Enlarge image

West Virginia West Virginia

WV/AG-1 State Tax

REV 9/15 Environmental Agricultural Equipment Tax Credit Department

Business WV Tax ID

Name Number

Tax Period

To

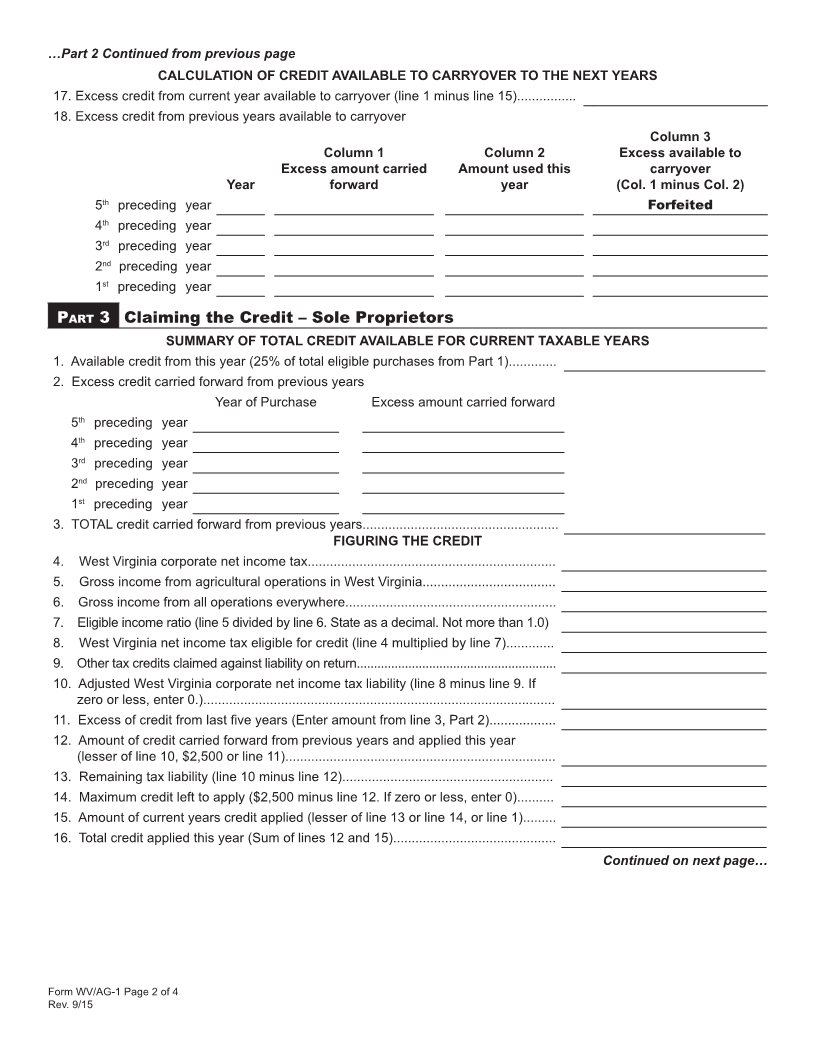

Part 1 Eligible Purchases

Date placed into use or Description Cost

service

Total eligible purchases during the taxable year (Add costs above)..............................

Part 2 Claiming the Credit – Corporations

SUMMARY OF TOTAL CREDIT AVAILABLE FOR CURRENT TAXABLE YEAR

1. Available credit from this year (25% of total eligible purchases from Part 1).............

2. Excess credit carried forward from previous years

Year of Purchase Excess amount carried forward

5 thpreceding year

4 thpreceding year

3 rdpreceding year

2 ndpreceding year

1 stpreceding year

3. TOTAL credit carried forward from previous years.....................................................

FIGURING THE CREDIT

4. West Virginia corporate net income tax...................................................................

5. Gross income from agricultural operations in West Virginia....................................

6. Gross income from all operations everywhere.........................................................

7. Eligible income ratio (line 5 divided by line 6. State as a decimal. Not more than 1.0)

8. West Virginia net income tax eligible for credit (line 4 multiplied by line 7).............

9. Other tax credits claimed against liability on return..........................................................

10. Adjusted West Virginia corporate net income tax liability (line 8 minus line 9. If

zero or less, enter 0.)...............................................................................................

11. Excess of credit from last five years (Enter amount from line 3, Part 2)..................

12. Amount of credit carried forward from previous years and applied this year

(lesser of line 10, $2,500.00, or line 11)...................................................................

13. Remaining tax liability (line 10 minus line 12).........................................................

14. Maximum credit left to apply ($2,500 minus line 12. If zero or less, enter 0)..........

15. Amount of current years credit applied (lesser of line 13 or line 14, or line 1).........

16. Total credit applied this year (Sum of lines 12 and 15)............................................

Continued on next page…

Form WV/AG-1 Page 1 of 4

Rev. 9/15