Enlarge image

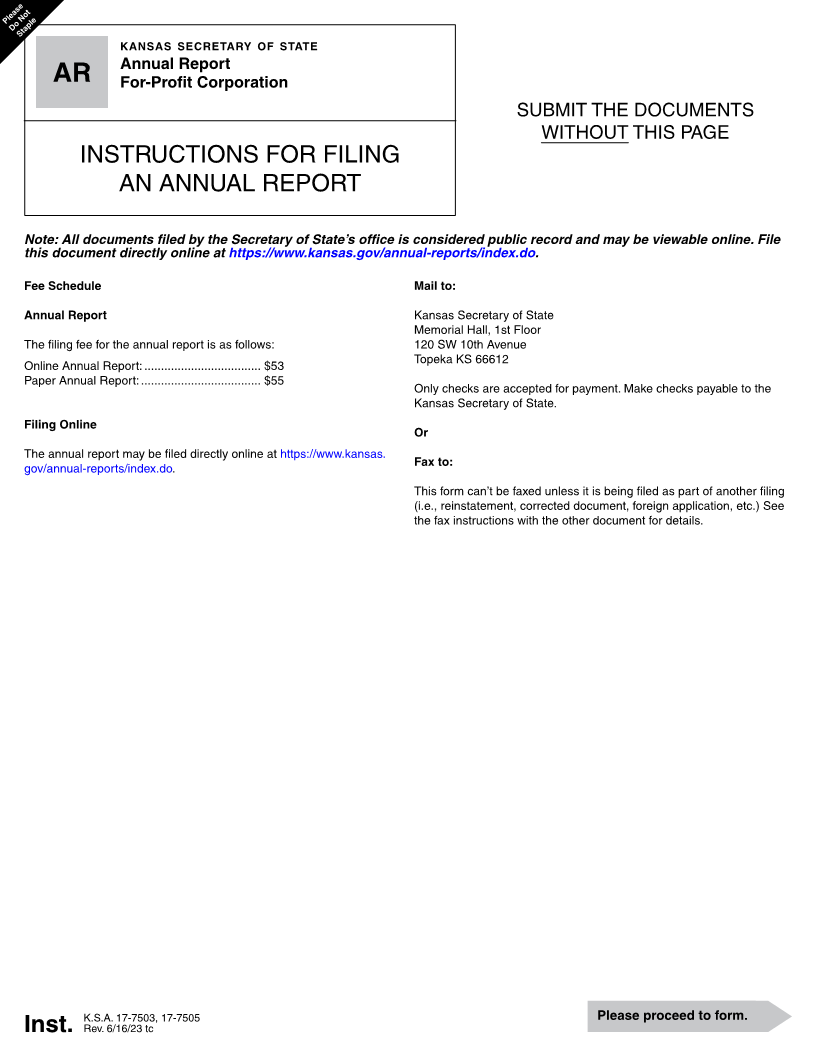

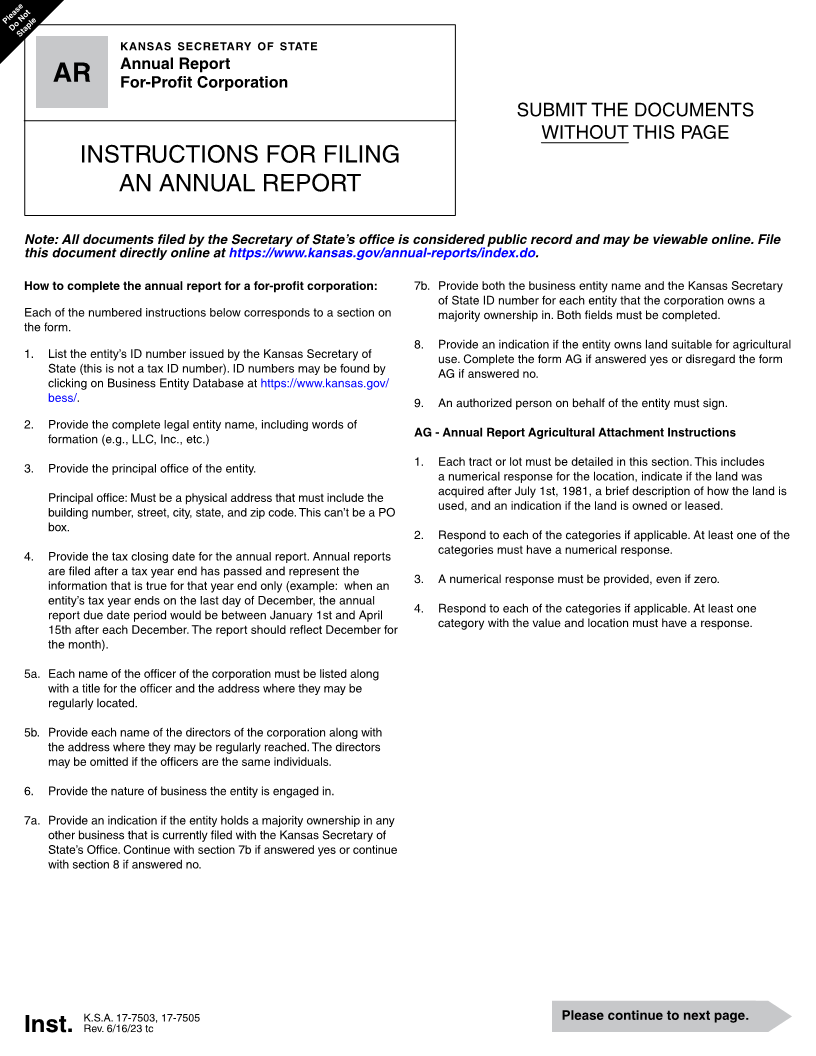

Please

Do NotStaple

kansas secretary of state

Annual Report

AR For-Profit Corporation

SUBMIT THE DOCUMENTS

WITHOUT THIS PAGE

INSTRUCTIONS FOR FILING

AN ANNUAL REPORT

Note: All documents filed by the Secretary of State’s office is considered public record and may be viewable online. File

this document directly online at https://www.kansas.gov/annual-reports/index.do.

How to complete the annual report for a for-profit corporation: 7b. Provide both the business entity name and the Kansas Secretary

of State ID number for each entity that the corporation owns a

Each of the numbered instructions below corresponds to a section on majority ownership in. Both fields must be completed.

the form.

