Enlarge image

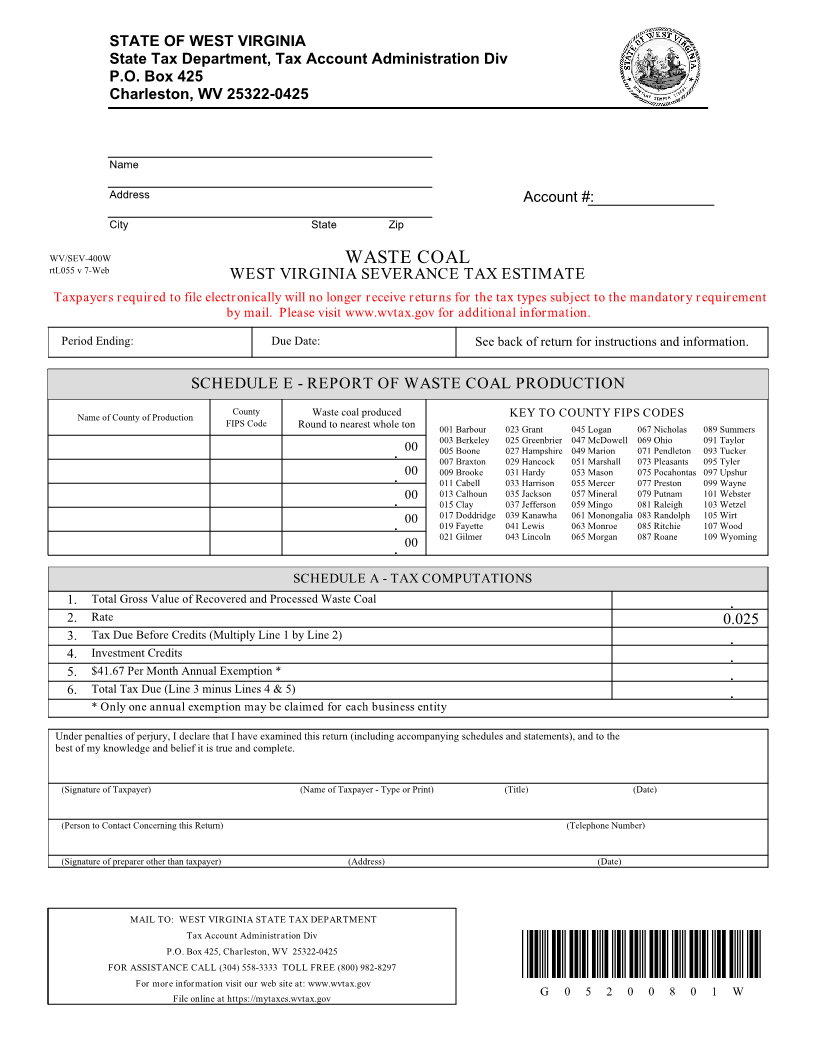

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address Account #:

City State Zip

WV/SEV-400W WASTE COAL

rtL055 v7-Web WEST VIRGINIA SEVERANCE TAX ESTIMATE

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement

by mail. Please visit www.wvtax.gov for additional information.

Period Ending: Due Date: See back of return for instructions and information.

SCHEDULE E - REPORT OF WASTE COAL PRODUCTION

Name of County of Production County Waste coal produced KEY TO COUNTY FIPS CODES

FIPS Code Round to nearest whole ton 001 Barbour 023 Grant 045 Logan 067 Nicholas 089 Summers

003 Berkeley 025 Greenbrier 047 McDowell 069 Ohio 091 Taylor

. 00 005 Boone 027 Hampshire 049 Marion 071 Pendleton 093 Tucker

007 Braxton 029 Hancock 051 Marshall 073 Pleasants 095 Tyler

. 00 009 Brooke 031 Hardy 053 Mason 075 Pocahontas 097 Upshur

011 Cabell 033 Harrison 055 Mercer 077 Preston 099 Wayne

. 00 013 Calhoun 035 Jackson 057 Mineral 079 Putnam 101 Webster

015 Clay 037 Jefferson 059 Mingo 081 Raleigh 103 Wetzel

. 00 017 Doddridge 039 Kanawha 061 Monongalia 083 Randolph 105 Wirt

019 Fayette 041 Lewis 063 Monroe 085 Ritchie 107 Wood

. 00 021 Gilmer 043 Lincoln 065 Morgan 087 Roane 109 Wyoming

SCHEDULE A - TAX COMPUTATIONS

1. Total Gross Value of Recovered and Processed Waste Coal .

2. Rate 0.025

3. Tax Due Before Credits (Multiply Line 1 by Line 2) .

4. Investment Credits .

5. $41.67 Per Month Annual Exemption * .

6. Total Tax Due (Line 3 minus Lines 4 & 5) .

* Only one annual exemption may be claimed for each business entity

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements), and to the

best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

(Person to Contact Concerning this Return) (Telephone Number)

(Signature of preparer other than taxpayer) (Address) (Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.wvtax.gov

G 0 5 2 0 0 8 0 1 W

File online at https://mytaxes.wvtax.gov