Enlarge image

2019 Fiduciary Income Tax For a fast refund, file electronically! See back cover for details. ksrevenue.org

Enlarge image | 2019 Fiduciary Income Tax For a fast refund, file electronically! See back cover for details. ksrevenue.org |

Enlarge image |

GENERAL INFORMATION

If any due date falls on a Saturday, Sunday, or legal holiday, substitute the next regular workday.

Who Must Resident Estate or Trust. The fiduciary of a resident estate or trust must file a Kansas Fiduciary Income Tax return

(K-41) if the estate or trust had any taxable income or there is withholding tax due for the nonresident beneficiaries. A

File a Return resident estate is the estate of a person who was a Kansas resident at the time of death. All other estates are nonresident

estates. A resident trust is any trust which is administered by the trustee in Kansas. A trust being administered outside of

Kansas shall not be considered a resident trust merely because the governing instrument or a law requires that the laws

of Kansas be followed with respect to interpretation or administration of the trust. All other trusts are nonresident trusts.

Nonresident Estate or Trust. The fiduciary of a nonresident estate or trust must file a Kansas Fiduciary Income

Tax Return if the estate or trust had taxable income or gain derived from Kansas sources. This includes income or

gain from: 1) real or tangible personal property located within Kansas; 2) a business, profession or occupation carried

on within Kansas; or, 3) services performed within Kansas.

For a nonresident estate or trust, income from the following is not considered to be derived from Kansas sources:

annuities, interest, dividends, or gains from the sale or exchange of intangible personal property, unless part of the

income from a business, trade, profession, or occupation carried on within Kansas.

When and You should complete your Kansas fiduciary return after the federal fiduciary return is complete. It is due no later

than the 15th day of the fourth month after the close of the taxable year (generally April 15 for those operating on a

Where to File

calendar year basis). Mail your Fiduciary Income Tax return to the address shown on Form K-41.

For a quick and easy filing solution, submit your return electronically. See back cover for details.

Extension of If you are unable to complete your Kansas fiduciary return by the filing deadline, you may request an extension of

time to file. If you filed Form 7004 with the IRS for an extension of time, enclose a copy of that form with your completed

Time to File

An extension of K-41. (Kansas does not have a separate extension request form but will accept an approved federal Extension of Time

time to file is not an To File form.) If you do not pay the tax amount due (may be estimated) by the original due date, you will owe interest

extension to pay. and may also be charged a penalty on any balance due.

Accounting The accounting period for which the Kansas fiduciary return is filed and the method of accounting used must be the

same as that used for federal tax purposes. If, for federal purposes, the taxable year for the estate or trust changes

Period

or the method of accounting is changed, the changes also apply to the Kansas return.

Withholding Kansas law requires the fiduciary of a resident estate or trust to submit the payment of withholding tax for its

nonresident beneficiaries, if it is $5 or more, with the filing of Form K-41. Complete Part IV, and enter the total from

Tax Payments

Column E on line 6 of Form K-41.

Estimated Estates and trusts are required to make federal estimated tax payments; however, Kansas statutes exempt estates

Tax and trusts from making estimated tax payments for Kansas fiduciary purposes.

Fiduciary Fiduciaries must provide each beneficiary with the amount of the fiduciary modification to be used in the preparation

Reporting to of the beneficiary’s Kansas individual income tax return. See page 2, Part II, Column D of Form K-41.

Beneficiaries In addition, fiduciaries must provide each nonresident beneficiary with the amount of their share of income and

credits from page 3, Part IV of Form K-41, and when Kansas tax is withheld, supply Form K-18 to the nonresident

beneficiary. Fiduciary modifications, beneficiaries’ shares of fiduciary modifications, and beneficiaries’ shares of income

and credits are computed on pages 2 and 3 of Form K-41 in Parts I, II, III and IV.

Federal Return Enclose with Form K-41 a copy of your Federal Form 1041, including all schedules as filed with the IRS. The

processing of your Kansas fiduciary return may be delayed if your federal fiduciary return is not included.

Confidential Income tax information disclosed to the Department of Revenue, either on returns or through department investigation,

is held in strict confidence by law. The Department of Revenue and the IRS have an agreement under which income

Information

tax information is exchanged. This is to verify the accuracy and consistency of information reported on federal and

Kansas fiduciary returns.

Amended You must file an amended K-41 when: 1) an error was made on your Kansas return, 2) there is a change (error or

adjustment) on another state’s return, or 3) there is a change (error or adjustment) on your federal return. To amend

Returns

your original return, use Form K-41 and mark the amended return check box. Pay the full amount of tax and interest

due and no late pay penalty will be assessed. See our website for interest rates.

If you are filing an amended federal return for the same taxable year as this amended return, enclose a copy of the

amended federal return and an explanation of all changes made on your amended Kansas return. If your amended

federal return is adjusted or disallowed, provide the Department of Revenue with a copy of the adjustment or denial letter.

If you have not yet filed a Kansas K-41 but you filed your original federal return and the federal return has been

amended or adjusted, use the information on the amended/adjusted federal return to complete your original Kansas

return. A copy of both the original and amended federal returns should be enclosed with the Kansas return along with

an explanation of the changes.

