Enlarge image

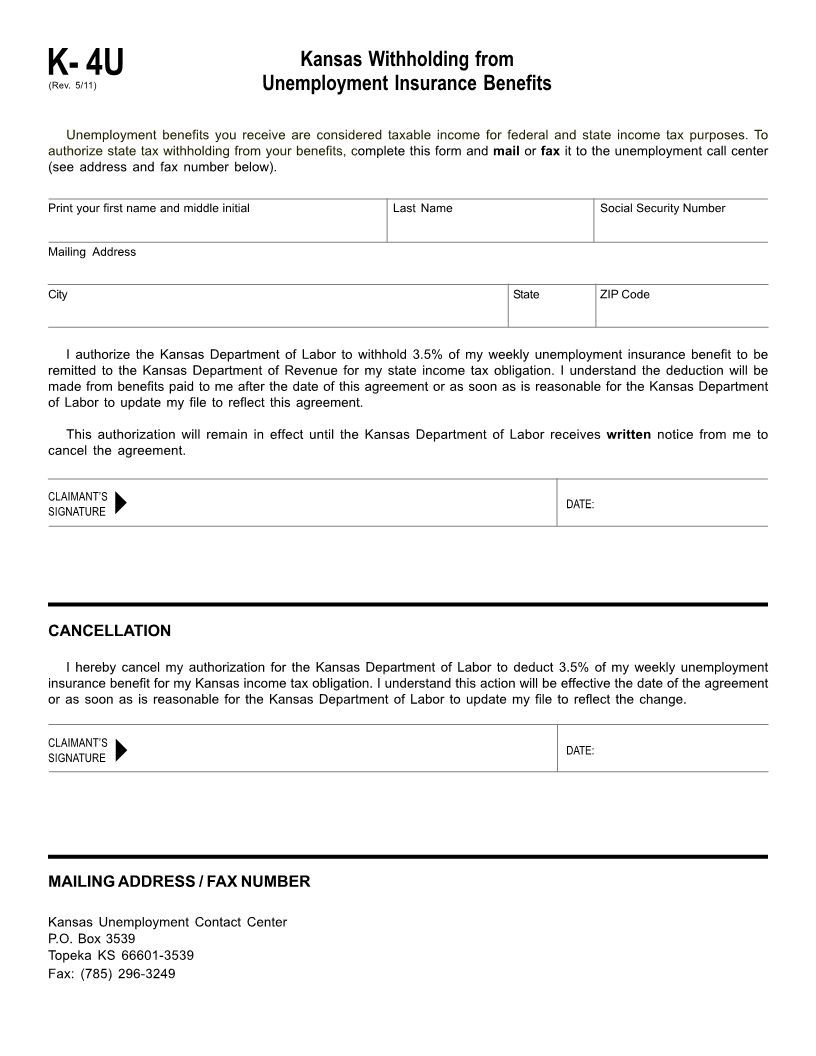

Kansas Withholding from

K- 4U

(Rev. 5/11) Unemployment Insurance Benefits

Unemployment benefits you receive are considered taxable income for federal and state income tax purposes. To

authorize state tax withholding from your benefits, complete this form and mail or fax it to the unemployment call center

(see address and fax number below).

Print your first name and middle initial Last Name Social Security Number

Mailing Address

City State ZIP Code

I authorize the Kansas Department of Labor to withhold 3.5% of my weekly unemployment insurance benefit to be

remitted to the Kansas Department of Revenue for my state income tax obligation. I understand the deduction will be

made from benefits paid to me after the date of this agreement or as soon as is reasonable for the Kansas Department

of Labor to update my file to reflect this agreement.

This authorization will remain in effect until the Kansas Department of Labor receives written notice from me to

cancel the agreement.

CLAIMANT’S

DATE:

SIGNATURE `

CANCELLATION

I hereby cancel my authorization for the Kansas Department of Labor to deduct 3.5% of my weekly unemployment

insurance benefit for my Kansas income tax obligation. I understand this action will be effective the date of the agreement

or as soon as is reasonable for the Kansas Department of Labor to update my file to reflect the change.

CLAIMANT’S

DATE:

SIGNATURE `

MAILING ADDRESS / FAX NUMBER

Kansas Unemployment Contact Center

P.O. Box 3539

Topeka KS 66601-3539

Fax: (785) 296-3249