Enlarge image

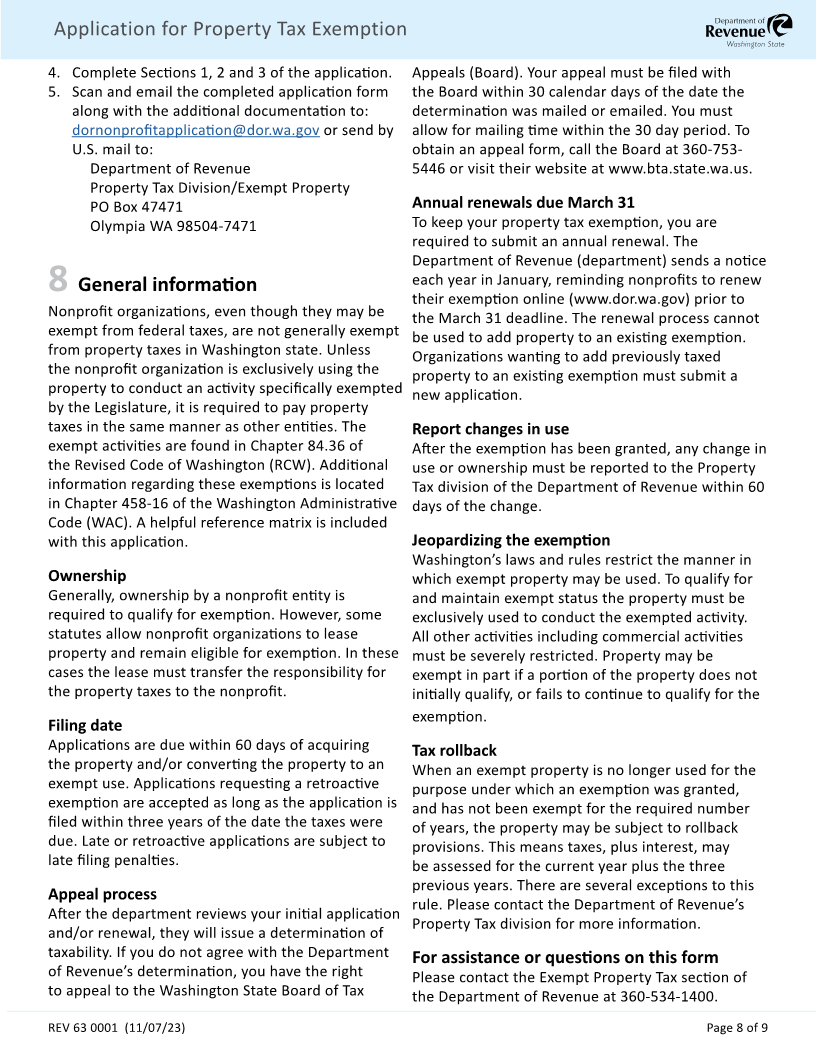

Application for Property Tax Exemption

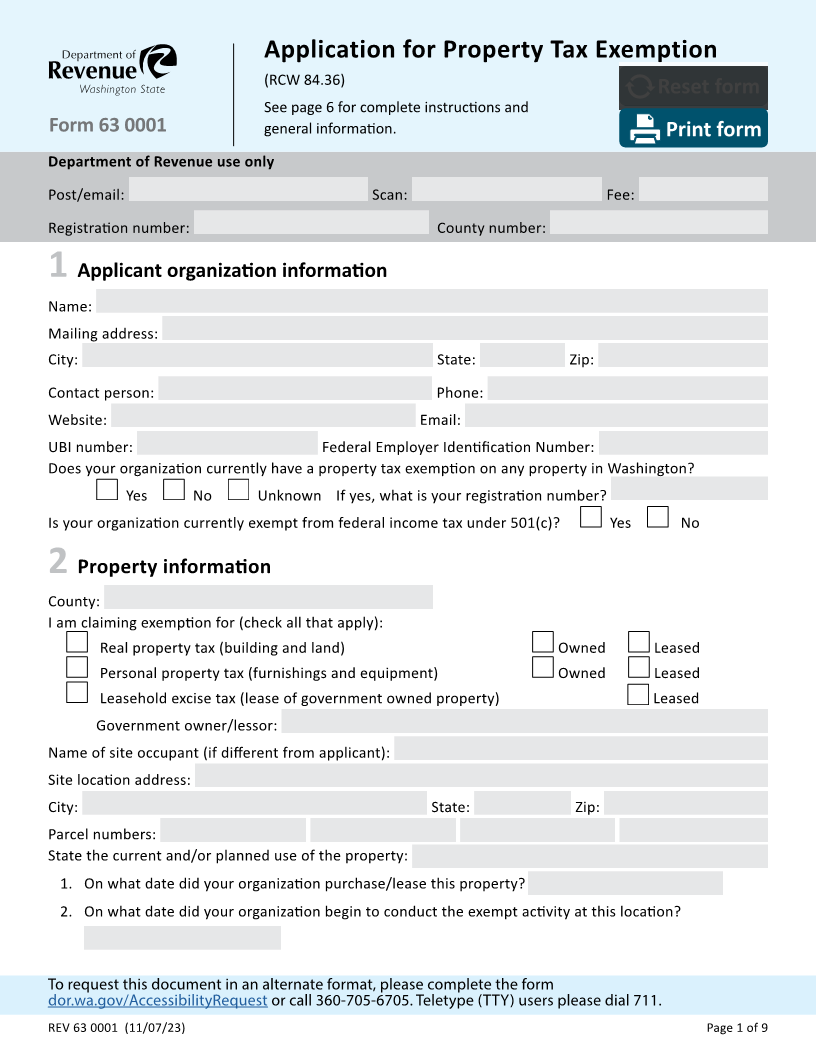

Application for Property Tax Exemption

(RCW 84.36)

Reset form

See page 6 for complete instructions and

Form 63 0001 general information. Print form

Department of Revenue use only

Post/email: Scan: Fee:

Registration number: County number:

1 Applicant organization information

Name:

Mailing address:

City: State: Zip:

Contact person: Phone:

Website: Email:

UBI number: Federal Employer Identification Number:

Does your organization currently have a property tax exemption on any property in Washington?

Yes No Unknown If yes, what is your registration number?

Is your organization currently exempt from federal income tax under 501(c)? Yes No

2 Property information

County:

I am claiming exemption for (check all that apply):

Real property tax (building and land) Owned Leased

Personal property tax (furnishings and equipment) Owned Leased

Leasehold excise tax (lease of government owned property) Leased

Government owner/lessor:

Name of site occupant (if different from applicant):

Site location address:

City: State: Zip:

Parcel numbers:

State the current and/or planned use of the property:

1. On what date did your organization purchase/lease this property?

2. On what date did your organization begin to conduct the exempt activity at this location?

To request this document in an alternate format, please complete the form

dor.wa.gov/AccessibilityRequest or call 360-705-6705. Teletype (TTY) users please dial 711.

REV 63 0001 (11/07/23) Page 1 of 9