8. Provide an indication if the entity owns land suitable for agricultural

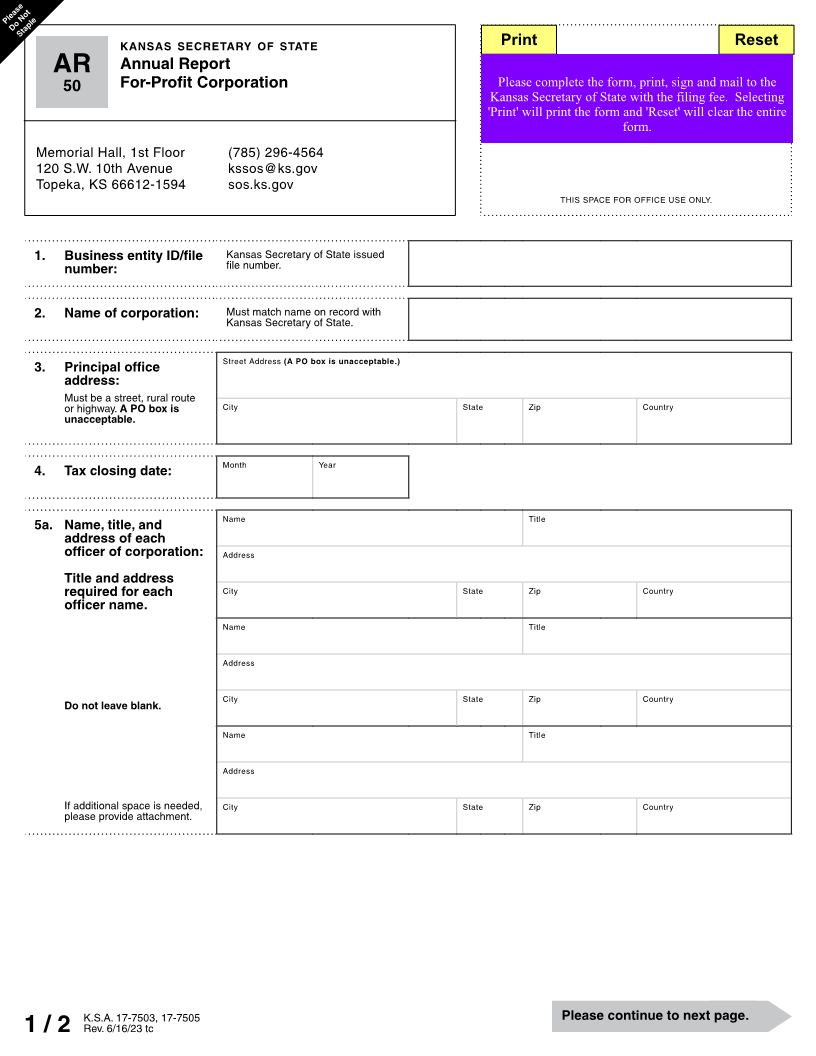

1. List the entity’s ID number issued by the Kansas Secretary of use. Complete the form AG if answered yes or disregard the form

State (this is not a tax ID number). ID numbers may be found by AG if answered no.

clicking on Business Entity Database at https://www.kansas.gov/

bess/. 9. An authorized person on behalf of the entity must sign.

2. Provide the complete legal entity name, including words of

