Enlarge image

2020 WEST VIRGINIA CORPORATION NET INCOME TAX PAGE 1 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

Enlarge image | 2020 WEST VIRGINIA CORPORATION NET INCOME TAX PAGE 1 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS |

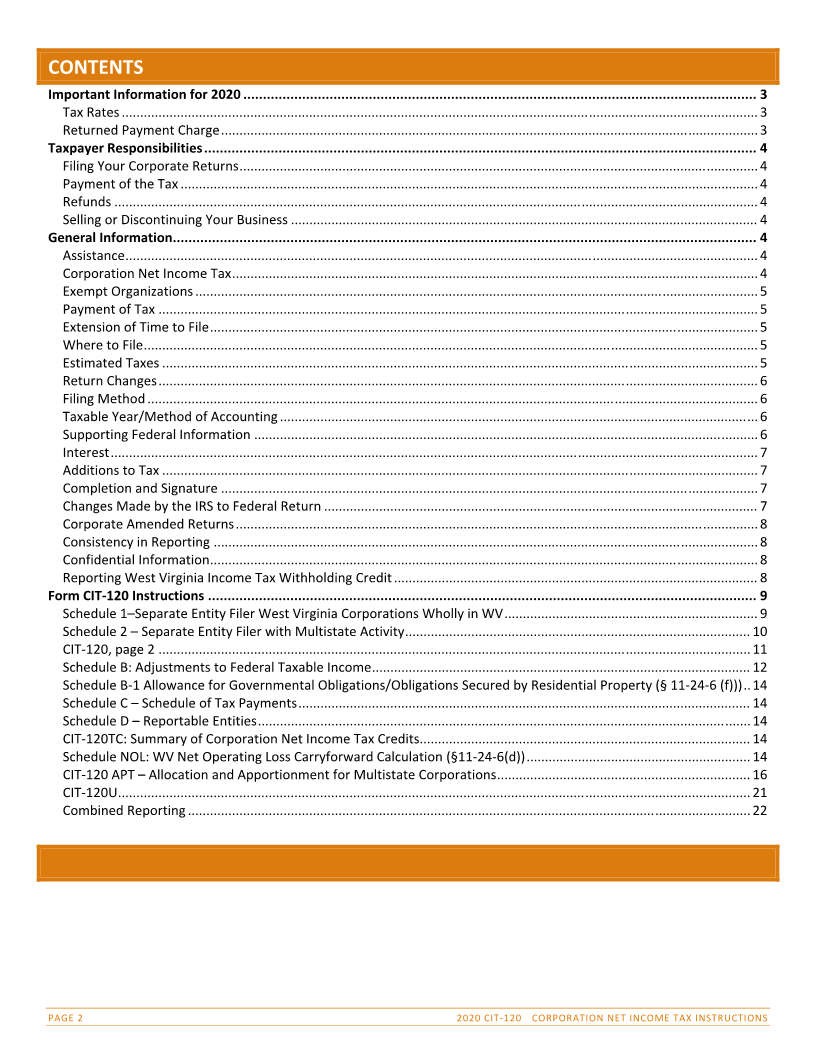

Enlarge image | CONTENTS Important Information for 2020 ................................................................................................................................... 3 Tax Rates.............................................................................................................................................................................3 Returned Payment Charge..................................................................................................................................................3 Taxpayer Responsibilities............................................................................................................................................. 4 Filing Your Corporate Returns.............................................................................................................................................4 Payment of the Tax .............................................................................................................................................................4 Refunds ...............................................................................................................................................................................4 Selling or Discontinuing Your Business ............................................................................................................................... 4 General Information..................................................................................................................................................... 4 Assistance............................................................................................................................................................................4 Corporation Net Income Tax...............................................................................................................................................4 Exempt Organizations.........................................................................................................................................................5 Payment of Tax ...................................................................................................................................................................5 Extension of Time to File.....................................................................................................................................................5 Where to File.......................................................................................................................................................................5 Estimated Taxes ..................................................................................................................................................................5 Return Changes...................................................................................................................................................................6 Filing Method......................................................................................................................................................................6 Taxable Year/Method of Accounting..................................................................................................................................6 Supporting Federal Information .........................................................................................................................................6 Interest................................................................................................................................................................................7 Additions to Tax ..................................................................................................................................................................7 Completion and Signature ..................................................................................................................................................7 Changes Made by the IRS to Federal Return ...................................................................................................................... 7 Corporate Amended Returns..............................................................................................................................................8 Consistency in Reporting ....................................................................................................................................................8 Confidential Information.....................................................................................................................................................8 Reporting West Virginia Income Tax Withholding Credit................................................................................................... 8 Form CIT 120‐ Instructions ............................................................................................................................................ 9 Schedule 1–Separate Entity Filer West Virginia Corporations Wholly in WV..................................................................... 9 Schedule 2 – Separate Entity Filer with Multistate Activity.............................................................................................. 10 CIT 120,‐ page 2 .................................................................................................................................................................11 Schedule B: Adjustments to Federal Taxable Income....................................................................................................... 12 Schedule B ‐ 1 Allowance for Governmental Obligations/Obligations Secured by Residential Property (§ 11 24 6 (f)))..14‐ ‐ Schedule C – Schedule of Tax Payments........................................................................................................................... 14 Schedule D – Reportable Entities......................................................................................................................................14 CIT 120TC:‐ Summary of Corporation Net Income Tax Credits.......................................................................................... 14 Schedule NOL: WV Net Operating Loss Carryforward Calculation (§11 24 6(d)).............................................................14‐ ‐ CIT 120‐ APT – Allocation and Apportionment for Multistate Corporations..................................................................... 16 CIT 120U............................................................................................................................................................................21‐ Combined Reporting.........................................................................................................................................................22 PAGE 2 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS |

Enlarge image |

IMPORTANT INFORMATION FOR

For periods beginning on or after January 1, 2020, annual returns will have a due date of April 15, 2021 and an extended

due date of October 15, 2021. Fiscal and 52/53 week‐ returns will be due on the 15th day of the fourth month following

the end of the period with an extension period of six months.

TAX RATES

For tax years beginning on or after January , , the Corporate Net Income Tax Rate is . % ‐ ‐ (§ ).

Effective January , , taxpayers who had annual remittance of any single tax equal to or greater than ,

during fiscal year are required to electronically file returns and make payments using Electronic Funds

Transfer (EFT) for periods beginning on or after January , .

Failure to comply with the requirement to remit payments by EFT without first obtaining a waiver may result in a

civil penalty of three ( ) percent of each payment which was to be paid by EFT. Visit our website www.tax.wv.gov

for additional information.

RETURNED PAYMENT CHARGE

The Tax Department will recover a $15.00 fee associated with any returned bank transactions. These bank transactions

include but are not limited to the following:

Direct Debit (payment) transactions returned for insufficient funds.

Stopped payments.

Bank refusal to authorize payment for any reason.

Direct Deposit of refunds to closed accounts.

Direct Deposit of refunds to accounts containing inaccurate or illegible account information.

Checks returned for insufficient funds will incur a $28.00 fee.

The fee charged for returned or rejected payments will be to recover only the amount charged to the State Tax

Department by the financial institutions.

Important: There are steps that can be taken to minimize the likelihood of a rejected financial transaction occurring:

Be sure that you are using the most current bank routing and account information.

If you have your tax return professionally prepared, the financial information used from a prior year return often

pre‐ populates the current return as a step saver. It is important that you verify this information with your tax

preparer by reviewing the bank routing and account information from a current check. This will ensure the

information is accurate and current if a bank account previously used was closed or changed either by you or the

financial institution.

If you prepare your tax return at home using tax preparation software, the financial information used from a prior

year return often pre populates‐ the current return as a step saver. It is important that you verify this information

by reviewing the bank routing and account information from a current check. This will ensure the information is

accurate and current if a bank account previously used was closed or changed either by you or the financial

institution.

If you prepare your tax return by hand using a paper return, be sure that all numbers requesting a direct deposit

of refund entered are clear and legible.

If making a payment using MyTaxes, be sure that the bank routing and account number being used is current.

If scheduling a delayed debit payment for an electronic return filed prior to the due date, make sure that the bank

routing and account number being used will be active on the scheduled date.

Be sure that funds are available in your bank account to cover the payment when checks or delayed debit

payments are presented.

