Enlarge image

1

Enlarge image | 1 |

Enlarge image |

TableofContents

1. What’sNew&Generalinformation page3

2. MyTaxes page4

3. RecordFormat&RecordDelimiter page5

4. RequiredRSrecordlayout page6

5. RequiredRVrecordlayout page7

6. SplittingLargeFiles page8

7. ImportingW ‐ 2FilesviaMyTaxes page9

8. Contactinformation page10

9. CDRom page11

10.WV IT105TransmitterSummary‐ page12

2

|

Enlarge image |

WV/IT 105‐

12/2020

What’sNewfor2020

Any employer who uses a payroll service or is required to file a withholding return for 25 or more

employeesmustfileelectronically.

WestVirginiaisoperatingonaJanuary31duedate.

2020withholdingdatamustbesubmittedviaMyTaxessecurewebsite (seepg.4)

AllfilesMUSTcontaintheIT 103intheRVrecord(seepg.7) ‐

Note! themoneyfieldsintheRVrecorddifferfromthestandardEFW2format

UseonlyWHOLEDOLLARentries(seepg.7)

ThesubmissionMUSTincludetheRSandRVrecord(pgs.6 7) ‐

ForeveryRE,theremustbeacorrespondingRVrecord

Failuretoincludetheserecordswillresultinthesubmissionbeingrejected.

GeneralInformation

WestVirginiaAcceptsEFW2FormatONLY ! WefollowthecurrentSocialSecurityAdministration’s

EFW2publicationlocated:

https://www.ssa.gov/employer/EFW2&EFW2C.htm?_ga=2.256134920.226340051.1603121534-

1129845913.1603121534

ONLYSubmityourfileONEtime.Duplicatesubmissionswillnegativelyimpactyouraccountandthe

accountsofthoseyouhavesubmittedfor.

ALLFilessubmittedtoWestVirginiaMUSTbeintext(.txt)format,512bytesinlengthperline

AllfilesMUSThaverecorddelimiters.

CorrectedW ‐ 2smustbesubmittedonpaperwithanamendedWV/IT 103form‐

PrioryeardatamustbesubmittedonCDRom(seepg.11&12)

Filesizecanbenolargerthan30,000recordsperfile.Largefileswillneedtobe split. Eachfilemust

containafullsetofrecordtypes: RA,RE,RW,RS,RT,RV&RF(seepage8fordetails)

3

|

Enlarge image |

WV/IT 105‐

12/2020

MyTaxesprovidesamoresecureenvironmenttosubmitdatafilesandrequireslesspaperworktoprocess. If

youarenotalreadyregisteredforMyTaxes,whenaccessing https://mytaxes.wvtax.gov youwillberequiredto

completethefollowingsteps:

TaxpayerVerification–ThisrequiresyourFederalTaxIDNumber,individualtaxpayerIDnumber,social

securitynumberorWVtaxIDnumber. (IfyouareunsureofyourWVID,contactTaxpayerServicesat

1‐ 800 982‐ 8297)‐

Youwillchooseataxaccounttype,theaccountnumberandyourzipcode.

CreateLogonInformation

AddAccesstoAccounts(Optional)

Onceregistered,youmayrequestaccesstoanyorallyourtaxaccountsthatareavailableonMyTaxes.

Ifyouarea PayrollServiceProvider andhavenotyetregistered,contact Christine.D.Stephenson@wv.gov

ALLOTHERregistrationquestionsmustcontactTaxpayerServicesDivisionat ‐1 800 982‐ 8297‐

