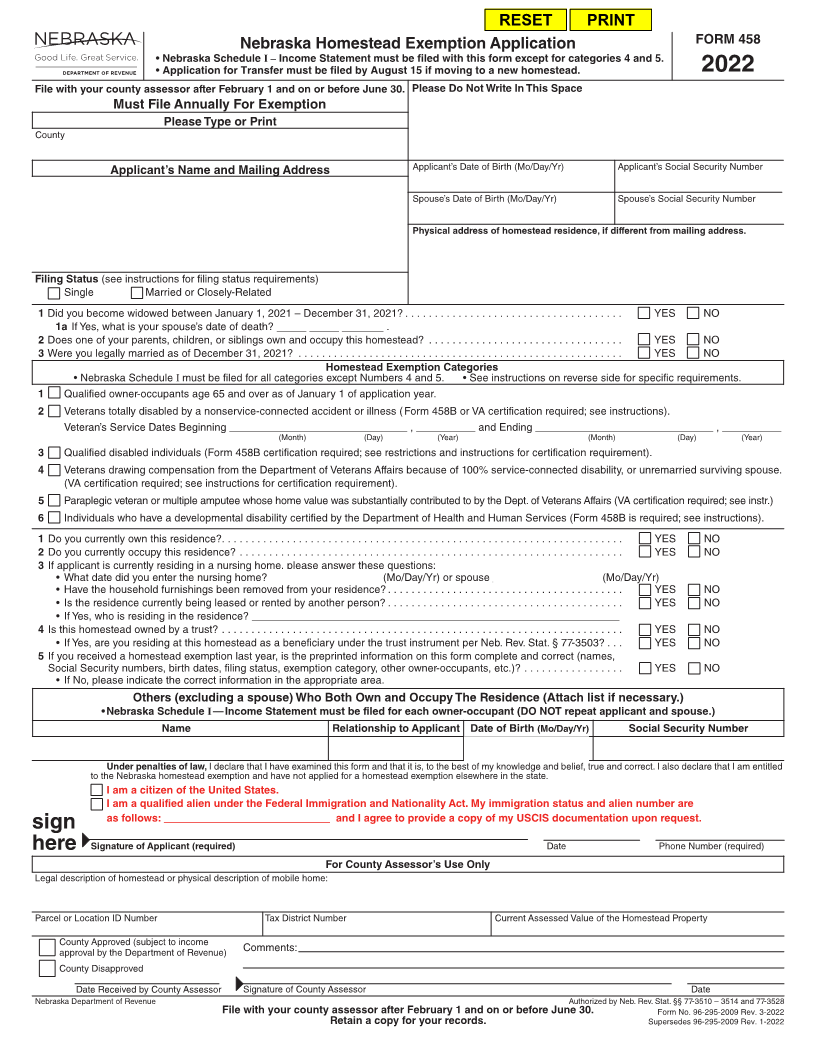

Enlarge image

RESET PRINT

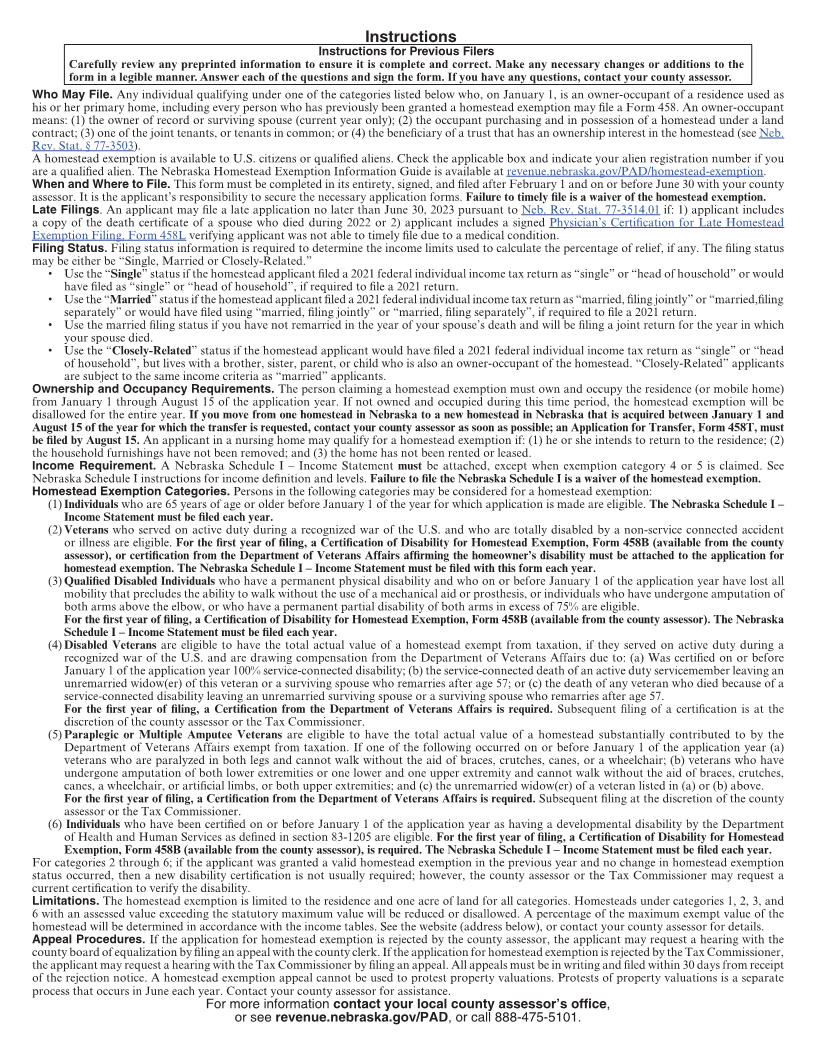

Nebraska Homestead Exemption Application FORM 458

• Nebraska Schedule I – Income Statement must be filed with this form except for categories 4 and 5.

• Application for Transfer must be filed by August 15 if moving to a new homestead. 2022

File with your county assessor after February 1 and on or before June 30. Please Do Not Write In This Space

Must File Annually For Exemption

Please Type or Print

County

Applicant’s Name and Mailing Address Applicant’s Date of Birth (Mo/Day/Yr) Applicant’s Social Security Number

/ /

Spouse’s Date of Birth (Mo/Day/Yr) Spouse’s Social Security Number

/ /

Physical address of homestead residence, if different from mailing address.

Filing Status (see instructions for filing status requirements)

Single Married or Closely-Related

1 Did you become widowed between January 1, 2021 – December 31, 2021? ..................................... YES NO

1a If Yes, what is your spouse’s date of death? _____/_____/_______ .

2 Does one of your parents, children, or siblings own and occupy this homestead? ................................. YES NO

3 Were you legally married as of December 31, 2021? ....................................................... YES NO

Homestead Exemption Categories

• Nebraska Schedule Imust be filed for all categories except Numbers 4 and 5. • See instructions on reverse side for specific requirements.

1 Qualified owner-occupants age 65 and over as of January 1 of application year.

2 Veterans totally disabled by a nonservice-connected accident or illness ( Form 458B or VA certification required; see instructions).

Veteran’s Service Dates Beginning ______________________________ , __________ and Ending ______________________________ , __________

(Month) (Day) (Year) (Month) (Day) (Year)

3 Qualified disabled individuals (Form 458B certification required; see restrictions and instructions for certification requirement).

4 Veterans drawing compensation from the Department of Veterans Affairs because of 100% service-connected disability, or unremarried surviving spouse.

(VA certification required; see instructions for certification requirement).

5 Paraplegic veteran or multiple amputee whose home value was substantially contributed to by the Dept. of Veterans Affairs (VA certification required; see instr.)

6 Individuals who have a developmental disability certified by the Department of Health and Human Services (Form 458B is required; see instructions).

1 Do you currently own this residence?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . YES NO

2 Do you currently occupy this residence? ................................................................. YES NO