PAGE 3 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image | TAXPAYER RESPONSIBILITIES FILING YOUR CORPORATE RETURNS Returns should be filed by the due date. You may obtain forms by calling 1 800 982 8297. ‐ Forms‐ ‐ may also be obtained from any of our regional field offices or from the State Tax Department website at tax.wv.gov. Failure to file returns will result in your account being referred to our Compliance Division for corrective action. Please file all required tax returns even if you owe no tax for the reporting period. All applicable pages of the return must be filed. PAYMENT OF THE TAX The full amount of tax owed is due and payable on the original due date of the tax return. Failure to pay the full amount of tax by the due date will result in interest and penalties being added to any unpaid amount of tax. If you are unable to pay the full amount of tax on the due date, you should file your tax return along with a written explanation of why you are unable to pay and when you will pay the tax due. REFUNDS You are entitled to a refund of any amount that you overpaid. All or part of any overpayment may be applied as a credit against your liability for such tax for other periods. A claim for refund (usually a tax return showing an overpayment) must be filed within three years of the due date of the return or two years from the date the tax was paid, whichever expires later. The overpayment will be used by the Tax Department against other tax liabilities due. If the Tax Department does not respond to your request within six months of the due date or the extended due date on overpayment of Corporation Net Income Tax, you may submit in writing a request for an administrative hearing to present your reasons why you feel you are entitled to the refund. Interest is allowed and paid on any refund upon which the Department has failed to timely act and which is final and conclusive. If the Tax Department denies or reduces a request for a refund, a written request for an administrative hearing may be submitted. Failure to respond to a denial or reduction within sixty days will result in the denial/reduction becoming final and conclusive and not subject to further administrative or judicial review. SELLING OR DISCONTINUING YOUR BUSINESS If you sell or discontinue your business, notify the Tax Department in writing as soon as possible after your business is sold or discontinued. All final tax returns should be filed. GENERAL INFORMATION The information in this booklet is for calendar year 2020 returns and for fiscal year returns beginning in 2020 and ending in 2021. The information in this book is intended to help you complete your returns and is not a substitute for tax laws and regulations. ASSISTANCE Address questions to the West Virginia State Tax Department, Taxpayer Services Division, PO Box 3784, Charleston, WV 25337 3784‐ or by telephone at (304) 558 3333,‐ toll free at 1 800 ‐ 982 8297.‐ ‐ CORPORATION NET INCOME TAX The Corporation Net Income Tax is a tax on the West Virginia taxable income of every domestic or foreign corporation which enjoys the benefits and protections of the government and laws in the State of West Virginia or derives income from property, activity or other sources in West Virginia. The term “corporation” includes a joint stock company and any association or other organization which is taxable as a corporation under federal income tax laws. PAGE 4 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS |

Enlarge image | The West Virginia Corporation Net Income Tax is a federal conformity tax in that the starting point in computing West Virginia taxable income is the federal taxable income of the corporation. Certain increasing and decreasing adjustments, as required by state law, must be made to federal taxable income to arrive at West Virginia taxable income. Corporations are required to allocate certain types of nonbusiness income to West Virginia and apportion their remaining income. The Corporation Net Income Tax rate is six and one half percent‐ (.065). EXEMPT ORGANIZATIONS Any corporation exempt from federal income tax is also exempt from West Virginia Corporation Net Income Tax. In addition, certain insurance companies, certain production credit associations, trusts established under 29 U.S.C. 186, and other organizations specifically exempt under the laws of West Virginia are also exempt. If you are a tax exempt‐ organization with unrelated business income that is subject to federal tax, you must pay the West Virginia Corporation Net Income. PAYMENT OF TAX DUE DATE: A corporation’s annual West Virginia Corporation Net Income Tax Return is due on or before the 15th day of the fourth month after the close of the taxable year. The filing of returns is required whether any tax is due. A tax exempt ‐ organization’s annual West Virginia Corporation Net Income Tax Return is due on or before the 15th day of the fifth month after the close of the taxable year. Make your remittance payable to the West Virginia State Tax Department. PAYMENT OPTIONS: Effective January 1, 2020, taxpayers who had annual remittance of any single tax equal or greater than $50,000 during fiscal year 2019 are required to electronically file returns and make payments using Electronic Funds Transfer (EFT) for periods beginning on or after January 1, 2020. Returns filed with a balance due may use any of the following payment options: Check or Money Order made payable to the West Virginia State Tax Department, Electronic Funds Transfer or Payment by Credit Card. Visit tax.wv.gov for additional payment information. EXTENSION OF TIME TO FILE An extension of time to file a federal return is automatically accepted by West Virginia as an extension of time to file the West Virginia return. A copy of the federal extension form must be attached to the West Virginia return when filed and the extended due date must be entered on top of the return. Returns filed after the due date, without supporting documents and extended due date entered on the top of the return, will be processed as late filed and interest and penalties will be assessed. A state extension of time to file may be obtained, even if a federal extension has not been requested, provided a written request is made to the West Virginia State Tax Department prior to the due date of the West Virginia return. An extension of time to file does not extend the time for payment of any tax due. If you have an extension of time to file, payment of any tax due may be made by filing a West Virginia extension form (see instructions for Form CIT 120EXT). ‐ To avoid interest and penalties, payment must be received on or before the due date of the return. WHERE TO FILE West Virginia State Tax Department Tax Account Administration Division Corporate Tax Unit PO Box Charleston, WV ‐ ESTIMATED TAXES Estimated Corporation Net Income Tax payments are required for any corporation which can reasonably expect its West Virginia taxable income to be more than $10,000 (which equals a tax liability after tax credits of more than $650) and are due in four equal installments on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. Due to the PAGE 5 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS |

Enlarge image |

Coronavirus (COVID 19)‐ pandemic, any estimated payments originally due from April 15 through thJuly 15 were due onth

July 15 2020.th

RETURN CHANGES

The following Schedules are new or have been updated in the 2020 tax period:

All forms have been redesignated, changing “CNF” to “CIT”

Revised – UB CR‐

FILING METHOD

The following filing methods may be used for filing your Corporation Net Income Tax (WV Code §11 24 13a). ‐ ‐

SEPARATE ENTITY BASED: Use this method if you are filing a separate return and you are not engaged in a unitary business

with one or more other corporations.

Forms and schedules you may/will need to complete for a separate entity based corporation‐ return:

CIT‐ 120 pages 1 & 2 CIT‐ 120 Schedule C

CIT‐ 120 Schedule 1 CIT‐ 120 Schedule D

CIT‐ 120 Schedule 2 CIT‐ 120 Schedule NOL

CIT‐ 120 Schedule TC CIT‐ 120 APT Schedules A1, A2

CIT‐ 120 Schedule U CIT‐ 120 APT Schedule B

CIT‐ 120 Schedules B, ‐ B 1

What are the filing requirements? Corporations that are members of the same unitary business group must file a combined

report including all required information of every business engaging in the unitary business with the corporation. This

report must be filed with each members’ separate return unless the group elects to designate a corporation as surety and

file a combined return.

SEPARATE COMBINED: Use this method if you are filing a combined report but a separate return. Forms and schedules

you may/will need to complete a separate combined return are the same as required for Separate Entity Filers except that

the Schedule UB CR‐ is required. Visit tax.wv.gov to obtain this worksheet.

ALL COMBINED FILERS: Must complete UB CR and‐ attach to return.

GROUP COMBINED: Corporations use this method if they are members of the same unitary business group and elect to

designate a surety. Taxpayer must designate surety FEIN in space provided.

Forms and schedules you may/will need to complete a group combined return:

CIT-120 pages 1 & 2 CIT-120 Schedule U

CIT-120 Schedule C CIT-120 Schedule NOL

CIT-120 Schedule D CIT-120 Schedule UB

CIT-120 Schedule TC CIT-120 Schedule UB-CR

TAXABLE YEAR/METHOD OF ACCOUNTING

You must use the same taxable year and method of accounting as you use for federal tax purposes.

