Enlarge image

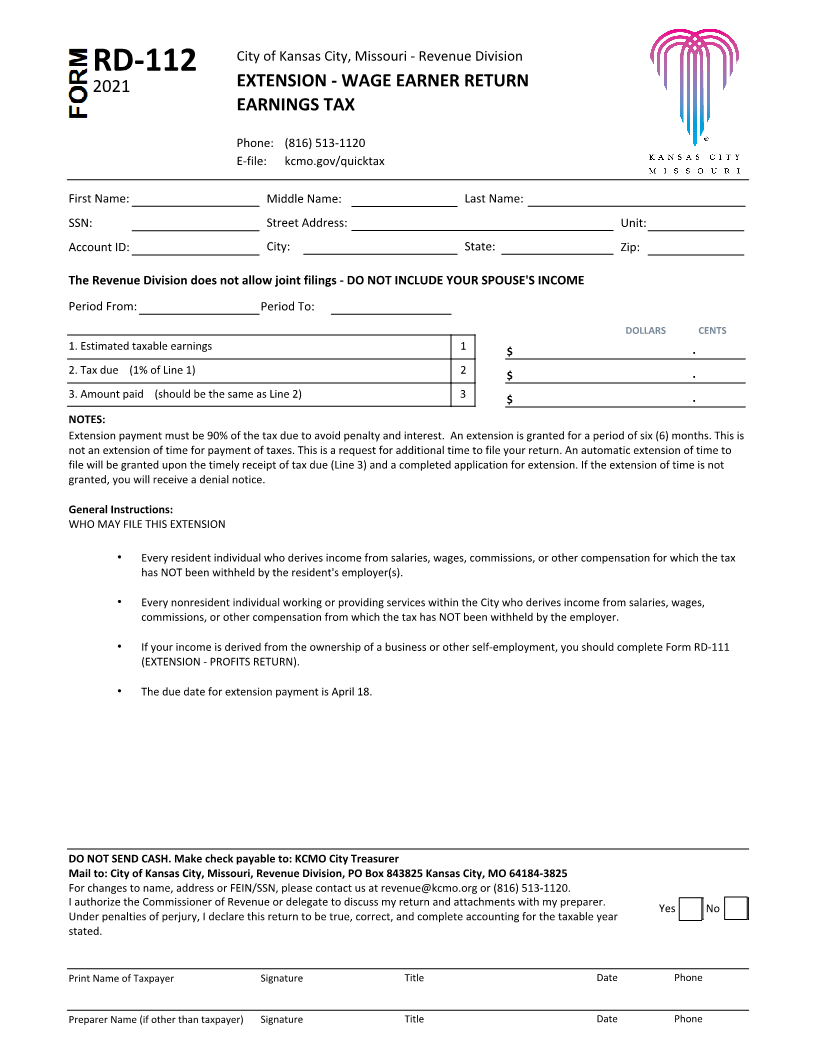

City of Kansas City, Missouri - Revenue Division

RD-112

EXTENSION - WAGE EARNER RETURN

2021

EARNINGS TAX

Phone: (816) 513-1120

E-file: kcmo.gov/quicktax

First Name: Middle Name: Last Name:

SSN: Street Address: Unit:

Account ID: City: State: Zip:

The Revenue Division does not allow joint filings - DO NOT INCLUDE YOUR SPOUSE'S INCOME

Period From: Period To:

DOLLARS CENTS

1. Estimated taxable earnings 1 $ .

2. Tax due (1% of Line 1) 2 $ .

3. Amount paid (should be the same as Line 2) 3 $ .

NOTES:

Extension payment must be 90% of the tax due to avoid penalty and interest. An extension is granted for a period of six (6) months. This is

not an extension of time for payment of taxes. This is a request for additional time to file your return. An automatic extension of time to

file will be granted upon the timely receipt of tax due (Line 3) and a completed application for extension. If the extension of time is not

granted, you will receive a denial notice.

General Instructions:

WHO MAY FILE THIS EXTENSION

• Every resident individual who derives income from salaries, wages, commissions, or other compensation for which the tax

has NOT been withheld by the resident's employer(s).

• Every nonresident individual working or providing services within the City who derives income from salaries, wages,

commissions, or other compensation from which the tax has NOT been withheld by the employer.

• If your income is derived from the ownership of a business or other self-employment, you should complete Form RD-111

(EXTENSION - PROFITS RETURN).

• The due date for extension payment is April 18.

DO NOT SEND CASH. Make check payable to: KCMO City Treasurer

Mail to: City of Kansas City, Missouri, Revenue Division, PO Box 843825 Kansas City, MO 64184-3825

For changes to name, address or FEIN/SSN, please contact us at revenue@kcmo.org or (816) 513-1120.

I authorize the Commissioner of Revenue or delegate to discuss my return and attachments with my preparer. Yes No

Under penalties of perjury, I declare this return to be true, correct, and complete accounting for the taxable year

stated.

Print Name of Taxpayer Signature Title Date Phone

Preparer Name (if other than taxpayer) Signature Title Date Phone