Enlarge image

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

_____________________________________________________________

TESTName CUSTOMER Letter Id: L1469374464

1001_____________________________________________________________ LEE ST E Issued: 10/09/2020

AddressCHARLESTON WV 25301-1725 Account #: 2276-2396

_____________________________________________________________ Period: 12/31/2020

City State Zip

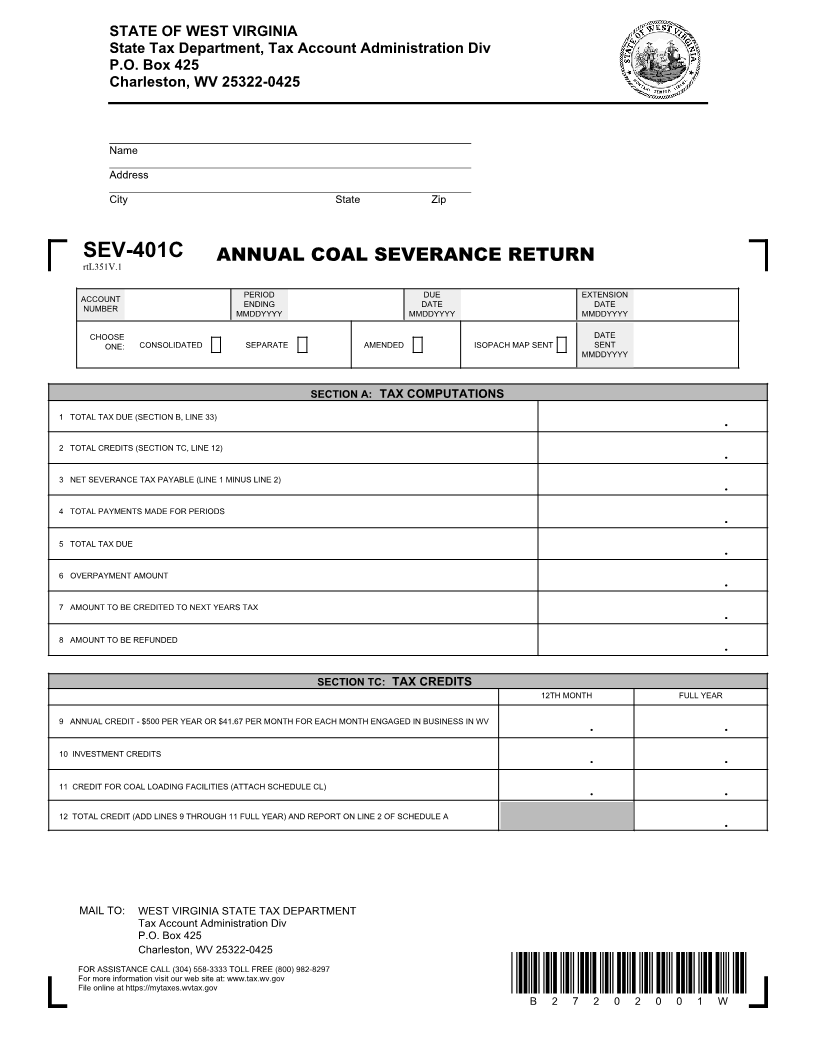

SEV-401C ANNUAL COAL SEVERANCE RETURN

rtL351V.1

ACCOUNT PERIOD DUE EXTENSION

NUMBER ENDING DATE DATE

MMDDYYYY MMDDYYYY MMDDYYYY

CHOOSE DATE

ONE: CONSOLIDATED SEPARATE AMENDED ISOPACH MAP SENT SENT

MMDDYYYY

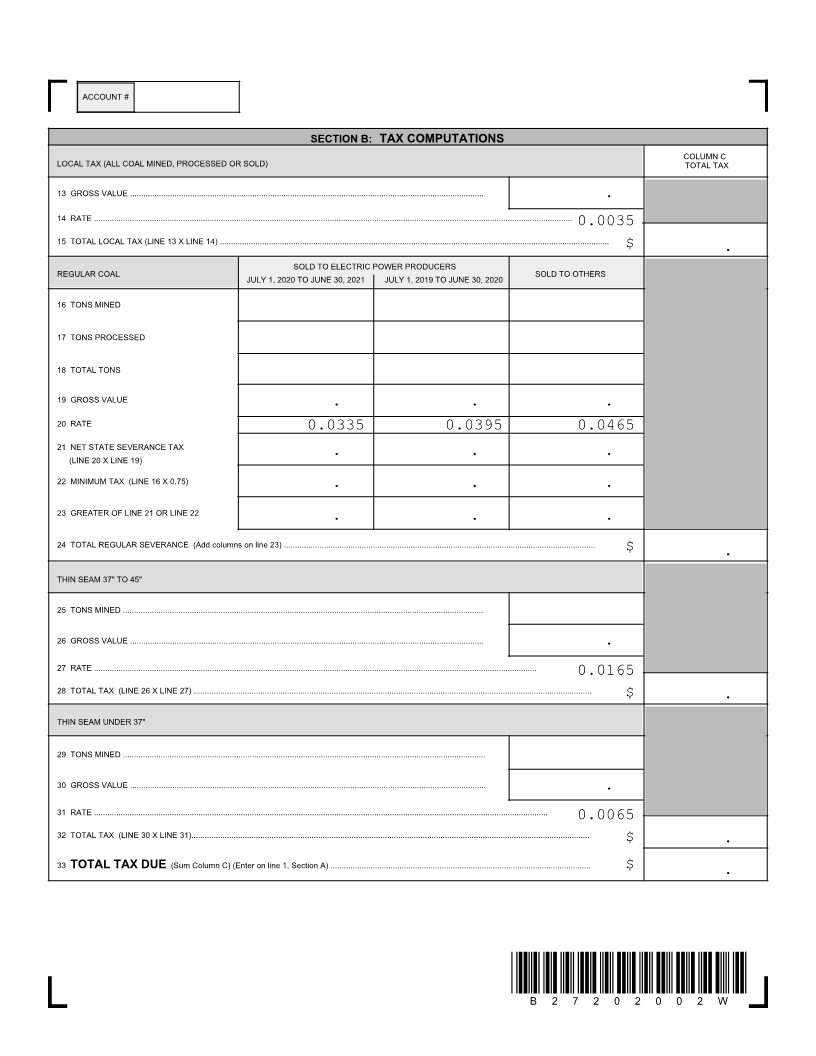

SECTION A: TAX COMPUTATIONS

1 TOTAL TAX DUE (SECTION B, LINE 33)

.

2 TOTAL CREDITS (SECTION TC, LINE 12)

.

3 NET SEVERANCE TAX PAYABLE (LINE 1 MINUS LINE 2)

.

4 TOTAL PAYMENTS MADE FOR PERIODS

.

5 TOTAL TAX DUE

.

6 OVERPAYMENT AMOUNT

.

7 AMOUNT TO BE CREDITED TO NEXT YEARS TAX

.

8 AMOUNT TO BE REFUNDED

.

SECTION TC: TAX CREDITS

12TH MONTH FULL YEAR

9 ANNUAL CREDIT - $500 PER YEAR OR $41.67 PER MONTH FOR EACH MONTH ENGAGED IN BUSINESS IN WV

. .

10 INVESTMENT CREDITS

. .

11 CREDIT FOR COAL LOADING FACILITIES (ATTACH SCHEDULE CL)

. .

12 TOTAL CREDIT (ADD LINES 9 THROUGH 11 FULL YEAR) AND REPORT ON LINE 2 OF SCHEDULE A

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

B 2 7 2 0 2 0 0 1 W