SUPPORTING FEDERAL INFORMATION

You must attach to your West Virginia return a copy of pages 1 through 5, along with any applicable supporting documents/schedules,

of your signedfederal incometax return as filed with the Internal RevenueService. If you attach a pro forma federal income tax return,

the following consolidated return data is also required: a copy of pages 1 through 5 of the consolidated federal return plus supporting

schedulesshowingtheconsolidationincomestatement,balancesheet,eliminationsandadjustments;acopyoffederalForm851;anda

PAGE 6 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image | signedstatementexplainingthedifferences,ifany,betweentheincomestatementandbalancesheetreportedforfederalconsolidated filingandthatreportedforWestVirginiapurposes.IncludeScheduleM ‐ 3whenapplicable. Corporations shall attach the federal documents to the West Virginia Corporation Net Income Tax Return. INTEREST You must pay the entire tax due on or before the due date of the tax return (determined without regard for an extension of time to file). If you do not pay the entire tax due on or before the due date, you must pay interest on the amount of the underpayment from the due date to the date paid. Interest is always due, without exception, on any underpayment of tax. Interest is imposed by an adjusted rate established by the Tax Commissioner. The interest rate will be determined and in effect for periods of six months. Interest rates in effect for various periods are: 1/1/92 to 6/30/92 9% 1/1/02 to 6/30/02 8% 7/1/92 to 12/31/95 8% 7/1/02 to 12/31/16 9.5% 1/1/96 to 12/31/96 9% 1/1/17 to 12/31/17 8% 1/1/97 to 12/31/97 8% 1/1/18 to 12/31/18 8.75% 1/1/98 to 12/31/98 9% 1/1/19 to 12/31/19 9.75% 1/1/99 to 6/30/00 8% 1/1/20 to 12/31/20 9.25% 7/1/00 to 12/31/01 9% Contact the West Virginia State Tax Department, Taxpayer Services Division at 1 800 ‐ 982 8297,‐ for the‐ interest rate in effect for other periods. Also, Administrative Notices may be found online at tax.wv.gov notifying of adjusted interest rates. ADDITIONS TO TAX LATE FILING. Additions to tax are imposed for failure to file a return on or before the due date (determined with regard to an extension of time to file). On any amount of tax shown to be due on the return, the additions to tax for late filing is five percent (.05) per month or any part of a month not to exceed twenty five percent‐ (.25). LATE PAYMENT. Additions to tax are imposed for failure to pay all tax shown to be due on a return on or before the due date (determined without regard to an extension of time to file). The additions to tax for late payment is imposed at the rate of one half of one percent (.005) per month or part of a month not to exceed twenty five percent‐ (.25). When both the five percent (.05) additions to tax for late filing and the one half of one percent (.005) additions to tax for late payment are imposed, the maximum monthly percent is five percent (.05) not to exceed fifty percent (.50) of the tax due. FAILURE TO PAY ESTIMATED TAX. Corporations that are required to make estimated payments of their tax liability are subject to additions to tax for failing to pay at least ninety percent (.90) of their annual tax liability. The additions are imposed at the same rate as interest is imposed. See Form CIT 120U for more‐ information on the additions to tax for underpayment of estimated tax. COMPLETION AND SIGNATURE All applicable sections of the return must be completed and all required supporting documents must be attached. An incomplete return will not be accepted as timely filed. The return must be signed by an authorized officer. If the return is prepared by someone other than the taxpayer, the preparer must also sign the return and enter his or her complete address. CHANGES MADE BY THE IRS TO FEDERAL RETURN Any corporation whose reported income or deductions are changed or corrected by the Internal Revenue Service or through renegotiation of a contract with the United States is required to report the change or correction to the West PAGE 7 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS |

Enlarge image |

Virginia State Tax Department. This report must be made within ninety days of the final determination by filing an

amended/RAR, return and attaching a copy of the revenue agent’s report detailing such adjustments.

CORPORATE AMENDED RETURNS

A corporation that filed an amended return with the Internal Revenue Service must file an amended return with the West

Virginia State Tax Department within ninety days of filing the amended federal return.

File Form CIT 120,‐ pages 1 and 2, completing all appropriate lines and checking the Amended box under “Return Type” on

page 1. Because WV uses barcodes on tax forms it is important to use the appropriate forms for the tax year being amended.

Example: If you are amending a tax return for the period ending 12 31 2018; ‐ use‐ the 2018 CNF 120 forms. ‐

Note: Tax forms for different years may use different line numbers; read the line instructions carefully.

If you received a refund, or had an amount credited on the original return, enter that amount on Line 14 of Form CIT 120, ‐

page 2. For 2020, prior years should file CNF 120, and‐ enter any refund or amount credited on line 14, page 2.

Attach all schedules that have amended figures in order to verify the changes made to the return.

Example: There was a change made to your Adjustments to Federal Taxable Income; be sure to attach Schedule B with the

amended figures.

Amended Returns filed for the purpose of obtaining a refund of an overpayment must be filed within three years of the

due date of the return (with regard to an extension of time to file), or two years from the date the tax was paid, whichever

expires later. If your Amended Return has a balance due, send the payment along with the tax return.

CONSISTENCY IN REPORTING

In completing your West Virginia Corporation Net Income Tax Return, if you depart from or modify past procedures for

classifying business income and nonbusiness income, for valuing property or including or excluding property in the

property factor, for treating compensation paid in the payroll factor, for including or excluding gross receipts in the sales

factor, you must disclose by separate attached schedule detailing the nature and extent of the variances or modifications.

If you make sales of tangible personal property which are shipped into a state in which you are not taxable, you must

identify the state to which the property is shipped and report the total amount of sales assigned to such state.

CONFIDENTIAL INFORMATION

Tax information which is disclosed to the West Virginia State Tax Department, whether through returns or through

department investigation, is held in strict confidence by law. The State Tax Department, the United States Internal

Revenue Service and other states have agreements under which tax information is exchanged. This is to verify the accuracy

and consistency of information reported on federal, other state, and West Virginia tax returns.

REPORTING WEST VIRGINIA INCOME TAX WITHHOLDING CREDIT

A West Virginia Income Tax Withholding Credit is created when a payment is made by another entity for the benefit of

the Corporation filing this return.

Electronic Filed Returns – It will be necessary to submit a Form NRW 2, WVK‐ 1C, WVK‐ 1, or 1099‐ as part of your electronic

return as part of the electronic file and not as a PDF if you are claiming a withholding credit. These documents will be used

to verify the withholding credits claimed on your return. If withholding is from nonresident sale of real estate the Federal ‐

Schedule D must be attached as a PDF attachment.

Paper Filed Returns – Enter the total amount of West Virginia tax withheld on your behalf by another entity on your return.

A completed NRW 2,‐ WVK 1C or‐ 1099 must be enclosed with your paper return. Failure to submit these documents will

result in the disallowance of the withholding credit claimed. Note: Local or municipal fees cannot be claimed as West Virginia

income tax withheld. If the withholding source is for a nonresident sale of real estate transaction, a form WV/NRSR must be

completed and on file with the State Tax Department prior to submitting a tax return. Additionally, a Federal Schedule D

must be submitted. If withholdings are related to form WV/NRSR, please indicate in the box provided on line 12.

PAGE 8 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

FORM CIT ‐ INSTRUCTIONS

Enter beginning and ending tax year dates covered by this return. Clearly print or type your name and address. If filing

under extension, enter the extended due date. In the “Check Applicable Boxes” section, mark all that apply to the

corporate return being filed.

*********

Attachments and statements required: Attach all additional information and statements required as part of your Form

CIT 120‐ as they apply to your filing method.

Attach a copy of pages 1 through 5 of your signed federal return (Form 1120), and Schedule M 3 if applicable. ‐ If filing

separate West Virginia and consolidated federal, attach your pro forma federal, consolidated federal Form 851 (Affiliation

Schedule), plus spreadsheets of the income and expenses, and balance sheet entries for EVERY corporation included in

the consolidated federal return.

Attach a schedule of other states in which you have property or paid salaries during the taxable year. Indicate those states

in which you are filing corporate tax returns based on, or measured by, net income for this taxable year.

Attach a schedule of other states in which you have sales of tangible personal property during the taxable year and in

which you are not taxed (e.g. P.L.86 272).‐ Indicate by state the amount of sales not subject to tax.

If filing as a Separate Filer, complete Schedule 1 if you are a wholly WV corporation or Schedule 2 if you have multistate

activity.

SCHEDULE –SEPARATE ENTITY FILER WEST VIRGINIA CORPORATIONS WHOLLY IN WV

Line 1 ‐ Enter total taxable income from your federal income tax return Form 1120 or your pro forma return. A “pro

forma” return is the return that you would have filed if you had filed your federal return on a separate return

basis.

Line 2 ‐ Enter total increasing adjustments from Form CIT 120,‐ Schedule B, line 12.

Line 3 ‐ Enter total decreasing adjustments from Form CIT 120,‐ Schedule B, line 25.

Line 4 ‐ West Virginia adjusted taxable income. Add line1 plus line 2 minus line 3.

Line 5 ‐ Enter the total from column 6 of Schedule NOL.

Line 6 ‐ Subtract line 5 from line 4.