Page 2

|

Enlarge image |

LINE INSTRUCTIONS FOR FORM K-41, PAGE 1

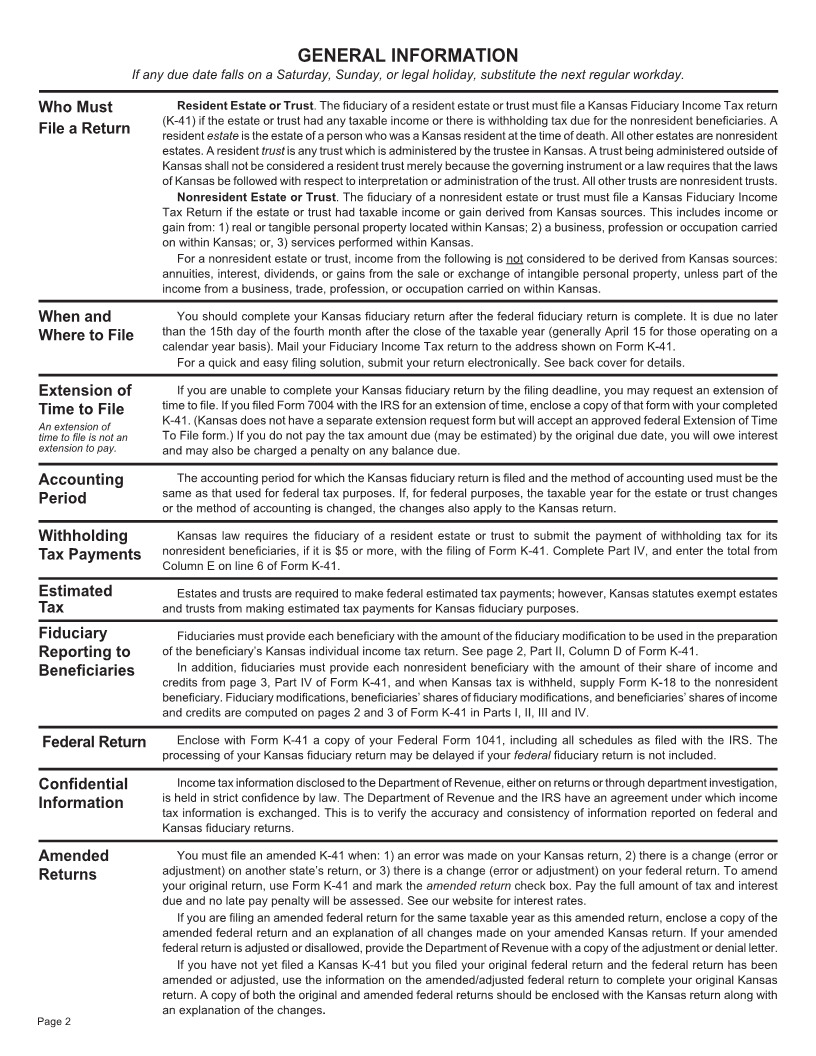

Heading. Type or print your name and address in the spaces Foreign Tax Credit. As used in this section “state” means any

provided. If your name or address changed since you last filed, mark state of the United States, District of Columbia, Puerto Rico, any

an “X” in the box below the heading. If filing an amended return, mark territory or possession of the United States, and any foreign country

an “X” in the box below your name and address. or political subdivision of a foreign country. The Kansas credit for

Telephone Number. If a problem should arise in processing your foreign taxes is first limited to the difference between the actual tax

return, it is helpful that the Department of Revenue have a telephone paid to the foreign country and the foreign tax credit allowed on the

number where you can be reached during office hours. The number federal return. If you claimed the foreign tax paid as an itemized

you provide will be kept confidential. deduction on your federal return, no credit is allowed in this section.

Filing Status. The filing status shown on Form K-41 will reflect Foreign Tax Worksheet

the nature of the entity for which the return is being filed.

A. 2019 tax paid to the foreign country....................... $ ____________

Residency Status. Residents: If you are filing for a resident estate

or trust, check the box for residents. If all income is taxable to the B. LESS: Federal foreign tax credit allowed............... $ ____________

fiduciary and no distributions are made or required to be made, only C. EQUALS: Kansas foreign tax limitation. Enter this

Part I must be completed. If there are only resident beneficiaries, or amount on line 1 of the following worksheet........... $ ____________

if no amounts are distributable to nonresident beneficiaries, then it

is necessary to complete only Parts I and II. If there are nonresident If you are a Kansas resident, use the following worksheet to

beneficiaries, then it is generally necessary to complete all parts. determine your credit for tax paid to another state(s). Nonresidents

However, if amounts distributed to nonresidents are nontaxable, may not claim this credit against Kansas tax.

then Part IV may be omitted. Nonresidents: If you are filing for a

nonresident estate or trust, check the box for nonresidents. If there Other State Tax Credit Worksheet

are resident and/or nonresident beneficiaries, then all parts must be 1) Income tax paid to another state(s) and included

completed. However, if all income is taxable to the fiduciary, then in your 2019 Kansas Adjusted Gross Income....... $ ____________

only Parts I and II must be completed.

2) Kansas tax liability ................................................ $ ____________

Date Established. Enter date of death or date the trust was

established. 3) Other state’s taxable income ................................ $ ____________

LINE 1 (FEDERAL TAXABLE INCOME): Residents: Enter on 4) Kansas taxable income......................................... $ ____________

line 1 the federal taxable income shown on page 1 of the Federal 5) Percentage limitation (divide line 3 by line 4)........ _________ %

Fiduciary Return, Form 1041. Nonresidents: Enter on line 1 the

amount reported in Part III, line 48, column D of Form K-41. 6) Limitation amount (multiply line 2 by line 5).......... $ ____________

LINE 2 (KANSAS FIDUCIARY MODIFICATION): Residents: 7) Allowable credit (amount from line 1 or line 6,

If there has been no distribution to beneficiaries, enter the fiduciary whichever is less).................................................. $ ____________

modification from page 2, line 26. If there has been a distribution to

beneficiaries, enter the fiduciary’s portion of the modification from LINE 9 (OTHER NONREFUNDABLE CREDITS): Enter the total

page 2, line (j). Nonresidents: No modification is to be made on this of all tax credits for which you are eligible. The list below includes

line by a nonresident estate or trust. some of the more common credits In. claiming credits, you must

LINE 3 (KANSAS TAXABLE INCOME): If line 2 is a positive complete and enclose with your Form K-41 the required schedule(s).

amount, add line 2 to line 1 and enter result on line 3. If line 2 is a Business and Job Development (for carry forward use only) ........ K-34

negative amount, subtract line 2 from line 1 and enter result. If you Community Service Contribution ............................................ K-60

made no entry on line 2, your Kansas taxable income is the same as Declared Disaster Capital Investment (for carry forward use only) K-87

your federal taxable income so enter that amount on line 3. Disabled Access ..................................................................... K-37

LINE 4 (TAX): To compute the fiduciary income tax, refer to the High Performance Incentive Program .................................... K-59

tax computation schedule on the last page of Form K-41. Enter the Individual Development Account ............................................ K-68

tax amount on line 4. Purchases from Qualified Vendor.............................................K-44

LINE 5 (TAX ON LUMP SUM DISTRIBUTIONS): If a resident Research and Development (for carry forward use only)............... K-53

estate or trust received income from a lump sum distribution and a Low Income Student Scholarship Credit ................................ K-70

federal tax was imposed on this income in accordance with federal Venture and Local Seed Capital (for carry forward use only) ........ K-55

Internal Revenue Code, Section 402(e), then the resident estate

or trust is also subject to Kansas tax on the lump sum distribution. LINE 10 (TOTAL CREDITS): Add lines 8 and 9 and enter the

Enter on line 5 an amount equal to 13% of the federal tax on the result on line 10.

ordinary income portion of the lump sum distribution determined on LINE 11 (BALANCE): Subtract line 10 from line 7 and enter result

federal Form 4972. (cannot be less than zero).

