Enlarge image

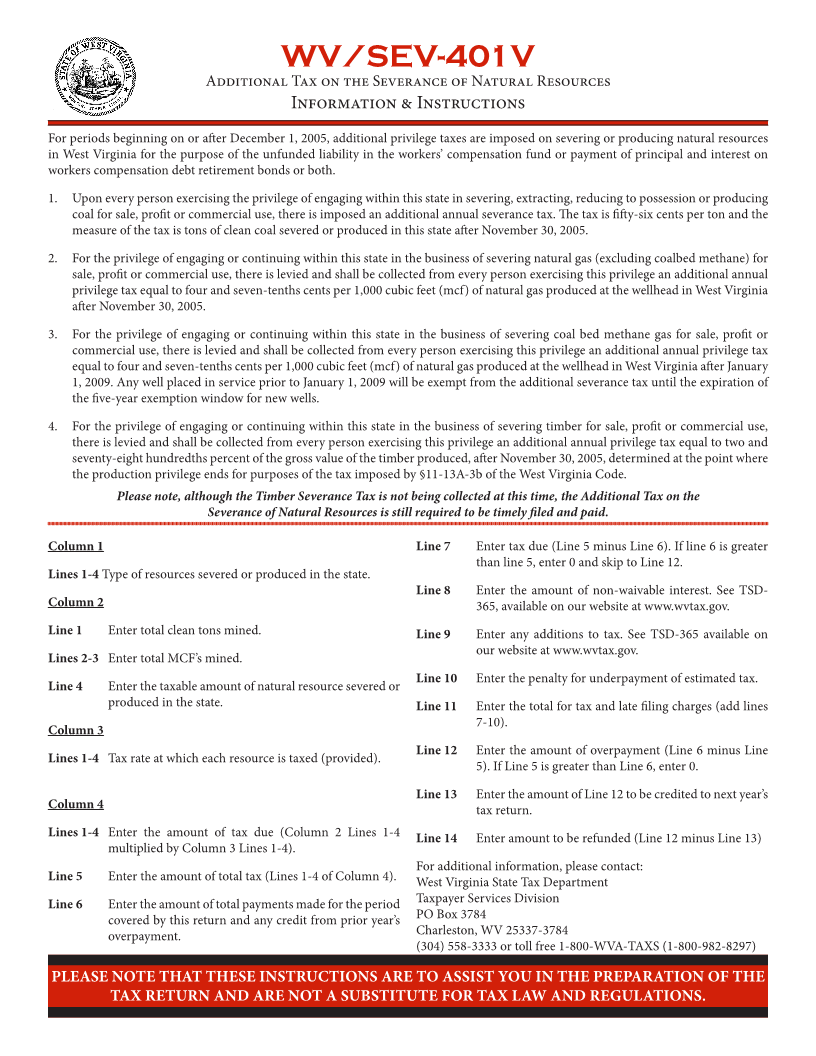

WV/SEV-401V

Additional Tax on the Severance of Natural Resources

Information & Instructions

For periods beginning on or after December 1, 2005, additional privilege taxes are imposed on severing or producing natural resources

in West Virginia for the purpose of the unfunded liability in the workers’ compensation fund or payment of principal and interest on

workers compensation debt retirement bonds or both.

1. Upon every person exercising the privilege of engaging within this state in severing, extracting, reducing to possession or producing

coal for sale, profit or commercial use, there is imposed an additional annual severance tax. The tax is fifty-six cents per ton and the

measure of the tax is tons of clean coal severed or produced in this state after November 30, 2005.

2. For the privilege of engaging or continuing within this state in the business of severing natural gas (excluding coalbed methane) for

sale, profit or commercial use, there is levied and shall be collected from every person exercising this privilege an additional annual

privilege tax equal to four and seven-tenths cents per 1,000 cubic feet (mcf) of natural gas produced at the wellhead in West Virginia

after November 30, 2005.

3. For the privilege of engaging or continuing within this state in the business of severing coal bed methane gas for sale, profit or

commercial use, there is levied and shall be collected from every person exercising this privilege an additional annual privilege tax

equal to four and seven-tenths cents per 1,000 cubic feet (mcf) of natural gas produced at the wellhead in West Virginia after January

1, 2009. Any well placed in service prior to January 1, 2009 will be exempt from the additional severance tax until the expiration of

the five-year exemption window for new wells.

4. For the privilege of engaging or continuing within this state in the business of severing timber for sale, profit or commercial use,

there is levied and shall be collected from every person exercising this privilege an additional annual privilege tax equal to two and

seventy-eight hundredths percent of the gross value of the timber produced, after November 30, 2005, determined at the point where

the production privilege ends for purposes of the tax imposed by §11-13A-3b of the West Virginia Code.

Please note, although the Timber Severance Tax is not being collected at this time, the Additional Tax on the

Severance of Natural Resources is still required to be timely filed and paid.

Column 1 Line 7 Enter tax due (Line 5 minus Line 6). If line 6 is greater

than line 5, enter 0 and skip to Line 12.

Lines 1-4 Type of resources severed or produced in the state.

Line 8 Enter the amount of non-waivable interest. See TSD-

Column 2 365, available on our website at www.wvtax.gov.

Line 1 Enter total clean tons mined. Line 9 Enter any additions to tax. See TSD-365 available on

our website at www.wvtax.gov.

Lines 2-3 Enter total MCF’s mined.

Line 10 Enter the penalty for underpayment of estimated tax.

Line 4 Enter the taxable amount of natural resource severed or

produced in the state. Line 11 Enter the total for tax and late filing charges (add lines

7-10).

Column 3

Line 12 Enter the amount of overpayment (Line 6 minus Line

Lines 1-4 Tax rate at which each resource is taxed (provided).

5). If Line 5 is greater than Line 6, enter 0.

Line 13 Enter the amount of Line 12 to be credited to next year’s

Column 4 tax return.

Lines 1-4 Enter the amount of tax due (Column 2 Lines 1-4 Line 14 Enter amount to be refunded (Line 12 minus Line 13)

multiplied by Column 3 Lines 1-4).

For additional information, please contact:

Line 5 Enter the amount of total tax (Lines 1-4 of Column 4). West Virginia State Tax Department

Line 6 Enter the amount of total payments made for the period Taxpayer Services Division

covered by this return and any credit from prior year’s PO Box 3784

overpayment. Charleston, WV 25337-3784

(304) 558-3333 or toll free 1-800-WVA-TAXS (1-800-982-8297)

PLEASE NOTE THAT THESE INSTRUCTIONS ARE TO ASSIST YOU IN THE PREPARATION OF THE

TAX RETURN AND ARE NOT A SUBSTITUTE FOR TAX LAW AND REGULATIONS.