Line 7 ‐ REIT Inclusion and other Taxable income.

Line 8 ‐ Add lines 6 and 7.

Line 9 ‐ 2020 WV Corporate Tax Rate .065.

Line 10 ‐ Multiply line 8 by the Corporate Net Income Tax Rate in line 9.

Line 11 ‐ Enter the result from column 2, line 17 of completed Form CIT 120TC. The‐ total amount of credits cannot

exceed the net income tax on line 10.

Line 12 ‐ Subtract line 11 from line 10. This is your Adjusted Corporate Net Income Tax. Enter this amount on CIT 120, ‐

page 2, line 9.

PAGE 9 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

SCHEDULE – SEPARATE ENTITY FILER WITH MULTISTATE ACTIVITY

Line 1 ‐ Enter total taxable income from your federal income tax return Form 1120 or your pro forma return. A “pro

forma” return is the return that you would have filed if you had filed your federal return on a separate return

basis.

Line 2 ‐ Enter total increasing adjustments from Form CIT 120,‐ Schedule B, line 12.

Line 3 ‐ Enter total decreasing adjustments from Form CIT 120,‐ Schedule B, line 25.

Line 4 ‐ West Virginia adjusted taxable income. Add line 1 plus line 2 minus line 3.

Line 5 ‐ Total nonbusiness income allocated everywhere (Form CIT 120APT,‐ Schedule A 1, line ‐ 9, column 3).

Line 6 ‐ Subtract line 5 from line 4. This is your total income subject to apportionment.

Line 7 ‐ Complete Form CIT 120APT,‐ Schedule B and enter the result of part 1, line 8; part 2 or part 3, column 3.

** IMPORTANT NOTE REGARDING LINE 7 **

FORM CIT 120APT,‐ SCHEDULE B MUST BE COMPLETED AND ATTACHED.

FAILURE TO ATTACH COMPLETED FORM WILL RESULT IN 100% APPORTIONMENT TO WEST VIRGINIA.

Line 8 ‐ Line 6 multiplied by line 7

Line 9 ‐ Enter the total allocation of nonbusiness income allocated to West Virginia from CIT 120APT, Schedule‐ A2,

line 13.

Line 10 Add ‐ lines 8 and 9.

Line 11 Enter ‐ the total from column 6 of Schedule NOL.

Line 12 Subtract ‐ line 11 from line 10.

Line 13 REIT ‐ Inclusion and other Taxable income.

Line 14 Add ‐ lines 12 and 13.

Line 15 2020 ‐ WV Corporate Tax Rate .065.

Line 16 Multiply ‐ line 14 by the Corporate Net Income Tax Rate in line 15.

Line 17 ‐ Enter the result from column 2, line 17 of completed Form CIT 120TC. The‐ total amount of credits cannot exceed

the net income tax on line 16.

Line 18 Subtract ‐ line 17 from line 16. This is your Adjusted Corporate Net Income Tax. Enter this amount on CIT 120, ‐

page 2, line 9.

PAGE 10 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

CIT‐ , PAGE

Line 9 ‐ Enter the adjusted Corporate Net Income Tax amount from either Schedule 1, line 12, Schedule 2, line 18 or

Schedule UB CR,‐ total of all groups.

Line 10 ‐ Prior year carry forward credit from your previous Corporate Net Income Tax return.

Line 11 ‐ Enter total estimated tax payments and any extension payment made with Form CIT 120EXT. ‐

Line 12 ‐ Enter the total amount of withholding credit from Form NRW 2, Form‐ WVK 1C, and/or‐ Form 1099. Check box

if withholding is from NRSR (nonresident sale of real estate).

Line 13 ‐ Add lines 10 through 12. This total MUST match the total payments on Schedule C.

Line 14 ‐ If this an amended return, enter the amount of any overpayment previously refunded or credited.

Line 15 ‐ Subtract line 14 from line 13. This is your company’s total payments.

Line 16 ‐ If line 15 is larger than line 9 enter your overpayment here.

Line 17 ‐ Enter the amount of the overpayment in line 16 that you wish to have credited to 2021 taxes.

Line 18 ‐ Enter the amount of the overpayment in line 16 that you wish to have refunded (subtract line 17 from line

16).

Line 19 ‐ If line 15 is smaller than line 9, enter the tax due on this line.

Line 20 ‐ Determine the amount of interest due. For information regarding interest, see the general information on

page 7 of this instruction booklet.

Line 21 ‐ Determine additions to tax due. For information regarding additions to tax, see the general information on

page 7 of this instruction booklet.

Line 22 ‐ Enter the amount of penalty for underpayment of estimated tax from Form CIT 120U, line‐ 6.

Line 23 ‐ Add lines 19 through 22. This is the balance due with this return. Make check payable to West Virginia State

Tax Department or see www.tax.wv.gov for other payment options.

PAGE 11 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

SCHEDULE B: ADJUSTMENTS TO FEDERAL TAXABLE INCOME

ADJUSTMENTS INCREASING FEDERAL TAXABLE INCOME

Line 1 ‐ Enter exempt interest or dividends from any state or local bonds or securities from your federal return Form

1120, Schedule K or on Schedule M 1. ‐

Line 2 ‐ Enter the amount of US Government obligation interest or dividends not exempt from state tax, less any

related expenses not deducted on the federal return. Attach supporting documentation.

Line 3 ‐ Attach an itemized schedule of taxes based upon income from line 17 of your federal income tax return, Form

1120 or pro forma Form 1120.

Line 4 ‐ Taxpayers can elect to expense the cost of certain air and water pollution control facilities located in West

Virginia in the year in which the cost of acquisition, construction or development was paid or incurred. Eligible

air and water pollution control facilities are those located in West Virginia that are “certified pollution control

facilities” as defined by Section 169 of the Internal Revenue Code. If this election is made, the total amount

of any federal deduction for depreciation or amortization of such facilities is disallowed. The election is made

on the return for the year in which the cost is paid or incurred. Once made, the election or non election is ‐

irrevocable.

A taxpayer who reports all income to this state will make the adjustments for the cost of the facilities on CIT ‐

120 Schedule B, line 20. The depreciation or amortization on the facilities, including that attributable to cost

expensed this year as well as prior years, deducted on the federal return, is entered on CIT 120 Schedule ‐ B,

line 4. A taxpayer who is subject to allocation and apportionment makes the adjustment for the cost of the

facilities on Form CIT 120APT‐ Schedule A2, line 10, column 3. The depreciation or amortization on the facilities

deducted on the federal return for this year as well as previous years, is entered on Form CIT 120APT Schedule‐

A2, lines 11 and 12 of column 3.

Line 5 ‐ Corporations which are exempt from federal income tax are also exempt from West Virginia Corporation Net

Income Tax. If such a corporation has unrelated business taxable income (as defined by Section 512 of the

Internal Revenue Code), they must pay West Virginia Corporation Net Income Tax on the unrelated business

taxable income. Enter the unrelated business taxable income as reported on Federal Form 990T.

Line 6 ‐ Enter the amount of Net Operating Loss from Federal Form 1120, line 29a.

Line 7 ‐ If you claim the West Virginia Neighborhood Investment Program Tax Credit, any deduction, decreasing

adjustment, or decreasing modification taken on your federal return for any charitable contribution made to

such Neighborhood Investment Program and for which the West Virginia credit is claimed, must be added

back on this line.

Line 8 ‐ Taxpayers with foreign source income must adjust their federal taxable income by the amount of their taxable

income or loss from sources outside the United States. In determining foreign source income, the provisions

of Sections 861, 862, and 863 of the Internal Revenue Code apply.

Complete the following worksheet.

FOREIGN SOURCE INCOME WORKSHEET PETITIONING FOR AN ALTERNATIVE METHOD OF APPORTIONMENT

1. Taxable income from sources outside the United States

2. LESS foreign dividend gross-up

3. LESS subpart F income

4. West Virginia adjustment

If the amount on line 4 of the worksheet is a positive figure, enter it on CIT 120, Schedule ‐ B, line 19. If it is a negative

figure, enter the amount of the loss on CIT 120, Schedule‐ B, line 8 without the negative sign.

PAGE 12 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

Attach copies of Federal Form 1118 to support your calculation. If you did not file Federal Form 1118, you must prepare

and file a pro forma Federal Form 1118 to support your adjustment. If you filed a consolidated Federal Form 1118 and file

separate or unitary West Virginia returns, attach both the true consolidated and a pro forma Federal Form 1118 to support

your adjustment.