LINE 6 (NONRESIDENT BENEFICIARY TAX): Enter the LINE 12 (KANSAS INCOME TAX WITHHELD): Enter any

amount of nonresident beneficiary tax reported on page 3, Part IV amount of Kansas withholding. The Department of Revenue does

of Form K-41. This amount is the total of column E. not require that copies of W-2 or 1099 forms be enclosed with your

LINE 7 (TOTAL KANSAS TAX): Add lines 4, 5 and 6. return; however, the Department reserves the right to ask for this

LINE 8 (CREDIT FOR TAXES PAID TO OTHER STATES information at a later date.

(FOR RESIDENTS ONLY)): If you paid income tax to another LINE 13 (KANSAS ESTIMATED TAX PAID): Enter the total of

state, and the income derived from the other state is included in any estimated tax payments you made for your 2019 return.

your Kansas adjusted gross income (KAGI), you may be eligible for Enter

LINE 14 (AMOUNT PAID WITH KANSAS EXTENSION):

a credit against your Kansas tax liability. If you had income from a

any amount paid with an extension of time request.

state that has no state income tax, make no entry on line 8 and go

to line 9. A copy of the return filed with the other state(s), or a copy LINE 15 (REFUNDABLE PORTION OF TAX CREDITS): Enter

of Federal Form 1116 (if applicable) for claiming a foreign tax credit, the refundable portion of your tax credits. Enclose a copy of the

must be enclosed with Kansas Form K-41. schedule(s) with your return.

Page 3

|

Enlarge image |

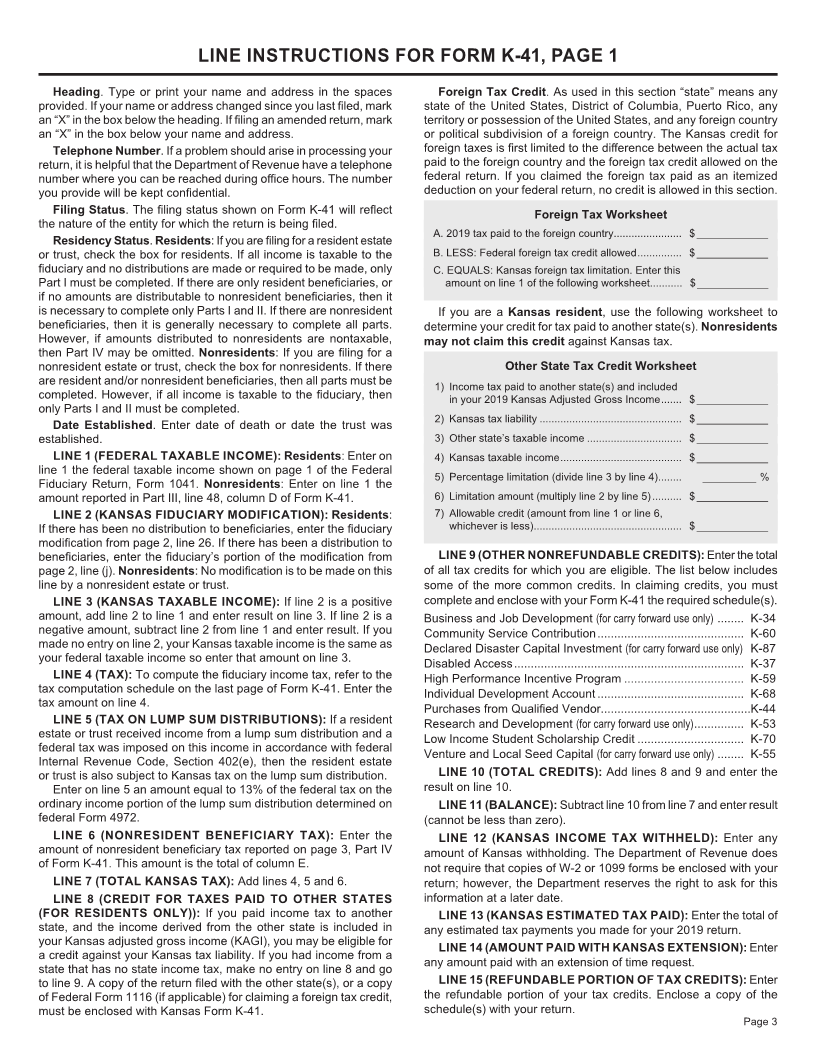

LINE 16 (PAYMENTS REMITTED WITH ORIGINAL RETURN): LINE 22 (BALANCE DUE): Add lines 19, 20 and 21 and enter the

If you are filing an amended K-41 for the 2019 tax year, enter the result on line 22. Write your federal Employer Identification Number

amount of money you remitted to KDOR with your original 2019 return. (EIN) on your check or money order, made payable to Kansas

LINE 17 (OVERPAYMENT FROM ORIGINAL RETURN): If you Fiduciary Tax and send it with your return. Do not send cash. A

are filing an amended K-41 for the 2019 tax year, enter the amount of balance due of less than $5.00 need not be paid.

overpayment shown on your original return. Since you were refunded LINE 23 (REFUND): If line 18 is greater than line 11, subtract

this amount, it is a subtraction entry. line 11 from line 18 and enter the amount of the refund on line 23.

LINE 18 (TOTAL REFUNDABLE CREDITS): Add lines 12 through Amounts less than $5.00 will not be refunded.

16 and subtract line 17. Enter the total on line 18.

Normal processing time to issue a refund for a paper-filed tax

LINE 19 (UNDERPAYMENT): If your tax balance on line 11 is

return is 16 weeks. Errors on your return, photocopied forms, and

greater than your total refundable credits on line 18, enter the difference

incomplete returns or those with missing documentation will cause

on line 19. NOTE: If the amount on line 19 is not paid by the due date,

or if a balance due return is filed after the due date, penalty and interest delays in processing refunds. For a faster refund - file electronically!

will be added according to the rules outlined in lines 20 and 21. Usually processed within 4 weeks. See back cover. NOTE: If there

Extension of Time. Interest is due on any delinquent tax balance, is any other liability owed the State of Kansas, the fiduciary income

even if you were granted an extension of time to file. If 90% of your tax refund will be applied to that liability.

tax liability is paid on or before the original due date of your return, Signatures: The fiduciary MUST sign Form K-41. If prepared by

an automatic extension is applied and no penalty is assessed. someone other than the fiduciary, the preparer should also sign. No

LINE 20 (INTEREST): Using the underpayment amount on line refund can be made unless the return is properly signed.

19, compute interest at .5% for each month (or portion thereof) from

the due date of the return. Preparer Authorization Box: It may be necessary that the

Department contact you about your tax return. If you wish to have

LINE 21 (PENALTY): Compute penalty at 1% per month (or the Director of Taxation or his/her designee contact your tax preparer

portion thereof) from the due date of the return on the amount on instead, please give permission to do so by checking this box.

line 19. The maximum penalty is 24%.