4

|

Enlarge image |

WV/IT 105‐

12/2020

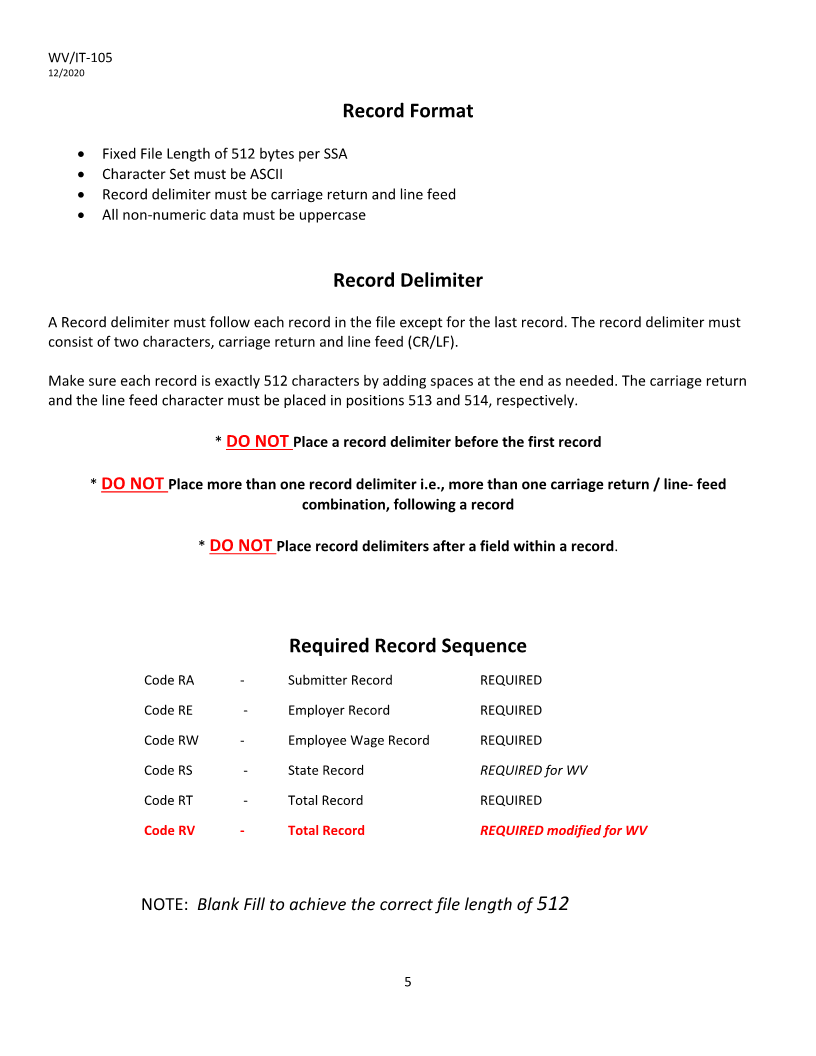

RecordFormat

FixedFileLengthof512bytesperSSA

CharacterSetmustbeASCII

Recorddelimitermustbecarriagereturnandlinefeed

Allnon numericdatamustbeuppercase‐

RecordDelimiter

ARecorddelimitermustfolloweachrecordinthefileexceptforthelastrecord.Therecorddelimitermust

consistoftwocharacters,carriagereturnandlinefeed(CR/LF).

Makesureeachrecordisexactly512charactersbyaddingspacesattheendasneeded.Thecarriagereturn

andthelinefeedcharactermustbeplacedinpositions513and514,respectively.

* DONOT Placearecorddelimiterbeforethefirstrecord

* DONOT Placemorethanonerecorddelimiteri.e.,morethanonecarriagereturn/line feed ‐

combination,followingarecord

* DONOT Placerecorddelimitersafterafieldwithinarecord .

RequiredRecordSequence

CodeRA ‐ SubmitterRecord REQUIRED

CodeRE EmployerRecord REQUIRED

CodeRW ‐ EmployeeWageRecord REQUIRED

CodeRS StateRecord REQUIREDforWV

CodeRT TotalRecord REQUIRED

CodeRV ‐ TotalRecord REQUIREDmodifiedforWV

NOTE: BlankFilltoachievethecorrectfilelengthof 512

5

|

Enlarge image |

WV/IT 105‐

12/2020

CodeRS StateRecord(EmployeeInformation)*REQUIRED* ‐

Location Field Length Specification

1 2‐ RecordIdentifier 2 Required.Enter“RS”

3 4‐ StateCode 2 Required.Enter"54”. cannotbe“WV”

10 18‐ SocialSecurityNumber 9 cannotbe000,111,999,etc.