Line 9 ‐ Enter the amount of foreign taxes as deducted on your Federal Form 1120.

Line 10 ‐ Add back for expenses related to certain REIT’s and regulated investment companies and certain interest and

intangible expenses (WV Code §11 24‐ 4b).‐

Line 11 ‐ Other increasing adjustments. Please submit a statement of explanation for any amount entered with your

return.

Line 12 ‐ Add lines 1 through 11. Enter the total on Form CIT 120, Schedule‐ 1, line 2 or CIT 120, Schedule‐ 2, line 2.

ADJUSTMENTS DECREASING FEDERAL TAXABLE INCOME

Line 13 ‐ Enter the amount of refund or credit of income taxes or taxes based upon net income imposed by this state

or any other jurisdiction included in federal taxable income. Attach supporting documentation.

Line 14 ‐ Enter the amount of interest expense on obligations or securities of any state or its political subdivisions

disallowed in determining federal taxable income. Attach supporting documentation.

Line 15 ‐ Enter the amount of US Government obligation interest or dividends included in federal but exempt from

state tax, less related expenses deducted on your federal return. Attach supporting documentation.

Line 16 ‐ Enter total salary expense not allowed on your federal return due to claiming the federal jobs credit and

include a copy of Federal Form 3800 or 5884. Note: this decreasing adjustment is only applicable to the Work

Opportunity Credit from Federal Form 5884.

Line 17 ‐ Enter the total foreign dividend gross up (IRC‐ Section 78) from Federal Form 1120.

Line 18 ‐ Enter the total subpart F income (IRC Section 951) from Federal Form 1120.

Line 19 ‐ See instructions for CIT 120‐ Schedule B, line 8. If Foreign Source Income from worksheet line 4 is positive,

enter amount here.

Line 20 ‐ See instructions for CIT 120‐ Schedule B, line 4. Multistate corporations must use CIT 120APT, Schedule‐ A2,

line 10.

Line 21 ‐ A decreasing adjustment to federal taxable income is allowed for employer contributions to a medical savings

account established pursuant to WV Code §33 16 15,‐ to‐ the extent included in federal taxable income, less

any portion of the employer’s contributions withdrawn for purposes other than payment of medical expenses.

The amount taken as a decreasing adjustment may not exceed the maximum amount that would have been

deducted from the corporation’s federal taxable income if the aggregate amount of the corporation’s

contributions to individual medical savings accounts established under WV Code §33 16 15 had been‐ ‐

contributions to a qualified plan as defined under the Employee Retirement Income Security Act of 1974

(ERISA), as amended.

Line 22 ‐ Qualified Opportunity Zone business income. You must include a copy of IRS 8996.

Line 23 ‐ Other decreasing adjustments. Please submit a statement of explanation for any amount entered on your

return.

Line 24 ‐ Taxpayers that own certain tax exempt‐ government obligations and obligations secured by certain residential

property located in West Virginia can take a special allowance that further reduces federal taxable income.

Complete Form CIT 120,‐ Schedule B 1 ‐ to determine the amount of the allowance.

Line 25 ‐ Add lines 13 through 24. Enter the amount here and on CIT 120, Schedule‐ 1, line 3 or CIT 120, Schedule‐ 2, line

3.

PAGE 13 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

SCHEDULE B ‐ ALLOWANCE FOR GOVERNMENTAL OBLIGATIONS/OBLIGATIONS SECURED BY

RESIDENTIAL PROPERTY (§ ‐ ‐ (F))

Taxpayers that own certain tax exempt‐ government obligations and obligations secured by certain residential property

located in West Virginia can take a special allowance that further reduces federal taxable income. Complete CIT 120 ‐

Schedule B ‐ 1 to determine the amount of the allowance. The value of these obligations and loans is determined using the

average of the monthly beginning and ending account balances. These account balances are determined at cost in the

same manner that such obligations, investments and loans are reported on the balance sheet of your federal tax return.

Lines 1 through 4 ‐ Attach copy of worksheets supporting the calculation of average monthly balance.

Line 6 ‐ Average the beginning and ending balance of Federal Form 1120, Schedule L, line 15.

Line 8 ‐ CIT 120,‐ Schedule 1, line 1 or Schedule 2, line 1 plus CIT 120, Schedule ‐ B, line 12 minus the sum of lines 13

through 23, plus Form CIT 120APT,‐ Schedule A2, lines 10, 11, and 12.

SCHEDULE C – SCHEDULE OF TAX PAYMENTS

Use this schedule to list any Corporation Net Income Tax payments made which the taxpayer is applying to this return.

List the following for each payment: name of corporation making payment; FEIN of corporation making the payment; date

of payment; type of payment (application of overpayment from prior year, estimated payment, extension payments made

with an extension return or withholding credits claimed on return); and amount of payments. The total amount of

payments must equal the amount reported on Form CIT 120, line‐ 13.

If the number of payments reported on Schedule C exceeds 10, you must file electronically.

SCHEDULE D – REPORTABLE ENTITIES

If any boxes were checked in the Reportable Entities Section of page 1, the names and FEIN of the reportable entities must

be entered on Schedule D, even if no payments were applicable to those entities.

If the number of entities reported on Schedule D exceeds 10, you must file electronically.

CIT‐ TC: SUMMARY OF CORPORATION NET INCOME TAX CREDITS

The CIT 120TC,‐ Summary of Corporation Net Income Tax Credits, is a form used by corporations to summarize the tax

credits that they claim against their Corporation Net Income Tax liability. In addition to completing the CIT 120TC, each ‐

tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Please note that

some tax credit schedules require a completed application to be submitted and approved before the tax credit schedule

can be filed. Both the CIT 120TC‐ and the appropriate credit calculation schedule(s) or form(s) must be attached to your

return in order to claim a tax credit.

Line 15 ‐ Total credits: Add column 2, lines 1 through 16.

Enter the total amount in column 2, Credits Used, on CIT 120TC, ‐ line 17.

Note that the amount of credit used cannot be greater than the Corporate Net income Tax assessed on the return. For

additional information and a copy of the tax credit schedules and applications please visit tax.wv.gov.

SCHEDULE NOL: WV NET OPERATING LOSS CARRYFORWARD CALCULATION (§ ‐ ‐ (D))

WHO SHOULD COMPLETE SCHEDULE NOL?

All corporations claiming a West Virginia net operating loss carry forward deduction on Form CIT 120, Schedule ‐ 1, line 5,

CIT 120,‐ Schedule 2, line 11 or Schedule UB CR, column‐ 16 must complete this schedule to support their net operating

loss deduction. Schedule NOL is not a claim for refund. It is a calculation schedule to support the net operating loss

carryforward deduction.

PAGE 14 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

Any amount claimed as a federal net operating loss deduction must be added back to federal taxable income on West

Virginia Form CIT 120,‐ Schedule B, line 6 for a separate filer or column 2f (entity specific of applicable group) if a combined

filer. The West Virginia net operating loss carryforward deduction is entered on Form CIT 120, Schedule‐ 1, line 5, Schedule

2, line 11 or Schedule UB CR,‐ column 16 of each applicable group.

West Virginia NOL generated in periods after 2017 can be carried forward indefinitely. Any WV Net Operating Loss

deduction, which was generated in periods after 2017, is limited to 80% of taxable income. Note that rules for pre 2018 ‐

WV NOL remain the same.

A net operating loss deduction of a multistate corporation is subject to West Virginia allocation and apportionment rules.

The West Virginia net operating loss deduction is limited to net operating losses incurred by a corporation which did

business in West Virginia and filed Corporation Net Income Tax Returns in prior taxable years.

The amount of net operating loss deduction available to an affiliated group, which elects for the first time to file a

consolidated return for a taxable year ending after July 1, 1988, is limited to the net operating losses incurred by members

of the affiliated group which did business in West Virginia and filed separate West Virginia returns in prior years.

A West Virginia net operating loss deduction will not be allowed for net operating losses of those members of the affiliated

group which did no business in West Virginia in prior taxable years and were not required to file West Virginia Corporation

Net Income Tax Returns.

SRLY RULES. The separate return limitation years (SRLY) rules set forth in Treasury Regulation §1.1502 apply in

determining the allowable West Virginia net operating loss deduction.

When the SRLY rules apply, a member of an affiliated group’s net operating loss carried forward from its separate return

year can only offset that portion of the taxable income attributable to that member of the group.

Schedule NOL is designed to support the claiming of a West Virginia net operating loss carryforward deduction by

providing information on the year of the loss and how the loss was/is being used. Enter on Schedule NOL those loss years

that give rise to the current taxable year’s net operating loss carryforward deduction.

