Enlarge image

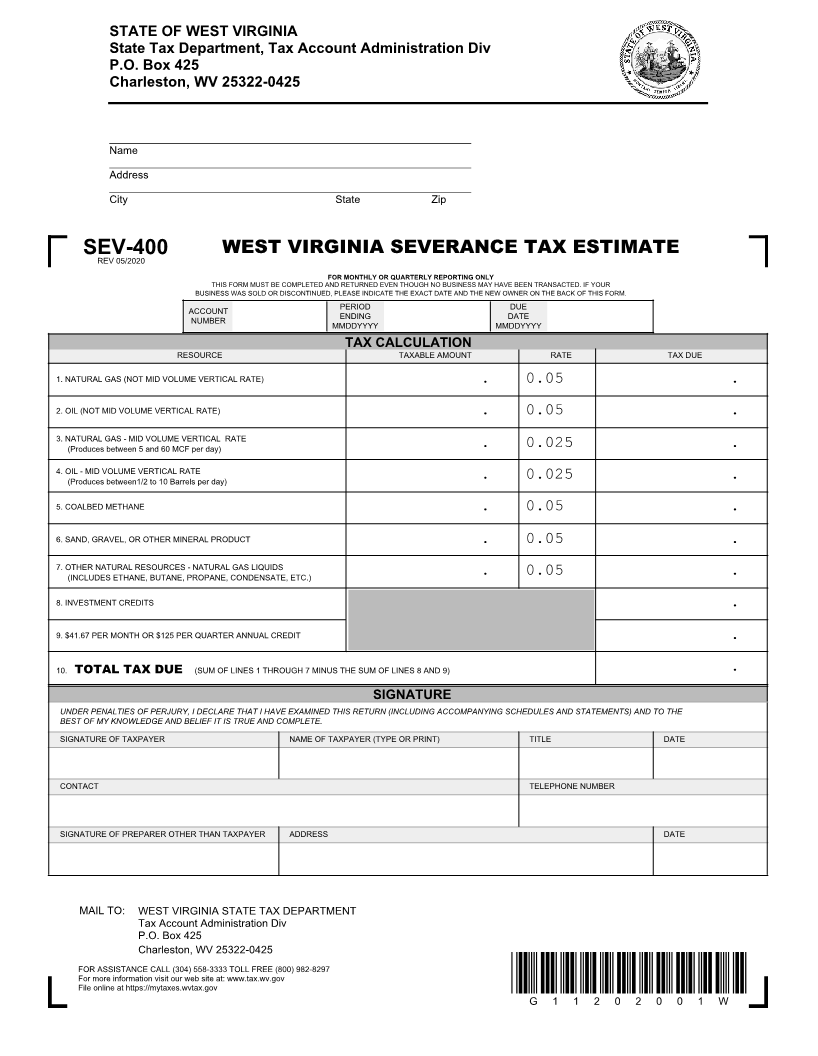

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

_____________________________________________________________

NameTEST CORPORATION 1 Letter Id: L1184948224

1001_____________________________________________________________ LEE ST E Issued: 10/07/2020

