Enlarge image

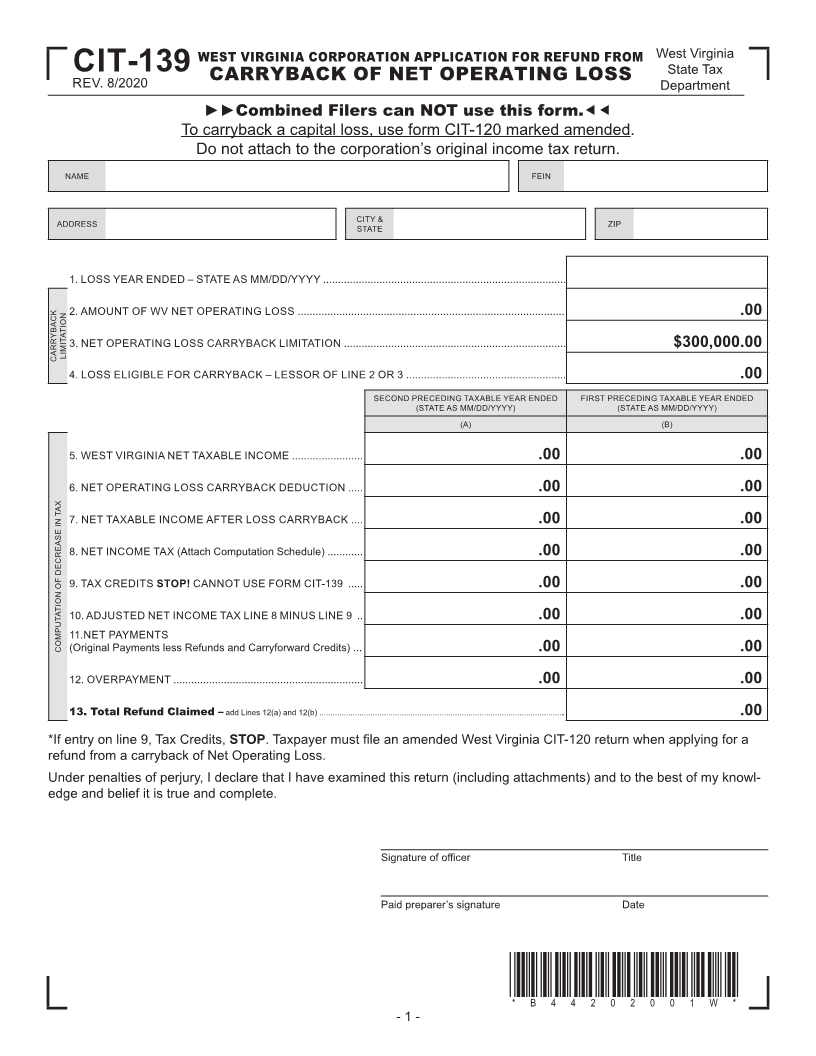

WEST VIRGINIA CORPORATION APPLICATION FOR REFUND FROM West Virginia

CIT-139 State Tax

REV. 8/2020 CARRYBACK OF NET OPERATING LOSS

Department

►►Combined Filers can NOT use this form.

To carryback a capital loss, use form CIT-120 marked amended.

Do not attach to the corporation’s original income tax return.

NAME FEIN

ADDRESS CITY & ZIP

STATE

1. LOSS YEAR ENDED – STATE AS MM/DD/YYYY ..................................................................................

2. AMOUNT OF WV NET OPERATING LOSS .......................................................................................... .00

3. NET OPERATING LOSS CARRYBACK LIMITATION ........................................................................... $300,000.00

CARRYBACK LIMITATION

4. LOSS ELIGIBLE FOR CARRYBACK – LESSOR OF LINE 2 OR 3 ...................................................... .00

SECOND PRECEDING TAXABLE YEAR ENDED FIRST PRECEDING TAXABLE YEAR ENDED

(STATE AS MM/DD/YYYY) (STATE AS MM/DD/YYYY)

(A) (B)

5. WEST VIRGINIA NET TAXABLE INCOME ........................ .00 .00

6. NET OPERATING LOSS CARRYBACK DEDUCTION ..... .00 .00

7. NET TAXABLE INCOME AFTER LOSS CARRYBACK .... .00 .00

8. NET INCOME TAX (Attach Computation Schedule) ............ .00 .00

9. TAX CREDITS STOP! CANNOT USE FORM CIT-139 ..... .00 .00

10. ADJUSTED NET INCOME TAX LINE 8 MINUS LINE 9 .. .00 .00

11.NET PAYMENTS

COMPUTATION OF DECREASE IN TAX (Original Payments less Refunds and Carryforward Credits) ... .00 .00

12. OVERPAYMENT ................................................................ .00 .00

13. Total Refund Claimed – add Lines 12(a) and 12(b) .............................................................................................................. .00

*If entry on line 9, Tax Credits,STOP. Taxpayer must fi le an amended West Virginia CIT-120 return when applying for a

refund from a carryback of Net Operating Loss.

Under penalties of perjury, I declare that I have examined this return (including attachments) and to the best of my knowl-

edge and belief it is true and complete.

Signature of o fficer Title

Paid preparer’s signature Date

*B44202001W*

*B44202001W*

- 1 -