Column 1. Year of loss. Enter in column 1 the applicable tax year ending date(s) for the year(s) that you had net operating

loss(es).

Column 2 Enter name and FEIN of the Consolidated Parent Corporation if you filed a consolidated return prior to 2009

and had a West Virginia Net Operating Loss or enter name and FEIN of all separate members’ West Virginia

net operating losses that filed separately prior to 2009.

Column 3. Amount of West Virginia net operating loss. Enter the amount of West Virginia net operating loss that

corresponds to the year of the loss shown in Column 1.

Column 4. Amount carried back to years prior to loss year. Enter the total amount of loss for the taxable year entered in

column 1 that was carried back to a year, or years prior to the year of the actual loss.

Column 5. Amount carried forward to years prior to this year. Enter the total amount of loss for the taxable year entered

in column 1 that was carried forward to a year, or years, prior to the current taxable year.

Column 6. Amount being used this year. Enter the amount of loss for the taxable year entered in column 1 that is being

used to offset West Virginia taxable income for the current taxable year.

Column 7. Remaining unused net operating loss. Enter the amount of loss for the tax year entered in column 1 that

remains to be carried to a taxable year subsequent to the current taxable year.

TOTAL NET OPERATING LOSS CARRYFORWARD DEDUCTION FOR CURRENT TAXABLE YEAR.

The amount of the West Virginia net operating loss carryforward deduction claimed on Form CIT 120, Schedule‐ 1, Schedule

2 or Schedule UB CR‐ of the current year’s tax return must equal the sum of Form CIT 120, Schedule ‐ NOL, column 6. In no

instance may the West Virginia net operating loss carryforward deduction reduce West Virginia taxable income below

zero.

PAGE 15 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image | CIT‐ APT – ALLOCATION AND APPORTIONMENT FOR MULTISTATE CORPORATIONS SCHEDULES A & A – ALLOCATION OF NONBUSINESS INCOME If your business activities take place both within and without West Virginia and you are also taxable in another state, certain items of nonbusiness income that are included in federal taxable income are directly allocated. All other income must be apportioned. Business income arises from transactions and activities in the regular course of the corporation’s trade or business and include income from tangible and intangible property if the acquisition, management, or disposition of the property constitutes integral parts of the corporation’s trade or business. Nonbusiness income includes all income that is not properly classified as business income less all expenses attributable to the production of this income. Nonbusiness income is allocated to West Virginia if (1) the corporation’s commercial domicile, the principal place from which the trade or business is managed is located in West Virginia; or (2) property creating the nonbusiness income is utilized in West Virginia. Nonbusiness income from real property is allocated to West Virginia if the corporation’s commercial domicile is located in West Virginia, or, in the case of patents or copyrights, if they are used in West Virginia. For a detailed discussion of allocation of nonbusiness income, you may request a copy of Publication TSD 392, ‐ “Corporation Net Income Tax Nonbusiness Income”, by contacting our Taxpayer Services Division or online at tax.wv.gov. Determine nonbusiness income allocated to West Virginia and outside West Virginia by completing Form CIT 120APT, ‐ Schedules A1 and A2. Only those types of nonbusiness income listed on Form CIT 120APT, Schedules‐ A1 and A2 can be allocated. Any other types of income that the corporation classifies as nonbusiness must be apportioned. Line 9 ‐ Enter the amount from Form CIT 120APT,‐ Schedule A1, column 3, line 9 on Form CIT 120, Schedule ‐ 2, line 5. Line 13 ‐ Enter the amount from Form CIT 120APT,‐ Schedule A2, column 3, line 13 to Form CIT 120, Schedule ‐ 2, line 9. SCHEDULE B – APPORTIONMENT FORMULA If your business activities take place both within and without West Virginia and you are also taxable in another state, all net income, after deducting those items of nonbusiness income allocated on Form CIT 120APT, ‐ Schedules A1 and A2 must be apportioned to West Virginia by using the appropriate apportionment formula. Completion of CIT 120APT, ‐ Schedule B is required even if apportionment is zero. Special apportionment formulas apply to motor carriers and to financial organizations. If you are filing for a financial organization, follow the apportionment instructions for Form CIT 120APT, ‐ Schedule B, Part 3. If you are filing for a motor carrier, follow the apportionment instructions for Form CIT 120APT ‐ Schedule B, Part 2. All other multistate corporations will use the standard apportionment formula of payroll, property, and sales, with the sales factor double weighted, and will complete CIT 120APT, ‐ Schedule B Parts 1 through 3 as applicable. PETITIONING FOR AN ALTERNATIVE METHOD OF APPORTIONMENT To use an alternate method of allocation and apportionment, you must petition the Tax Commissioner to use some other basis to determine your taxable net income. Your petition for an alternate method must be filed no later than the normal due date of your return. You must have written permission to use an alternate apportionment method before filing your return. Permission will only be granted if you can show that the statutory formula does not properly reflect your taxable income, and if the alternate method properly and fairly shows your West Virginia taxable income. Your petition should include your name and address, state of incorporation and principal place of business, a description of the kind(s) of business in which you are engaged, a detailed statement of how sales are made in West Virginia, a computation of your West Virginia taxable income using the statutory apportionment formula and using your proposed alternate formula, and a summary of the facts that support your position. Send your petition to West Virginia State Tax Department, Tax Account Administration Division, Corporate Tax Unit, PO Box 1202, Charleston, WV 25324 1202.‐ PAGE 16 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS |

Enlarge image |

MULTISTATE CORPORATIONS – FOUR FACTOR FORMULA

Part 1

To determine your West Virginia apportionment percentage, first determine the following factors:

Property Factor. Property includes all real and tangible personal property owned or rented and used during the taxable

year to produce business income. Property used in connection with the items of nonbusiness income allocated in Form

CIT 120APT,‐ Schedule A1 and A2 shall be excluded from the factor.

Property must be included in the property factor if it is actually used or is available for or capable of being used during the

taxable year. Property held as reserves, standby facilities or reserve sources of materials must be included. Property or

equipment under construction (except goods in process that can be inventoried) must be excluded until it is actually used

to generate business income. Movable property, such as tools, construction equipment and trucks, used both within and

without West Virginia, shall be included in the numerator of the fraction on the basis of total time within the state during

the taxable year.

Property owned is valued at original cost. Property rented is valued at eight times the net annual rental rate. Leasehold

improvements are considered property owned and are included at their original cost. Generally, original cost is the basis

of the property for federal income tax purposes at the time of acquisition and adjusted by subsequent capital additions of

improvements and partial dispositions by reason of sale, exchange, abandonment, etc. As a general rule, property is

included in the factor by averaging its value at the beginning and ending of the taxable period. The Tax Commissioner may

require or allow averaging by monthly values if such a method is required to properly reflect the average value of the

taxpayer’s property for the taxable year.

Line 1 ‐ Divide column 1 by column 2 and enter result in column 3. State the result as a decimal and round to six (6)

places after the decimal.

Payroll Factor. The payroll factor shall include the amount of compensation paid to employees during the taxable year.

The total amount paid is determined upon the basis of the taxpayer’s accounting method for federal income tax purposes.

If you have adopted the accrual method of accounting for federal purposes, all compensation shall be deemed to have

been paid. Compensation may be included in the payroll factor by use of the cash basis only if you have permission from

the Tax Commissioner for an alternate method of apportionment. Compensation means wages, salaries, commissions,

and other forms of remuneration paid to employees for personal services. Payments made to an independent contractor

or any other person not properly classified as an employee are excluded. Only amounts paid directly to employees are

included in the payroll factor. Do not include compensation paid to employees engaged exclusively in an activity that

generates nonbusiness income that you allocated on Form CIT 120APT, ‐ Schedules A1 and A2.

The denominator (column 2) of the payroll factor is the total compensation paid by the taxpayer during the taxable year,

as shown on the federal income tax return filed with the Internal Revenue Service and as reflected in the schedule of

wages and salaries and that portion of the cost of goods sold which reflect compensation.

The numerator (column 1) of the payroll factor is the total amount paid in this state during the taxable year by the taxpayer

for compensation. Compensation is paid in this state if any of the following tests, applied consecutively, are met:

a. The employee’s service is performed entirely within this state;

b. The employee’s service is performed both within and without this state, but the service performed without this state is

“incidental” to the employee’s service within this state (the word incidental means any service which is temporary or

transitory in nature or which is rendered in connection with an isolated transaction);

c. If the employee’s services are performed both within and without this state, the employee’s compensation will be attributed

to this state:

1. If the employee’s base of operations is in this state;

2. If there is no base of operations in any state in which part of the service is performed, but the place from which the

service is directed or controlled is in this state; or

3. If the base of operations or the place from which the service is directed or controlled is not in any state in which some

part of the service is performed, but the employee’s residence is in this state.