formation (e.g., LLC, Inc., etc.) AG - Annual Report Agricultural Attachment Instructions

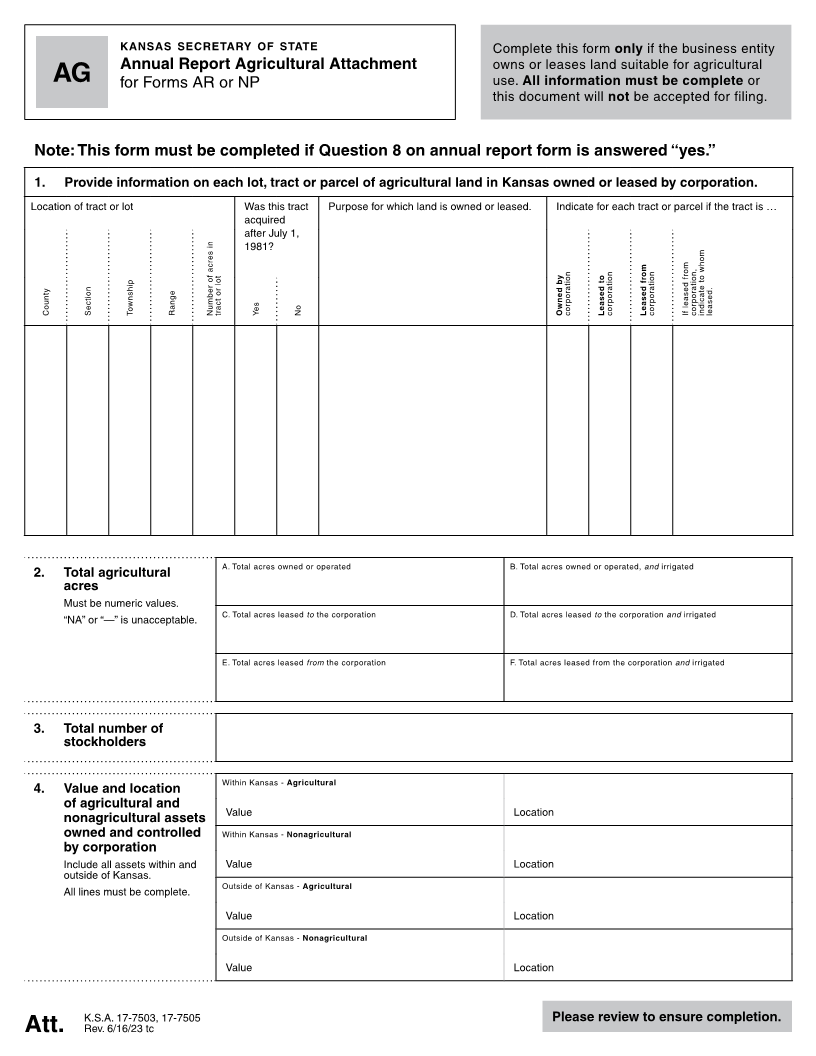

1. Each tract or lot must be detailed in this section. This includes

3. Provide the principal office of the entity.

a numerical response for the location, indicate if the land was

acquired after July 1st, 1981, a brief description of how the land is

Principal office: Must be a physical address that must include the

used, and an indication if the land is owned or leased.

building number, street, city, state, and zip code. This can’t be a PO

box.

