Enlarge image

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

_____________________________________________________________

BAILEYName #2 / COLEMAN #3 GROUP Letter Id: L1743411744

270_____________________________________________________________ SARVIS FORK RD Issued: 06/28/2021

AddressSANDYVILLE WV 25275-9718 Account #: 2213-7083

_____________________________________________________________ Period: 12/31/2021

City State Zip

SEV-401REV 05/2020 WEST VIRGINIA SEVERANCE TAX ANNUAL RETURN

ACCOUNT PERIOD DUE EXTENSION

NUMBER ENDING DATE DATE

MMDDYYYY MMDDYYYY MMDDYYYY

FINAL AMENDED SEPARATE CONSOLIDATED

BEFORE YOU COMPLETE THIS PAGE, YOU MUST COMPLETE THE SUPPORTING SCHEDULES.

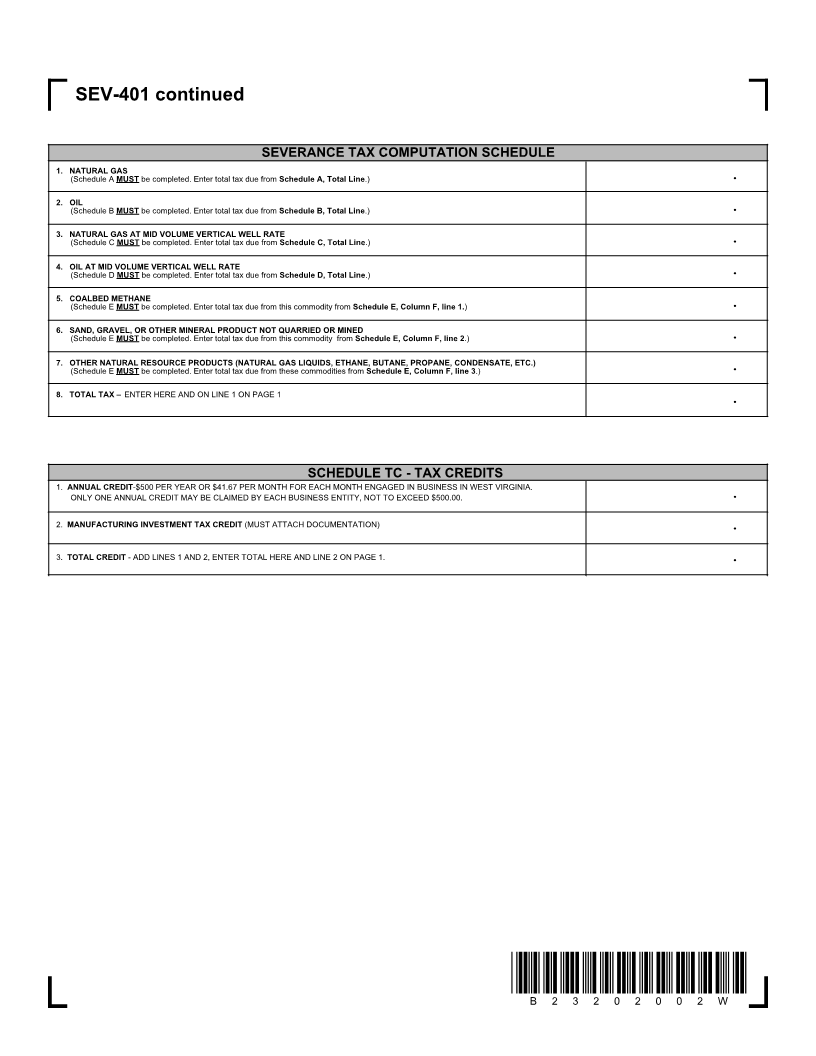

TAX CALCULATION

1. TOTAL TAX (PAGE 2, SEVERANCE TAX COMPUTATION SCHEDULE, LINE 8) .

2. TOTAL CREDITS (PAGE 2, SCHEDULE TC, LINE 3) .

3. ADJUSTED TAX (LINE 1 MINUS LINE 2) IF LINE 2 IS GREATER THAN LINE 1, ENTER 0 .

4. TOTAL PAYMENTS MADE FOR THE PERIOD COVERED BY THIS RETURN AND ANY CREDIT FROM PRIOR YEARS OVERPAYMENT .

5. BALANCE OF TAX DUE (LINE 3 MINUS LINE 4)

IF LINE 4 IS GREATER THAN LINE 3 ENTER 0, AND ENTER AMOUNT OVERPAID ON LINE 6. .

6. OVERPAYMENT AMOUNT (LINE 4 MINUS LINE 3) IF LINE 3 IS GREATER THAN LINE 4, ENTER 0 .

7. AMOUNT OF LINE 6 TO BE CREDITED TO NEXT YEAR’S TAX .

8. AMOUNT OF LINE 6 TO BE REFUNDED (LINE 6 MINUS LINE 7) .

SIGNATURE

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE

BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE AND COMPLETE.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (TYPE OR PRINT) TITLE DATE

CONTACT TELEPHONE NUMBER

SIGNATURE OF PREPARER OTHER THAN TAXPAYER ADDRESS DATE

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

B 2 3 2 0 2 0 0 1 W