PAGE 17 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

Base of operation is the place from which the employee starts their work and to which they customarily return in order

to receive instructions or communications from customers or others, or to replenish stock or other materials, repair

equipment, or perform any other functions necessary to the exercise of their trade or profession at some other point or

points.

Determine the payroll factor by entering the appropriate amounts on line 2. Enter West Virginia payroll in column 1 and

payroll everywhere in column 2.

Line 2 ‐ Divide column 1 by column 2 and enter result in column 3. State the result as a decimal and round to six (6)

places after the decimal

Sales factor. The term “sales” means all gross receipts of the taxpayer that are business income. The sales factor includes

all gross receipts derived from transactions and activity in the regular course of your trade or business, less returns, and

allowances. Do not include interest or dividends from obligations of the United States government, which are exempt

from taxation in West Virginia, or gross receipts from an activity that produced nonbusiness income that you allocated on

Form CIT 120APT,‐ Schedules A1 and A2.

The denominator (column 2) of the sales factor includes all gross receipts derived from transactions and activity in the

regular course of your trade or business that was reflected in your gross income reported and as appearing on your federal

income tax return unless otherwise excluded. Sales of tangible personal property delivered or shipped to a purchaser

within a state in which you are not taxed (e.g., under Public Law 86 272) are‐ to be excluded from the denominator.

The numerator (column 1) of the sales factor includes all gross receipts attributable to West Virginia and derived from

transactions and activity in the regular course of your trade or business. All interest income, service charges or time price ‐

differential charges incidental to such gross receipts must be included regardless of the place where the accounting

records are maintained or the location of the contract or other evidence of indebtedness.

Sales of tangible personal property. Gross receipts from sales of tangible personal property are in West Virginia (1) if the

property is received in West Virginia by the purchaser (except sales to the United States government) regardless of the

F.O.B. point or other conditions of sales; or (2) if the property is shipped from an office, store, warehouse, factory, or other

place of storage in West Virginia and the purchaser is the United States government.

Sales within West Virginia are generally determined on a destination basis. If the purchaser picks up or otherwise receives

the property in West Virginia, the sale is treated as taking place in this state. If the property is delivered by common carrier

or other means of transportation, the place at which the property is received, after all transportation is completed, is the

place where the sale took place. Direct delivery in West Virginia, other than for purposes of transportation, to a person or

firm designated by a purchaser, constitutes delivery to the purchaser in West Virginia regardless of where title passes or

other conditions of sale. Direct delivery outside West Virginia, to a person or firm designated by a purchaser, does not

constitute delivery to a person in this state.

Other sales. Gross receipts from transactions other than sales of tangible personal property are attributable to West

Virginia if (1) the income producing activity which gives rise to the receipts is performed entirely in West Virginia; (2) the

income producing activity is performed both in and outside West Virginia and a greater portion of the income producing

activity is performed in this state than in any other state, based on cost of performance; or (3) if the sale constitutes

business income to the taxpayer, or the taxpayer is a financial organization subject to the special apportionment rules.

Refer to West Virginia Code §11 24 7‐ for‐ a discussion of income producing activity and cost of performance.

Gross receipts from the sale, lease, rental, or licensing of real property are in West Virginia if the real property is located

in this state. Gross receipts from the rental, lease or licensing of tangible personal property are in West Virginia if the

property is located in this state. If such property is both within and without West Virginia during the rental, lease or

licensing period, gross receipts attributable to West Virginia shall be determined based upon the total time within the

state during the taxable year. Gross receipts for the performance of personal services are in West Virginia if such services

are performed in this state.

Determine the sales factor by entering the appropriate amount on line 3. Enter West Virginia sales in column 1 and sales

everywhere in column 2.

PAGE 18 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

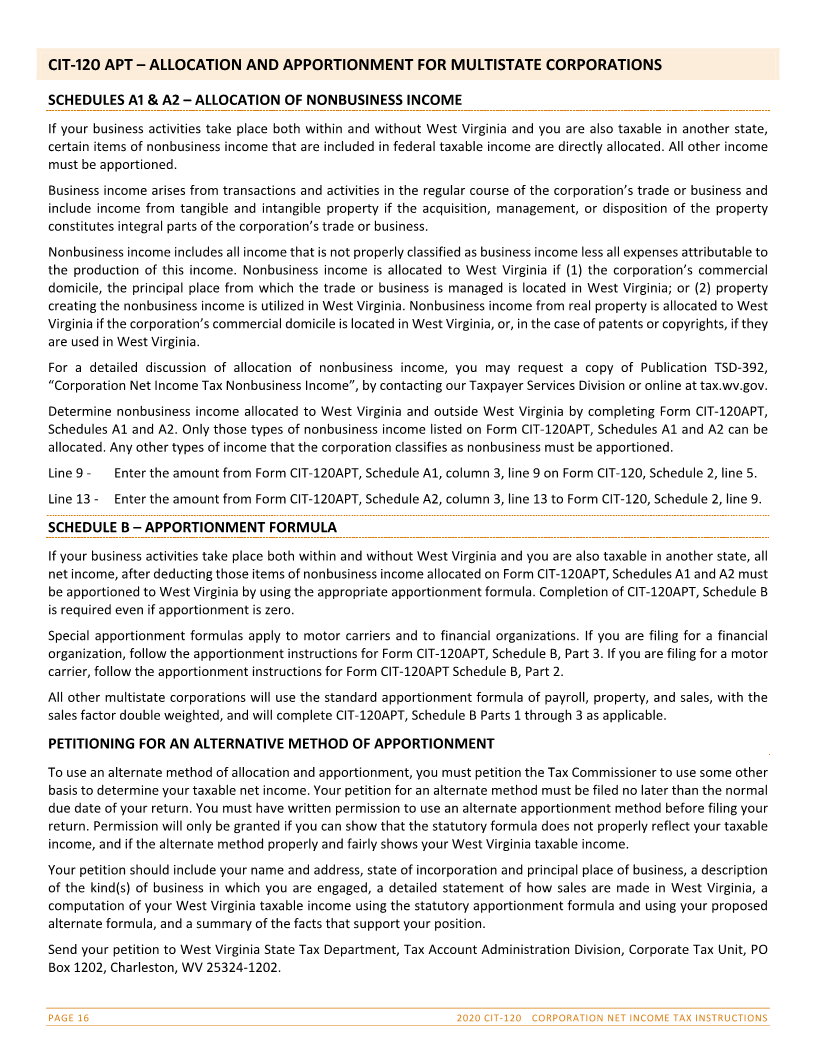

Line 3 ‐ Column 2. Total Sales. This amount when added to the total gross nonbusiness income as shown on CIT ‐

120APT, Schedule A1, line 9, must equal the sum of your items of gross income as reported on your federal

income tax return. Any differences must be noted and explained in an attachment to your return.

$ Sum of gross income items on federal return

$ Less total allocated income (CIT-120APT, Schedule A1, line 9)

$ Equals Form CIT-120APT, Schedule B, line 3, column 2

Line 4 ‐ Enter the total gross receipts from sales of tangible personal property delivered or shipped to a purchaser

within a state in which you are not taxed (e.g., Public Law 86 272). This ‐ is the throw out rule per WV Code

§11 24‐ 7(e)(11)(B)‐ and §11 23 5(l)(2).‐ ‐

Line 5 ‐ In column 1, enter the amount from line 3. In Column 2, subtract line 4 from line 3 and enter the difference.

Divide column 1, line 5 by column 2, line 5 and enter the result in column 3, line 5. State the result as a decimal

and round to six (6) places after the decimal.

Line 6 Enter line 5 again.

Line 7 ‐ Add column 3, lines 1, 2, 5, and 6 and enter the sum in column 3.

Line 8 ‐ Divide the six (6) digit decimal from column 3, line 7 by the number 4, reduced by the number of factors, if

any, showing zero in column 2, lines 1, 2, 5, and 6. Enter the six (6) digit decimal fraction here and on Form

CIT 120,‐ Schedule 2, line 7.

MOTOR CARRIERS – SPECIAL SINGLE FACTOR FORMULA

PART 2 – VEHICLE MILES.