2. Respond to each of the categories if applicable. At least one of the

categories must have a numerical response.

4. Provide the tax closing date for the annual report. Annual reports

are filed after a tax year end has passed and represent the

3. A numerical response must be provided, even if zero.

information that is true for that year end only (example: when an

entity’s tax year ends on the last day of December, the annual

4. Respond to each of the categories if applicable. At least one

report due date period would be between January 1st and April

category with the value and location must have a response.

15th after each December. The report should reflect December for

the month).

5a. Each name of the officer of the corporation must be listed along

with a title for the officer and the address where they may be

regularly located.

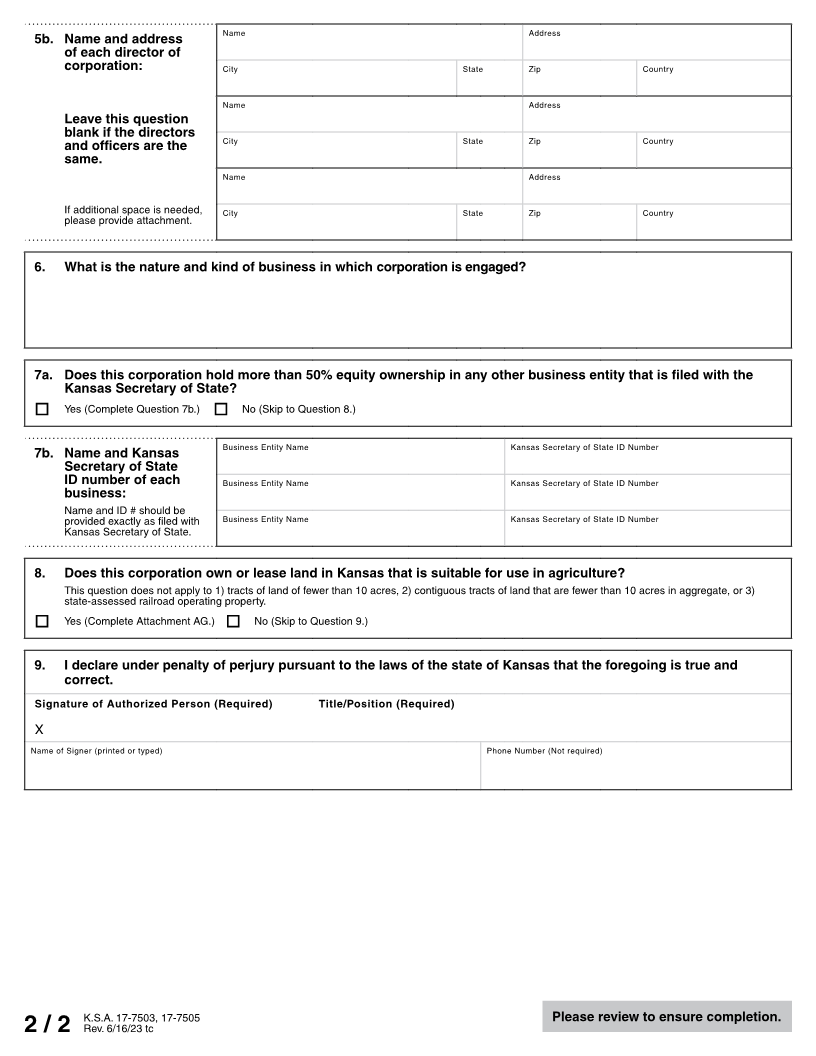

5b. Provide each name of the directors of the corporation along with

the address where they may be regularly reached. The directors

may be omitted if the officers are the same individuals.

6. Provide the nature of business the entity is engaged in.

7a. Provide an indication if the entity holds a majority ownership in any

other business that is currently filed with the Kansas Secretary of

State’s Office. Continue with section 7b if answered yes or continue

with section 8 if answered no.

K.S.A. 17-7503, 17-7505 Please continue to next page.

Inst. Rev. 6/16/23 tc