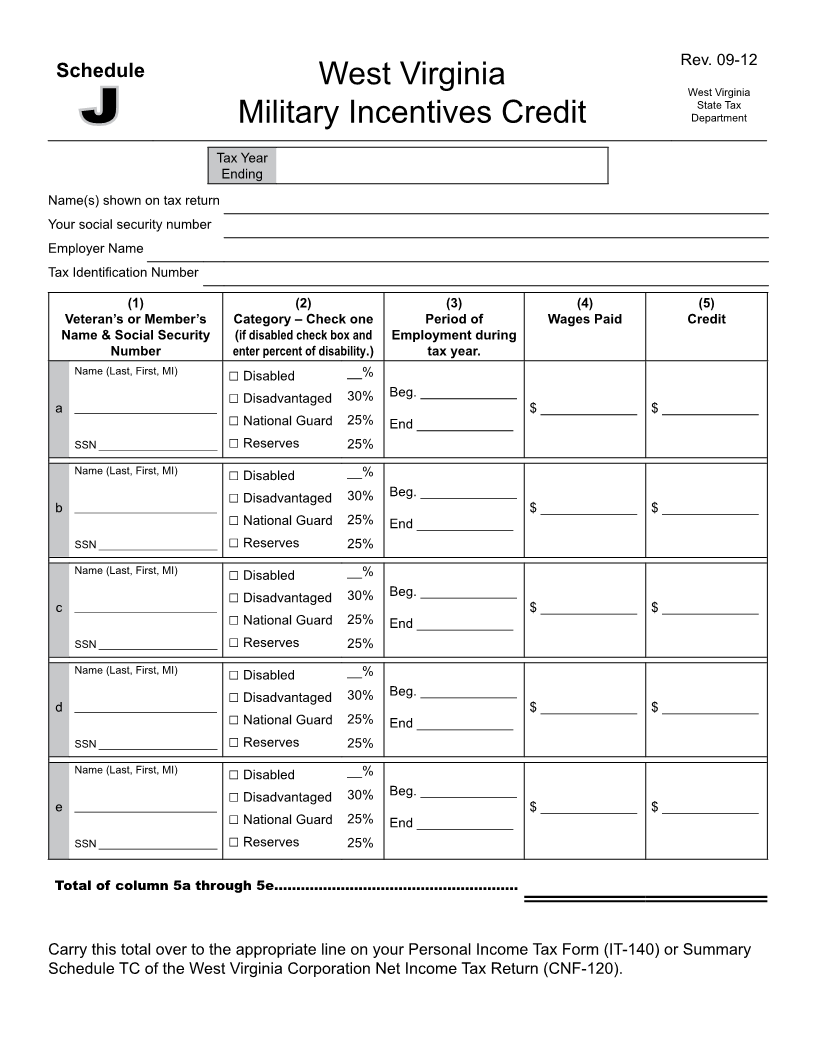

(1) (2) (3) (4) (5)

Veteran’s or Member’s Category – Check one Period of Wages Paid Credit

Name & Social Security (if disabled check box and Employment during

Number enter percent of disability.) tax year.

Name (Last, First, MI) __%

□ Disabled

a ________________________ □ Disadvantaged 30% Beg. _____________

$ _____________ $ _____________

□ National Guard 25% End _____________

SSN ____________________ □ Reserves 25%

Name (Last, First, MI) __%

□ Disabled

b ________________________ □ Disadvantaged 30% Beg. _____________

$ _____________ $ _____________

□ National Guard 25% End _____________

SSN ____________________ □ Reserves 25%

Name (Last, First, MI) __%

□ Disabled

c ________________________ □ Disadvantaged 30% Beg. _____________

$ _____________ $ _____________

□ National Guard 25% End _____________

SSN ____________________ □ Reserves 25%

Name (Last, First, MI) __%

□ Disabled

d ________________________ □ Disadvantaged 30% Beg. _____________

$ _____________ $ _____________

□ National Guard 25% End _____________

SSN ____________________ □ Reserves 25%

Name (Last, First, MI) __%

□ Disabled

e ________________________ □ Disadvantaged 30% Beg. _____________

$ _____________ $ _____________

□ National Guard 25% End _____________

SSN ____________________ □ Reserves 25%

Total of column 5a through 5e.......................................................

Carry this total over to the appropriate line on your Personal Income Tax Form (IT-140) or Summary

Schedule TC of the West Virginia Corporation Net Income Tax Return (CNF-120).