Enlarge image

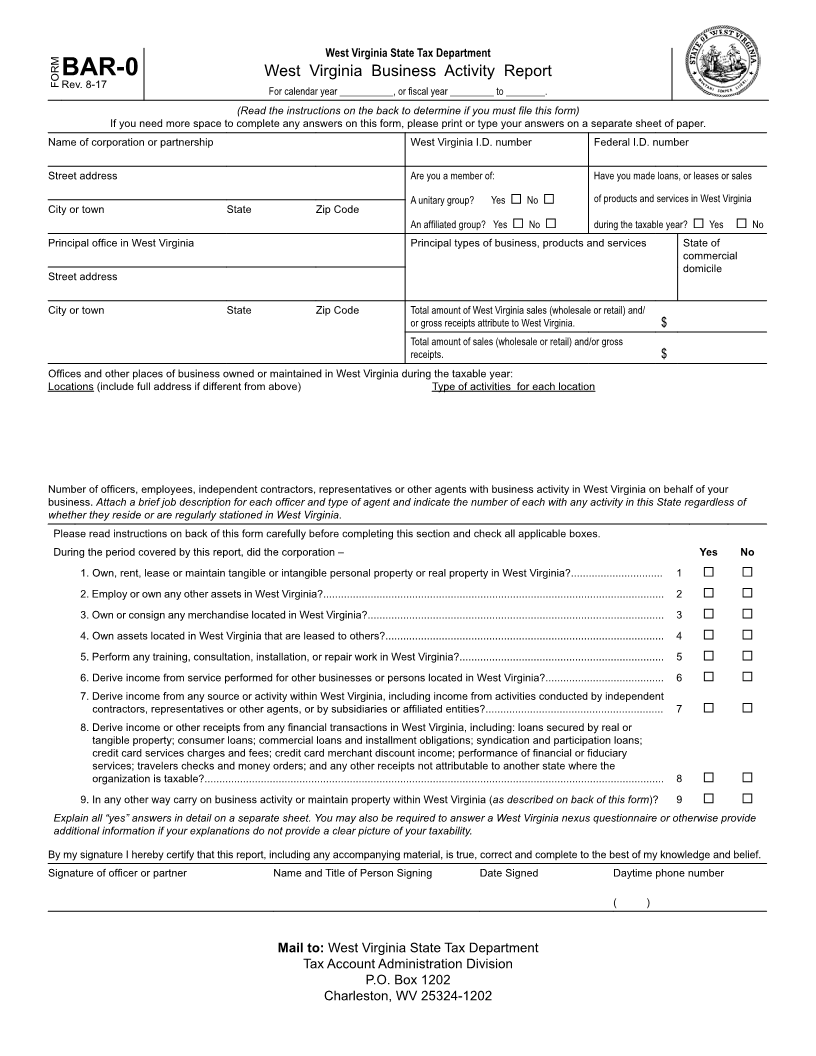

West Virginia State Tax Department

BAR-0FORM West Virginia Business Activity Report

Rev. 8-17 For calendar year ___________, or fiscal year _________ to ________.

(Read the instructions on the back to determine if you must file this form)

If you need more space to complete any answers on this form, please print or type your answers on a separate sheet of paper.

Name of corporation or partnership West Virginia I.D. number Federal I.D. number

Street address Are you a member of: Have you made loans, or leases or sales

A unitary group? Yes No of products and services in West Virginia

City or town State Zip Code

An affiliated group? Yes No during the taxable year? Yes No

Principal office in West Virginia Principal types of business, products and services State of

commercial

domicile

Street address

City or town State Zip Code Total amount of West Virginia sales (wholesale or retail) and/

or gross receipts attribute to West Virginia. $

Total amount of sales (wholesale or retail) and/or gross

receipts. $

Offices and other places of business owned or maintained in West Virginia during the taxable year:

Locations (include full address if different from above) Type of activities for each location

Number of officers, employees, independent contractors, representatives or other agents with business activity in West Virginia on behalf of your

business. Attach a brief job description for each officer and type of agent and indicate the number of each with any activity in this State regardless of

whether they reside or are regularly stationed in West Virginia.

Please read instructions on back of this form carefully before completing this section and check all applicable boxes.

During the period covered by this report, did the corporation – Yes No

1. Own, rent, lease or maintain tangible or intangible personal property or real property in West Virginia?............................... 1

2. Employ or own any other assets in West Virginia?................................................................................................................... 2

3. Own or consign any merchandise located in West Virginia?.................................................................................................... 3

4. Own assets located in West Virginia that are leased to others?.............................................................................................. 4

5. Perform any training, consultation, installation, or repair work in West Virginia?..................................................................... 5

6. Derive income from service performed for other businesses or persons located in West Virginia?........................................ 6

7. Derive income from any source or activity within West Virginia, including income from activities conducted by independent

contractors, representatives or other agents, or by subsidiaries or affiliated entities?............................................................ 7

8. Derive income or other receipts from any financial transactions in West Virginia, including: loans secured by real or

tangible property; consumer loans; commercial loans and installment obligations; syndication and participation loans;

credit card services charges and fees; credit card merchant discount income; performance of financial or fiduciary

services; travelers checks and money orders; and any other receipts not attributable to another state where the

organization is taxable?........................................................................................................................................................... 8

9. In any other way carry on business activity or maintain property within West Virginia (as described on back of this form)? 9

Explain all “yes” answers in detail on a separate sheet. You may also be required to answer a West Virginia nexus questionnaire or otherwise provide

additional information if your explanations do not provide a clear picture of your taxability.

By my signature I hereby certify that this report, including any accompanying material, is true, correct and complete to the best of my knowledge and belief.

Signature of officer or partner Name and Title of Person Signing Date Signed Daytime phone number

( )

Mail to: West Virginia State Tax Department

Tax Account Administration Division

P.O. Box 1202

Charleston, WV 25324-1202