Enlarge image

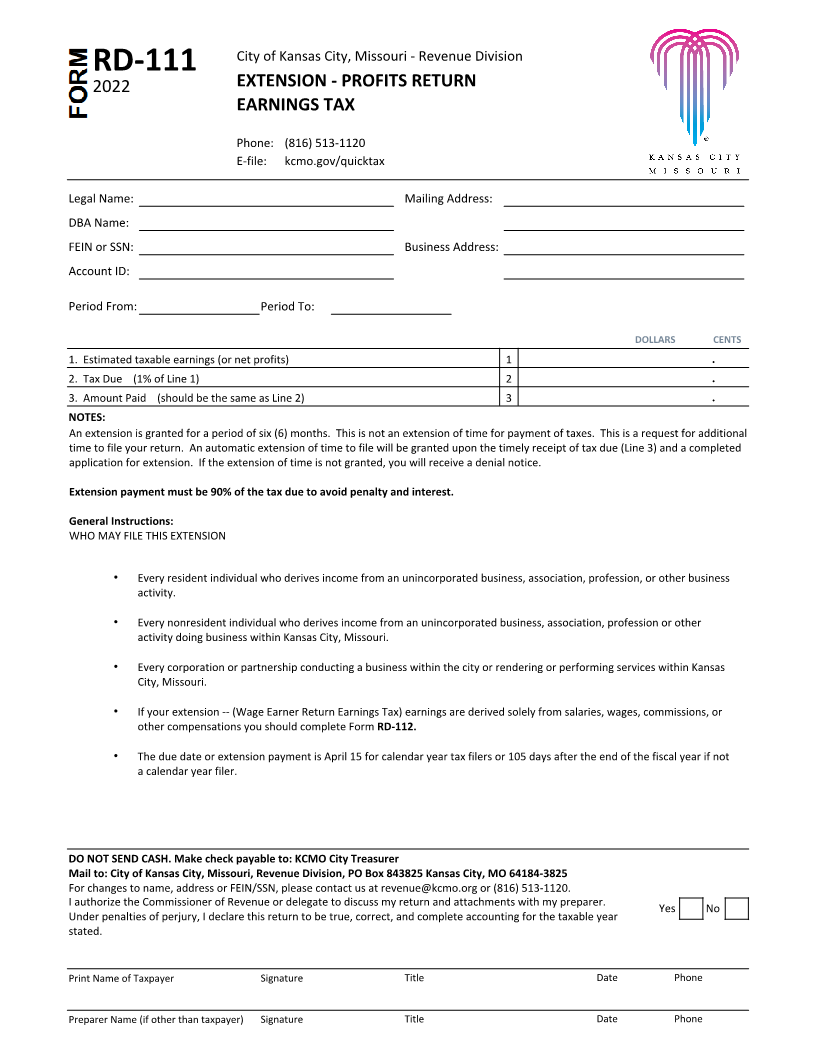

City of Kansas City, Missouri - Revenue Division

RD-111

2022 EXTENSION - PROFITS RETURN

EARNINGS TAX

Phone: (816) 513-1120

E-file: kcmo.gov/quicktax

Legal Name: Mailing Address:

DBA Name:

FEIN or SSN: Business Address:

Account ID:

Period From: Period To:

DOLLARS CENTS

1. Estimated taxable earnings (or net profits) 1 .

2. Tax Due (1% of Line 1) 2 .

3. Amount Paid (should be the same as Line 2) 3 .

NOTES:

An extension is granted for a period of six (6) months. This is not an extension of time for payment of taxes. This is a request for additional

time to file your return. An automatic extension of time to file will be granted upon the timely receipt of tax due (Line 3) and a completed

application for extension. If the extension of time is not granted, you will receive a denial notice.

Extension payment must be 90% of the tax due to avoid penalty and interest.

General Instructions:

WHO MAY FILE THIS EXTENSION

• Every resident individual who derives income from an unincorporated business, association, profession, or other business

activity.

• Every nonresident individual who derives income from an unincorporated business, association, profession or other

activity doing business within Kansas City, Missouri.

• Every corporation or partnership conducting a business within the city or rendering or performing services within Kansas

City, Missouri.

• If your extension -- (Wage Earner Return Earnings Tax) earnings are derived solely from salaries, wages, commissions, or

other compensations you should complete Form RD-112.

• The due date or extension payment is April 15 for calendar year tax filers or 105 days after the end of the fiscal year if not

a calendar year filer.

DO NOT SEND CASH. Make check payable to: KCMO City Treasurer

Mail to: City of Kansas City, Missouri, Revenue Division, PO Box 843825 Kansas City, MO 64184-3825

For changes to name, address or FEIN/SSN, please contact us at revenue@kcmo.org or (816) 513-1120.

I authorize the Commissioner of Revenue or delegate to discuss my return and attachments with my preparer. Yes No

Under penalties of perjury, I declare this return to be true, correct, and complete accounting for the taxable year

stated.

Print Name of Taxpayer Signature Title Date Phone

Preparer Name (if other than taxpayer) Signature Title Date Phone