Enlarge image

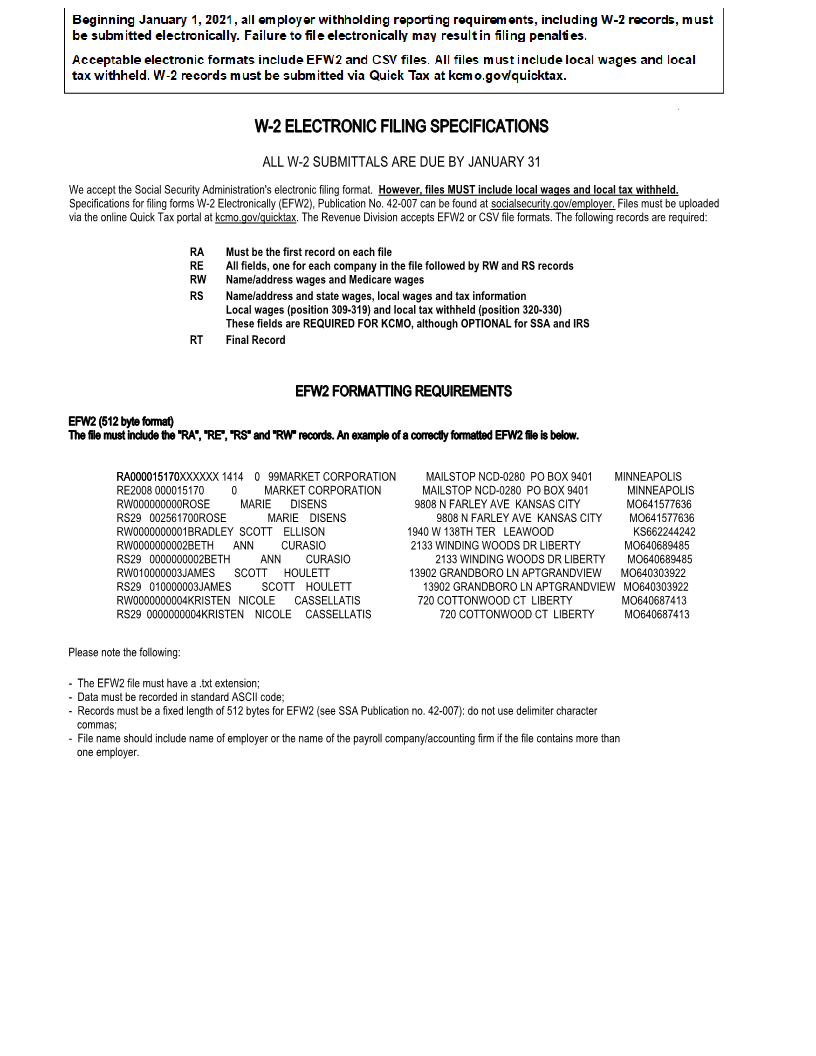

W-2 ELECTRONIC FILING SPECIFICATIONS ALL W-2 SUBMITTALS ARE DUE BY JANUARY 31 We accept the Social Security Administration's electronic filing format. However, files MUST include local wages and local tax withheld. Specifications for filing forms W-2 Electronically (EFW2), Publication No. 42-007 can be found at socialsecurity.gov/employer. Files must be uploaded via the online Quick Tax portal at kcmo.gov/quicktax. The Revenue Division accepts EFW2 or CSV file formats. The following records are required: RA Must be the first record on each file RE All fields, one for each company in the file followed by RW and RS records RW Name/address wages and Medicare wages RS Name/address and state wages, local wages and tax information Local wages (position 309-319) and local tax withheld (position 320-330) These fields are REQUIRED FOR KCMO, although OPTIONAL for SSA and IRS RT Final Record EFW2 FORMATTING REQUIREMENTS EFW2 (512 byte format) The file must include the "RA", "RE", "RS" and "RW" records. An example of a correctly formatted EFW2 file is below. RA000015170XXXXXXRA000015170 1414 0 99MARKET CORPORATION MAILSTOP NCD-0280 PO BOX 9401 MINNEAPOLIS RE2008 000015170 0 MARKET CORPORATION MAILSTOP NCD-0280 PO BOX 9401 MINNEAPOLIS RW000000000ROSE MARIE DISENS 9808 N FARLEY AVE KANSAS CITY MO641577636 RS29 002561700ROSE MARIE DISENS 9808 N FARLEY AVE KANSAS CITY MO641577636 RW0000000001BRADLEY SCOTT ELLISON 1940 W 138TH TER LEAWOOD KS662244242 RW0000000002BETH ANN CURASIO 2133 WINDING WOODS DR LIBERTY MO640689485 RS29 0000000002BETH ANN CURASIO 2133 WINDING WOODS DR LIBERTY MO640689485 RW010000003JAMES SCOTT HOULETT 13902 GRANDBORO LN APTGRANDVIEW MO640303922 RS29 010000003JAMES SCOTT HOULETT 13902 GRANDBORO LN APTGRANDVIEW MO640303922 RW0000000004KRISTEN NICOLE CASSELLATIS 720 COTTONWOOD CT LIBERTY MO640687413 RS29 0000000004KRISTEN NICOLE CASSELLATIS 720 COTTONWOOD CT LIBERTY MO640687413 Please note the following: - The EFW2 file must have a .txt extension; - Data must be recorded in standard ASCII code; - Records must be a fixed length of 512 bytes for EFW2 (see SSA Publication no. 42-007): do not use delimiter character commas; - File name should include name of employer or the name of the payroll company/accounting firm if the file contains more than one employer.