MustsendpaperifnoSSNassigned

19 33‐ FirstName 15

34 48‐ MiddleNameorInitial 15

49 68‐ LastName 20

248 267‐ EmployerAccountNumber 20 Use9digitFEIN . LeftJustify.Nospacesordashes.

274 275‐ StateCode 2 Required.Enter"54". cannotbe“WV”

276 286‐ StateTaxableWages 11 Required.Currency.RightJustify,ZeroFill

287 297‐ StateIncomeTaxWithheld 11 Required.Currency.RightJustify,ZeroFill

298 512‐ BlankFilled

Thecarriagereturnandthelinefeedcharactermustbeplacedinpositions513and514,respectively.

6

|

Enlarge image |

WV/IT 105‐

12/2020

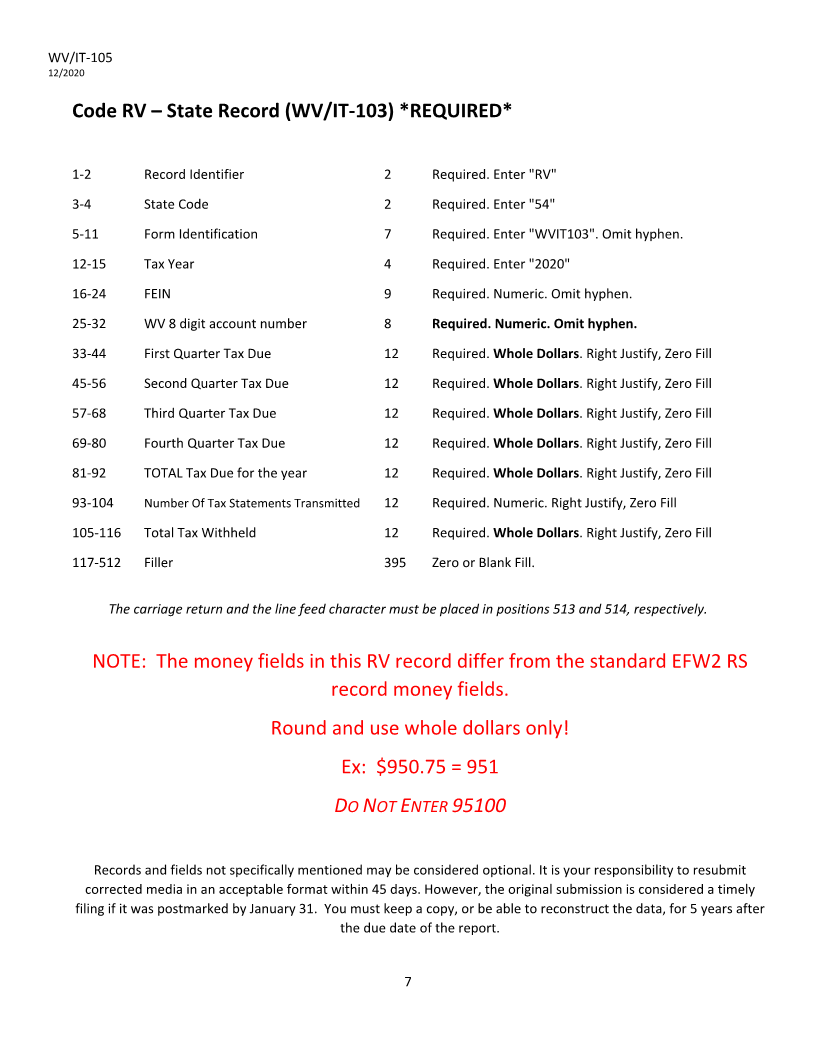

CodeRV–StateRecord(WV/IT 103)*REQUIRED*‐

1 2‐ RecordIdentifier 2 Required.Enter"RV"

3 4‐ StateCode 2 Required.Enter"54"

5 11‐ FormIdentification 7 Required.Enter"WVIT103".Omithyphen.