LINE INSTRUCTIONS FOR FORM K-41, PAGES 2 AND 3

PART I — MODIFICATIONS TO FEDERAL TAXABLE INCOME n Learning Quest Education Savings Program. Enter amount

LINE 24a (STATE AND MUNICIPAL INTEREST): Enter interest of any “nonqualified withdrawal” from the Learning Quest

income received, credited, or earned from any state or municipal Education Savings Program.

obligations during the taxable year, less any related expenses n Kansas Expensing Recapture. If you have a Kansas

(management fees, trustee fees, interest, etc.) directly incurred in the expensing deduction recapture amount from Schedule

purchase of state or political subdivision obligations. Do not include K-120EX, enter the amount of your deduction on line 24d and

those specifically exempt from income tax by Kansas law, such as: enclose a copy of your completed K-120EX and federal Form

Kansas turnpike authority bonds, Board of Regents bonds for Kansas 4562.

colleges and universities, electrical generation revenue bonds, urban LINE 24e (TOTAL ADDITIONS): Add lines 24a through 24d.

renewal bonds, industrial revenue bonds, or Kansas highway bonds.

LINE 25a(INTEREST ON U.S. GOVERNMENT OBLIGATIONS):

Interest income on obligations of Kansas or any political Enter any interest or dividend income received on obligations or

subdivision thereof, issued after December 31, 1987, shall be securities of any authority, commission, or instrumentality of the

excluded from computation of Kansas taxable income.

United States and its possessions, less any related expenses

LINE 24b (STATE INCOME TAX OR LOCAL TAXES): Enter (management fees, trustee fees, interest, etc.) directly incurred in

any state, county, or city income or earnings taxes which are included the purchase of such obligations or securities, to the extent they

in your federal deductions. are included in federal taxable income if they are exempt from state

LINE 24c (ADMINISTRATIVE EXPENSES): Enter the amount income taxes under the laws of the United States. Such income paid

of administrative expenses claimed on both the Kansas estate tax to shareholders through a mutual fund is also exempt from Kansas

return and on the federal fiduciary tax return. tax. If the mutual fund invests in both exempt and non-exempt

LINE 24d (OTHER ADDITIONS TO FEDERAL TAXABLE federal obligations, the modification allowed will be that portion of

INCOME): Enter the total of these additions to federal taxable income: the distribution received from the mutual fund attributable to direct

n Federal Income Tax Refund. Generally, there will be no obligations of the U.S. government, as determined by the mutual fund.

entry here unless an amended federal return has been filed These obligations include: U.S. Savings Bonds, U.S. Treasury Bills,

for a prior year due to an investment credit carry back or a net Federal Land Bank, etc. Enclose a schedule indicating the name of

operating loss carry back which resulted in a federal income each U.S. Government obligation claimed.

tax refund in 2019 for that prior year. LINE 25b (STATE INCOME TAX REFUNDS): Enter any state

n Partnership, S Corporation, or Fiduciary Adjustments. If or local income tax refunds which are included in line 1 of Form K-41.

income was received from a partnership, S corporation, joint LINE 25c (RETIREMENT BENEFITS): Enter total amount of

venture, syndicate, estate or trust, enter your proportionate benefits received from the following plans that are included in your

share of any required addition adjustments. The partnership,

S corporation, or trustee will provide you the necessary federal adjusted gross income.

information to determine these amounts. • Federal Civil Service Retirement or Disability Fund payments

n Community Service Contribution Credit. Enter amount of and any other amounts received as retirement benefits from

any charitable contribution claimed on the federal return used employment by the federal government or for service in the

to compute this credit on Schedule K-60. United States Armed Forces

n Low Income Student Scholarship Credit. Enter the amount • Retirement plans administered by the U.S. Railroad Retirement

of any charitable contribution claimed on your federal return Board, including U.S. Railroad Retirement Benefits, tier I, tier II,

used to compute this credit on Schedule K-70. dual vested benefits, and supplemental annuities

Page 4

|

Enlarge image |

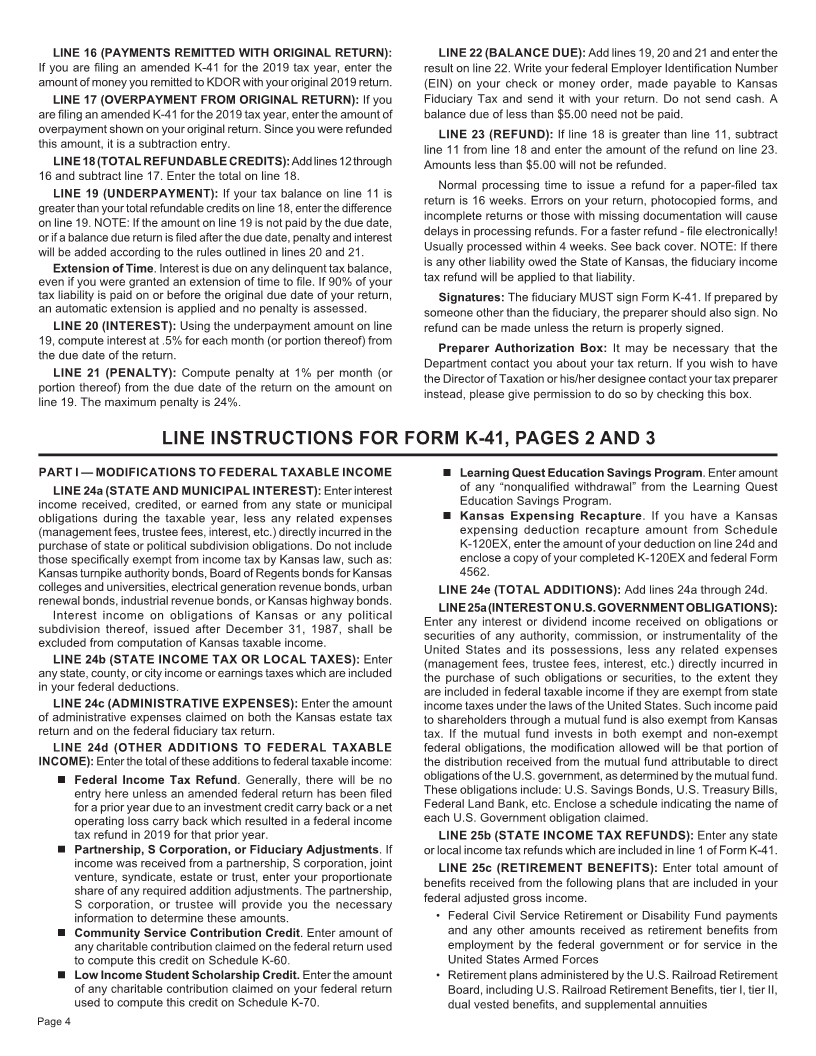

2019

140019

K-41(Rev. 7-19) KANSAS FIDUCIARY INCOME TAX

DO NOT STAPLE

For the taxable year beginning ________________________2 0 1 9 ; ending ______________________

Name of Estate or Trust

Employer ID Number (EIN)

Name of Fiduciary

Mailing Address (Number and Street, including Rural Route) Telephone Number

City, Town or Post Office State Zip Code School District Number County Abbreviation

Filing Information If your name or address has changed since last year, mark an “X” in this box If this is an amended return, mark an “X” in this box.

