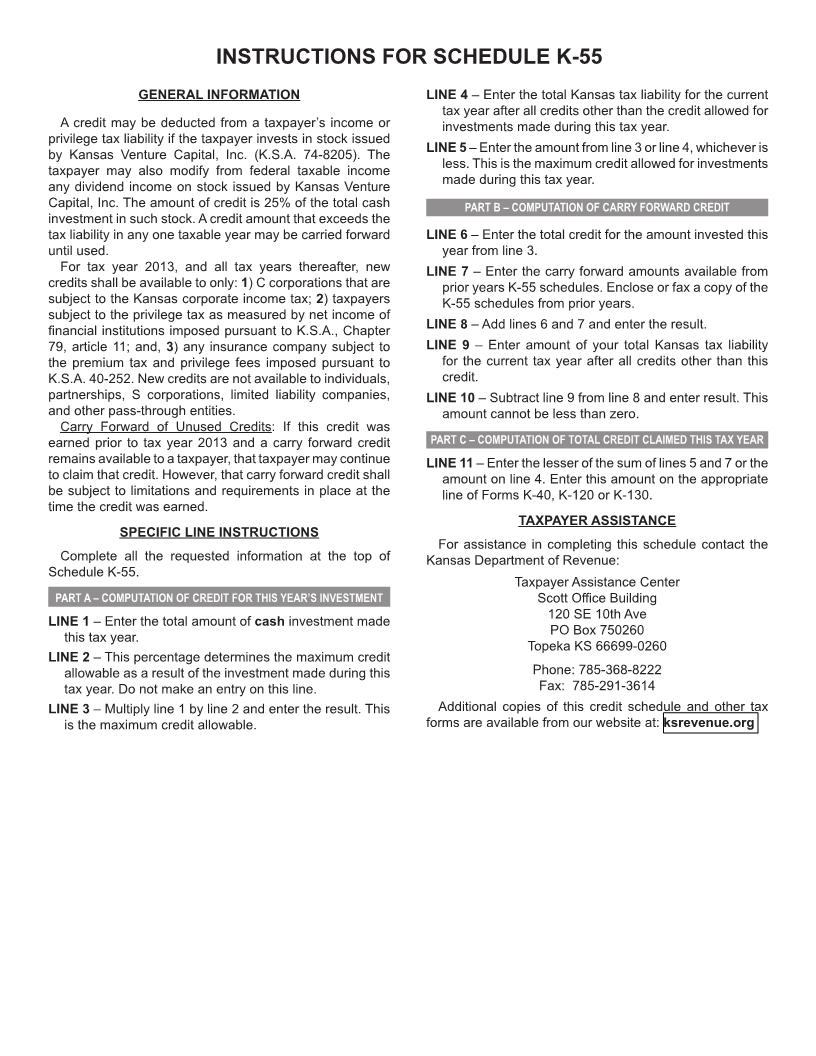

Enlarge image

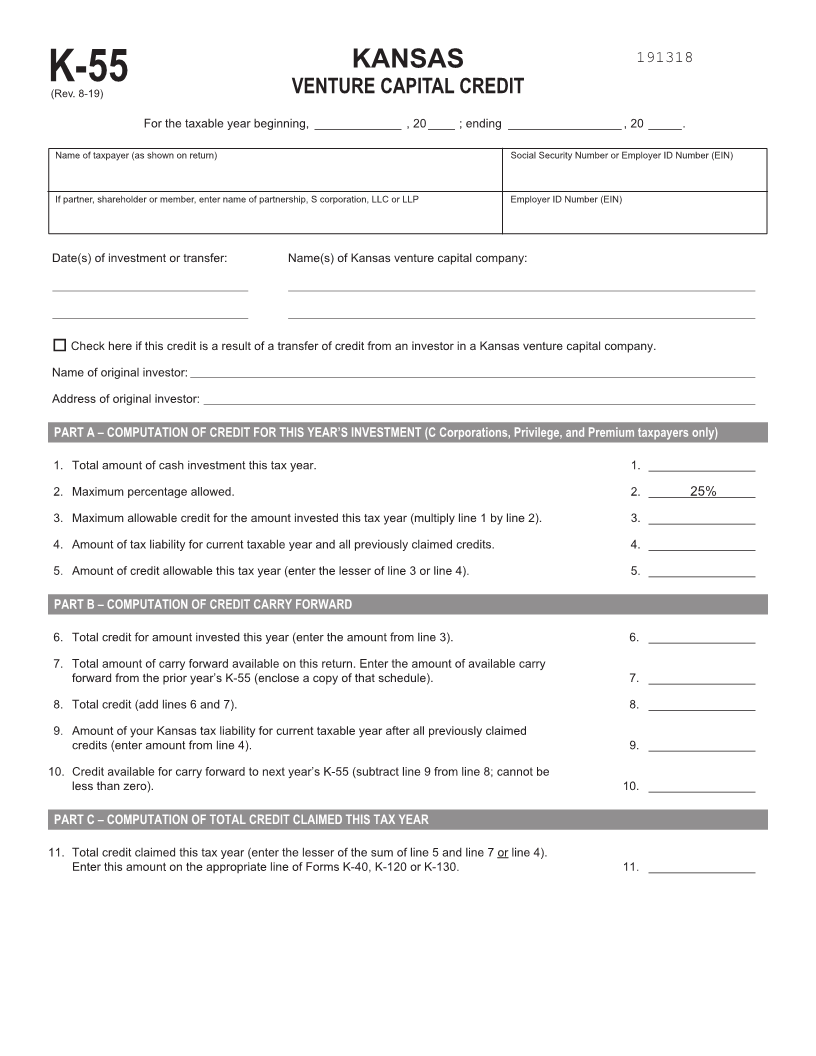

191318

KANSAS

K-55(Rev. 8-19) VENTURE CAPITAL CREDIT

For the taxable year beginning, _____________ , 20____ ; ending _________________ , 20 _____.

Name of taxpayer (as shown on return) Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP Employer ID Number (EIN)

Date(s) of investment or transfer: Name(s) of Kansas venture capital company:

____________________________________________ _________________________________________________________________________________________________________

____________________________________________ _________________________________________________________________________________________________________

o Check here if this credit is a result of a transfer of credit from an investor in a Kansas venture capital company.

Name of original investor: _______________________________________________________________________________________________________________________________

Address of original investor: ____________________________________________________________________________________________________________________________

PART A – COMPUTATION OF CREDIT FOR THIS YEAR’S INVESTMENT (C Corporations, Privilege, and Premium taxpayers only)

1. Total amount of cash investment this tax year. 1. ________________

2. Maximum percentage allowed. 2. ________________25%

3. Maximum allowable credit for the amount invested this tax year (multiply line 1 by line 2). 3. ________________

4. Amount of tax liability for current taxable year and all previously claimed credits. 4. ________________

5. Amount of credit allowable this tax year (enter the lesser of line 3 or line 4). 5. ________________

PART B – COMPUTATION OF CREDIT CARRY FORWARD

6. Total credit for amount invested this year (enter the amount from line 3). 6. ________________

7. Total amount of carry forward available on this return. Enter the amount of available carry

forward from the prior year’s K-55 (enclose a copy of that schedule). 7. ________________

8. Total credit (add lines 6 and 7). 8. ________________

9. Amount of your Kansas tax liability for current taxable year after all previously claimed

credits (enter amount from line 4). 9. ________________

10. Credit available for carry forward to next year’s K-55 (subtract line 9 from line 8; cannot be

less than zero). 10. ________________

PART C – COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

11. Total credit claimed this tax year (enter the lesser of the sum of line 5 and line 7 or line 4).

Enter this amount on the appropriate line of Forms K-40, K-120 or K-130. 11. ________________