12 15‐ TaxYear 4 Required.Enter"2020"

16 24‐ FEIN 9 Required.Numeric.Omithyphen.

25 32‐ WV8digitaccountnumber 8 Required.Numeric.Omithyphen.

33 44‐ FirstQuarterTaxDue 12 Required. WholeDollars .RightJustify,ZeroFill

45 56‐ SecondQuarterTaxDue 12 Required. WholeDollars .RightJustify,ZeroFill

57 68‐ ThirdQuarterTaxDue 12 Required. WholeDollars .RightJustify,ZeroFill

69 80‐ FourthQuarterTaxDue 12 Required. WholeDollars .RightJustify,ZeroFill

81 92‐ TOTALTaxDuefortheyear 12 Required. WholeDollars .RightJustify,ZeroFill

93 104‐ NumberOfTaxStatementsTransmitted 12 Required.Numeric.RightJustify,ZeroFill

105 116‐ TotalTaxWithheld 12 Required. WholeDollars .RightJustify,ZeroFill

117 512‐ Filler 395 ZeroorBlankFill.

Thecarriagereturnandthelinefeedcharactermustbeplacedinpositions513and514,respectively.

NOTE: ThemoneyfieldsinthisRVrecorddifferfromthestandardEFW2RS

recordmoneyfields.

Roundandusewholedollarsonly!

Ex: $950.75=951

DON OT NTER E 95100

Recordsandfieldsnotspecificallymentionedmaybeconsideredoptional.Itisyourresponsibilitytoresubmit

correctedmediainanacceptableformatwithin45days.However,theoriginalsubmissionisconsideredatimely

filingifitwaspostmarkedbyJanuary31. Youmustkeepacopy,orbeabletoreconstructthedata,for5yearsafter

theduedateofthereport.