AddressCHARLESTON WV 25301-1725 Account #: 2275-4088

_____________________________________________________________ Period: 01/31/2021

City State Zip

SEV-400REV 05/2020 WEST VIRGINIA SEVERANCE TAX ESTIMATE

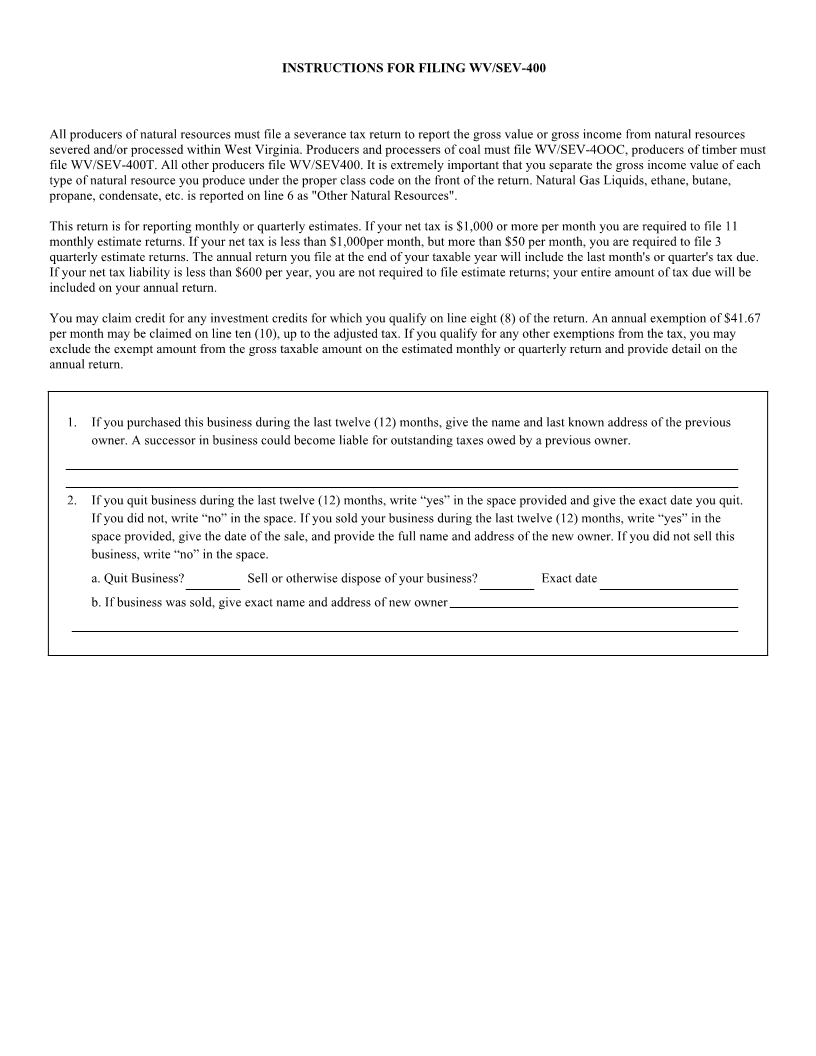

FOR MONTHLY OR QUARTERLY REPORTING ONLY

THIS FORM MUST BE COMPLETED AND RETURNED EVEN THOUGH NO BUSINESS MAY HAVE BEEN TRANSACTED. IF YOUR

BUSINESS WAS SOLD OR DISCONTINUED, PLEASE INDICATE THE EXACT DATE AND THE NEW OWNER ON THE BACK OF THIS FORM.

ACCOUNT PERIOD DUE

NUMBER ENDING DATE

MMDDYYYY MMDDYYYY

TAX CALCULATION

RESOURCE TAXABLE AMOUNT RATE TAX DUE

1. NATURAL GAS (NOT MID VOLUME VERTICAL RATE) . 0.05 .

2. OIL (NOT MID VOLUME VERTICAL RATE) . 0.05 .

3. NATURAL GAS - MID VOLUME VERTICAL RATE

(Produces between 5 and 60 MCF per day) . 0.025 .

4. OIL - MID VOLUME VERTICAL RATE(Produces between1/2 to 10 Barrels per day) . 0.025 .

5. COALBED METHANE . 0.05 .

6. SAND, GRAVEL, OR OTHER MINERAL PRODUCT . 0.05 .

7. OTHER NATURAL RESOURCES - NATURAL GAS LIQUIDS . 0.05 .

(INCLUDES ETHANE, BUTANE, PROPANE, CONDENSATE, ETC.)

8. INVESTMENT CREDITS .

9. $41.67 PER MONTH OR $125 PER QUARTER ANNUAL CREDIT .

10. TOTAL TAX DUE (SUM OF LINES 1 THROUGH 7 MINUS THE SUM OF LINES 8 AND 9) .

SIGNATURE

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE

BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE AND COMPLETE.

SIGNATURE OF TAXPAYER NAME OF TAXPAYER (TYPE OR PRINT) TITLE DATE

CONTACT TELEPHONE NUMBER

SIGNATURE OF PREPARER OTHER THAN TAXPAYER ADDRESS DATE

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

G 1 1 2 0 2 0 0 1 W