Enlarge image

Schedule EOTC-1

InstructIons for EconomIc opportunIty tax crEdIt

(for pErIods aftEr January 1, 2015)

General Information least 280 new jobs is allowed a credit equal to 25% of its

the purpose of the economic Opportunity tax Credit is to qualified investment, and a business creating at least 520

promote net employment growth within West Virginia. in new jobs can claim 30% of its qualified investment. For

return for net employment growth (e.g., twenty (20) new projects having qualified investment of $20 million or more

jobs) through capital investment, the state provides a tax that are constructed using construction labor and mechanics

credit to offset the additional taxes directly attributable to the numbering 75 or more employees or equivalent employees,

qualified investment and new jobs. who are paid an average wage of at least prevailing wage;

the new jobs percentage for the 20 to 520 employee range

the economic Opportunity tax Credit is available to is increased by 5 percentage points.

qualified businesses that make a qualified investment (on

or after January 1, 2003) in a new or expanded business in If New West Virginia Jobs Total at The Applicable

West Virginia and, as a result of this investment, create at least: Percentage is:

least twenty (20) new jobs. Qualified business include only 520 30%

those engaged in the activities of manufacturing, information

processing, warehousing, non-retail goods distribution, 280 25%

qualified research and development, the relocation of a 20 20%

corporate headquarters, or destination-oriented recreation

and tourism. 15 Corporate headquarters relocation only 10%

10 small business credit (see below) 10%

application for credit required

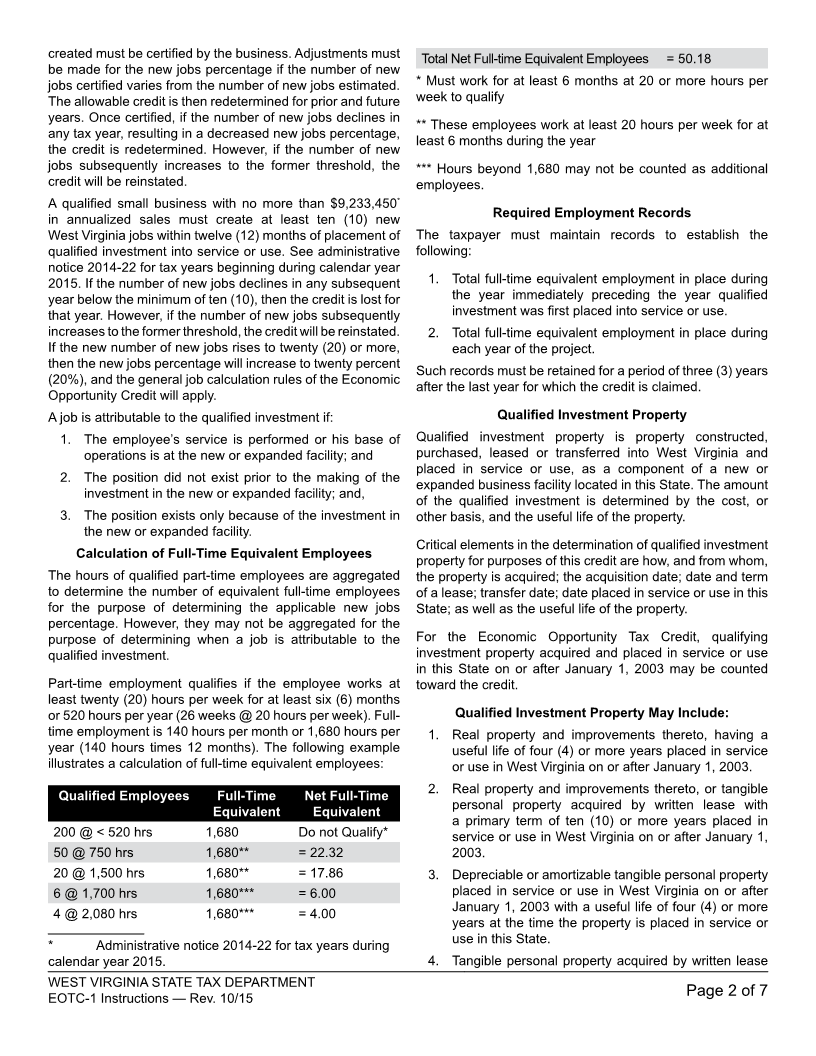

Jobs Calculation

taxpayers must complete an application for West Virginia

economic Opportunity tax Credit (Form WV/eOtC-a) with the new jobs percentage is based on the number of new

the Tax Commissioner and receive written acknowledgment jobs created in this state that are directly attributable to

of such application prior to claiming the credit. the application the qualified investment in a new or expanded business

must be filed annually no later than the due date of the facility. the number of new jobs created by the investment

taxpayer’s annual income tax return determined with regard is determined by the net increase in employment by the

to any extension of time for filling such returns. Form WV/ business (or controlled group of businesses) in West Virginia

EOTC-A must be filed on a timely basis before claiming tax over a base year level. the base year is the 12-month

credits. Failure to do so will result in forfeiture of 50% of the period immediately preceding the placement of qualified

annual credit allowance utilized until the application is filed. investment into service or use. The hours of qualified

part-time employees may be aggregated to determine the

Certified Projects number of equivalent full-time employees for the purpose of

the economic Opportunity tax Credit may be claimed for a ascertaining the number of new jobs created.

project certified by the Tax Commissioner. A project eligible a “new Job” is one that did not exist in the business of the

for certification is one in which: taxpayer in this state prior to the investment in the new or

The qualified investment creates at least twenty (20) new expanded business facility. This position must be filled by a

jobs but such investment is placed in service or use over new employee. the number of new jobs is the net of new

a period of three (3) successive tax years rather than a jobs created less any jobs lost in any part or segment of

period of 365 days or less. the investment is eligible for the employer’s business in West Virginia over the same time

project certification only if made in accordance with a written period.

business facility development plan, and the investment a “new employee” is a West Virginia domiciled resident

placed in service or use during the first year would not have hired to fill one of the new jobs on a permanent basis.

been made without the expectation of making the qualified temporary or seasonal employment does not qualify as a

investment placed in service or use during the next two (2) new job. persons hired on a temporary or seasonal basis do

succeeding tax years. not qualify as new employees.

A qualified business creating at least twenty (20) new jobs For all economic Opportunity tax Credit applications, except

within three (3) tax years is allowed a credit equal to 20% small business, an estimation of the expected number of new

of its qualified investment. This percentage increases with jobs is made in the first taxable year for which the credit is

the number of new jobs created. a business creating at claimed. in the third tax year the actual number of new jobs

West Virginia state tax Department

eOtC-1 instructions — rev. 10/15 page 1 of 7