7

|

Enlarge image |

WV/IT 105‐

12/2020

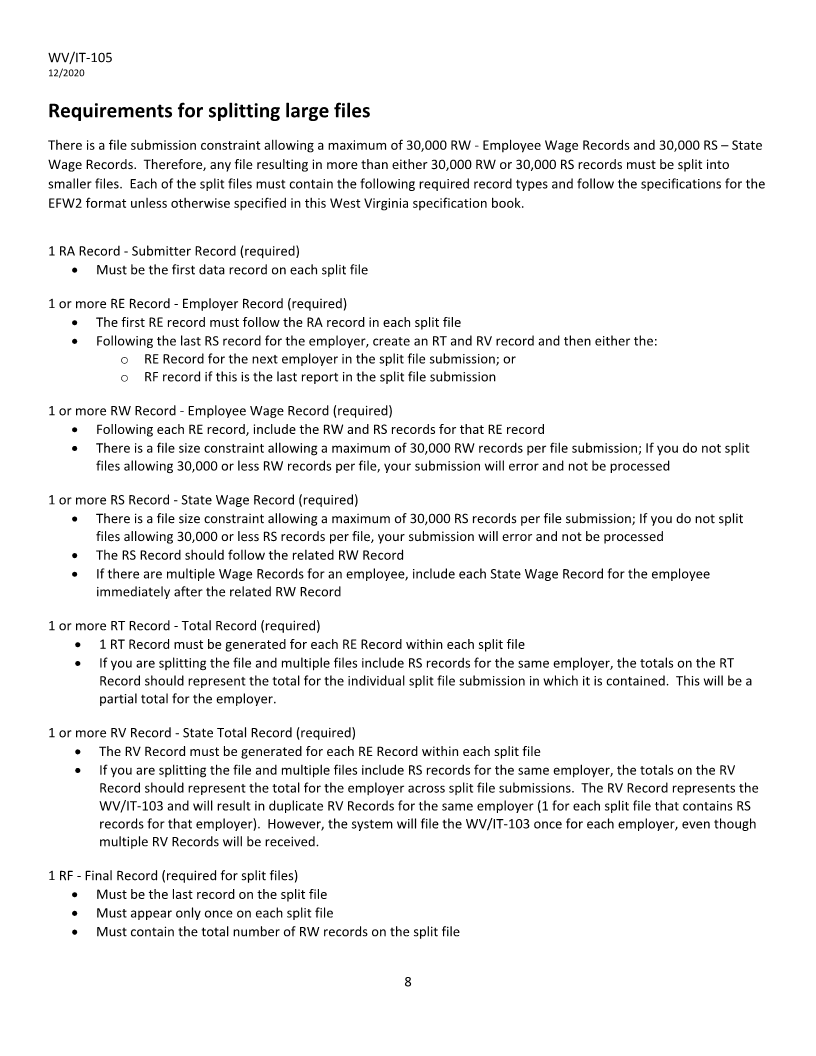

Requirementsforsplittinglargefiles

Thereisafilesubmissionconstraintallowingamaximumof30,000RW EmployeeWageRecordsand30,000RS–State ‐

WageRecords. Therefore,anyfileresultinginmorethaneither30,000RWor30,000RSrecordsmustbesplitinto

smallerfiles. Eachofthesplitfilesmustcontainthefollowingrequiredrecordtypesandfollowthespecificationsforthe

EFW2formatunlessotherwisespecifiedinthisWestVirginiaspecificationbook.

1RARecord SubmitterRecord(required) ‐

Mustbethefirstdatarecordoneachsplitfile

1ormoreRERecord EmployerRecord(required) ‐

ThefirstRErecordmustfollowtheRArecordineachsplitfile

FollowingthelastRSrecordfortheemployer,createanRTandRVrecordandtheneitherthe:

o RERecordforthenextemployerinthesplitfilesubmission;or

o RFrecordifthisisthelastreportinthesplitfilesubmission

1ormoreRWRecord EmployeeWageRecord(required) ‐

FollowingeachRErecord,includetheRWandRSrecordsforthatRErecord

Thereisafilesizeconstraintallowingamaximumof30,000RWrecordsperfilesubmission;Ifyoudonotsplit

filesallowing30,000orlessRWrecordsperfile,yoursubmissionwillerrorandnotbeprocessed

1ormoreRSRecord StateWageRecord(required) ‐

Thereisafilesizeconstraintallowingamaximumof30,000RSrecordsperfilesubmission;Ifyoudonotsplit

filesallowing30,000orlessRSrecordsperfile,yoursubmissionwillerrorandnotbeprocessed

TheRSRecordshouldfollowtherelatedRWRecord

IftherearemultipleWageRecordsforanemployee,includeeachStateWageRecordfortheemployee

immediatelyaftertherelatedRWRecord

1ormoreRTRecord TotalRecord(required) ‐

1RTRecordmustbegeneratedforeachRERecordwithineachsplitfile

IfyouaresplittingthefileandmultiplefilesincludeRSrecordsforthesameemployer,thetotalsontheRT

Recordshouldrepresentthetotalfortheindividualsplitfilesubmissioninwhichitiscontained. Thiswillbea

partialtotalfortheemployer.

1ormoreRVRecord StateTotalRecord(required) ‐

TheRVRecordmustbegeneratedforeachRERecordwithineachsplitfile

IfyouaresplittingthefileandmultiplefilesincludeRSrecordsforthesameemployer,thetotalsontheRV

Recordshouldrepresentthetotalfortheemployeracrosssplitfilesubmissions. TheRVRecordrepresentsthe

WV/IT 103andwillresultinduplicateRVRecordsforthesameemployer(1foreachsplitfilethatcontainsRS‐

recordsforthatemployer). However,thesystemwillfiletheWV/IT 103onceforeachemployer,eventhough‐

multipleRVRecordswillbereceived.

