Enlarge image

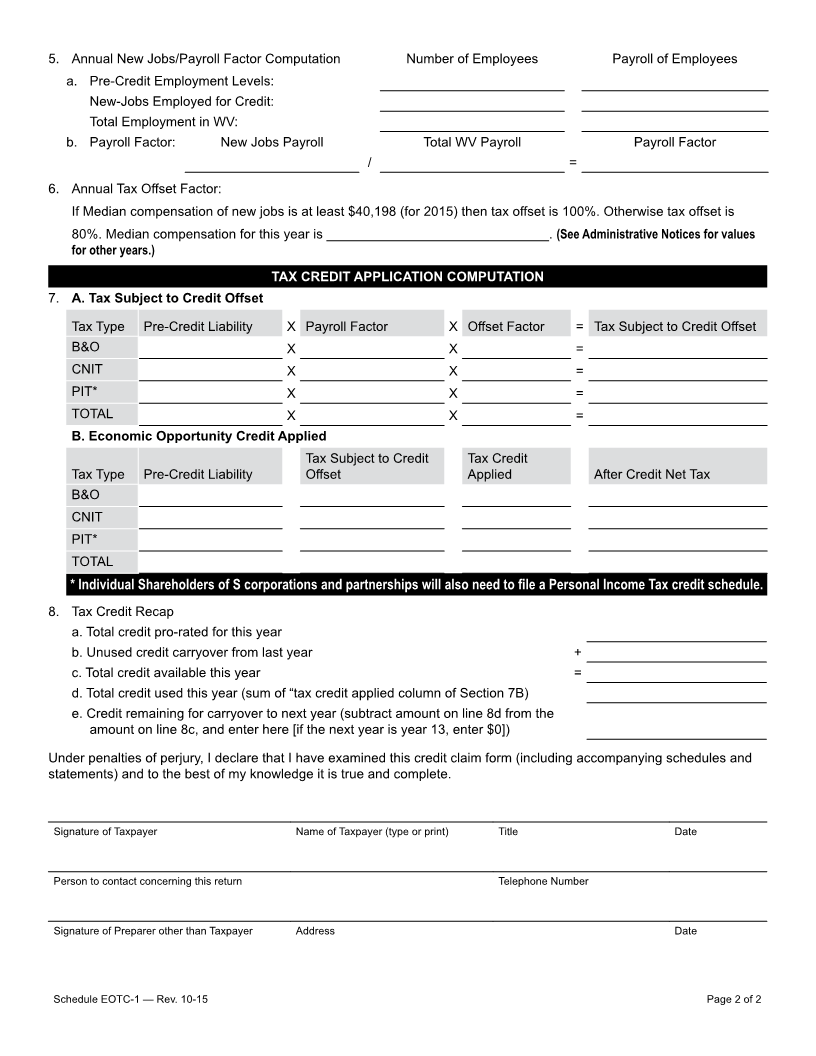

Schedule

EOTC-1 Economic Opportunity Tax Credit

Rev. 10-15 (For periods AFTER January 1, 2015)

Tax Year:

Beginning: Ending:

MM YYYY MM YYYY

NAICS FEIN, TID,

Code or SSN

Business Name: ___________________________________________________________________

Street Address: ____________________________________________________________________

________________________________________________________________________________

City, Town or Post Office: ____________________________ State: _________ Zip Code_________

Certified Multiple Year Projects

1. Investment Year(s): 1. 2. 3.

2. Investment Summary: Cost Percentage Qualified

Investment with Useful Life of 4-6 years x 33.33%

Investment with Useful Life of 6-8 years x 66.66%

Investment with Useful Life of 8+ years x 100.00%

Total Qualified Investment 4.

New Jobs Percentage

If number of new jobs created is at least [Small Business Only] 10 then 10%

If number of new jobs created is at least [Corp. Headquarters Only] 15 then 10%

If number of new jobs created is at least 20 then 20%

If number of new jobs created is at least 280 then 25%

If number of new jobs created is at least 520 then 30%

Add 5% to new jobs percentage if you employ at least 75 full-time equivalent construction

workers at prevailing wage in $20 million or greater investment project.

3. Available Credit Calculation:

Qualified Investment X New Jobs Percentage = Tax Credit X 10% / year

4. Pro-Rated Credit Allocation Summary at 10% per year for 10 years [Multiple year projects only]

Year Available Year 1 + Year 2 + Year 3 = Total Credit

+ + =

+ + =

+ + =

+ + =

+ + =

+ + =

+ + =

+ + =

+ + =

+ + =

Schedule EOTC-1 — Rev. 10-15 Page 1 of 2