Enlarge image

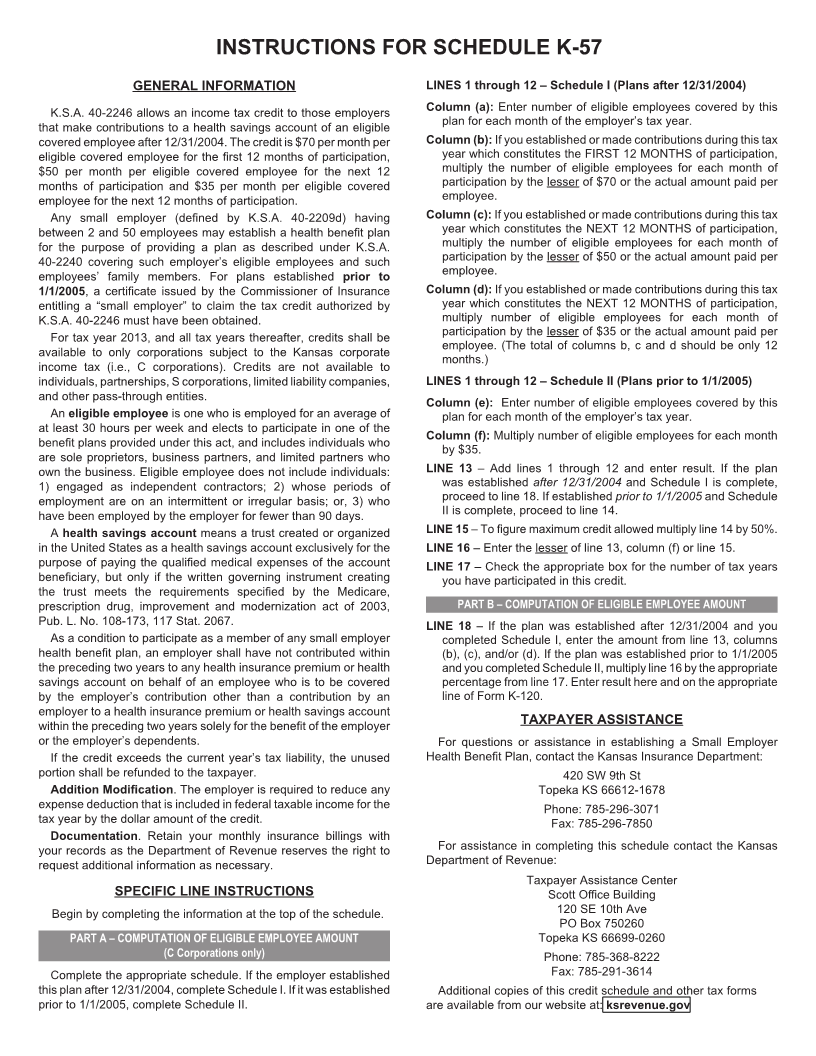

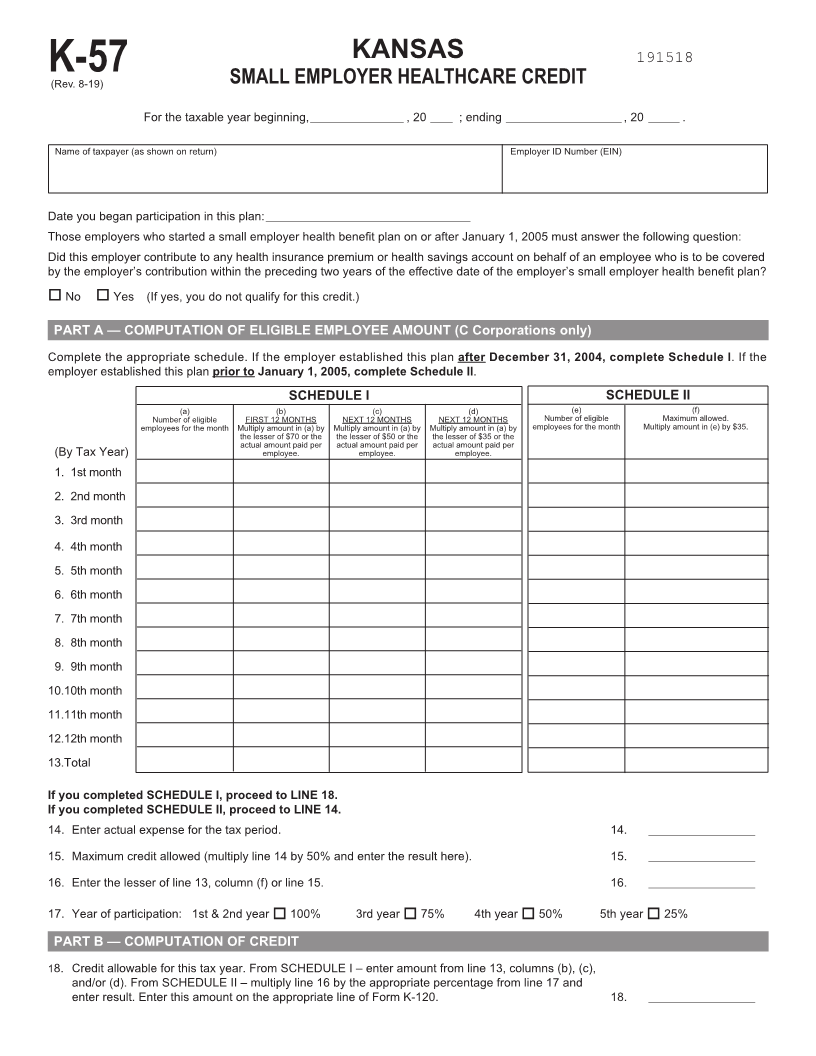

KANSAS 191518

K-57(Rev. 8-19) SMALL EMPLOYER HEALTHCARE CREDIT

For the taxable year beginning, _____________________ , 20 _____ ; ending __________________________ , 20 _______ .

Name of taxpayer (as shown on return) Employer ID Number (EIN)

Date you began participation in this plan:______________________________________________

Those employers who started a small employer health benefit plan on or after January 1, 2005 must answer the following question:

Did this employer contribute to any health insurance premium or health savings account on behalf of an employee who is to be covered

by the employer’s contribution within the preceding two years of the effective date of the employer’s small employer health benefit plan?

o No o Yes (If yes, you do not qualify for this credit.)

PART A — COMPUTATION OF ELIGIBLE EMPLOYEE AMOUNT (C Corporations only)

Complete the appropriate schedule. If the employer established this plan after December 31, 2004, complete Schedule I. If the

employer established this plan prior to January 1, 2005, complete Schedule II.

SCHEDULE I SCHEDULE II

(a) (b) (c) (d) (e) (f)

Number of eligible FIRST 12 MONTHS NEXT 12 MONTHS NEXT 12 MONTHS Number of eligible Maximum allowed.

