Enlarge image

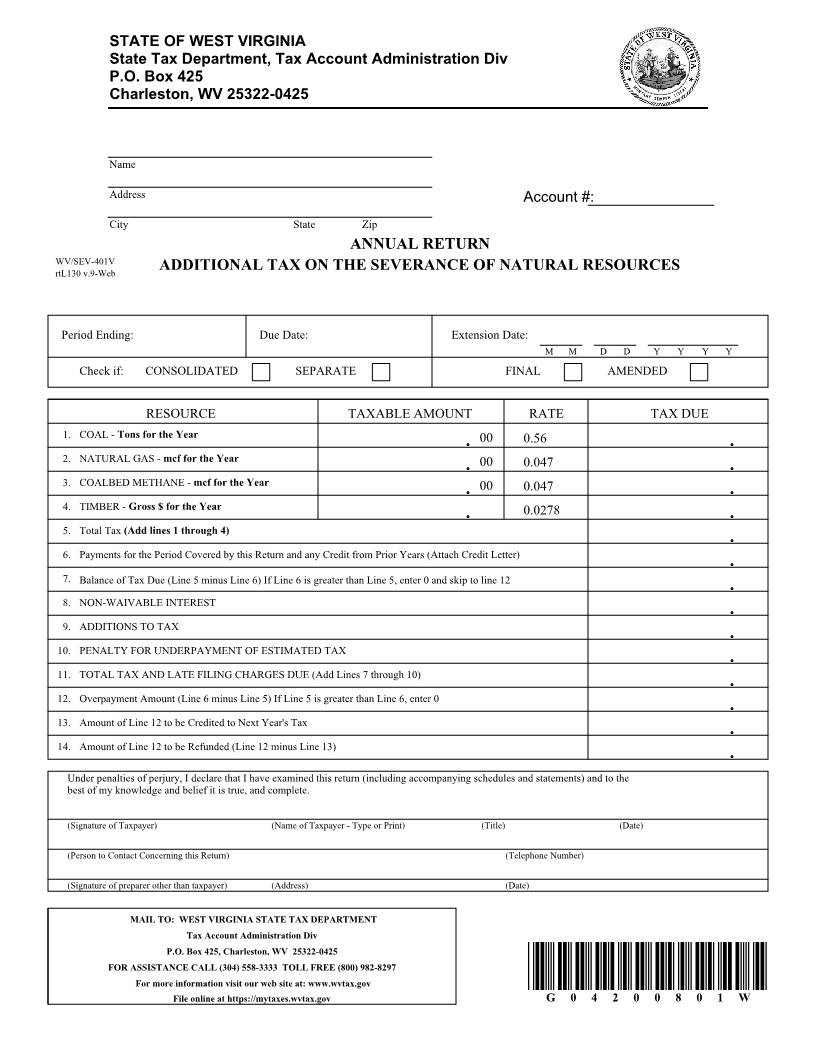

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address Account #:

City State Zip

ANNUAL RETURN

WV/SEV-401V ADDITIONAL TAX ON THE SEVERANCE OF NATURAL RESOURCES

rtL130 v.9-Web

Period Ending: Due Date: Extension Date:

M M D D Y Y Y Y

Check if: CONSOLIDATED SEPARATE FINAL AMENDED

RESOURCE TAXABLE AMOUNT RATE TAX DUE

1. COAL - Tons for the Year . 00 0.56 .

2. NATURAL GAS - mcf for the Year . 00 0.047 .

3. COALBED METHANE - mcf for the Year . 00 0.047 .

4. TIMBER - Gross $ for the Year . 0.0278 .

5. Total Tax (Add lines 1 through 4) .

6. Payments for the Period Covered by this Return and any Credit from Prior Years (Attach Credit Letter) .

7. Balance of Tax Due (Line 5 minus Line 6) If Line 6 is greater than Line 5, enter 0 and skip to line 12 .

8. NON-WAIVABLE INTEREST .

9. ADDITIONS TO TAX .

10. PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX .

11. TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 7 through 10) .

12. Overpayment Amount (Line 6 minus Line 5) If Line 5 is greater than Line 6, enter 0 .

13. Amount of Line 12 to be Credited to Next Year's Tax .

14. Amount of Line 12 to be Refunded (Line 12 minus Line 13) .

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer) (Name of Taxpayer - Type or Print) (Title) (Date)

(Person to Contact Concerning this Return) (Telephone Number)

(Signature of preparer other than taxpayer) (Address) (Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.wvtax.gov

File online at https://mytaxes.wvtax.gov G 0 4 2 0 0 8 0 1 W