Enlarge image

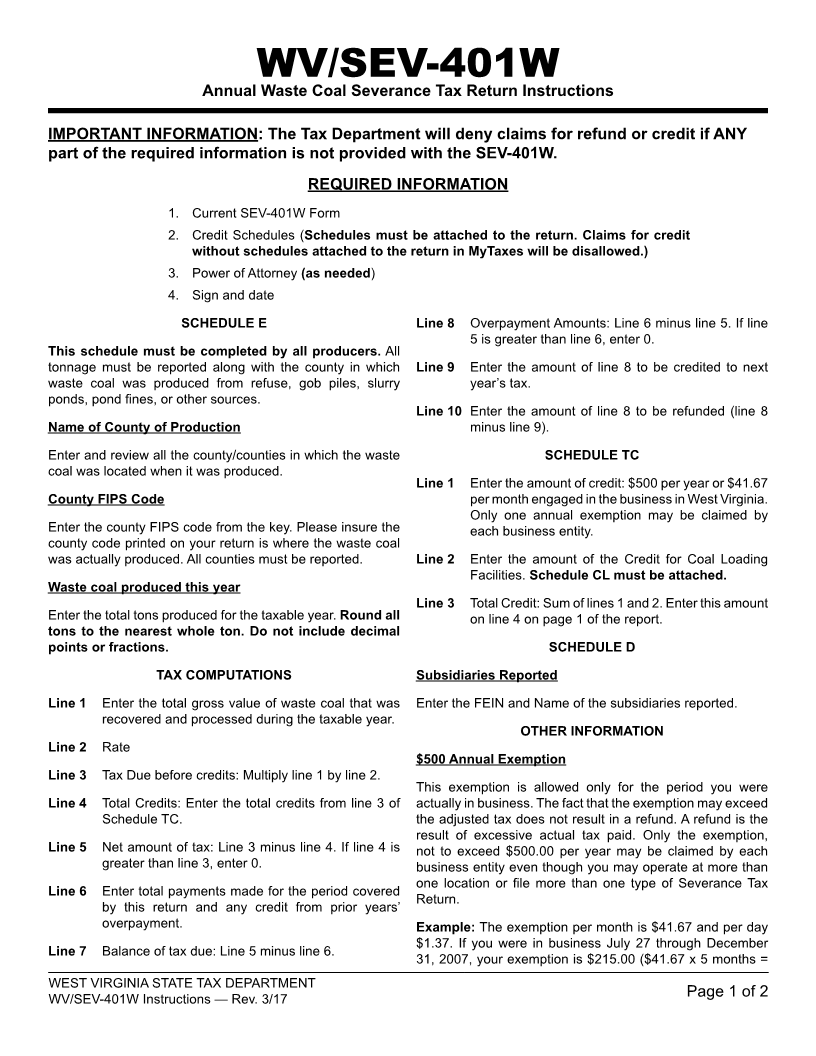

WV/SEV-401W

Annual Waste Coal Severance Tax Return Instructions

ImpoRTAnT InfoRmATIon: The Tax Department will deny claims for refund or credit if AnY

part of the required information is not provided with the SEV-401W.

REquIRED InfoRmATIon

1. Current seV-401W Form

2. Credit schedules (Schedules must be attached to the return. Claims for credit

without schedules attached to the return in myTaxes will be disallowed.)

3. power of attorney (as needed)

4. sign and date

SChEDulE E line 8 Overpayment amounts: Line 6 minus line 5. if line

5 is greater than line 6, enter 0.

This schedule must be completed by all producers. all

tonnage must be reported along with the county in which line 9 enter the amount of line 8 to be credited to next

waste coal was produced from refuse, gob piles, slurry year’s tax.

ponds, pond fines, or other sources.

line 10 enter the amount of line 8 to be refunded (line 8

name of County of production minus line 9).

enter and review all the county/counties in which the waste SChEDulE TC

coal was located when it was produced.

line 1 enter the amount of credit: $500 per year or $41.67

County fIpS Code per month engaged in the business in West Virginia.

Only one annual exemption may be claimed by

enter the county Fips code from the key. please insure the each business entity.

county code printed on your return is where the waste coal

was actually produced. all counties must be reported. line 2 enter the amount of the Credit for Coal Loading

Facilities. Schedule Cl must be attached.

Waste coal produced this year

line 3 total Credit: sum of lines 1 and 2. enter this amount

enter the total tons produced for the taxable year. Round all on line 4 on page 1 of the report.

tons to the nearest whole ton. Do not include decimal

points or fractions. SChEDulE D

TAx CompuTATIonS Subsidiaries Reported

line 1 enter the total gross value of waste coal that was enter the Fein and name of the subsidiaries reported.

recovered and processed during the taxable year.

oThER InfoRmATIon

line 2 rate

$500 Annual Exemption

line 3 tax Due before credits: multiply line 1 by line 2.

this exemption is allowed only for the period you were

line 4 total Credits: enter the total credits from line 3 of actually in business. the fact that the exemption may exceed

schedule tC. the adjusted tax does not result in a refund. a refund is the

result of excessive actual tax paid. Only the exemption,

line 5 net amount of tax: Line 3 minus line 4. if line 4 is not to exceed $500.00 per year may be claimed by each

greater than line 3, enter 0. business entity even though you may operate at more than

one location or file more than one type of Severance Tax

line 6 enter total payments made for the period covered

return.

by this return and any credit from prior years’

overpayment. Example: the exemption per month is $41.67 and per day

$1.37. if you were in business July 27 through December

line 7 Balance of tax due: Line 5 minus line 6.

31, 2007, your exemption is $215.00 ($41.67 x 5 months =

West Virginia state tax Department

WV/seV-401W instructions — rev. 3/17 page 1 of 2