Enlarge image

191218

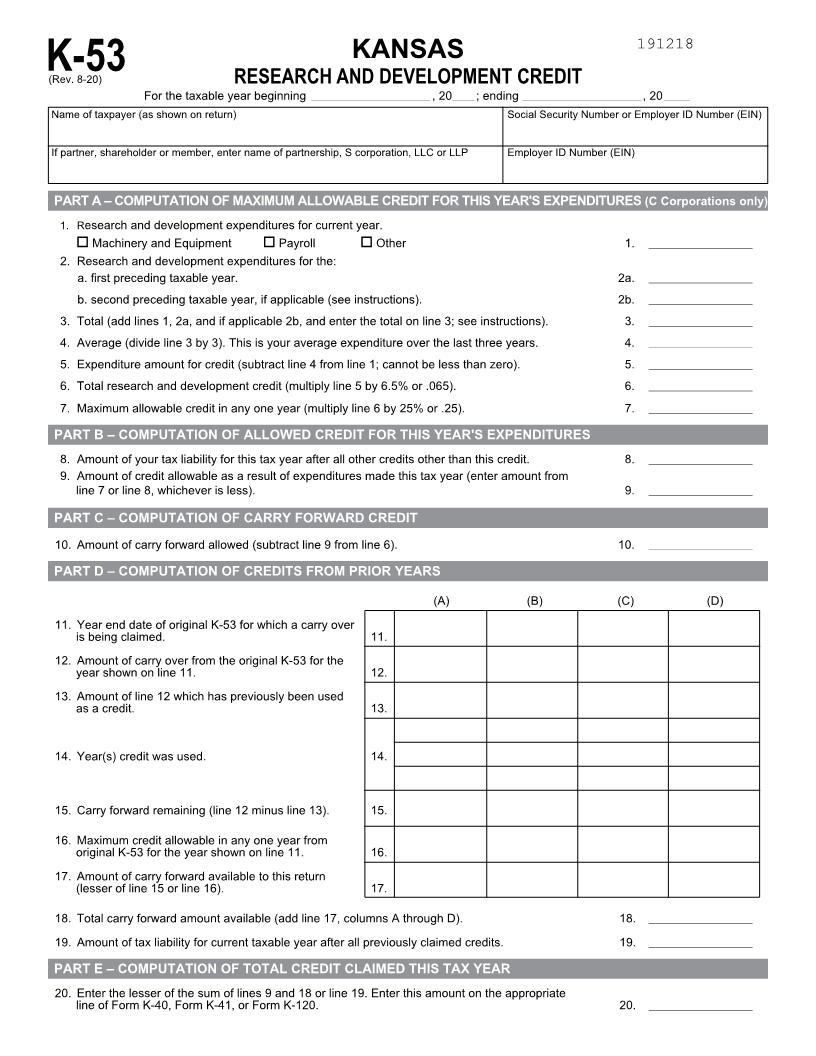

KANSAS

K-53(Rev. 8-20) RESEARCH AND DEVELOPMENT CREDIT

For the taxable year beginning ________________________________ , 20______ ; ending ________________________________ , 20_______

Name of taxpayer (as shown on return) Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP Employer ID Number (EIN)

PART A – COMPUTATION OF MAXIMUM ALLOWABLE CREDIT FOR THIS YEAR'S EXPENDITURES (C Corporations only)

1. Research and development expenditures for current year.

o Machinery and Equipment o Payroll o Other 1. ____________________________

2. Research and development expenditures for the:

a. first preceding taxable year. 2a. ____________________________

b. second preceding taxable year, if applicable (see instructions). 2b. ____________________________

3. Total (add lines 1, 2a, and if applicable 2b, and enter the total on line 3; see instructions). 3. ____________________________

4. Average (divide line 3 by 3). This is your average expenditure over the last three years. 4. ____________________________

5. Expenditure amount for credit (subtract line 4 from line 1; cannot be less than zero). 5. ____________________________

6. Total research and development credit (multiply line 5 by 6.5% or .065). 6. ____________________________

7. Maximum allowable credit in any one year (multiply line 6 by 25% or .25). 7. ____________________________

PART B – COMPUTATION OF ALLOWED CREDIT FOR THIS YEAR'S EXPENDITURES

8. Amount of your tax liability for this tax year after all other credits other than this credit. 8. ____________________________

9. Amount of credit allowable as a result of expenditures made this tax year (enter amount from

line 7 or line 8, whichever is less). 9. ____________________________

PART C – COMPUTATION OF CARRY FORWARD CREDIT

10. Amount of carry forward allowed (subtract line 9 from line 6). 10. ____________________________

PART D – COMPUTATION OF CREDITS FROM PRIOR YEARS

(A) (B) (C) (D)

11. Year end date of original K-53 for which a carry over

is being claimed. 11.

12. Amount of carry over from the original K-53 for the

year shown on line 11. 12.

13. Amount of line 12 which has previously been used

as a credit. 13.

14. Year(s) credit was used. 14.

15. Carry forward remaining (line 12 minus line 13). 15.

16. Maximum credit allowable in any one year from

original K-53 for the year shown on line 11. 16.

17. Amount of carry forward available to this return

(lesser of line 15 or line 16). 17.

18. Total carry forward amount available (add line 17, columns A through D). 18. ____________________________

19. Amount of tax liability for current taxable year after all previously claimed credits. 19. ____________________________

PART E – COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

20. Enter the lesser of the sum of lines 9 and 18 or line 19. Enter this amount on the appropriate

line of Form K-40, Form K-41, or Form K-120. 20. ____________________________