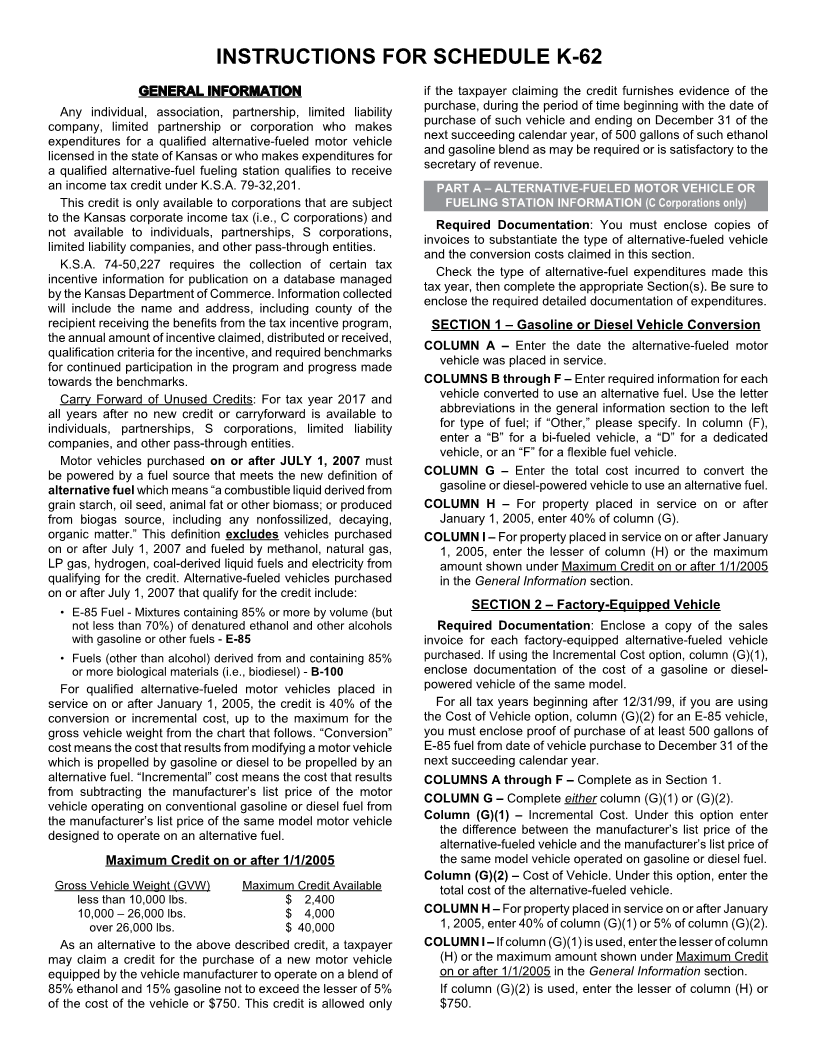

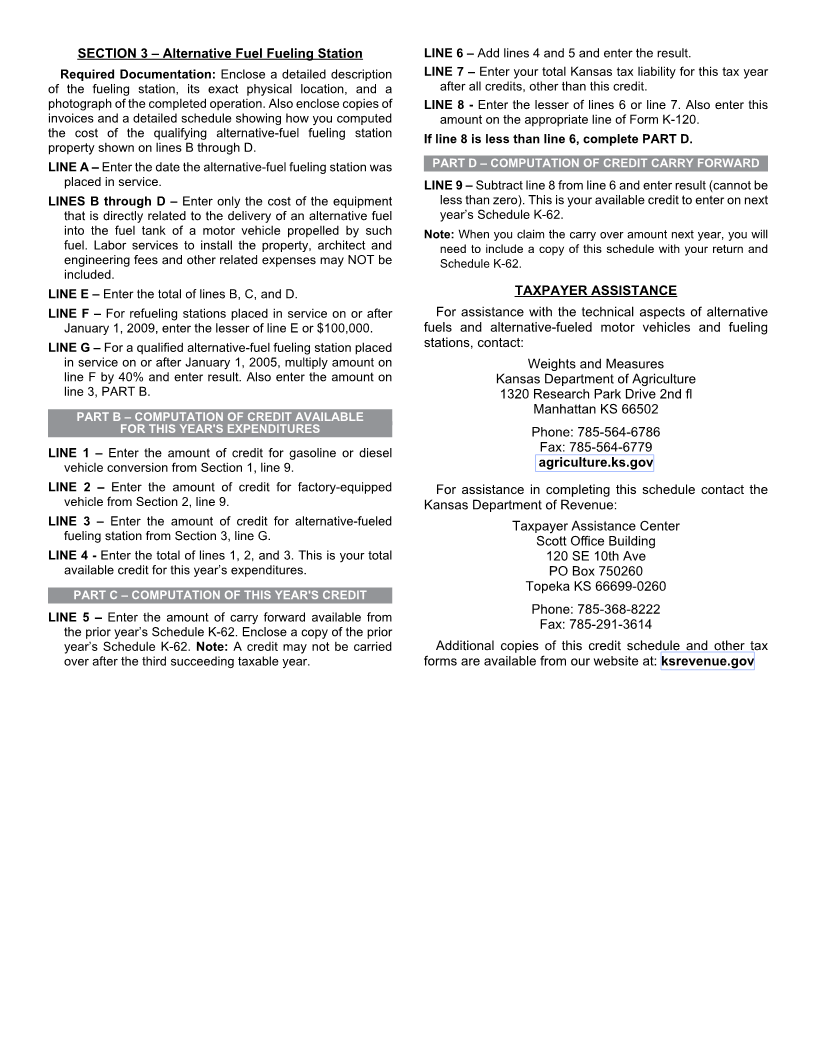

Enlarge image

191801

KANSAS

K-62(Rev. 8-20) ALTERNATIVE-FUEL TAX CREDIT

For the taxable year beginning _________________________________ , 20_______; ending _________________________________ , 20_______

Name of taxpayer (as shown on return) Employer ID Number (EIN)

PART A – ALTERNATIVE-FUELED MOTOR VEHICLE AND FUELING STATION INFORMATION (C Corporations only)

Check the type(s) of alternative-fuel expenditures made and placed in service this tax year. Refer to the instructions to complete the

application section(s), and enclose the required documentation.

o Gasoline or diesel vehicle conversion. Complete SECTION 1 on the back of this form.

o Factory-equipped alternative-fueled vehicle. Complete SECTION 2 on the back of this form.

o Alternative-fuel fueling station. Complete the following SECTION 3

SECTION 3 – Alternative-Fueled Fueling Station (see instructions and enclose required documentation)

A. Date facility placed in service. A. ___________________________________

B. Expenditures for compression equipment. B. ___________________________________

C. Expenditures for storage tanks/receptacles. C. ___________________________________

D. Expenditures for delivery property. D. ___________________________________

E. Total qualified alternative-fuel fueling station expenditures. E. ___________________________________

F. Amount of fueling station expenditures available for the credit (see instructions). F. ___________________________________

G. Amount of credit (see instructions). Enter here and on line 3 below. G. __________________________________

PART B – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR'S EXPENDITURES

1. Amount of credit for gasoline or diesel vehicle conversion (from line 9, Section 1). 1. ___________________________________

2. Amount of credit for factory-equipped vehicle (from line 9, Section 2). 2. ___________________________________

3. Amount of credit for alternative-fueled fueling station (from line G, Section 3). 3. ___________________________________

4. Total credit available (add lines 1, 2, and 3). 4. ___________________________________

PART C – COMPUTATION OF THIS YEAR'S CREDIT

5. Amount of carry forward available on this return. Enter the amount of carry forward from the

prior year’s Schedule K-62. 5. ___________________________________

6. Total credit available this tax year (add lines 4 and 5). 6. ___________________________________

7. Your tax liability for this tax year after all credits other than this credit. 7. ___________________________________

8. Alternative fuel credit for this tax year. Enter the lesser of lines 6 or 7 here and on the appropriate

line of K-120. 8. ___________________________________

If line 8 is less than line 6, complete Part D.

PART D – COMPUTATION OF EXCESS CREDIT CARRY FORWARD

9. Amount of carry forward available to report on your Schedule K-62 for next year (subtract line 8

from line 6). 9. ____________________________________