Enlarge image

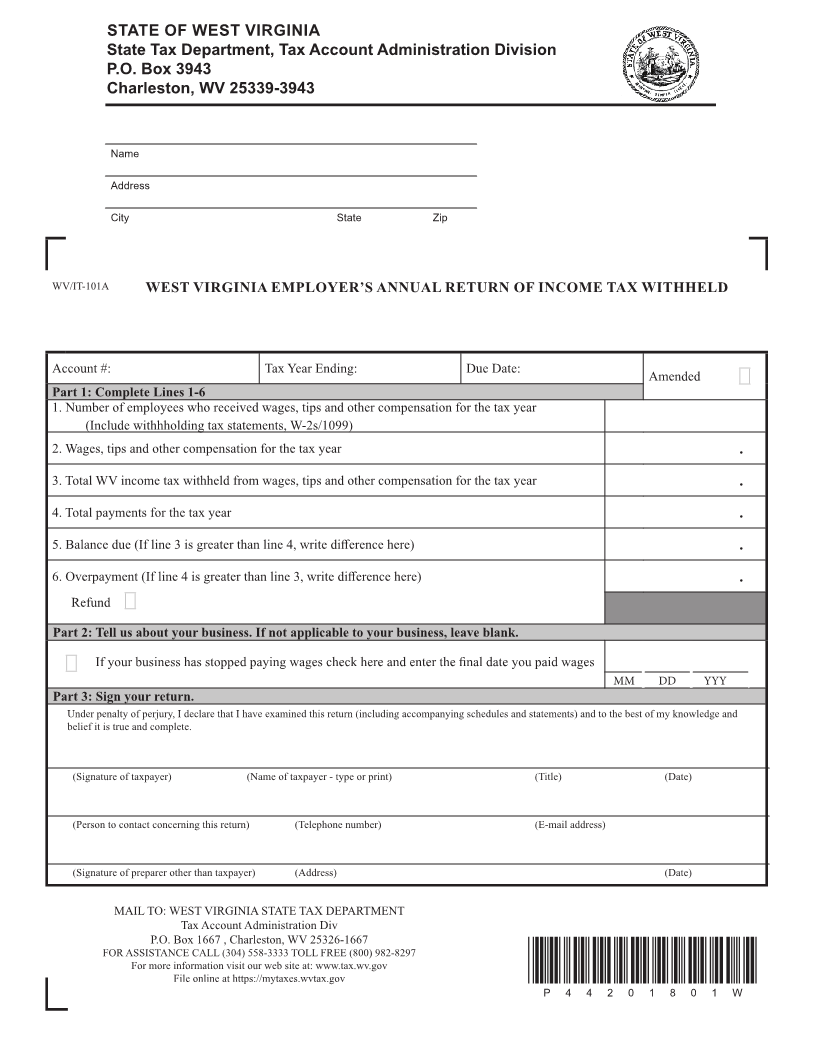

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Division

P.O. Box 3943

Charleston, WV 25339-3943

Name

Address

City State Zip

WV/IT-101A WEST VIRGINIA EMPLOYER’S ANNUAL RETURN OF INCOME TAX WITHHELD

Account #: Tax Year Ending: Due Date:

Amended

Part 1: Complete Lines 1-6

1.Number of employees who received wages, tips and other compensation for the tax year

(Include withhholding tax statements, W-2s/1099)

2.Wages, tips and other compensation for the tax year .

3.Total WV income tax withheld from wages, tips and other compensation for the tax year .

4.Total payments for the tax year .

5.Balance due (If line 3 is greater than line 4, write difference here) .

6.Overpayment (If line 4 is greater than line 3, write difference here) .

Refund

Part 2: Tell us about your business. If not applicable to your business, leave blank.

If your business has stopped paying wages check here and enter the final date you paid wages

MM DD YYY

Part 3: Sign your return.

Under penalty of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and

belief it is true and complete.

(Signature of taxpayer) (Name of taxpayer - type or print) (Title) (Date)

(Person to contact concerning this return) (Telephone number) (E-mail address)

(Signature of preparer other than taxpayer) (Address) (Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 1667 , Charleston, WV 25326-1667

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov *P44201801W*

P 4 4 2 0 1 8 0 1 W