Filing Status (Mark ONE) Residency Status (Mark ONE) Date Established

Estate Resident Date of decedent’s death or date trust established:

Trust Nonresident (See instructions)

_________________________

Bankruptcy Estate MONTH DAY YEAR

1. Federal taxable income (Residents: Federal Form 1041; Nonresidents: Part III, line 48, column D) .......... 1 00

2. Resident fiduciary’s share of modifications to federal taxable income (residents only) 2

Part I, line 26 or Part II, line (j)..................................................................................................................... 00

Income

3. Kansas taxable income (Line 1 plus or minus line 2. See instructions) ....................................................... 3 00

4. Tax (from tax computation schedule on the last page of this form).................................................................... 4 00

5. Kansas tax on lump sum distributions (see instructions) ................................................................................... 5 00

6. Nonresident beneficiary tax (Part IV total of column E) ..................................................................................... 6 00

Tax Computation 7. TOTAL KANSAS TAX (add lines 4, 5 and 6) ...................................................................................................... 7 00

8. Credit for taxes paid to other states (resident estates or trusts only; see instructions)..................................... 8 00

9. Other nonrefundable credits (enclose all appropriate schedules) ..................................................................... 9 00

DO NOT SUBMIT

Credits 10. Total credits (add lines 8 and 9)......................................................................................................................... 10 00

11. Balance (subtract line 10 from line 7; cannot be less than zero)....................................................................... 11 00

12. Kansas income tax withheld .............................................................................................................................. 12 00

13. Kansas estimated tax paidPHOTOCOPIES................................................................................................................................ 13 00

14. Amount paid with Kansas extension.................................................................................................................. 14 00

15. Refundable portion of tax credits....................................................................................................................... 15 00

16. Amended filers: Payments remitted with original return ................................................................................. 16 00

17. Amended filers: OF THIS FORMOverpayment from original return (this figure is a subtraction; see instructions) .............. 17 00

Withholding & Payments

18. Total refundable credits (add lines 12 through 16 and subtract line 17)............................................................ 18 00

19. UNDERPAYMENT (if line 11 is greater than line 18).......................................................................................... 19 00

20. INTEREST (see instructions) ............................................................................................................................. 20 00

21. PENALTY (see instructions) ............................................................................................................................... 21 00

Write your EIN on your check or money order

22. BALANCE DUE (add lines 19, 20 and 21) .............................................. and make payable to: Kansas Fiduciary Tax 22 00

NOTE: If both the “TOTAL line in Part IV, Column E” and “amount on line 22” are zero, DO NOT FILE this return.

Refund or Balance Due 23. REFUND (if line 18 is greater than line 11) ........................................................................................................ 23 00

PLEASE COMPLETE THE BACK OF THIS FORM

|

Enlarge image |

140119

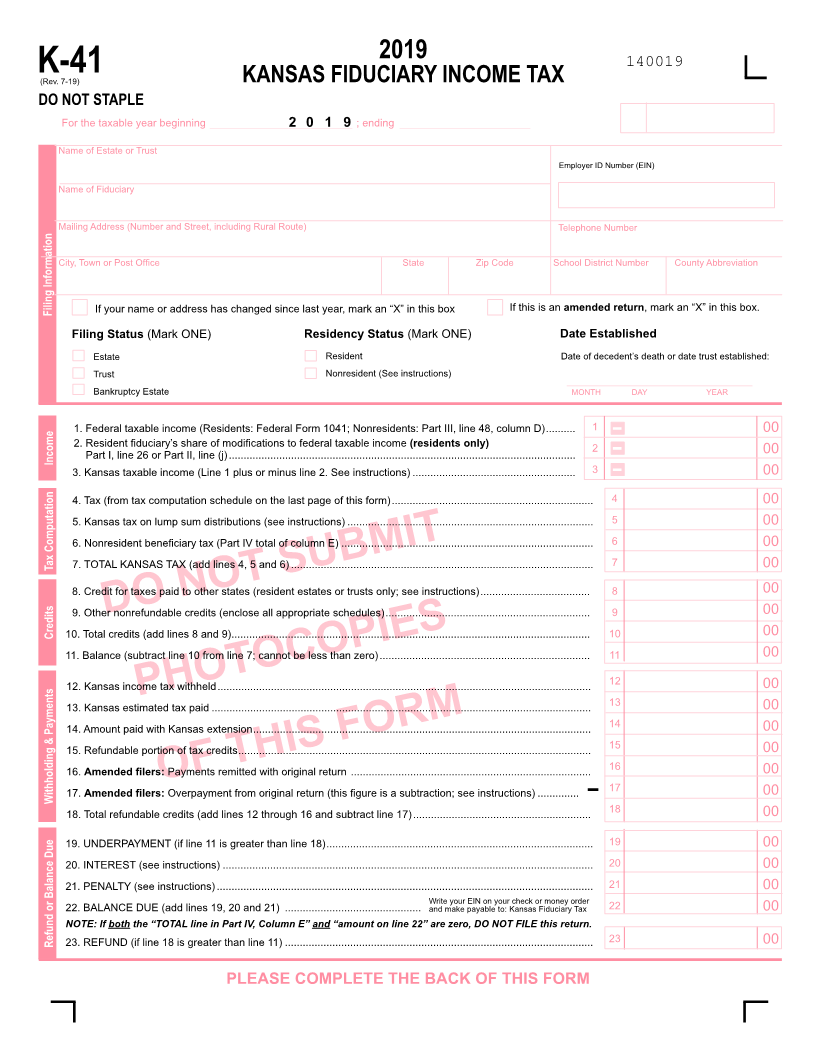

PART I - MODIFICATIONS TO FEDERAL TAXABLE INCOME

24. Additions to federal taxable income:

a. State and local bond interest (reduced by related expenses, enclose schedule)................................................. 24a 00

b. State or local taxes measured by income deducted on the federal return ........................................................... 24b 00

c. Administrative expenses claimed as deductions on Kansas estate tax return ..................................................... 24c 00

d. Other additions (see instructions, enclose schedule) .......................................................................................... 24d

