Enlarge image

West Virginia Schedule AFTC-1 West Virginia

AFTC-1 Alternative-Fuel Tax Credit State Tax

REV. 02/2020 (For periods AFTER January 1, 2015) Department

Taxpayer ID

Name Number

TAX PERIOD

BEGINNING ENDING

MM DD YYYY MM DD YYYY

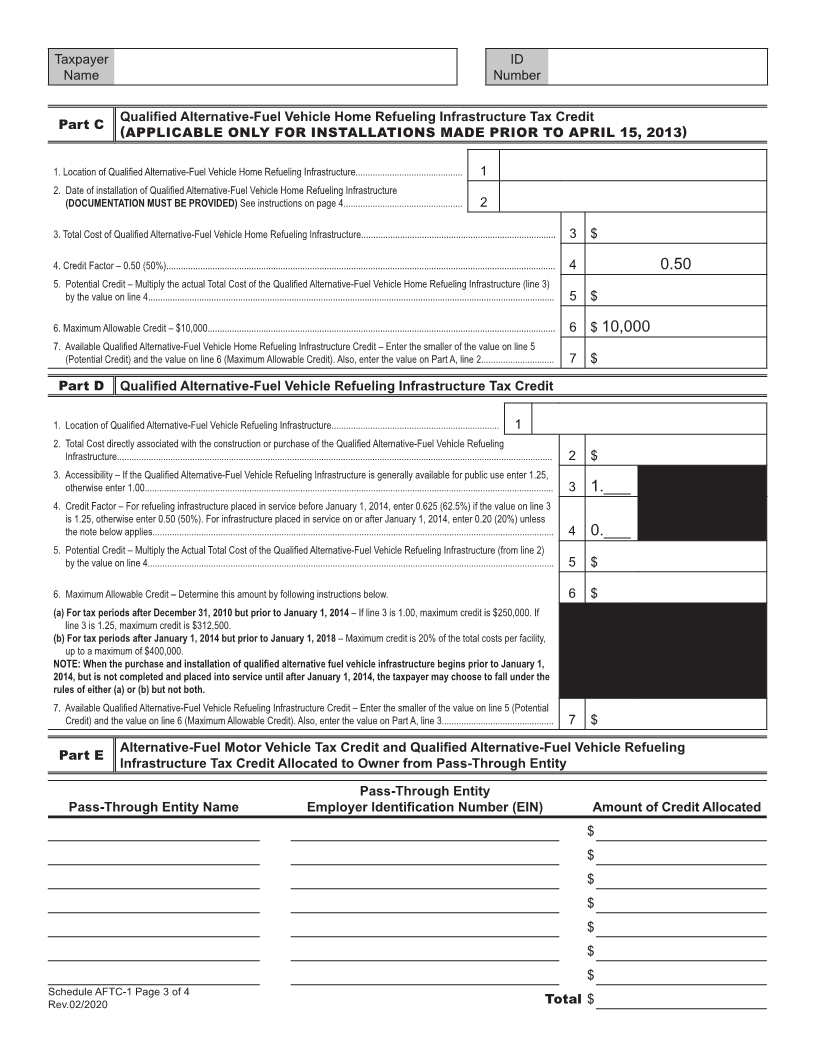

► Taxpayers desiring to claim the Alternative-Fuel Motor Vehicle Tax Credit must complete Parts A and B of this Schedule.

► Taxpayers desiring to claim the Quali fied Alternative-Fuel Vehicle Home Refueling Infrastructure Tax Credit must complete Parts A and C of the Schedule.

► Taxpayers desiring to claim the Quali fied Alternative-Fuel Vehicle Refueling Infrastructure Tax Credit must complete Parts A and D of this Schedule.

► An owner Taxpayer desiring to claim Alternative-Fuel Tax Credit allocated by a Pass-Through Entity subsidiary must complete Parts A and E of this Schedule.

Under penalties of perjury, I declare that I have examined this credit claim form (including accompanying schedules and

statements) and to the best of my knowledge it is true and complete.

