Enlarge image

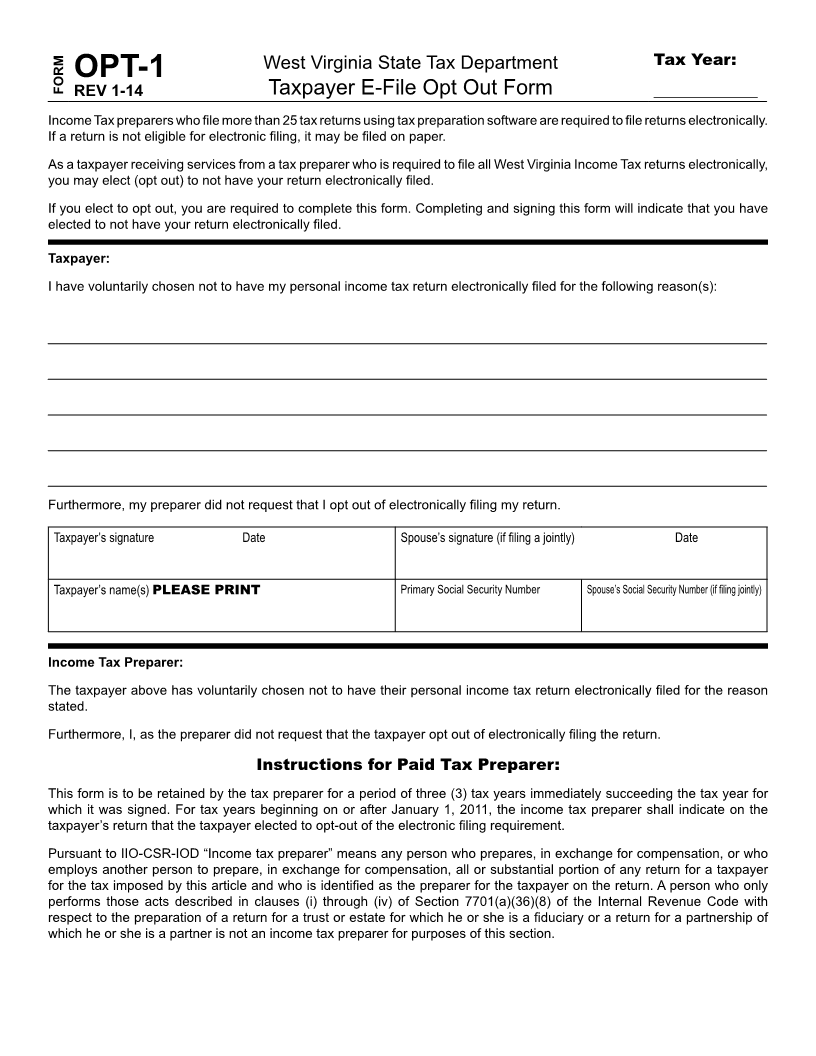

West Virginia State Tax Department Tax Year:

FORM OPT-1

REV 1-14 Taxpayer E-File Opt Out Form _____________

Income Tax preparers who file more than 25 tax returns using tax preparation software are required to file returns electronically.

If a return is not eligible for electronic filing, it may be filed on paper.

As a taxpayer receiving services from a tax preparer who is required to file all West Virginia Income Tax returns electronically,

you may elect (opt out) to not have your return electronically filed.

If you elect to opt out, you are required to complete this form. Completing and signing this form will indicate that you have

elected to not have your return electronically filed.

Taxpayer:

I have voluntarily chosen not to have my personal income tax return electronically filed for the following reason(s):

Furthermore, my preparer did not request that I opt out of electronically filing my return.

Taxpayer’s signature Date Spouse’s signature (if filing a jointly) Date

Taxpayer’s name(s) please prinT Primary Social Security Number Spouse’s Social Security Number (if filing jointly)

Income Tax Preparer:

The taxpayer above has voluntarily chosen not to have their personal income tax return electronically filed for the reason

stated.

Furthermore, I, as the preparer did not request that the taxpayer opt out of electronically filing the return.

instructions for paid Tax preparer:

This form is to be retained by the tax preparer for a period of three (3) tax years immediately succeeding the tax year for

which it was signed. For tax years beginning on or after January 1, 2011, the income tax preparer shall indicate on the

taxpayer’s return that the taxpayer elected to opt-out of the electronic filing requirement.

Pursuant to IIO-CSR-IOD “Income tax preparer” means any person who prepares, in exchange for compensation, or who

employs another person to prepare, in exchange for compensation, all or substantial portion of any return for a taxpayer

for the tax imposed by this article and who is identified as the preparer for the taxpayer on the return. A person who only

performs those acts described in clauses (i) through (iv) of Section 7701(a)(36)(8) of the Internal Revenue Code with

respect to the preparation of a return for a trust or estate for which he or she is a fiduciary or a return for a partnership of

which he or she is a partner is not an income tax preparer for purposes of this section.