DO NOT SUBMIT 00

e. Total additions to federal income (add lines 24a through 24d) ............................................................................. 24e 00

25. Subtractions from federal taxable income:

a. Interest on U.S. Government obligations (reduced by related expenses, enclose schedule) .............................. 25a 00

b. State income tax refunds reported as income on federal returnPHOTOCOPIES........................................................................... 25b 00

c. Exempt retirement benefits................................................................................................................................... 25c 00

d. Other subtractions from federal taxable income (see instructions, enclose schedule)......................................... 25d 00

e. Total subtractions from federal taxable income (add lines 25a through 25d) ......................................................... 25e 00

OF THIS FORM

26. Net modification to federal taxable income (subtract line 25e from line 24e) ............................................................. 26 00

PART II - COMPUTATION OF SHARES OF THE MODIFICATION TO FEDERAL TAXABLE INCOME

NOTE: The Kansas fiduciary modification is to be allocated among the beneficiaries and the fiduciary in proportion to their share of the sum

of the federal distributable net income and the amount distributed or required to be distributed from current income.

(A) (B) (C) (D)

Percent of Share of fiduciary adjustment (line 26,

Name and Address Social Security Number Distribution Part I, multiplied by column C)

RESIDENT BENEFICIARIES

(a) %

(b) %

(c) %

(d) %

NONRESIDENT BENEFICIARIES

(e) %

(f) %

(g) %

(h) %

(i) Charitable beneficiaries’ portion ( i ) %

Subtotal ........................................................................................................................................................... %

(j) Fiduciary’s portion ............................................................................................................................................( j ) %

Total................................................................................................................................................................. 100%

I authorize the Director of Taxation or the Director’s designee to discuss my return and enclosures with my preparer.

I declare under the penalties of perjury that to the best of my knowledge this is a true, correct, and complete return.

sign Signature of fiduciary Title Date

here

Signature of preparer other than fiduciary Address/Telephone Number Date

Mail to: Fiduciary Tax, Kansas Department of Revenue, PO Box 750260, Topeka, KS 66699-0260

|

Enlarge image |

FOR NONRESIDENT ESTATES AND TRUSTS OR RESIDENT ESTATES AND TRUSTS

WITH NONRESIDENT BENEFICIARIES 140219

PART III - COMPUTATION OF FEDERAL TAXABLE INCOME OF THE ESTATE OR TRUST FROM KANSAS SOURCES

(A) (B) (C) (D)

These items correspond to those listed on Total income as reported Amount from Nonresident fiduciary’s

Federal Form 1041 on Federal Form 1041 Kansas sources portion of Col. C & capital

gains not distributed

27. Interest income ..................................................................................................

28. Dividends ...........................................................................................................

29. Business income (loss)......................................................................................

30. Capital gain (loss) ..............................................................................................

31. Rents, royalties, partnerships, other estates and trusts, etc..............................

32. Farm income (loss) ............................................................................................

33. Ordinary income (loss).......................................................................................

34. Other income .....................................................................................................

35. Total income (Add lines 27 through 34) ........................................................

36. Interest ..............................................................................................................

37. Taxes.................................................................................................................

38. Fiduciary fees....................................................................................................

39. Charitable deduction .........................................................................................

40. Attorney, accountant, and return preparer fees.................................................

41a. Other deductions not subject to the 2% floor ....................................................

41b. Allowable miscellaneous itemized deductions subject to the 2% floor..............

42. Total (Add lines 36 through 41b)....................................................................

43. Subtract line 42 from line 35..............................................................................

44. Distributions to beneficiaries .............................................................................

45a. Estate tax deduction (fiduciary) .........................................................................

45b. Estate tax deduction (beneficiary) .....................................................................

46. Exemption (For Column D, see instructions)....................................................

47. Total (Add lines 44 through 46)......................................................................

48. Taxable income (Subtract line 47 from line 43) .................................................

49. Total percent of all nonresident beneficiaries - from Part II, lines (e), (f), (g) & (h)

50. Total Kansas income of nonresident beneficiaries (Multiply line 48 by line 49) .

PART IV - NONRESIDENT BENEFICIARIES’ SHARES OF INCOME AND TAX TO BE WITHHELD

(A) (B) (C) (D) (E)

Name and Address Social Security Beneficiary’s Kansas Tax to be withheld

Number Percentage Taxable Income (Multiply Col. D by 2.5%)

NONRESIDENT BENEFICIARIES

(a) %

(b) %

(c) %

(d) %

TOTAL. Enter amount from column E on line 6............................................................. %

|

Enlarge image |

140319

2019

K-18 FIDUCIARY REPORT OF NONRESIDENT BENEFICIARY TAX WITHHELD

KANSAS DEPARTMENT OF REVENUE

ENDING DATE OF ESTATE OR TRUSTS TAX YEAR __________________________________

NONRESIDENT BENEFICIARY’S NAME SOCIAL SECURITY NUMBER NAME OF ESTATE OR TRUST EIN OF TRUST

STREET ADDRESS OR RURAL ROUTE NONRESIDENT BENEFICIARY’S SHARE OF DISTRIBUTABLE

INCOME FROM KANSAS SOURCES:

Taxable income...................................................... $ _____________

CITY STATE ZIP CODE Modifications as if Kansas resident ....................... $ _____________

Amount of tax withheld .......................................... $ _____________*

* Beneficiary: Enter this amount on the “Kansas Income Tax Withheld” line of your

Kansas Individual Income Tax return (K-40).

TAX COMPUTATION SCHEDULE

If amount on line 3, Form K-41 is: Enter on line 4, Form K-41:

Over But Not Over

$ 0.................. $15,000.................... 3.1% of line 3

$15,000.................. $30,000.................... $465 plus 5.25% of excess over $15,000

$30,000...................................................... $1,252.50 plus 5.7% of excess over $30,000

TAX WITHHELD FOR NONRESIDENT BENEFICIARIES

Under Kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to

withhold 2.5% (.025) of the amount distributable to each nonresident beneficiary. The amount to be withheld

from each nonresident beneficiary is shown in Part IV, column (E). For each nonresident beneficiary from

whom tax is withheld, three copies of the Fiduciary Report of Nonresident Beneficiary Tax Withheld, Form

K-18, must be prepared. Copy the Form K-18 shown above or download from our website at ksrevenue.org.

Distribute copies of Form K-18 as follows:

– to the beneficiary from whom the tax is withheld to enclose with their Kansas Income Tax return.

– to the beneficiary for their records.

