Enlarge image

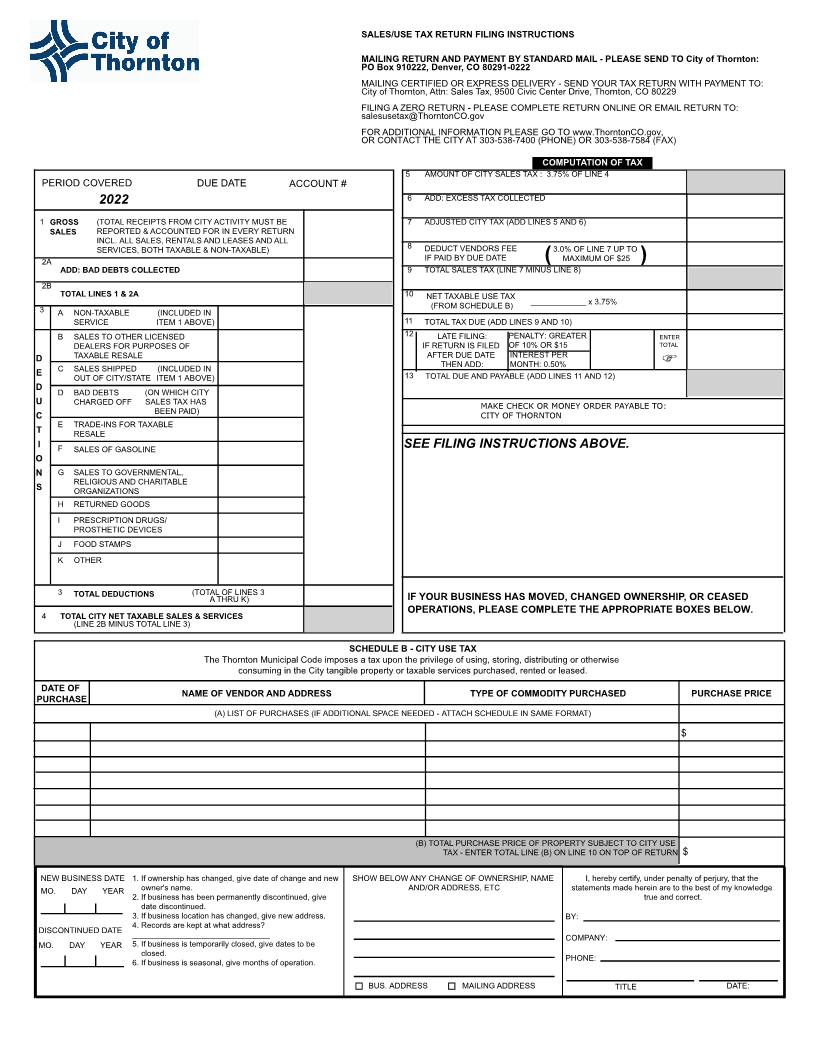

SALES/USE TAX RETURN FILING INSTRUCTIONS

MAILING RETURN AND PAYMENT BY STANDARD MAIL - PLEASE SEND TO City of Thornton:

PO Box 910222, Denver, CO 80291-0222

MAILING CERTIFIED OR EXPRESS DELIVERY - SEND YOUR TAX RETURN WITH PAYMENT TO:

City of Thornton, Attn: Sales Tax, 9500 Civic Center Drive, Thornton, CO 80229

FILING A ZERO RETURN - PLEASE COMPLETE RETURN ONLINE OR EMAIL RETURN TO:

salesusetax@ horntonT CO.gov

FOR ADDITIONAL INFORMATION PLEASE GO TO www. horntonT CO.gov,

OR CONTACT THE CITY AT 303-538-7400 (PHONE) OR 303-538-7584 (FAX)

