Enlarge image

Schedule L - Electric, Natural Gas, Sewer, and Water Utilities Rate Reduction Credit

Rev. March 2019

Electric, Natural Gas, Sewer, and Water Utilities Rate Reduction Credit

Public utilities who provide electric and gas utility service at special reduced rates to low income residential customers for the billing

months of December through April, or who provide water and/or sewer utility service at approved special reduced rates to certain low-

income residential customers in any month, are eligible to claim the credit. The West Virginia Public Service Commission will determine

the revenue deficiency resulting from the reduced rates and certify the amount of allowable credit.

A copy of the certification order must be attached to the return on which the credit is claimed.

An eligible taxpayer may claim the credit on the annual return for the taxable year in which it receives certification.

However, the credit is first claimed against the West Virginia Business and Occupation Tax liability, then against West Virginia

Corporation Net Income Tax liability. Any portion of the credit then remaining may be carried over to the next year's Business and

Occupation Tax liability and is applied before any other credits for that year. There is no provision for carryover to the Corporation Net

Income Tax.

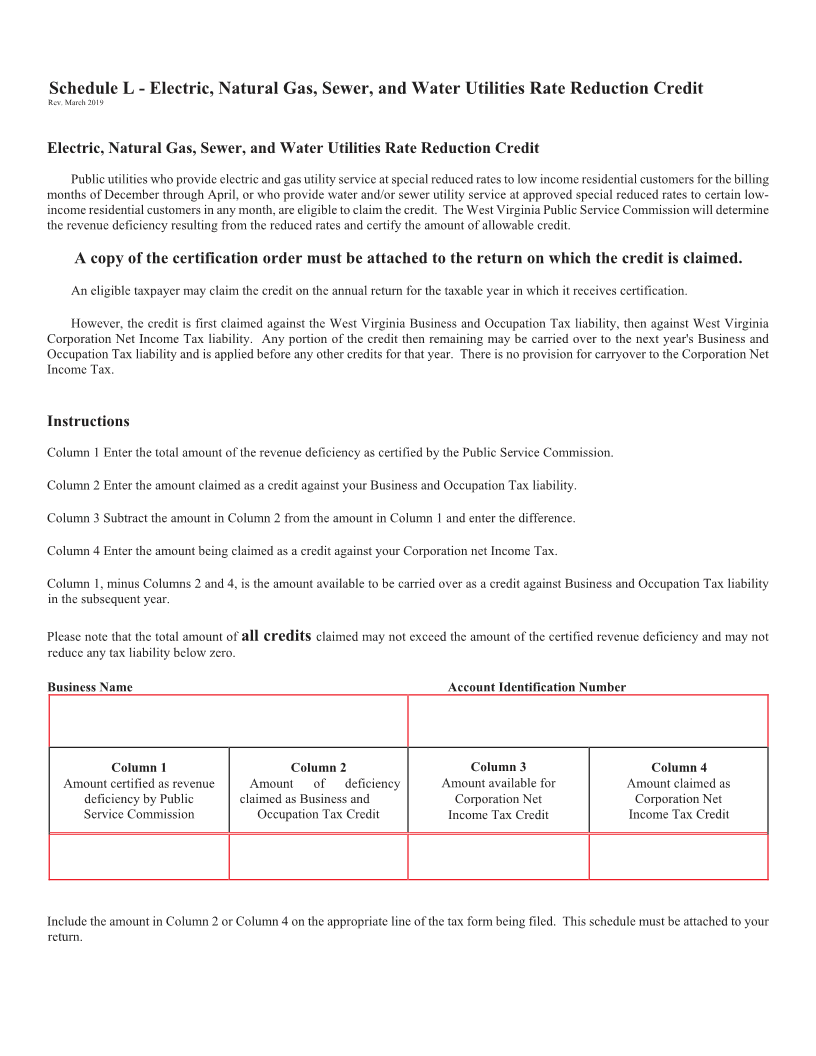

Instructions

Column 1 Enter the total amount of the revenue deficiency as certified by the Public Service Commission.

Column 2 Enter the amount claimed as a credit against your Business and Occupation Tax liability.

Column 3 Subtract the amount in Column 2 from the amount in Column 1 and enter the difference.

Column 4 Enter the amount being claimed as a credit against your Corporation net Income Tax.

Column 1, minus Columns 2 and 4, is the amount available to be carried over as a credit against Business and Occupation Tax liability

in the subsequent year.

Please note that the total amount of all credits claimed may not exceed the amount of the certified revenue deficiency and may not

reduce any tax liability below zero.

Business Name Account Identification Number

Column 1 Column 2 Column 3 Column 4

Amount certified as revenue Amount of deficiency Amount available for Amount claimed as

deficiency by Public claimed as Business and Corporation Net Corporation Net

Service Commission Occupation Tax Credit Income Tax Credit Income Tax Credit

Include the amount in Column 2 or Column 4 on the appropriate line of the tax form being filed. This schedule must be attached to your

return.