– to be retained by fiduciary.

|

Enlarge image |

• Kansas Public Employees’ Retirement (KPERS) annuities n S Corporation Privilege Adjustment. If you are a shareholder

• Kansas Police and Firemen’s Retirement System pensions in a bank, savings and loan, or other financial institution that is

• Distributions from Police and Fire Department retirement plans organized as an S corporation, enter the portion of any income

for the city of Overland Park, Kansas received that was not distributed as a dividend. This income

• Kansas Teachers’ Retirement annuities has already been taxed on the privilege tax return filed by the

• Kansas Highway Patrol pensions S corporation financial institution.

• Kansas Justices and Judges Retirement System annuities n Electrical Generation Revenue Bonds. Enter the amount

• Board of Public Utilities pensions included in federal taxable income.

• Income from retirement annuity contracts purchased for faculty n Learning Quest Education Savings Program . Enter

and others employed by the State Board of Regents or by contributions deposited in the Learning Quest Education

educational institutions under its management with either their Savings Program, or a qualified 529 tuition program

direct contributions or through salary reduction plans established by another state, up to a maximum of $3,000 per

• Amounts received by retired employees of Washburn University student (beneficiary).

as retirement and pension benefits under the university’s n Armed Forces Recruitment, Sign-Up or Retention Bonus.

retirement plan Members of the armed forces of the United States (including

• Certain pensions received from Kansas first class cities that are Kansas army and air national guard): enter amounts received

not covered by KPERS as a recruitment, sign up or retention bonus you received as

LINE 25d (OTHER SUBTRACTIONS FROM FEDERAL an incentive to join, enlist or remain in the armed forces of the

TAXABLE INCOME): Enter on line 25d the total of these other United States, to the extent included in federal adjusted gross

subtractions from federal taxable income. NOTE: You may not income. Also include amounts you received for repayment of

subtract the amount of income reported to another state. educational or student loans incurred by you or for which you

are obligated, and received as a result of your service in the

n Fiduciary of an Estate or Trust may make a contribution armed forces of the United States, to the extent included in

into a Kansas Achieving a Better Life Experience (ABLE) federal adjusted gross income.

account for a disabled individual.

n Organ Donor Expenses. Unreimbursed travel, lodging, and

n Social Security Benefits (for taxpayers with federal medical expenditures incurred by you or your dependent, while

adjusted gross income of $75,000 or less). Enter the

living, for the donation of human organ(s) to another person

amount received as benefits under the Social Security Act

for transplant; to the extent that the expenditures are included

(including SSI) in 2019, to the extent it is included in federal

in your federal adjusted gross income. This subtraction

adjusted gross income.

modification cannot exceed $5,000. See NOTICE 14-03 for

n KPERS Lump Sum Roll Over. Enter the amounts withdrawn more information.

from a qualified retirement account and include any earnings

thereon to the extent that the amounts withdrawn were LINE 25e (TOTAL SUBTRACTIONS): Add lines 25a through

originally received as a KPERS lump sum payment at 25d and enter the total on line 25e.

retirement that you rolled over into a qualified retirement LINE 26 (NET MODIFICATION TO FEDERAL TAXABLE

account and the amount entered is included in federal adjusted INCOME): Subtract line 25e from line 24e. Enter the total on line 26 and

gross income. Do not make an entry if the amount withdrawn on line 2, page 1, Form K-41. If there are beneficiaries, refer to Part II.

consists of income that was originally received from retirement

PART II – COMPUTATION OF SHARES OF THE

annuity contracts purchased for faculty and others employed

MODIFICATION TO FEDERAL TAXABLE INCOME

by the State Board of Regents or by educational institutions

under its management with either their direct contributions or Part II is used to determine the allocation of the shares of the

through salary reduction plans or, a pension received from Kansas fiduciary modification. The Kansas fiduciary modification is

any Kansas first class city that is not covered by the Kansas divided among the beneficiaries and the fiduciary in proportion to

Public Employee’s Retirement System. their share of the federal distributable net income plus the amount

n KPERS Lump Sum Distribution. Employees who terminated contributed or required to be contributed from current income to

KPERS employment after July 1, 1984, and elect to receive their charitable beneficiaries.

contributions in a lump sum distribution will report their taxable If there is no federal distributable net income, each beneficiary’s

contributions on their federal return. Subtract the amount of share of the Kansas fiduciary modification shall be in proportion to

the withdrawn accumulated contributions or partial lump-sum each share of the estate or trust income distributed. Any balance of

payment(s) to the extent either is included in federal adjusted the Kansas fiduciary modification not allocated to the beneficiaries

gross income. See NOTICE 05-04 for additional information. is allocable to the fiduciary.

n Sale of Kansas Turnpike Bonds. Enter the gain from the When the allocation of the Kansas fiduciary modification, as

sale of Kansas Turnpike Bonds if the gain was included in provided by law, would result in an amount that is substantially

the federal taxable income. inequitable, the fiduciary may, with the permission of the Director

of Taxation, use such other methods of allocation that will produce

n Partnership, S Corporation or Fiduciary Adjustments. If a fair and equitable result to both the fiduciary and the beneficiary.

income was received from a partnership, S corporation, joint Kansas law does not permit the fiduciary to elect to pay the tax on

venture, syndicate, trust or estate, enter the proportionate income properly applicable to a beneficiary by including such income

share of any required subtraction adjustments. The in its share of the modification. The estate or trust must advise each

partnership, S corporation, or beneficiary will provide you with beneficiary of their share of the Kansas fiduciary modification. The

the necessary information to determine this amount. amount reported in Column D is the amount which the fiduciary is

n Jobs Tax Credit. Enter amount of the federal targeted jobs tax required to submit to each beneficiary.

credit disallowance claimed on the federal income tax return. Column A: Enter on lines (a), (b), (c) and (d) the names

n Kansas Venture Capital, Inc. Dividends. Enter amount of and addresses of Kansas resident beneficiaries. Nonresident

dividend income received from Kansas Venture Capital, Inc. beneficiaries should be listed on lines (e), (f), (g) and (h).