1RF FinalRecord(requiredforsplitfiles) ‐

Mustbethelastrecordonthesplitfile

Mustappearonlyonceoneachsplitfile

MustcontainthetotalnumberofRWrecordsonthesplitfile

8

|

Enlarge image |

WV/IT 105‐

12/2020

HowdoI?

ImportaFile…

Selectthe SubmitW ‐ 2 hyperlink(totheright)

Select IMPORT button(toprightcorner)

SelectBrowsetolocateyourW 2file ‐

Choosethefileyouwanttoimport, SelectOpen

Select IMPORT button–clickonlyonceaslargefilesmaytakeaminutetoimport. Onlyonefilemay

beimportedpersubmission

Oncefileisimported,thegrayboxeswillpopulatethenumberofEmployersandEmployeesinthefile.

Click NEXT (lowerright)toviewyourfiledataonthescreens

Onceyou’veviewedallthedata,the SUBMIT buttonwillbeavailable(lowerright)

Enteryourpasswordand OK

Youwillreceiveaconfirmationnumber

NOTE:ifthereareerrorsdetected,youwillbeunabletoproceeduntiltheyareresolved. Anycorrectionsneededmust

bemadewithintheactualfile,notonscreen.

ManuallyEnterW ‐ 2’s…

*** RequiredFieldsaredesignatedbytinyorangetriangleintheupperLeftcorner ***

Selectthe SubmitW ‐ 2 hyperlink(totheright)

Select Checkbox tomanuallyinputW ‐ 2forms,click Next (lowerright)

Typethe4digit TaxYear inthelastboxoftheprepopulatedEmployerRecord,click Next (Note:this

pageisprepopulatedwiththebusinessname/addressasyouareregisteredinoursystem)

EntertheEmployeesSSNandotherrequiredfields(deliveryaddressisNOTrequired)

o Youmayeitherclick Next toentertheirwagedataorremainonthispageandenterall

employeesatonetimethenproceedtothewagedataentrybyclicking Next.

Onceallemployeeswagedataisentered,click Next (lowerright)

YoumaynowvieweachemployeeW 2by ‐ clickingtheViewW ‐ 2circle ,thenchoosingthe ViewW ‐ 2

hyperlinknexttoit

Younowhavetheoptionto SUBMIT (lowerright)

Enteryourpasswordandselect OK

Youwillreceiveaconfirmationnumber

NOTE: YoumaySAVEatanypointduringentryandreturnlatertoEditSubmissionandSubmit.

9

|

Enlarge image |

WV/IT 105‐

12/2020

ContactInformation

MailingAddress :

WestVirginiaStateTaxDepartment

TAAD/Withholding

POBox3943

Charleston,WV25339 3943‐

CourierorOvernightDeliveries(ONLY):

WestVirginiaStateTaxDepartment

RevenueCenter/Withholding

1001LeeStreetEast

Charleston,WV25301 1725‐

Email

Christine.D.Stephenson@wv.gov

10

|

Enlarge image |

WV/IT 105‐

12/2020

If unabletocomplywithnewguidelines…

CDROMwillbepermittedforyourtransitionyearONLY

CDROMmusthaveExternalLabelcontainingthefollowing:

