Enlarge image

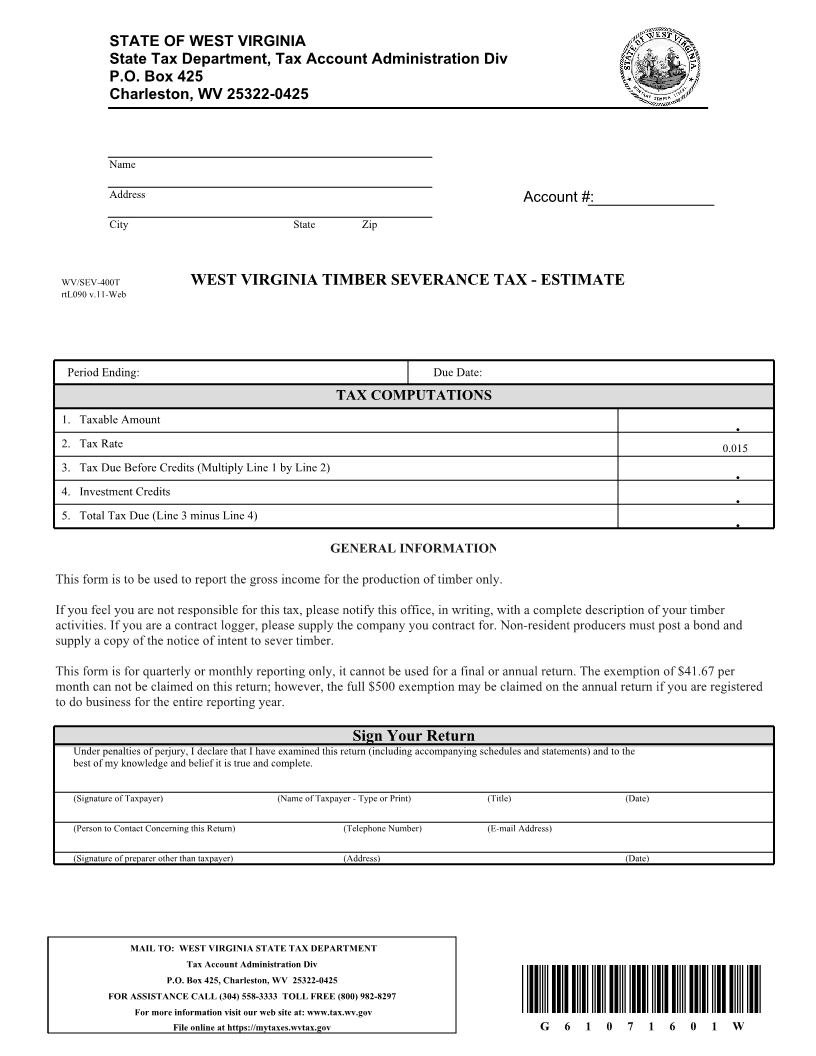

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address Account #:

City State Zip

WV/SEV-400T WEST VIRGINIA TIMBER SEVERANCE TAX - ESTIMATE

rtL090 v.11-Web

Period Ending: Due Date:

TAX COMPUTATIONS

1. Taxable Amount .

2. Tax Rate 0.015

3. Tax Due Before Credits (Multiply Line 1 by Line 2) .

4. Investment Credits .

5. Total Tax Due (Line 3 minus Line 4) .

GENERAL INFORMATION

This form is to be used to report the gross income for the production of timber only.

If you feel you are not responsible for this tax, please notify this office, in writing, with a complete description of your timber

activities. If you are a contract logger, please supply the company you contract for. Non-resident producers must post a bond and

supply a copy of the notice of intent to sever timber.

This form is for quarterly or monthly reporting only, it cannot be used for a final or annual return. The exemption of $41.67 per

month can not be claimed on this return; however, the full $500 exemption may be claimed on the annual return if you are registered

to do business for the entire reporting year.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

(Person to Contact Concerning this Return) (Telephone Number) (E-mail Address)

(Signature of preparer other than taxpayer) (Address) (Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov G 6 1 0 7 1 6 0 1 W