Page 9

|

Enlarge image |

Column B: Enter the Social Security numbers of the beneficiaries. by multiplying line 48, Column C, by the percentage entered on line

Column C: Enter the percentage of the estate or trust to be 49, Column C.

distributed to each beneficiary in accordance with the documents or Column D: Column D is to be completed by nonresident

the laws controlling distribution of the estate or trust. The percentage fiduciaries only. Enter in Column D that part of Column C applicable

allocated to charitable beneficiaries and to the fiduciary itself should to the fiduciary. The amount to be entered in Column D is computed

be shown on the appropriate lines. Total allocation must equal 100%. by multiplying each entry in Column C by the fiduciary’s percentage

Column D: Enter on lines (a) through (i) each beneficiary’s share of the Kansas fiduciary adjustment as shown in Part II.

of the Kansas fiduciary modification. Enter on line (j) the resident A capital gain from Kansas sources that is not distributed to the

fiduciary’s share of the modification. To determine each individual’s beneficiaries should be entered on line 30, Column D.

and the fiduciary’s share of the Kansas fiduciary modification, multiply NONRESIDENT FIDUCIARY EXEMPTION. Enter on line 46,

the amount on line 26, Part I, by the percentage in Column C. Part III, Column D, the amount of the nonresident fiduciary exemption

determined by the following formula:

PART III: COMPUTATION OF FEDERAL TAXABLE INCOME

OF THE ESTATE OR TRUST FROM KANSAS SOURCES 1) Exemption on federal Form 1041 ...................... $ _____________

Important:You need not complete Parts III and IV if you are filing a 2) Kansas income of nonresident estate or trust

resident estate or trust where all beneficiaries are Kansas residents. (Part III, line 43, Column D)............................... $ _____________

If there are any nonresident beneficiaries, complete Parts III and IV.

3) Federal income (Part III, line 43, Column B) ..... $ _____________

Part III is used to compute the federal taxable income of the estate

or trust from Kansas sources. It is to be completed by all resident 4) Ratio (Divide line 2 by line 3)................................ ___________ %

estates and trusts which have nonresident beneficiaries and by all 5) Nonresident fiduciary exemption

nonresident estates and trusts with income or gain from Kansas (multiply line 1 by line 4).................................... $ _____________

sources. Nonresident estates or trusts should report to Kansas only

that part of their federal taxable income derived from Kansas sources. Line 48, Column D, is the net income of the nonresident estate or

The income to be reported, and the modifications to that income, are trust from Kansas sources applicable to the fiduciary which should

determined in this part. be entered on line 1 of Form K-41.

Column A: Column A lists the items of income and modifications

that correspond to those shown on the federal fiduciary tax return. PART IV: NONRESIDENT BENEFICIARIES’ SHARE OF

Column B: Enter total income or deductions reported or claimed INCOME AND TAX TO BE WITHHELD

on the federal fiduciary tax return for each item listed in Column A. Part IV is used to compute the nonresident beneficiaries’ shares

Column C: Enter that part of each item of income reported in of income and to compute the amount of tax to be withheld by the

Column B that is derived from Kansas sources. Use direct accounting fiduciary of a resident estate or trust from the amount distributed

whenever possible. Intangible income is not considered to be from or distributable to the nonresident beneficiaries. Fiduciaries

Kansas sources except where it is part of a business, trade, or must provide to each nonresident beneficiary the amount of the

occupation carried on in Kansas. Income from other estates, trusts, nonresident beneficiary’s share of income. In addition, Kansas law

or partnerships should be modified, if necessary, before the item requires the fiduciary of a resident estate or trust to withhold tax

is entered in Column C. NOTE: Items entered in Column C should from a nonresident beneficiary and to pay the amount of this tax

reflect the amount that remains after all modifications have been with the Form K-41.

performed. For example, do not include in Column C any state or local Column A: Enter on lines (a) through (d) the names and addresses

income taxes deducted on the federal return; or any state income of the nonresident beneficiaries.

tax refunds reported as income on the federal return.

Do not carry over any administration expenses from Column B Column B: Enter the Social Security numbers of the nonresident

to Column C if these expenses were claimed on both the Kansas beneficiaries.

Estate Tax Return and the federal fiduciary tax return. Column C: Enter on lines (a) through (d) the percentage of the

Capital gains from Kansas sources should be entered in Column estate or trust to be distributed to each beneficiary in accordance with

C only if the gain is distributed to the beneficiaries. the documents or laws controlling distribution of the estate or trust.

Depreciation, depletion, and federal estate tax not included on NOTE: Since neither the resident beneficiaries’ nor the fiduciary’s

Federal Form 1041 and passed directly to the beneficiaries should percentages are shown here, it is unlikely this column will total 100%.

be entered on the appropriate lines of Column C (e.g., line 41a). Column D: Enter on lines (a) through (d) each beneficiary’s portion

Enter on line 41a other deductions not provided for on lines 36 of the total taxable income from Kansas sources by multiplying

through 40. These deductions should be directly allocated where Column C by the amount on line 48, Column C, Part III.

possible. If they cannot be directly allocated to the income from

Kansas sources, they should be apportioned by multiplying the Column E: Compute the amount of tax to be withheld from each

nonresident beneficiary by multiplying each beneficiary’s income in

deductions by the ratio of total Kansas income (line 35, Column C)

divided by total federal income (line 35, Column B). column D by 2.5%. Enter these amounts on lines (a) through (d). The

Enter on line 48, Column C, net income of the estate or trust from tax reported in this column is to be withheld and paid by the fiduciary

Kansas sources, after all modifications. for the beneficiary. Enter the total amount from Column E on page 1,

Enter on line 49, Column C, the total percentages of all line 6, Form K-41. Column E need not be calculated to completion

“nonresident” beneficiaries. These percentages are determined by if the nonresident share has already been withheld.

the documents or laws controlling distribution of the estate or trust. If any tax is required to be withheld, complete a Form K-18 for

Enter on line 50, Column C, the total income from Kansas each nonresident beneficiary. The Form K-18 and instructions are

sources of all nonresident beneficiaries. This amount is computed on the last page of Form K-41.

Page 10

|

Enlarge image |

NOTES

Page 11

|

Enlarge image |

Taxpayer Filing. For assistance in completing your Kansas Fiduciary Income Tax return, contact our

Taxpayer Assistance Center.

Assistance

ksrevenue.org Taxpayer Assistance Centers

Topeka Office Overland Park Office

120 SE 10th Avenue - 1st Floor 7600 W. 119th St., Suite A

Topeka, KS 66612-1588 Overland Park, KS 66213-1128

Hours: 8 a.m. to 4:45 p.m. (M-F)

Phone: 785-368-8222

Fax: 785-291-3614

Electronic Forms. If you choose to file paper, FILE the ORIGINAL form from this booklet, not a copy

or a form from an approved software package. For a list of approved vendors go to: https://www.

File &Pay ksrevenue.org/softwaredevelopers.html

Options

IRS e-File. Your Form K-41 can be filed electronically through IRS e-File. With IRS e-File

ksrevenue.org your return is electronically submitted to the IRS and the Kansas Department of Revenue using an

authorized provider.

Visit our website for a list of authorized IRS e-File providers and software products. Electronic

filing is quick and easy and within 48 hours of transmission you will receive confirmation that the

department has received your return.

|