Name,addressandFEINofsender

Nameandtelephonenumberofcontactperson

Typeofinformationbeingreported(e.g.W 2)andtaxyear ‐

Volumenumber(ifmulti volumereports)‐

FILENAMEMUSTBE: w2report.txt or w2report.zip andopento w2report.txt

Yourpackage must includeaWV/IT 105TransmitterSummaryReport‐

andWV/IT 103AnnualReconciliationoritwillberejected&returned.‐

WV/IT 103canbefoundonourwebsite:‐

http://tax.wv.gov/Documents/TaxForms/it103.pdf

11

|

Enlarge image |

WV/IT 105‐

12/2020

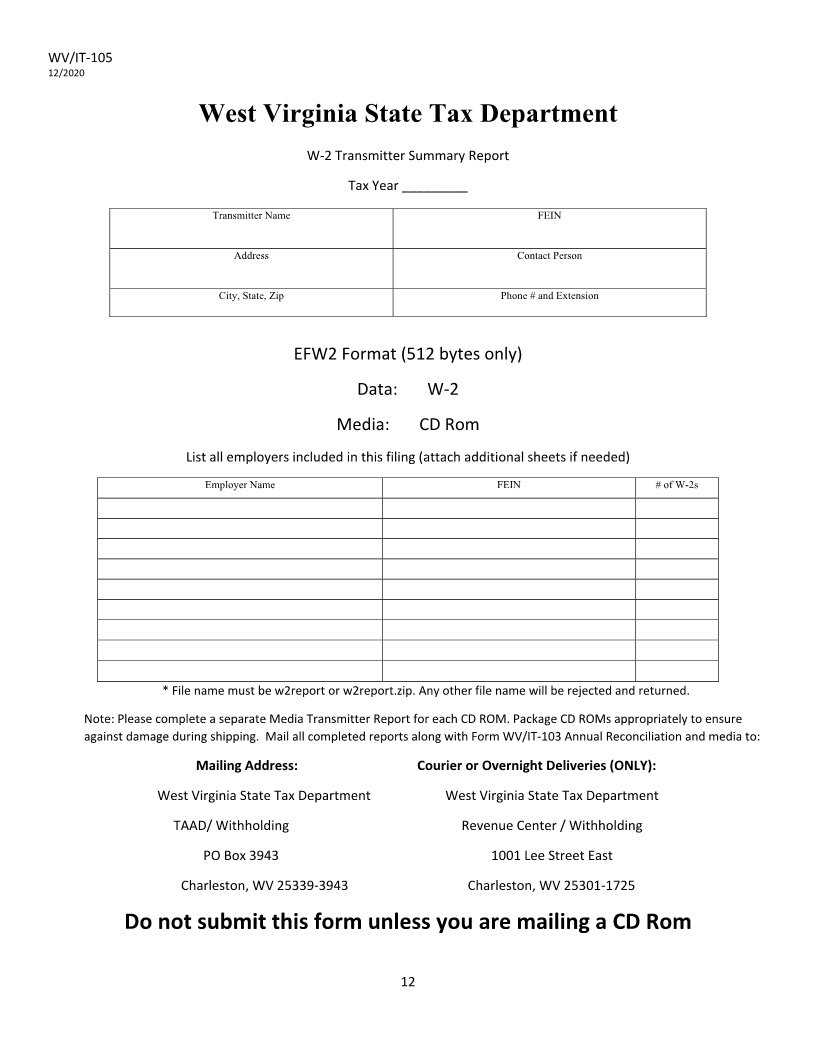

West Virginia State Tax Department

W 2TransmitterSummaryReport‐

TaxYear_________

Transmitter Name FEIN

Address Contact Person

City, State, Zip Phone # and Extension

EFW2Format(512bytesonly)

Data: ‐ W 2

Media: CDRom

Listallemployersincludedinthisfiling(attachadditionalsheetsifneeded)

Employer Name FEIN # of W-2s

*Filenamemustbew2reportorw2report.zip.Anyotherfilenamewillberejectedandreturned.

Note:PleasecompleteaseparateMediaTransmitterReportforeachCDROM.PackageCDROMsappropriatelytoensure

againstdamageduringshipping. MailallcompletedreportsalongwithFormWV/IT 103AnnualReconciliationandmediato:‐

MailingAddress: CourierorOvernightDeliveries(ONLY):

WestVirginiaStateTaxDepartment WestVirginiaStateTaxDepartment

TAAD/Withholding RevenueCenter/Withholding

POBox3943 1001LeeStreetEast

Charleston,WV25339 3943‐ Charleston,WV25301 1725‐

DonotsubmitthisformunlessyouaremailingaCDRom

12

|