Enlarge image

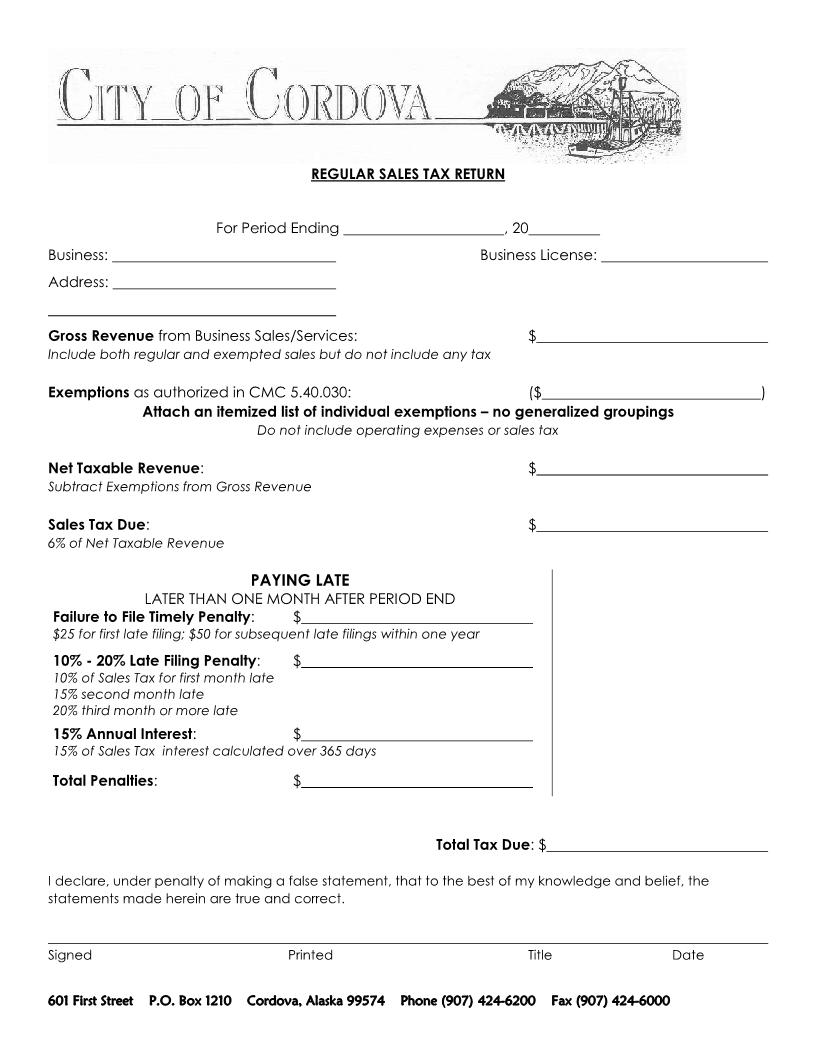

REGULAR SALES TAX RETURN

For Period Ending , 20

Business: Business License:

Address:

Gross Revenue from Business Sales/Services: $

Include both regular and exempted sales but do not include any tax

Exemptions as authorized in CMC 5.40.030: ($ )

Attach an itemized list of individual exemptions – no generalized groupings

Do not include operating expenses or sales tax

Net Taxable Revenue: $

Subtract Exemptions from Gross Revenue

Sales Tax Due: $

6% of Net Taxable Revenue

PAYING LATE

LATER THAN ONE MONTH AFTER PERIOD END

Failure to File Timely Penalty: $

$25 for first late filing; $50 for subsequent late filings within one year

10% - 20% Late Filing Penalty: $

10% of Sales Tax for first month late

15% second month late

20% third month or more late

15% Annual Interest: $

15% of Sales Tax interest calculated over 365 days

Total Penalties: $

Total Tax Due: $

I declare, under penalty of making a false statement, that to the best of my knowledge and belief, the

statements made herein are true and correct.

Signed Printed Title Date

601 First Street P.O. Box 1210 Cordova, Alaska 99574 Phone (907) 424-6200 Fax (907) 424-6000