3 If applicant is currently residing in a nursing home, please answer these questions:

• What date did you enter the nursing home? _____/_____/_______ (Mo/Day/Yr) or spouse _____/_____/_______ (Mo/Day/Yr)

• Have the household furnishings been removed from your residence? ........................................ YES NO

• Is the residence currently being leased or rented by another person? ........................................ YES NO

• If Yes, who is residing in the residence? ______________________________________________________________

4 Is this homestead owned by a trust? .................................................................... YES NO

• If Yes, are you residing at this homestead as a beneficiary under the trust instrument per Neb. Rev. Stat. § 77-3503? ... YES NO

5 If you received a homestead exemption last year, is the preprinted information on this form complete and correct (names,

Social Security numbers, birth dates, filing status, exemption category, other owner-occupants, etc.)? ................. YES NO

• If No, please indicate the correct information in the appropriate area.

Others (excluding a spouse) Who Both Own and Occupy The Residence (Attach list if necessary.)

• Nebraska Schedule I — Income Statement must be filed for each owner-occupant (DO NOT repeat applicant and spouse.)

Name Relationship to Applicant Date of Birth (Mo/Day/Yr) Social Security Number

/ /

Under penalties of law, I declare that I have examined this form and that it is, to the best of my knowledge and belief, true and correct. I also declare that I am entitled

to the Nebraska homestead exemption and have not applied for a homestead exemption elsewhere in the state.

I am a citizen of the United States.

I am a qualified alien under the Federal Immigration and Nationality Act. My immigration status and alien number are

as follows: ____________________________ and I agree to provide a copy of my USCIS documentation upon request.

sign

here Signature of Applicant (required) Date Phone Number (required)

For County Assessor’s Use Only

Legal description of homestead or physical description of mobile home:

Parcel or Location ID Number Tax District Number Current Assessed Value of the Homestead Property

County Approved (subject to income Comments:

approval by the Department of Revenue)

County Disapproved

Date Received by County Assessor Signature of County Assessor Date

Nebraska Department of Revenue Authorized by Neb. Rev. Stat. §§ 77-3510 – 3514 and 77-3528

File with your county assessor after February 1 and on or before June 30. Form No. 96-295-2009 Rev. 3-2022

Retain a copy for your records. Supersedes 96-295-2009 Rev. 1-2022