Enlarge image

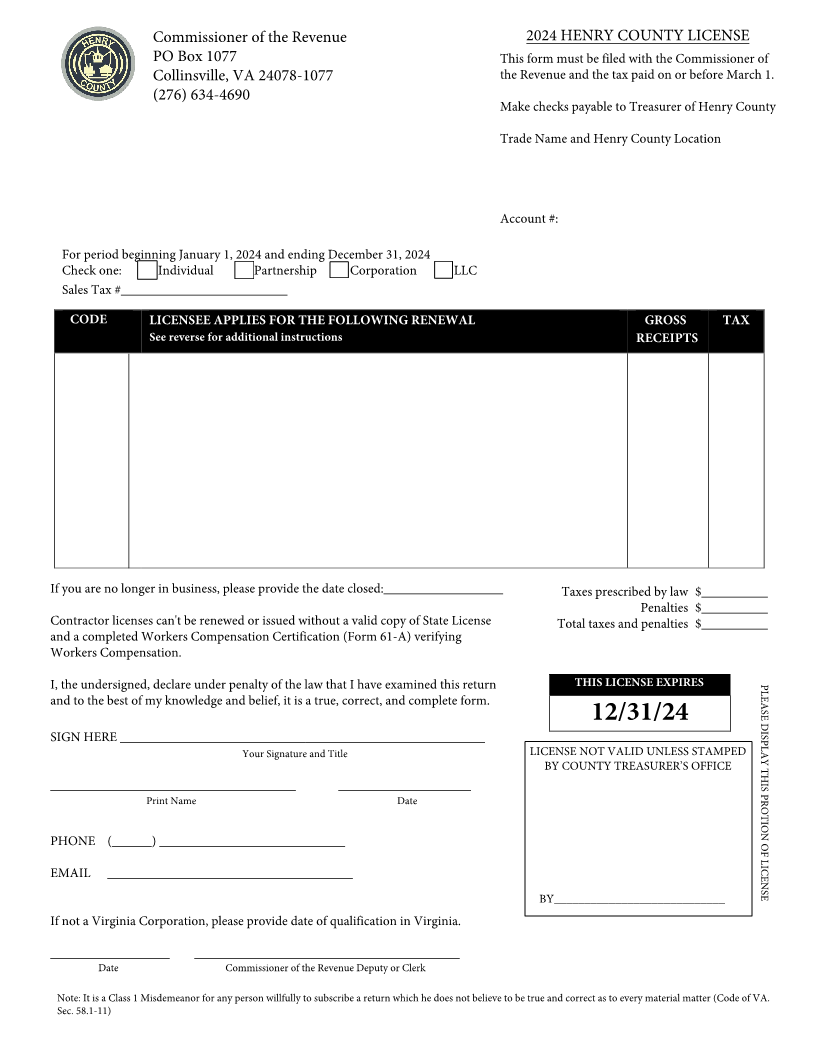

Commissioner of the Revenue 202 4HENRY COUNTY LICENSE

PO Box 1077 This form must be filed with the Commissioner of

Collinsville, VA 24078-1077 the Revenue and the tax paid on or before March 1.

(276) 634-4690

Make checks payable to Treasurer of Henry County

Trade Name and Henry County Location

Account #:

For period beginning January 1, 202 4 and ending December 31, 202 4

Check one: Individual Partnership Corporation LLC

Sales Tax #_________________________

CODE LICENSEE APPLIES FOR THE FOLLOWING RENEWAL GROSS TAX

See reverse for additional instructions RECEIPTS

If you are no longer in business, please provide the date closed:__________________ Taxes prescribed by law $__________

Penalties $__________

Contractor licenses can't be renewed or issued without a valid copy of State License Total taxes and penalties $__________

and a completed Workers Compensation Certification (Form 61-A) verifying

Workers Compensation.

I, the undersigned, declare under penalty of the law that I have examined this return THIS LICENSE EXPIRES PLEASE DISPLAY THIS PROTION OF LICENSE

and to the best of my knowledge and belief, it is a true, correct, and complete form.

12/31/24

SIGN HERE _______________________________________________________

Your Signature and Title LICENSE NOT VALID UNLESS STAMPED

BY COUNTY TREASURER’S OFFICE

_____________________________________ ____________________

Print Name Date

PHONE (______) ____________________________

EMAIL _____________________________________

BY____________________________

If not a Virginia Corporation, please provide date of qualification in Virginia.

__________________ ________________________________________

Date Commissioner of the Revenue Deputy or Clerk

Note: It is a Class 1 Misdemeanor for any person willfully to subscribe a return which he does not believe to be true and correct as to every material matter (Code of VA.

Sec. 58.1-11)