Motor carriers of property or passengers are subject to special apportionment rules. Motor carriers must apportion their

business income by using a single factor formula of vehicle miles.

A motor carrier is any person engaged in the transportation of passengers and/or property for compensation by a motor

propelled vehicle over roads in West Virginia, whether on a scheduled route or otherwise. The term “vehicle miles” means

the operations of a motor carrier over one mile.

The special apportionment formula for motor carriers does NOT apply if:

a. The motor carrier neither owns nor rents any real or tangible personal property located in West Virginia, has made no pickups

or deliveries within West Virginia, and has traveled less than 50,000 miles in West Virginia during the taxable year; or

b. The motor carrier neither owns nor rents any tangible personal property located in West Virginia except vehicles and made

no more than 12 trips into or through West Virginia during the taxable year.

Under either (A) or (B), the mileage traveled in West Virginia may not be more than five percent (.05) of the total vehicle

miles traveled in all states during the taxable year.

Determine the apportionment factor by entering the appropriate vehicle miles for West Virginia in column 1, and vehicle

miles everywhere in column 2.

Divide column 1 by column 2 and enter the result in column 3. State the result as a decimal fraction and round to six (6)

places after the decimal. Enter the six (6) digit decimal fraction from column 3 on CIT 120, Schedule ‐ 2, line 7.

FINANCIAL ORGANIZATIONS – SPECIAL SINGLE FACTOR FORMULA

PART 3 – GROSS RECEIPTS.

Financial organizations subject to apportionment must apportion their business income by using a single factor gross

receipts formula.

PAGE 19 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

A financial organization is any holding company or regulated financial corporation or subsidiary thereof, or any corporation

deriving more than fifty percent (.5) of its gross receipts from one or more of the following:

1. Making, acquiring, selling, or servicing loans or extensions of credit.

2. Leasing or acting as an agent, broker, or advisor in connection with leasing real and personal property that is the economic

equivalent of an extension of credit.

3. Operating a credit card business.

4. Rendering estate or trust services.

5. Receiving, maintaining, or otherwise handling deposits.

6. Engaging in any other activity with an economic effect comparable to any of the above.

Financial organizations regularly engaging in business in West Virginia shall apportion their business income by means of

a single factor of gross receipts apportionment formula. A financial organization not having its commercial domicile in

West Virginia is presumed to be regularly engaging in business in West Virginia if during any year it obtains or solicits

business with 20 or more persons within West Virginia, or the sum of its gross receipts attributable to sources in West

Virginia equals or exceeds $100,000.00.

Gross receipts from the following ownership interest (and certain related activities) will not be considered in determining

whether a financial organization is subject to taxation.

1. An interest in a real estate mortgage investment conduit, a real estate investment, or a regulated investment company;

2. An interest in a loan backed security representing ownership or participation in a pool of promissory notes or certificates or

interest that provide for payments in relation to payments or reasonable projections of payments on the notes or certificates;

3. An interest in a loan or other asset from which the interest is attributed to a consumer loan, a commercial loan, or a secured

commercial loan, and in which the payment obligations were solicited and entered into by a person that is independent and

not acting on behalf of the owner; or an interest in the right to service or collect income from such a loan or asset; or

4. An amount held in an escrow or trust account with respect to property described above.

However, if a financial organization is subject to taxation when gross receipts from these interests are not considered,

such receipts must then be included when determining the amount of taxes owed.

Neither the numerator nor the denominator of the gross receipts factor should include gross receipts from obligations

and certain loans on which you claim the special allowance on Form CIT 120, Schedule‐ B 1. ‐

Divide column 1 by column 2 and enter in column 3. State the result as a decimal fraction and round to six places after the

decimal. Enter the six (6) digit decimal fraction from column 3 on Form CIT 120, Schedule‐ 2, line 7.

PAGE 20 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

CIT‐ U

Use this form to determine if any penalty for underpayment of estimated West Virginia Corporation Net Income Tax is

due and, if so, the amount of the penalty.

Who must pay the penalty? A corporation is required to file a declaration of estimated corporation net income tax and

make estimated tax payments on Form WV/CIT 120ES‐ if its West Virginia taxable income can reasonably be expected to

exceed $10,000.00, which equals a tax liability after tax credits of more than $650.00 (Code §11 24 16). Estimated‐ ‐ tax is

a corporation’s expected income tax liability minus its tax credits. A taxpayer is required to remit, in equal installments on

the 15th day of the 4th, 6th, 9th, and 12th months of their taxable year, at least ninety percent (.90) of the tax due for the

filing period.

If a corporation did not pay enough estimated tax by the due dates, it may be assessed the penalty. This is true even if the

corporation is due a refund when its return is filed. The penalty is figured separately for each installment due date.

Therefore, the corporation may owe the penalty for an earlier installment due date, even if it paid enough tax later to

make up the underpayment. The underpayment of estimated tax penalty rate will be 9.25% in 2020.

PART : ALL FILERS MUST COMPLETE THIS PART

Line 1 ‐ Enter your Corporation Net Income Tax after credits (Form CIT 120, line 9).‐ If this amount is less than $650.00,

skip lines 2 and 3 and enter 0 on line 5.

Line 2 ‐ Multiply the amount on line 1 by ninety percent (.9) and enter the result here. This is the amount you should have

paid in estimated tax for this taxable year.

Line 3 ‐ Enter the Corporation Net Income Tax after credits from your 2019 return. If you did not file a 2019 return leave

this line blank.

Line 4 ‐ Enter the smaller of line 2 or line 3. If line 3 is blank enter the amount from line 2. This is the amount you should

have paid in estimated tax for this taxable year.

Line 5 ‐ Enter the amount from line 4. This is the amount of estimated Corporation Net Income Tax that should have been

paid.

DETERMINE YOUR PENALTY BY COMPLETING PART II, III, AND IV

Part II: Annualized Installment Worksheet

If your taxable income varied during the year, you may be able to lower or eliminate the amount of one or more required

installments by using the annualized installment worksheet. To use the annualized installment method to figure the

penalty, you must complete Part I, Part II, Part III, and Part IV of Form CIT 120U. Follow‐ the line by line instructions entered

on Form CIT 120U.‐

PART III: CALCULATE THE UNDERPAYMENT

Line 23 ‐ In column A, enter the estimated tax payments deposited by the 15th day of the 4th month of your tax year.

In column B, enter payments made after the 15th day of the 4th month through the 15th day of the 6th month

of your tax year.

In column C, enter payments made after the 15th day of the 6th month through the 15th day of the 9th month

of your tax year.

In column D, enter payments made after the 15th day of the 9th month through the 15th day of the 12th

month of the tax year.

Due to the Coronavirus (COVID 19)‐ pandemic, any estimated payments originally due from April 15 through Julyth 15 th

were due on July 15 2020.th

Line 29 ‐ If any of the columns in line 29 shows an underpayment, complete Part IV to figure the penalty for that period.

PAGE 21 2020 CIT 120‐ ‐ CORPORATION NET INCOME TAX INSTRUCTIONS

|

Enlarge image |

PART IV: CALCULATE THE PENALTY

Complete lines 31 through 42 to determine the amount of the penalty. The penalty is figured for the period of

underpayment determined under West Virginia Code §11 10 18a‐ using‐ the rate of interest determined under West

Virginia Code §11 10‐ ‐ 17 or 17a, whichever is appropriate for the taxable year. For underpayments involving periods after

January 1, 2021, see the instructions for lines 39 and 40.

Line 31 ‐ Enter the date on which the installment payment was made or the original due date of the annual return,

whichever is earlier. The due date of the return is the 15th day of the 4th month following the close of the

taxable year for corporations. The due date of the annual return of an exempt organization with unrelated

business taxable income is the 15th day of the 5th month following the close of the taxable year. The payment

of estimated tax is applied against underpayments of required installments in the order that installments are

required to be paid, regardless of which installment the payment pertains to.

For example, a corporation has an underpayment for the April 15th installment of $1,000. The June 15th installment

requires a payment of $2,500. On June 10th, the corporation deposits $2,500 to cover the June 15th installment. $1,000

of this payment is considered to be for the April 15th installment. The penalty for April 15th installment is figured to June

10th (56 days). The payment to be applied to the June 15th installment will then be $1,500.

If you made more than one payment for a required installment, attach a separate computation for each payment.

Lines 39 & 40 For ‐ underpayments involving periods after January 1, 2021, use the interest rate established by the State

Tax Commissioner. You can contact the West Virginia State Tax Department, Taxpayer Services Division, at 1 ‐