employees for the month Multiply amount in (a) by Multiply amount in (a) by Multiply amount in (a) by employees for the month Multiply amount in (e) by $35.

the lesser of $70 or the the lesser of $50 or the the lesser of $35 or the

actual amount paid per actual amount paid per actual amount paid per

(By Tax Year) employee. employee. employee.

1. 1st month

2. 2nd month

3. 3rd month

4. 4th month

5. 5th month

6. 6th month

7. 7th month

8. 8th month

9. 9th month

10.10th month

11.11th month

12.12th month

13.Total

If you completed SCHEDULE I, proceed to LINE 18.

If you completed SCHEDULE II, proceed to LINE 14.

14. Enter actual expense for the tax period. 14. ________________________

15. Maximum credit allowed (multiply line 14 by 50% and enter the result here). 15. ________________________

16. Enter the lesser of line 13, column (f) or line 15. 16. ________________________

17. Year of participation: 1st & 2nd year o 100% 3rd year o 75% 4th year o 50% 5th year o 25%

PART B — COMPUTATION OF CREDIT

18. Credit allowable for this tax year. From SCHEDULE I – enter amount from line 13, columns (b), (c),

and/or (d). From SCHEDULE II – multiply line 16 by the appropriate percentage from line 17 and

enter result. Enter this amount on the appropriate line of Form K-120. 18. ________________________