Enlarge image

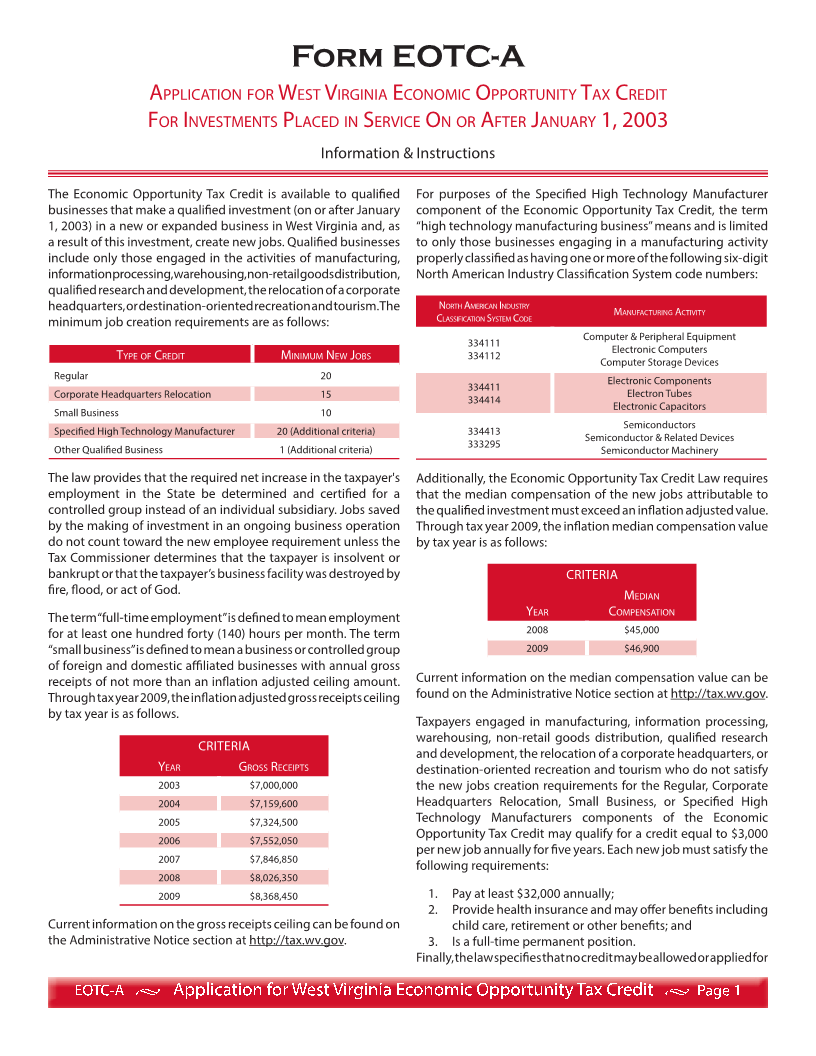

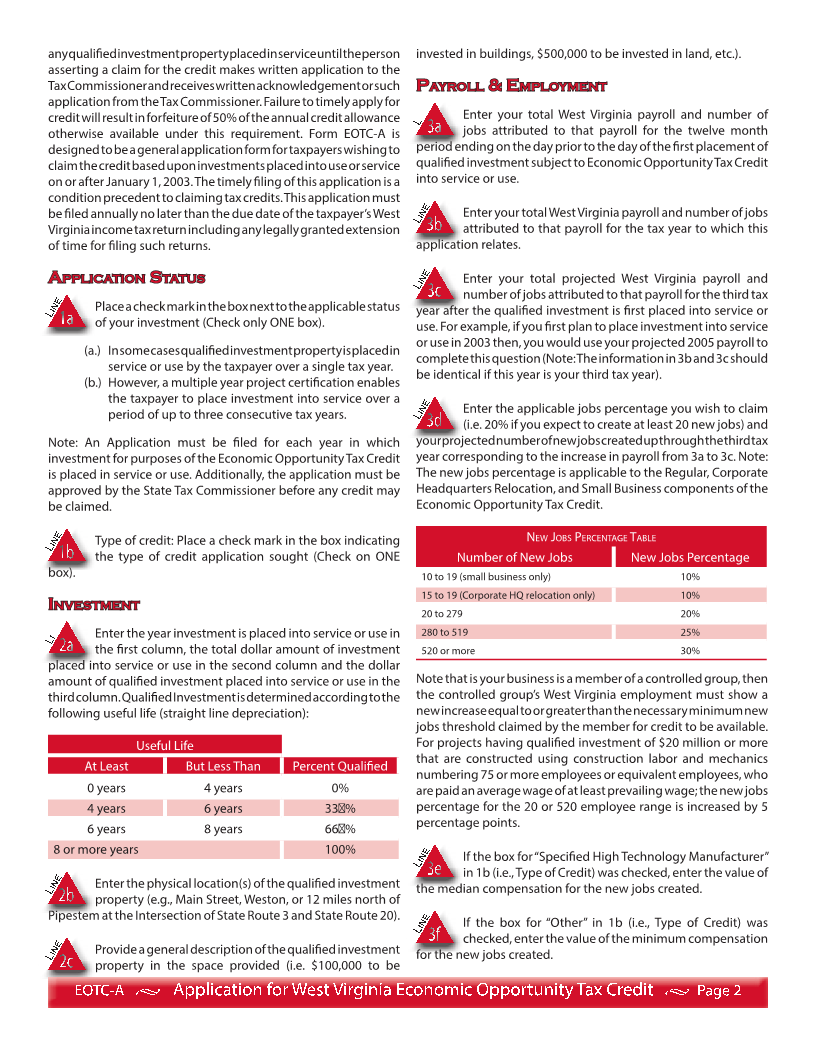

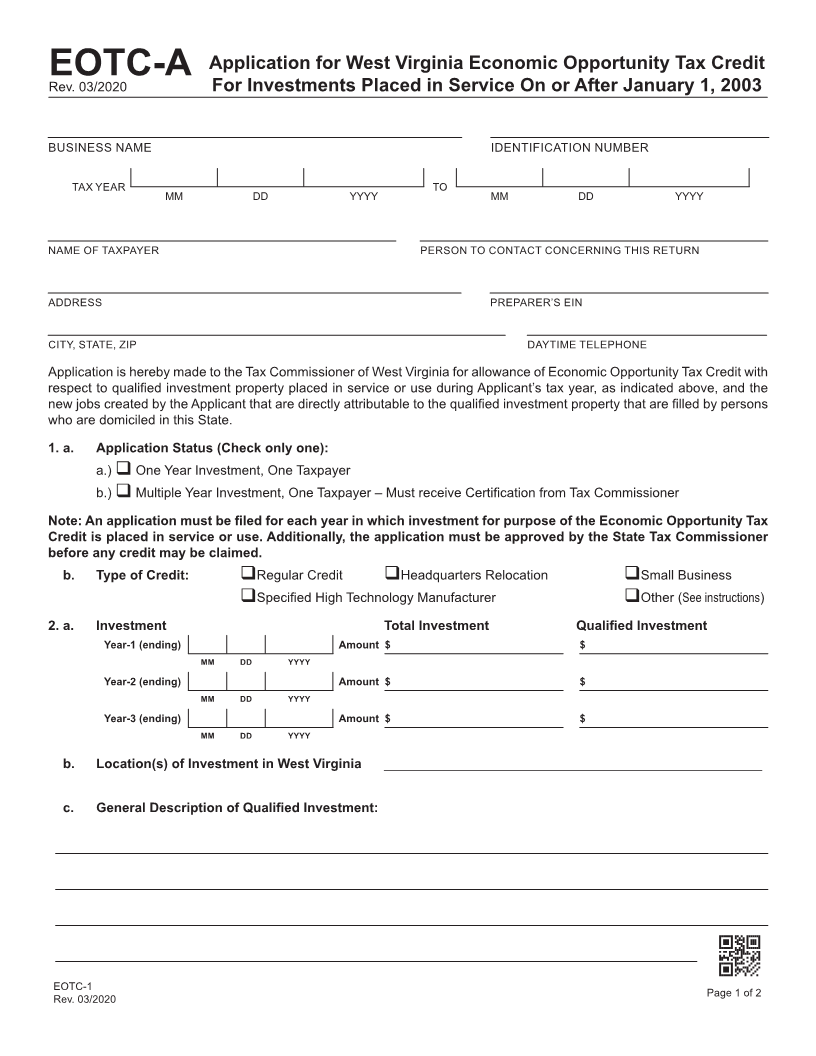

Application for West Virginia Economic Opportunity Tax Credit

EOTC-A

Rev. 03/2020 For Investments Placed in Service On or After January 1, 2003

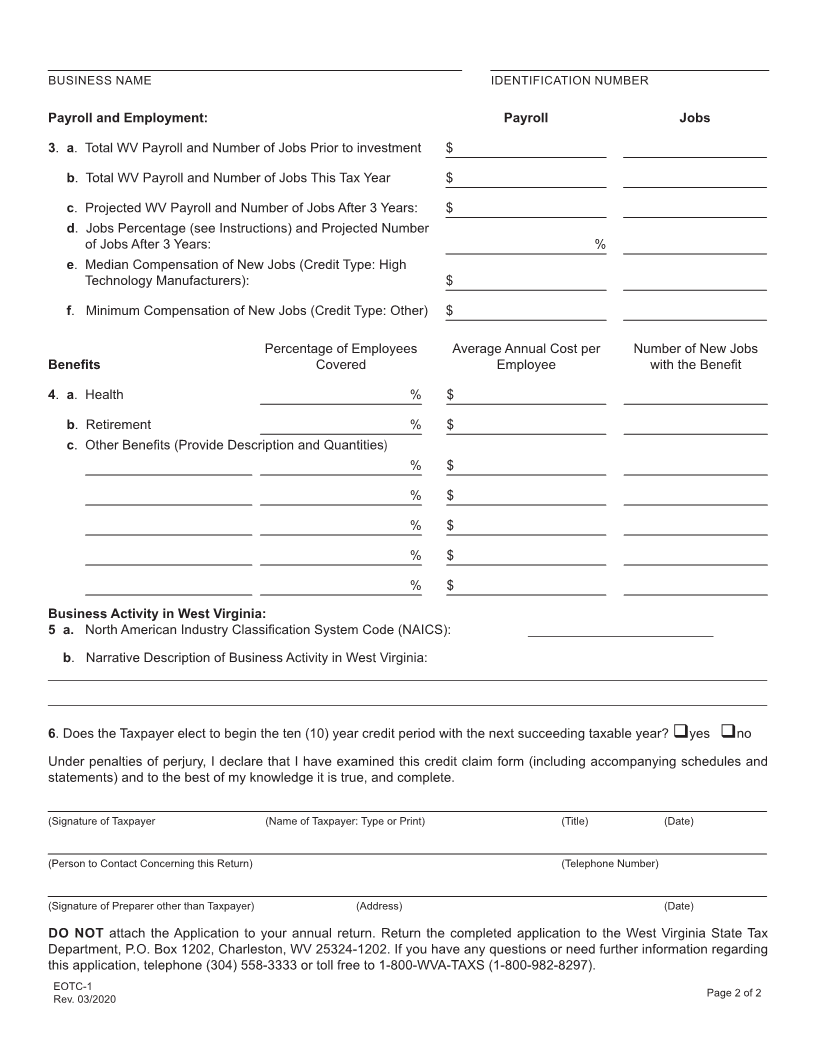

BUSINESS NAME IDENTIFICATION NUMBER

TAX YEAR TO

MM DD YYYY MM DD YYYY

NAME OF TAXPAYER PERSON TO CONTACT CONCERNING THIS RETURN

ADDRESS PREPARER’S EIN

CITY, STATE, ZIP DAYTIME TELEPHONE

Application is hereby made to the Tax Commissioner of West Virginia for allowance of Economic Opportunity Tax Credit with

respect to quali fied investment property placed in service or use during Applicant’s tax year, as indicated above, and the

new jobs created by the Applicant that are directly attributable to the quali fied investment property that are filled by persons

who are domiciled in this State.

1. a. Application Status (Check only one):

a.) One Year Investment, One Taxpayer

b.) Multiple Year Investment, One Taxpayer – Must receive Certi fi cation from Tax Commissioner

Note: An application must be filed for each year in which investment for purpose of the Economic Opportunity Tax

Credit is placed in service or use. Additionally, the application must be approved by the State Tax Commissioner

before any credit may be claimed.

b. Type of Credit: Regular Credit Headquarters Relocation Small Business

Speci fied High Technology Manufacturer Other (See instructions)

2. a. Investment Total Investment Quali fied Investment

Year-1 (ending) Amount $ $

MM DD YYYY

Year-2 (ending) Amount $ $

MM DD YYYY

Year-3 (ending) Amount $ $

MM DD YYYY

b. Location(s) of Investment in West Virginia ___________________________________________________

c. General Description of Quali fied Investment:

EOTC-1 Page 1 of 2

Rev. 03/2020