Signature of Taxpayer Name of Taxpayer (type or print) Title Date

Person to contact concerning this return Telephone Number

Signature of Preparer other than Taxpayer Address Date

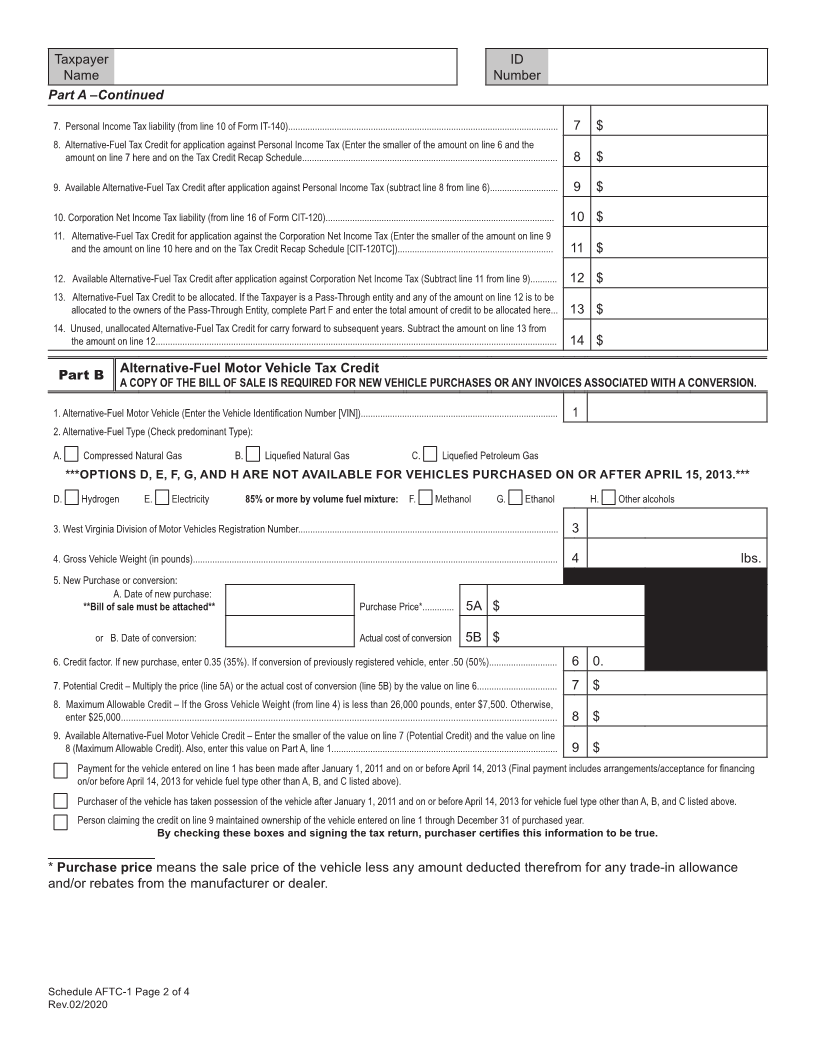

Part A Alternative-Fuel Tax Credit Summary

1. Current year Alternative-Fuel Motor Vehicle Credit from Part B, line 9 (Total if more than one qualifying vehicle). Amounts not

supported by Part B will be denied.................................................................................................................................................... 1$

2. Current year Quali fied Alternative-Fuel Vehicle Home Refueling Infrastructure Tax Credit from Part C, line 7. Amounts not

supported by Part C will be denied................................................................................................................................................... 2$

3. Current year Quali fied Alternative-Fuel Vehicle Refueling Infrastructure Tax Credit from Part D, line 6 (Total if more than one

qualifying refueling infrastructure). Amounts not supported by Part D will be denied........................................................................ 3$

4. Alternative-Fuel Motor Vehicle Tax Credit and Quali fied Alternative-Fuel Vehicle Refueling Infrastructure Tax Credit Allocated to the

Owner of a Pass-Through Entity that earned the credit as reported on Part E. Amounts not supported by Part E will be denied......... 4$

5. Unused, unallocated Alternative Fuel Tax Credit from prior years: 2015 $

2016 $

An amended tax return (2011 and/or 2012 IT-140, CIT-120, PTE-100 or IT-

140NRC) is required to claim previously unclaimed Alternative Fuel Tax 2017 $

Credits (AFTC). If the unclaimed AFTC is associated with previously 2018 $

un filed 2011 and/or 2012 tax returns, an original return is required for

the tax years claimed. Any and all supporting documentation must be 2019 $

present or the claim for credit will be denied.

2020 $

2021 $

Total 5$

6. Total Alternative-Fuel Tax Credit Available (add lines 1 through 5).................................................................................................... 6$

Continued on the next page…

Schedule AFTC-1 Page 1 of 4

Rev.02/2020