COMPUTATION OF TAX

5 AMOUNT OF CITY SALES TAX : 3.75% OF LINE 4

PERIOD COVERED DUE DATE ACCOUNT #

2022 6 ADD: EXCESS TAX COLLECTED

1 GROSS (TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE 7 ADJUSTED CITY TAX (ADD LINES 5 AND 6)

SALES REPORTED & ACCOUNTED FOR IN EVERY RETURN

INCL. ALL SALES, RENTALS AND LEASES AND ALL 8

SERVICES, BOTH TAXABLE & NON-TAXABLE) DEDUCT VENDORS FEE 3.0% OF LINE 7 UP TO

2A IF PAID BY DUE DATE ( MAXIMUM OF $25 )

ADD: BAD DEBTS COLLECTED 9 TOTAL SALES TAX (LINE 7 MINUS LINE 8)

2B

TOTAL LINES 1 & 2A 10 NET TAXABLE USE TAX x 3.75%

(FROM SCHEDULE B)

3 A NON-TAXABLE (INCLUDED IN

SERVICE ITEM 1 ABOVE) 11 TOTAL TAX DUE (ADD LINES 9 AND 10)

B SALES TO OTHER LICENSED 12 LATE FILING: PENALTY: GREATER ENTER

DEALERS FOR PURPOSES OF IF RETURN IS FILED OF 10% OR $15 TOTAL

D TAXABLE RESALE AFTER DUE DATE INTEREST PER

E C SALES SHIPPED (INCLUDED IN THEN ADD: MONTH: 0.50% F

OUT OF CITY/STATE ITEM 1 ABOVE) 13 TOTAL DUE AND PAYABLE (ADD LINES 11 AND 12)

D D BAD DEBTS (ON WHICH CITY

U CHARGED OFF SALES TAX HAS MAKE CHECK OR MONEY ORDER PAYABLE TO:

C BEEN PAID) CITY OF THORNTON

T E TRADE-INS FOR TAXABLE

RESALE

I F SALES OF GASOLINE SEE FILING INSTRUCTIONS ABOVE.

O

N G SALES TO GOVERNMENTAL,

S RELIGIOUS AND CHARITABLE

ORGANIZATIONS

H RETURNED GOODS

I PRESCRIPTION DRUGS/

PROSTHETIC DEVICES

J FOOD STAMPS

K OTHER

3 TOTAL DEDUCTIONS (TOTAL OF LINES 3 IF YOUR BUSINESS HAS MOVED, CHANGED OWNERSHIP, OR CEASED

A THRU K)

4 TOTAL CITY NET TAXABLE SALES & SERVICES OPERATIONS, PLEASE COMPLETE THE APPROPRIATE BOXES BELOW.

(LINE 2B MINUS TOTAL LINE 3)

SCHEDULE B - CITY USE TAX

The Thornton Municipal Code imposes a tax upon the privilege of using, storing, distributing or otherwise

consuming in the City tangible property or taxable services purchased, rented or leased.

DATE OF NAME OF VENDOR AND ADDRESS TYPE OF COMMODITY PURCHASED PURCHASE PRICE

PURCHASE

(A) LIST OF PURCHASES (IF ADDITIONAL SPACE NEEDED - ATTACH SCHEDULE IN SAME FORMAT)

$

(B) TOTAL PURCHASE PRICE OF PROPERTY SUBJECT TO CITY USE

TAX - ENTER TOTAL LINE (B) ON LINE 10 ON TOP OF RETURN $

NEW BUSINESS DATE 1. If ownership has changed, give date of change and new SHOW BELOW ANY CHANGE OF OWNERSHIP, NAME I, hereby certify, under penalty of perjury, that the

MO. DAY YEAR owner's name. AND/OR ADDRESS, ETC statements made herein are to the best of my knowledge

2. If business has been permanently discontinued, give true and correct.

date discontinued.

3. If business location has changed, give new address. BY:

DISCONTINUED DATE 4. Records are kept at what address?

_______________________________ COMPANY:

MO. DAY YEAR 5. If business is temporarily closed, give dates to be

closed. PHONE:

6. If business is seasonal, give months of operation.

o BUS. ADDRESS o MAILING ADDRESS TITLE DATE: