Enlarge image

2021 Homestead or Property Tax Refund for Homeowners For a fast refund, file electronically! See back cover for details. ksrevenue.gov

Enlarge image | 2021 Homestead or Property Tax Refund for Homeowners For a fast refund, file electronically! See back cover for details. ksrevenue.gov |

Enlarge image |

GENERAL INFORMATION

The

Filing a Claim Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s

homestead. A homestead is the house, mobile or manufactured home, or other dwelling subject to property tax

that you own and occupy as a residence. Your refund percentage is based on your total household income and the

Homestead refunds refund is a percentage of your general property tax. The maximum refund is $700.

are not available to The Property Tax Relief claim (K-40PT) allows a refund of property tax for low income senior citizens that own

renters. You must own their home. The refund is 75% of the property taxes actually and timely paid on real or personal property used as

your home to qualify.

their principal residence. Claimants that receive this refund cannot claim a Homestead refund.

The large purple boxes on Form K-40H and K-40PT allow us to process your refund claim faster and with fewer

errors. Please follow these important instructions when completing your form:

• Use only black or dark blue ink.

• Do not use dollar signs, lines, dashes, or other symbols. If a line does not apply to you, leave it blank.

• All entries must be rounded. If less than $.50 cents, round down. Round $.50 to $.99 to next higher dollar.

• Send the original claim form. Do not send a photocopy.

• If you are using an approved computer software program to prepare your claim, send the original form printed from your

printer. Do not send a photocopy.

Qualifications A homestead claim (K-40H) is for homeowners who own and occupy their homestead and were residents of

Kansas all of 2021. This refund program is not available to renters. As an owner your name is on the deed for

the homestead. As a resident the entire year and a homeowner, you are eligible if your total household income is

$36,600 or less and you: 1) were born before January 1, 1966, or 2) were blind or totally and permanently disabled

all of 2021, or 3) have a dependent child who lived with you the entire year who was born before January 1, 2021,

A person owning a and was under the age of 18 all of 2021.

homestead with an

appraised valuation for The property tax relief claim (K-40PT) is for homeowners that were 65 years of age or older, with a household

property tax purposes income of $20,900 or less, and a resident of Kansas all of 2021.

that exceeds $350,000 Only one refund claim (K-40H or K-40PT) may be filed for each household. A married couple OR two or more

does NOT qualify for a individuals who together occupy the same household may only file one claim. A married couple who own and occupy

homestead refund.

separate households may file separate claims and include only their individual income.

If you owe any delinquent property taxes on your home your homestead refund will be used to pay those delinquent

taxes. The Kansas Department of Revenue will send your entire refund to the County Treasurer.

If you moved during 2021, you may claim the general property tax paid for the period of time you lived in each

residence. Homeowners who rent out part of their homestead or use a portion of it for business may claim only the

general property tax paid for the part in which they live.

Definition of A household is you, or you and your spouse who occupy a homestead, or you and one or more individuals

not related through marriage who together occupy a homestead. Household income is generally all taxable and

a Household

nontaxable income received by all household members during 2021. If a household member lived with you only part

and Household of the year, you must include the income they received during the months they lived with you.

Income

Household income includes, but is not limited to:

• Taxable and nontaxable wages, salaries, and self-employment income.

• Federal earned income tax credit (EITC).

• Taxable and nontaxable interest and dividends.

• Social Security and SSI benefits. The amount included depends on which refund claim you file:

K-40H – 50% of Social Security and SSI benefits (except disability payments – see Excluded Income).

K-40PT – 100% of Social Security and SSI benefits (except disability payments – see Excluded Income).

• Railroad Retirement benefits (except disability payments).

• Veterans’ benefits and all other pensions and annuities (except disability payments).

• Welfare and Temporary Assistance to Family (TAF) payments.

• Unemployment, worker’s compensation and disability income.

Net operating loses and • Alimony received.

net capital losses cannot • Business and farm income.

be used to reduce total • Gain from business or investment property sales and any long-term capital gains included in federal adjusted gross income.

household income. DO

NOT subtract these • Net rents and partnerships (cannot be a negative figure).

losses from the income • Foster home care payments, senior companion stipends, and foster grandparent payments.

amounts. • School grants and scholarships (unless paid directly to the school).

• Gambling winnings, jury duty payments, and other miscellaneous income.

• ALL OTHER INCOME received in 2021 not specifically excluded (as follows).

Excluded Income — DO NOT include these items as household income:

• 50% of Social Security and SSI payments. This exclusion applies only to the Form K-40H, Homestead Claim. K-40PT filers

will report 100% of Social Security and SSI payments.

• Social Security disability payments.

• Social Security and SSI payments that were Social Security “disability or SSI disability” payments prior to a recipient

reaching full retirement age. These Social Security payments, that were once Social Security disability (or SSI disability)

payments, are NOT included in household income.

Page 2

|

Enlarge image | When and File your claim after December 31, 2021 but no later than April 15, 2022. Mail your claim to the address shown on the back of your K-40H or K-40PT. Where to File Late Claims – Claims filed after the due date may be accepted whenever good cause exists, provided the claim is filed within four years of the original due date. Examples of good cause include, but are not limited to, absence of the claimant from the state or country or temporary illness of the claimant at the time the claim was due. When filing a late claim, enclose an explanation with documentation as to why it is late. If your claim will be late because you have an extension of time to file your income tax return, enclose a copy of that federal extension with your claim. NOTE: Kansas does not have a separate extension of time form. WebFile is a simple, secure, fast and free Kansas electronic filing option. See back cover for details! Refund This optional program provides eligible homeowners an opportunity to apply a portion of their anticipated 2021 Advancement Homestead or Property Tax Relief refund to help pay the first half of their 2021 property taxes. The amount of the Program advancement is based on the 2020 refund amount. You may participate in this program by marking the Refund Advancement Program check box on your 2021 Form K-40H (or Form K-40PT). See instructions on page 6 for additional information. Signature and If a claimant is incapable of signing the claim, the claimant’s legal guardian, conservator, or attorney-in-fact may Fraudulent file the claim. When filing on behalf of an eligible claimant, a copy of your legal authority is required. Claims These refund programs are designed to provide tax relief only to those that qualify. Fraudulent claims filed will be denied and may result in criminal prosecution. Deceased When the person who has been the claimant for a household dies, another member of the household who qualifies Claimant as a claimant should file Form K-40H or K-40PT for the household. A separate claim on behalf of the decedent is not necessary. If a member of the decedent’s household (such as a surviving spouse) does NOT qualify to be the claimant, or when there are no other members of a decedent’s household, a claim may be filed for a deceased claimant if the Use the steps in the decedent was a resident of Kansas all of 2021 but died before filing a claim (after December 31, 2020) or died during worksheet on page 6 to 2021 and was a Kansas resident the entire portion of the year he or she was alive. compute a refund for a deceased claimant. Required Enclosures for Decedent Claims. You must enclose a copy of the death certificate, funeral home notice, or obituary statement with a decedent’s claim, AND one of the following: 1) If the estate is being probated, a copy of the Letters of Testamentary or letters of administration. 2) If the estate is not being probated, a completed Form RF-9, Decedent Refund Claim. Signature on a Decedent’s Claim. A decedent’s claim should be signed by the surviving spouse; executor or executrix; administrator; or other authorized person. Amending If, after mailing your claim, you find there is an error that will affect your refund amount, file an amended claim a Claim after you receive your refund from the original filing. To file an amended claim, obtain another copy of Form K-40H or Form K-40PT, and mark the “amended” box located to the right of the county abbreviation. Enter the information on the claim as it should have been, and enclose an explanation of the changes. If an additional refund is due you will receive it in 10 to 12 weeks. If the refund on the amended claim is LESS than the refund you received from the original claim, enclose a check or money order for the difference, made payable to the Kansas Department of Revenue. Write Homestead Repayment - Amended Claim and include the last 4 digits of your Social Security number (example: XXX-XX-1234). REFUND PERCENTAGE TABLE (For use in computing your refund on line 14 of Form K-40H) If the amount on line 10, Enter on If the amount on line 10, Enter on If the amount on line 10, Enter on Form, K-40H is: line 14: Form, K-40H is: line 14: Form, K-40H is: line 14: $ 0 to $ 6,000 ...............100% $ 13,001 to $14,000 ................. 68% $ 21,001 to $22,000 ................. 30% $ 6,001 to $ 7,000 ................ 96% $ 14,001 to $15,000 ................. 64% $ 22,001 to $23,000 ................. 25% $ 7,001 to $ 8,000 ................ 92% $ 15,001 to $16,000 ................. 60% $ 23,001 to $24,000 ................. 20% $ 8,001 to $ 9,000 ................ 88% $ 16,001 to $17,000 ................. 55% $ 24,001 to $25,000 ................. 15% $ 9,001 to $10,000 ................. 84% $ 17,001 to $18,000 ................. 50% $ 25,001 to $26,000 ................. 10% $ 10,001 to $11,000 ................. 80% $ 18,001 to $19,000 ................. 45% $ 26,001 to $36,600 ................... 5% $ 11,001 to $12,000 ................ 76% $ 19,001 to $20,000 ................. 40% $ 36,601 and over .......................... 0% $ 12,001 to $13,000 ................. 72% $ 20,001 to $21,000 ................ 35% Page 3 |

Enlarge image |

LINE-BY-LINE INSTRUCTIONS

CLAIMANT INFORMATION HOUSEHOLD INCOME — LINES 4 THROUGH 10

Social security number, name validation, and telephone Lines 4 through 8 will contain the total annual income amounts

number. Enter your Social Security number in the boxes above the received by you and your spouse during 2021. The income of ALL

name and address. (Do not enter the Social Security number under other persons who lived with you at any time during 2021 will be

which you are receiving benefits if not your own). entered on line 9, All Other Income. If a minor child or incapacitated

Using CAPITAL letters, enter the first four letters of your last name person holds legal title to the property, the income (wages, child

in the boxes provided. If your last name has fewer than four letters, support, etc.) will also be entered on line 9.

leave the remaining boxes empty. If the income amounts requested on lines 5 through 8 were

Enter the telephone number where you can be reached during included on line 4, do not include them again on lines 5 through 8.

our office hours so that we may contact you if a problem arises while Line 4 (2021 Wages OR Kansas Adjusted Gross Income AND

processing your claim. The number will be kept confidential. Federal Earned Income Tax Credit): If you are not required to file

Name and address. PRINT or TYPE your name and complete an income tax return, enter in the first space the total of all wages,

address – the physical location of your residence (not a P.O. Box), salaries, commissions, fees, bonuses, and tips received by you and

including apartment number or lot number. your spouse during 2021. If the amount of 2021 wages or Kansas

Deceased claimant. If you are filing on behalf of a claimant Adjusted Gross Income is negative, enter zero in the space provided.

who is deceased, mark an “X” in the box, and enter the date of the Enter this same amount in the purple boxes.

claimant’s death. Use the worksheet for Deceased Claimants on page If you file a Kansas income tax return, enter in the first space your

6 to figure the decedent’s refund. Be sure to enclose the additional Kansas Adjusted Gross Income (KAGI) from line 3 of your Form

documents required (see page 3). K-40, adding back net operating losses or net capital losses. Enter

Name or address change. If you filed a refund claim last year in the second space, any federal Earned Income Tax Credit (EITC)

and your name or address has changed, place an “X” in the box to received during 2021. This is generally the amount shown on your

the right of the address so we may update our records. 2020 federal tax return, but could also include an EITC for a prior

Amended claim. If you are filing an amended (corrected) claim, year that was received in 2021. Add your KAGI and EITC together

mark an “X” in the box. See further instructions on page 3. and enter the total in the purple boxes. Important—If line 4 is your

KAGI plus EITC, enter on lines 5 through 8 only the income amounts

QUALIFICATIONS — LINES 1 THROUGH 3 that are not already included in your KAGI on line 4.

To qualify, you must first have been a resident of Kansas all of Line 5 (All taxable income other than wages and pensions

2021. Next you must own and occupy your home – meaning that not included in Line 4): Enter all taxable interest and dividend

your name must be on the deed to the home. Contract for deed income, unemployment, self-employment income, business or farm

does qualify as ownership; however, a “rent to own” contract does income, alimony received, rental or partnership income, the gain

not qualify as ownership. If you were a Kansas resident all year and from business or investment property sales, and any long term

owned and occupied your home, complete ONLY the qualification line capital gains that were included in federal adjusted gross income.

that applies to your situation (i.e., if you are age 60 and also blind, A net operating loss or net capital loss may not be used to reduce

enter your birthdate in the boxes on line 1 and skip lines 2 and 3). household income. If you have nontaxable interest or dividends,

enter them on line 9, All Other Income.

Line 1 (Age qualification): If you were born before January 1,

If you used a portion of your homestead for rental or business

1966, enter the month, day, and year of your birth. Add a preceding

income, enter the net rental or business income on line 5. Note:

“0” for months and days with only one digit.

Also complete the worksheet on page 5 to determine the property

Line 2 (Disabled or blind qualification): If you are blind or tax amount to enter on line 12.

totally and permanently disabled, enter the month, day, and year you

Line 6 (Total Social Security and SSI benefits, including

became blind or disabled. (Veterans disability includes veterans Enter in the first space of line 6 the total

Medicare deductions):

50% or more permanently disabled.) The Kansas Department of

Social Security and Supplemental Security Income (SSI) benefits

Revenue must have on file documentation of permanent disability or

received by you and your spouse. Include amounts deducted for

blindness for your homestead claim. If you do not have documentation

Medicare, any Social Security death benefits, and any SSI payments

you must enclose with Form K-40H either 1)a copy of your Social not shown on the annual Social Security benefit statement. Do not

Security statement showing that your disability began prior to 2021,

include Social Security or SSI “disability” payments.

or 2)Schedule DIS (from page 11) completed by your doctor.

Enter the annual amount of any Social Security or SSI disability

Line 3 (Dependent child qualification :) If you have at least one benefits in the Excluded Income section on the back of Form K-40H.

dependent child, enter their name and date of birth (must be prior must enclose a copy of their benefit statement or

First time filers:

to January 1, 2021) in the spaces provided. NOTE: The child must award letter with their claim to verify that the Social Security income

have resided solely with the claimant the entire calendar year, be is excludable. If you are not required to enclose a copy, be sure to

under age 18 all of 2021, AND is or may be claimed as a dependent keep one for your records as the Department reserves the right to

by the claimant for income tax purposes. request it at a later date.

Surviving spouse: Mark this box if filing as surviving spouse

(and not remarried) of a disabled veteran or an active duty service If you do not have your annual Social Security benefits statement,

member who died in the line of duty. The disabled veteran must meet use the following method to compute the total received for 2021. Add

the qualifications in line 2. Enclose with your K-40H a copy of the the amount of your December 2021 check, plus the 2021 Medicare

original Veterans Disability Determination Letter or letter from your deduction of 148.50 (if applicable), and multiply by 12.

regional V.A. that includes the disability date prior to 2021 and the EXAMPLE: Your December, 2021 social security check is $771.00

You are covered by Medicare. Your part B premiums are $148.50

percentage of permanent disability being 50% or greater. month ($1,782 per year). Compute your benefits as follows:

If you are not a Kansas resident and homeowner and do not meet one $771.00 + $148.50 = $919.50. $919.50 X 12 months = $11,034.

of the other three qualifications, you do not qualify for this refund. (enter $11,034 in the first space on line 6.)

Page 4

|

Enlarge image | Multiply the total Social Security and SSI benefits received in2021 Line 12 (2021 general property taxes): Enter the total 2021 by 50% (.50) and enter result in the purple boxes on line 6. general property tax you have paid or will pay, as shown on your real Line 7 (Railroad Retirement benefits and all other pensions, estate tax statement (taxes on property valued at $350,000 or more annuities, and veterans benefits): Enter the amounts received does not qualify). Do not include special assessment taxes, such as during 2021 from railroad retirement benefits (including Tier I— Social those levied for streets, sewers, or utilities; charges for services, such Security equivalent benefits) and veterans’ pensions and benefits. as sewer services; interest or late charges; or taxes on agricultural DO NOT include veteran or railroad retirement “disability” payments. or commercial land. NOTE: The 2021 property tax is payable in two Note: Veterans disability includes veterans 50% or more permanently installments – the first is due December 20, 2021 and the second is disabled and surviving spouses of deceased disabled veterans. due May 10, 2022. It is the total of both installments (whether paid Also include on line 7 the total of all other taxable and nontaxable or not) that is entered on line 12. pensions and annuities received by you or your spouse that is not If you are filing on behalf of a claimant who died during 2021, already entered on line 4 or line 6, except Veterans’ and Railroad the property tax must be prorated based on the date of death. To Retirement “disability” payments. determine the property tax amount to enter here, use the steps for computing a decedent’s refund on the next page. Line 8 (TAF payments, general assistance, workers’ If you have delinquent property tax, mark the box on line 12. compensation and grants and scholarships :) Enter the Your entire homestead refund will be sent to your county treasurer amounts received during 2021 in the form of: TAF (Temporary to pay the delinquent property tax. Assistance to Families); welfare or general assistance payments; workers’ compensation; disability payments (excluding disability 2021 Property Tax Statement payments received from Social Security, SSI, Veterans and Railroad You are not required to send a copy of your 2021 property tax Retirement, or pensions that you entered on line 4 or line 7); and statement with your completed K-40H; however, you may be asked grants, scholarships, and foster grandparent payments. to provide it at a later date. If requested, submit a copy of your Line 9 (All other income. Enter the total amounts from the 2021 statement – NOT a basic receipt – to verify the property following list): Enclose with your claim a list showing the recipient(s), tax entered on line 12. The copy will not be returned. A property source(s), and amount(s) for the income entered on line 9. tax receipt that contains a breakdown of property tax among the • All income (regardless of source) received by adult individuals other general tax, special tax, fees, etc. (such as a receipt that is an exact than you and your spouse who lived in the homestead at any time during copy of the statement) is acceptable. The annual statement from 2021. For those who lived with you less than 12 months, include only the your mortgage company and property tax receipts are NOT income they received during the months they lived with you. Also list these acceptable. If you need a copy of your property tax statement, you individuals in the Members of Household section on the back of the claim. may request one through the office of your county clerk. • The income (child support, SSI, wages, etc.) of a minor child or incapacitated person, when that person is an owner of the homestead Mobile and Manufactured Homeowners or is on the rental agreement. • Any other income outlined as “household income” on page 2 that is not If you own your mobile home/manufactured home, enter on line 12 already entered on lines 4 through 8. the personal property taxes you paid on your home, and the general Line 10 (Total Household Income): Add lines 4 through 9 and property tax paid on the land. If you own your mobile home, but rent enter total. If the amount is negative, enter zero in the space provided. the land or lot on which it sits, enter on line 12 the personal property If more than $36,600 you do not qualify for a homestead refund. tax you paid on the mobile home. You may not claim the general Important: To expedite your refund, enclose a copy of pages 1 and property tax paid on the rented property. 2 of your federal Form 1040, statements from DCF (formerly SRS) Farm Owners and Social Security; and other documentation for income amounts If your homestead is part of a farm covered by a single property shown on lines 4 through 9. tax statement, you may use only the general property tax paid on the HOMESITE. REFUND — LINES 11 THROUGH 15 Line 13 (Amount of property tax allowed; cannot exceed Line 11 (Percent of property for rental or business use): If $700): Enter amount reported on line 12 or $700, whichever is less. part of your homestead was rented to others or used for business Line 14 (Homestead refund percentage): Your refund purposes during 2021, you may claim only the property taxes paid percentage is based on your total household income on line 10. on the portion that was used for personal purposes. Complete the Using the table at the bottom of page 3, find your income and enter following worksheet to determine the percent of rental or business the corresponding percentage on line 14. If the percentage is less use to enter on line 11 and property tax amount to enter on line 12, than 100%, leave the first box blank. Form K-40H. Note: Include the income received from the rental or Multiply line 13 by the percentage Line 15 (Homestead Refund): business use of your homestead on lines 4 or 5 of Form K-40H. on line 14 and enter the result. If the amount is less than $5, it will WORKSHEET for RENTAL or BUSINESS USE of HOME not be refunded. You will receive a refund in the amount shown on line 15 if there are no corrections made to your claim; you did If you filed Schedule C Form 1040, complete only lines 4, 5 and 6. not participate in the optional refund advancement program (see 1. Total number of rooms in your homestead ...................... _____________ page 3); you have no delinquent property taxes due to your County 2. Number of rooms rented or used for business ................ _____________ Treasurer; and you owe no other debt to the State of Kansas (see 3. Rental/business use percentage. Divide line 2 by Debtor Set-Off that follows). line 1. Enter result here and line 11 of Form K-40H ........ ____________ % IMPORTANT: Instructions for the back of your claim are on page 6. 4. Total 2021 general property tax ....................................... _____________ Before mailing it be sure to complete all sections, sign the claim, and 5. Multiply line 4 by line 3 (also include any property tax enclose all required documentation. deduction claimed on federal Schedule C) This is the rental/business portion of the property taxes. ... _____________ Debtor Set-Off 6. Subtract line 5 from line 4. This is the general If you owe a delinquent debt to the State of Kansas (such as child property tax on the nonbusiness portion of your support, student loan, medical bills, or income tax), your refund will homestead. Enter result on line 12, Form K-40H ............ _____________ be applied to that debt first and any remaining refund will be sent to Page 5 |

Enlarge image | you. Be advised that the set-off process will cause a delay of up to On line (g), enter wages received by a minor child and any other 12 weeks for any remaining refund. income not considered “household income” as outlined on page 2. Deceased Claimants First time filers must enclose a copy of their benefit statement or award letter with their claim to verify that the Social Security income If filing on behalf of a claimant who died during 2021, the refund is excludable. Previous filers should keep a copy for their records amount is prorated based on the decedent’s date of death. The taxes as the Department reserves the right to request it at a later date. (line 12) are also prorated based on the decedent’s date of death. Use the following steps to compute a refund on behalf of a decedent. MEMBERS OF HOUSEHOLD (BACK OF CLAIM FORM) See page 3 for required enclosures. All claimants must complete this section. As the claimant, enter REFUND COMPUTATION FOR DECEASED CLAIMANT your information on the first line. Then enter the name, date of birth, 1. Complete lines 1 through 11 of K-40H or 1 through 10 of K-40PT. and other requested information for EACH PERSON (adults and 2. Compute allowable property tax paid by decedent to date of death. Using children) who lived with you at any time during 2021. the table below, multiply the total 2021 property taxes by the applicable If the person lived with you all year, enter “12” in the Number of percentage for the month of the decedent’s death. Enter result on line months resided in household column and indicate whether their 12 of K-40H or line 11 of K-40PT. EXAMPLE: If claimant died in August 2021 and the 2021 taxes were $645, the income is included as part of the Household Income reported on lines property tax paid to date of death is 8/12ths (.667) of $645 for a result of $430 4 through 9 of K-40H. NOTE: For a child born during 2021, enter only ($645 X .667 = $430). the number of months from the date of birth to the end of the year. 3. Complete lines 13 and 14 of the K-40H; then continue by completing lines For example, enter “6” for a child born July 10, 2021. 4 through 6 of this worksheet. If filing a K-40PT, skip lines 4 through 6 and follow the instructions for K-40PT below. Signature: You, as the claimant, MUST sign the claim. If the claim 4. Multiply line 13 of K-40H by line 14 of K-40H. Enter result ______________ . was prepared by another, the preparer should also sign in the space 5. Enter percent from table below for month of decedent’s death _________ . provided, and supply a daytime phone number. 6. Multiply the result from line 4 by the percent in line 5. Enter the result Preparer authorization box: It may be necessary that we contact here _________________ and on line 15 of K-40H. you about your claim. By marking the box above the signature line, K-40PT: Multiply amount on line 11 of K-40PT by 75% (.75). Multiply you are authorizing the department’s director or their designee to the result by the percentage from the following table for the month of the discuss your claim and any enclosures with your preparer. If a paid decedent’s death. Enter this amount on line 12 of K-40PT. preparer is completing your return, they must sign and provide their Month Percent Month Percent Month Percent preparer tax identification number (PTIN). January .083 May .417 September .750 If the claim is being filed on behalf of a decedent, the surviving February .167 June .500 October .833 March .250 July .583 November .917 spouse or executor/executrix must sign it. See Deceased Claimants April .333 August .667 December 1.000 on page 3 for additional information and required enclosures. If the claimant is incapable of signing the claim, the person 2022 Refund Advancement Program Box authorized to sign MUST sign and enclose a copy of the appointing (See additional information about this program on page 3) documentation (i.e., guardian, conservator, power of attorney). By checking this box, you are requesting that the Department MAILING YOUR CLAIM: To prevent a delay in your receiving your of Revenue electronically transfer your 2022 advancement refund, be sure that you have a correct and complete claim. Before information directly to the County Treasurer to help pay the first half mailing it, please be sure you have: of your property taxes. If you do not check this box, you cannot participate in the 2022 advancement program, in which case none written your numbers clearly in each box; of your 2022 refund will be used to pay your 2022 property taxes. completed all required information and signed the claim; As a participant in this program, your 2021 refund will be used kept a complete copy of your claim for your records; enclosed, with Form K-40H, a copy of your Social Security to pay back the amount the Department of Revenue advanced the disability award letter or Schedule DIS completed by your physician county for your property taxes in December 2021. If there is a refund indicating date the disability began (disabled or blind claimants); amount left over, it will be sent to you in a check. To determine the placed all forms loosely in the envelope. DO NOT staple, tape or amount of your refund check, complete the following worksheet. use any type of fastening device on documents. Refund Advancement Worksheet AFTER YOU FILE: Keep a copy of your claim and all supporting documents. If you have a problem later and need to contact the 1. 2021 refund from line 15 of Form K-40H or line 12 Department of Revenue, it will save time if you have a copy of your of form K-40PT ............................................................ $ _________________ 2. 2021 refund advancement amount from your claim with you. Keep copies of all documents for at least four years. advancement letter ...................................................... $ _________________ Processing Refund Claims 3. Subtract line 2 from line 1 ........................................... $ _________________ Normal processing time for an error-free and complete paper- You will receive the amount on line 3 in a check from the Department of filed homestead refund claim is 20 to 24 weeks. Claims requiring Revenue if you have no other delinquent debts due the state of Kansas correspondence will take longer. Information for checking the status (see Debtor Setoff.) of your refund can be found on the back cover of this booklet. If you have a refund due on the K-40H (or K-40PT) and K-40 If your 2021 refund (line 15, K-40H or line 12, K-40PT) is LESS forms, wait until both returns are processed before expecting a than the advancement amount (line 2 of the Refund Advancement refund check. Your refund(s) are subject to debtor set-off for other Worksheet), you should pay the difference when you file your 2021 delinquent debts owed to the State of Kansas or County Treasurer. K-40H or K-40PT. Make your check or money order payable to the Department of Revenue and include the tax year and last 4 digits of Correspondence from the Department of Revenue your Social Security number (example: XXX-XX-1234). Should you receive a letter from the Department of Revenue about your claim, please respond to it immediately. Processing EXCLUDED INCOME (BACK OF CLAIM FORM) time necessary for a typical refund claim starts the day the missing Enter in this section the total received during 2021 by all household information is received by the department. If you have questions members (including minor children) from each of the sources listed about the letter or wish to discuss your claim in person, contact our in (a) through (f). Taxpayer Assistance Center (see back cover). Page 6 |

Enlarge image |

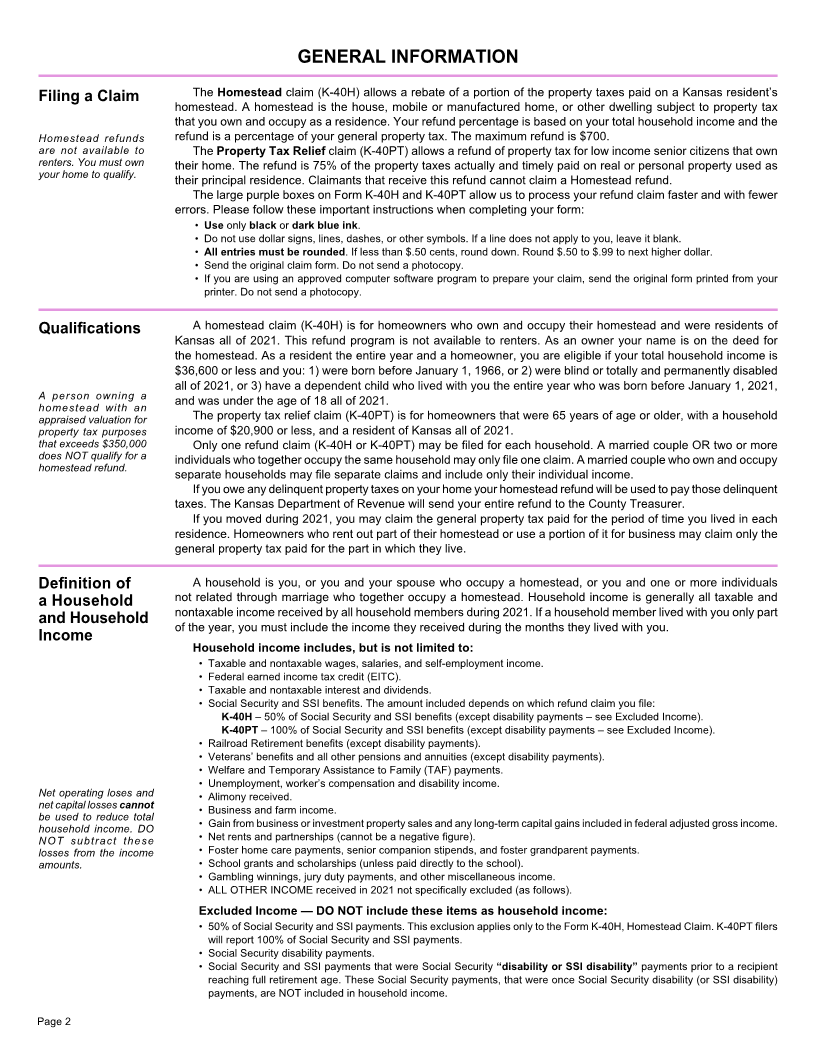

2021

K-40H(Rev. 7-21) 134121

KANSAS HOMESTEAD CLAIM

DO NOT STAPLE

FILE THIS CLAIM AFTER DECEMBER 31, 2021, BUT NO LATER THAN APRIL 15, 2022

Claimant’s First four letters of Claimant’s

Social Security claimant’s last name. Telephone

Number Use ALL CAPITAL letters. Number

Your First Name Initial Last Name Mark this box if claimant is

deceased (See instructions)...........

Date of Death ________________________

Mailing Address (Number and Street, including Rural Route) IMPORTANT: Mark this box if

name or address has changed.......

City, Town, or Post Office State Zip Code County Abbreviation

Mark this box if this is an

Name and Address amended claim ..............................

TO QUALIFY YOU MUST HAVE BEEN A RESIDENT OF KANSAS THE ENTIRE YEAR OF 2021 AND OWN YOUR HOME.

Answer ONLY the questions that apply to you: MONTH DAY YEAR

1. Age 55 or over for the entire year? Enter date of birth (must be prior to 1966) ..........................................

2. Disabled or blind for the entire year? Enter the date ENCLOSE Social Security Benefit

disability began. See instructions................... Verification Statement or Schedule DIS

3. Dependent child who resided with you and was under 18 years of age for the entire year?

Child’s name _________________________________________ . Enter date of birth (must be prior to 2021)......................

Qualifications

Mark this box if you are filing as surviving spouse of a disabled veteran OR of an active duty service

member who died in the line of duty (see instructions for this qualification and for required enclosures)

ENTER THE TOTAL RECEIVED IN 2021 FOR EACH TYPE OF INCOME. See instructions.

4. 2021 Wages OR Kansas Adjusted Gross Income (if negative, enter zero) $ ________________________ plus Federal

Earned Income Credit $ ________________________ . Enter the total ................................................................................. 00

5. All taxable income other than wages and pensions not included in Line 4. Do not subtract net operating losses

and capital losses ..................................................................................................................................................... 00

6. Total Social Security and SSI benefits, including Medicare deductions, received in 2021 (do not include

00

disability payments from Social Security or SSI) $ ________________________ . Enter 50% of this total............................

7. Railroad Retirement benefits and all other pensions, annuities, and veterans benefits (do not include 00

disability payments from Veterans and Railroad Retirement) ............................................................................

8. TAF payments, general assistance, worker’s compensation, grants and scholarships..................................... 00

Household Income

9. All other income, including the income of others who resided with you at any time during 2021 ...................... 00

10. TOTAL HOUSEHOLD INCOME (Add lines 4 through 9. If line 10 is more than $36,600 you do not qualify for a refund) 00

11. Percent of the homestead property that was rented or used for business in 2021 (see instructions) ....................................... %

12.2021 general property taxes, excluding specials. (Tax on property valued at Mark this box if you have

more than $350,000 does not qualify. See instructions.).............................. delinquent property tax. 00

13. Amount of property tax allowed. Enter amount from line 12 or $700, whichever is less........................................................... 00

14. Using your total household income on line 10 and the Refund Percentage Table, enter your refund percentage.................... %

Refund

15. HOMESTEAD REFUND (Multiply line 13 by percentage on line 14) ........................................................................................ 00

Important: If you filed Form ELG with your county, your refund will be reduced by the ELG amount applied to the first half of your 2021 property tax.

Mark this box if you wish to participate in the Refund Advancement Program (see instructions) ...........................

I authorize the Director of Taxation or the Director’s designee to discuss my K-40H and enclosures with my preparer.

I declare under the penalties of perjury that to the best of my knowledge and belief, this is a true, correct and complete claim.

Claimant’s signature Date Signature of preparer other than claimant

Signature Tax Preparer’s PTIN, EIN or SSN:

IMPORTANT: Please allow 20 to 24 weeks to process your refund.

COMPLETE THE BACK OF THIS FORM

|

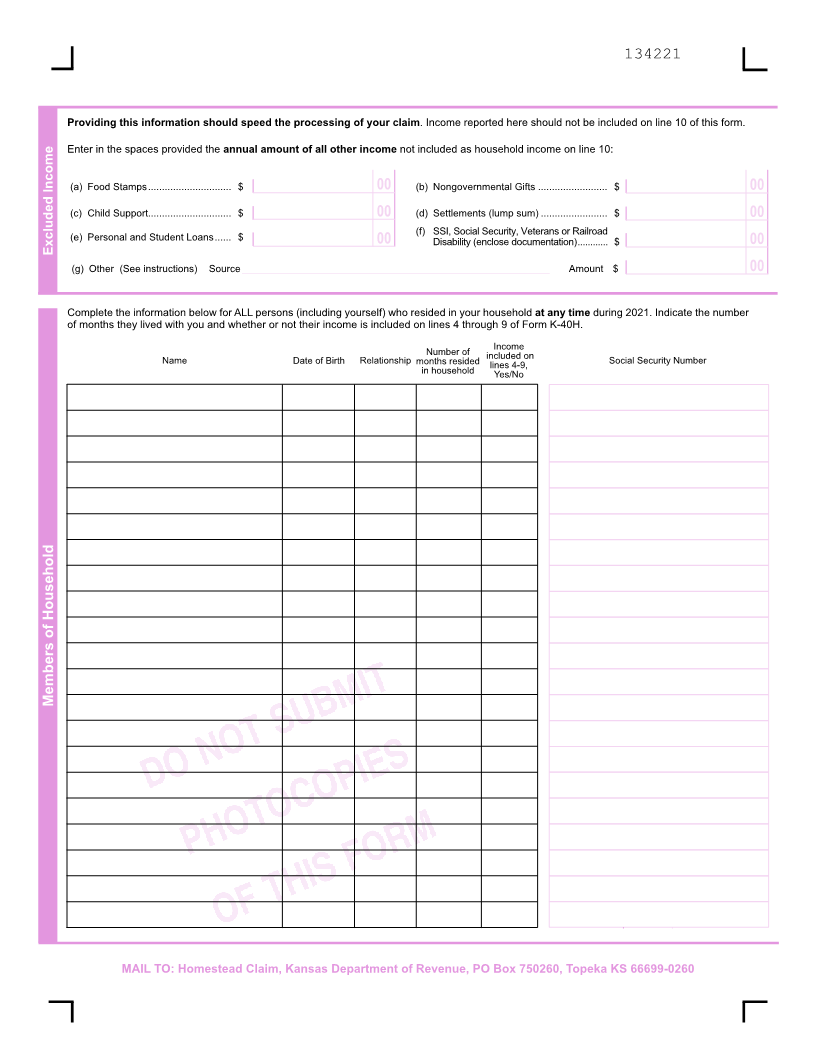

Enlarge image | 134221 Providing this information should speed the processing of your claim. Income reported here should not be included on line 10 of this form. Enter in the spaces provided the annual amount of all other income not included as household income on line 10: (a) Food Stamps.............................. $ 00 (b) Nongovernmental Gifts ......................... $ 00 (c) Child Support.............................. $ 00 (d) Settlements (lump sum) ........................ $ 00 Disability (enclose documentation)............ $ (e) Personal and Student Loans...... $ 00 (f) SSI, Social Security, Veterans or Railroad 00 Excluded Income (g) Other (See instructions) Source ___________________________________________________________________________________ Amount $ 00 Complete the information below for ALL persons (including yourself) who resided in your household at any time during 2021. Indicate the number of months they lived with you and whether or not their income is included on lines 4 through 9 of Form K-40H. Number of Income Name Date of Birth Relationship months resided included on Social Security Number in household lines 4-9, Yes/No Members of Household MAIL TO: Homestead Claim, Kansas Department of Revenue, PO Box 750260, Topeka KS 66699-0260 |

Enlarge image |

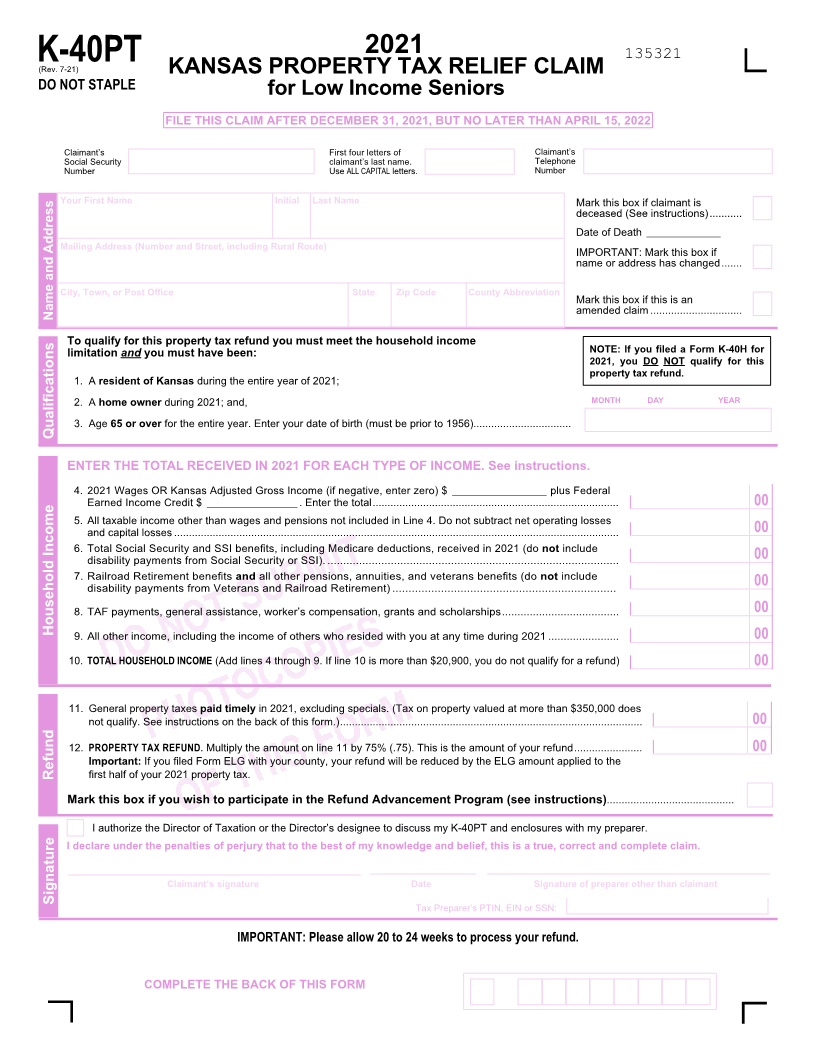

2021 135321

K-40PT(Rev. 7-21)

KANSAS PROPERTY TAX RELIEF CLAIM

DO NOT STAPLE

for Low Income Seniors

FILE THIS CLAIM AFTER DECEMBER 31, 2021, BUT NO LATER THAN APRIL 15, 2022

Claimant’s First four letters of Claimant’s

Social Security claimant’s last name. Telephone

Number Use ALL CAPITAL letters. Number

Your First Name Initial Last Name Mark this box if claimant is

deceased (See instructions)...........

Date of Death ____________________

Mailing Address (Number and Street, including Rural Route) IMPORTANT: Mark this box if

name or address has changed.......

City, Town, or Post Office State Zip Code County Abbreviation

Mark this box if this is an

Name and Address amended claim ...............................

To qualify for this property tax refund you must meet the household income

limitation and you must have been: NOTE: If you filed a Form K-40H for

2021, you DO NOT qualify for this

property tax refund.

1. A resident of Kansas during the entire year of 2021;

2. A home owner during 2021; and, MONTH DAY YEAR

3. Age 65 or over for the entire year. Enter your date of birth (must be prior to 1956).................................

Qualifications

ENTER THE TOTAL RECEIVED IN 2021 FOR EACH TYPE OF INCOME. See instructions.

4. 2021 Wages OR Kansas Adjusted Gross Income (if negative, enter zero) $ _________________________ plus Federal

Earned Income Credit $ ________________________ . Enter the total................................................................................... 00

5. All taxable income other than wages and pensions not included in Line 4. Do not subtract net operating losses

and capital losses ...................................................................................................................................................... 00

6. Total Social Security and SSI benefits, including Medicare deductions, received in 2021 (do not include

disability payments from Social Security or SSI). ............................................................................................ 00

7. Railroad Retirement benefits and all other pensions, annuities, and veterans benefits (do not include

disability payments from Veterans and Railroad Retirement) ..................................................................... 00

8. TAF payments, general assistance, worker’s compensation, grants and scholarships...................................... 00

Household Income

9. All other income, including the income of others who resided with you at any time during 2021 ....................... 00

10. TOTAL HOUSEHOLD INCOME (Add lines 4 through 9. If line 10 is more than $20,900, you do not qualify for a refund) 00

11. General property taxes paid timely in 2021, excluding specials. (Tax on property valued at more than $350,000 does

not qualify. See instructions on the back of this form.)...................................................................................................... 00

12. PROPERTY TAX REFUND. Multiply the amount on line 11 by 75% (.75). This is the amount of your refund....................... 00

Important: If you filed Form ELG with your county, your refund will be reduced by the ELG amount applied to the

Refund first half of your 2021 property tax.

Mark this box if you wish to participate in the Refund Advancement Program (see instructions)...........................................

I authorize the Director of Taxation or the Director’s designee to discuss my K-40PT and enclosures with my preparer.

I declare under the penalties of perjury that to the best of my knowledge and belief, this is a true, correct and complete claim.

Claimant’s signature Date Signature of preparer other than claimant

Signature

Tax Preparer’s PTIN, EIN or SSN:

IMPORTANT: Please allow 20 to 24 weeks to process your refund.

COMPLETE THE BACK OF THIS FORM

|

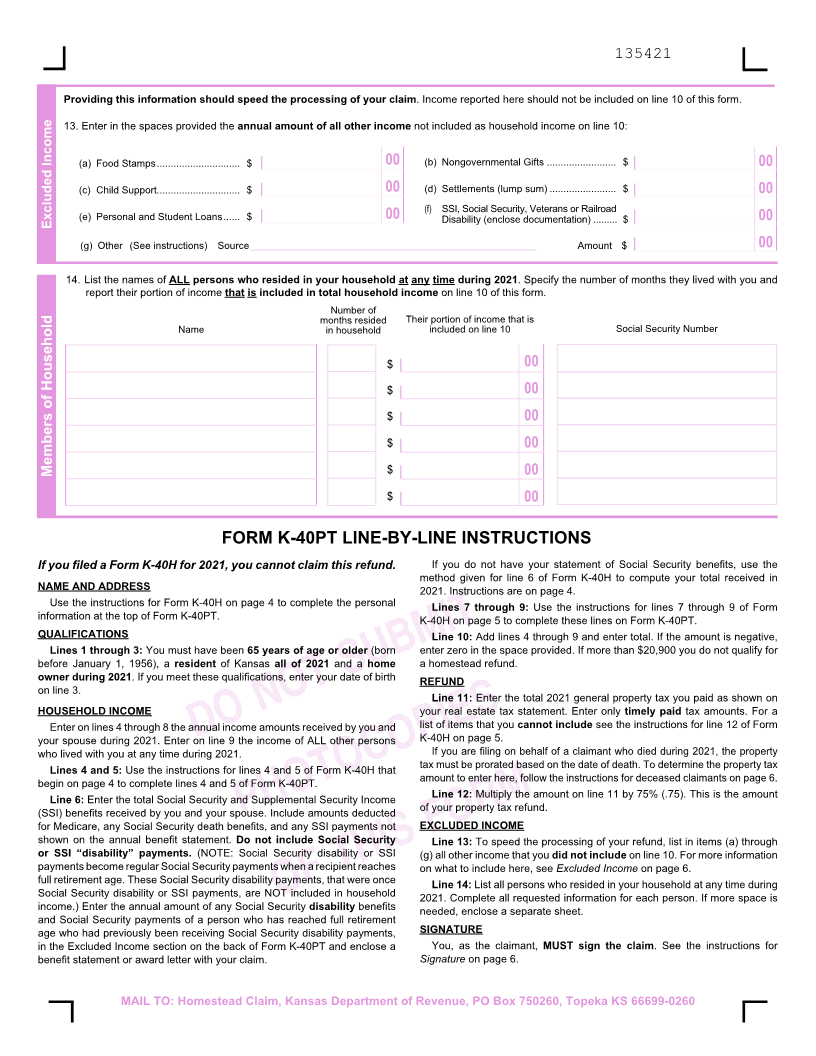

Enlarge image | 135421 Providing this information should speed the processing of your claim. Income reported here should not be included on line 10 of this form. 13. Enter in the spaces provided the annual amount of all other income not included as household income on line 10: (a) Food Stamps.............................. $ 00 (b) Nongovernmental Gifts ......................... $ 00 (c) Child Support.............................. $ 00 (d) Settlements (lump sum) ........................ $ 00 (f) SSI, Social Security, Veterans or Railroad Excluded Income (e) Personal and Student Loans...... $ 00 Disability (enclose documentation) ......... $ 00 (g) Other (See instructions) Source _____________________________________________________________________________ Amount $ 00 14. List the names of ALL persons who resided in your household at any time during 2021. Specify the number of months they lived with you and report their portion of income that is included in total household income on line 10 of this form. Number of months resided Their portion of income that is Name in household included on line 10 Social Security Number $ 00 $ 00 $ 00 $ 00 Members of Household $ 00 $ 00 FORM K-40PT LINE-BY-LINE INSTRUCTIONS If you filed a Form K-40H for 2021, you cannot claim this refund. If you do not have your statement of Social Security benefits, use the method given for line 6 of Form K-40H to compute your total received in NAME AND ADDRESS 2021. Instructions are on page 4. Use the instructions for Form K-40H on page 4 to complete the personal Lines 7 through 9: Use the instructions for lines 7 through 9 of Form information at the top of Form K-40PT. K-40H on page 5 to complete these lines on Form K-40PT. QUALIFICATIONS Line 10: Add lines 4 through 9 and enter total. If the amount is negative, Lines 1 through 3: You must have been 65 years of age or older (born enter zero in the space provided. If more than $20,900 you do not qualify for before January 1, 1956), a resident of Kansas all of 2021 and a home a homestead refund. owner during 2021. If you meet these qualifications, enter your date of birth REFUND on line 3. Line 11: Enter the total 2021 general property tax you paid as shown on HOUSEHOLD INCOME your real estate tax statement. Enter only timely paid tax amounts. For a Enter on lines 4 through 8 the annual income amounts received by you and list of items that you cannot include see the instructions for line 12 of Form your spouse during 2021. Enter on line 9 the income of ALL other persons K-40H on page 5. who lived with you at any time during 2021. If you are filing on behalf of a claimant who died during 2021, the property Lines 4 and 5: Use the instructions for lines 4 and 5 of Form K-40H that tax must be prorated based on the date of death. To determine the property tax begin on page 4 to complete lines 4 and 5 of Form K-40PT. amount to enter here, follow the instructions for deceased claimants on page 6. Line 6: Enter the total Social Security and Supplemental Security Income Line 12: Multiply the amount on line 11 by 75% (.75). This is the amount (SSI) benefits received by you and your spouse. Include amounts deducted of your property tax refund. for Medicare, any Social Security death benefits, and any SSI payments not EXCLUDED INCOME shown on the annual benefit statement. Do not include Social Security Line 13: To speed the processing of your refund, list in items (a) through or SSI “disability” payments. (NOTE: Social Security disability or SSI (g) all other income that you did not include on line 10. For more information payments become regular Social Security payments when a recipient reaches on what to include here, see Excluded Income on page 6. full retirement age. These Social Security disability payments, that were once Line 14: List all persons who resided in your household at any time during Social Security disability or SSI payments, are NOT included in household 2021. Complete all requested information for each person. If more space is income.) Enter the annual amount of any Social Security disability benefits needed, enclose a separate sheet. and Social Security payments of a person who has reached full retirement age who had previously been receiving Social Security disability payments, SIGNATURE in the Excluded Income section on the back of Form K-40PT and enclose a You, as the claimant, MUST sign the claim. See the instructions for benefit statement or award letter with your claim. Signature on page 6. MAIL TO: Homestead Claim, Kansas Department of Revenue, PO Box 750260, Topeka KS 66699-0260 |

Enlarge image |

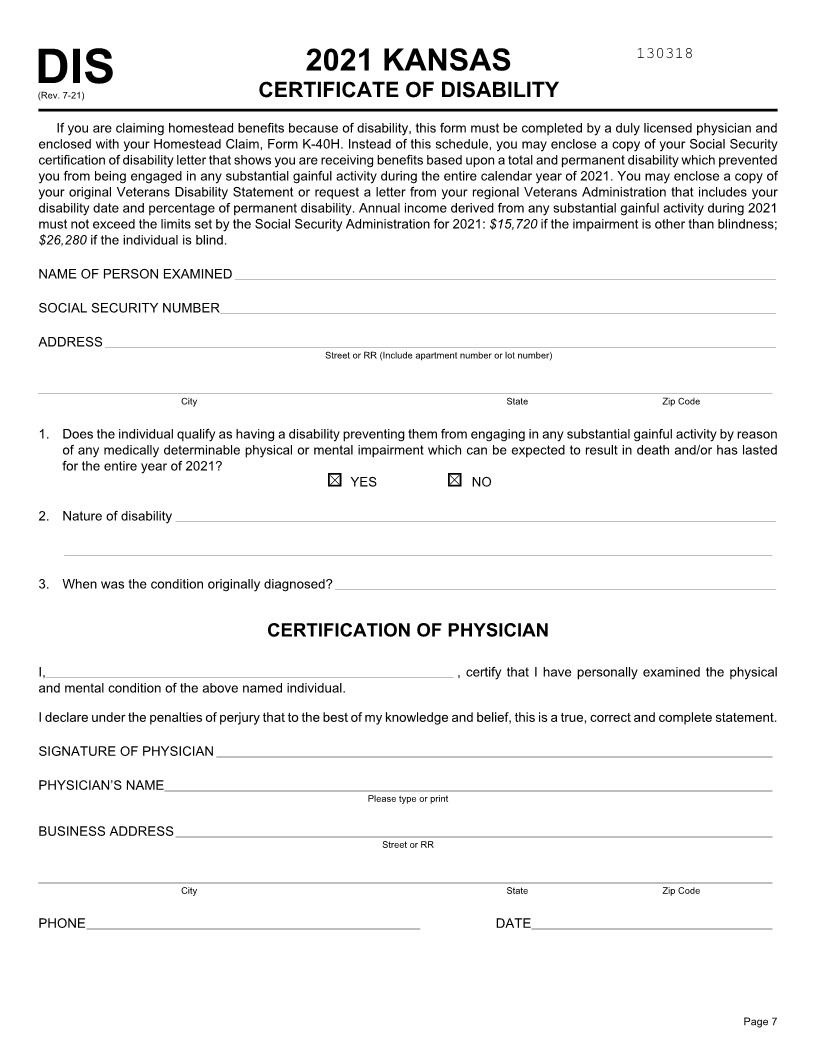

130318

2021 KANSAS

DIS(Rev. 7-21) CERTIFICATE OF DISABILITY

If you are claiming homestead benefits because of disability, this form must be completed by a duly licensed physician and

enclosed with your Homestead Claim, Form K-40H. Instead of this schedule, you may enclose a copy of your Social Security

certification of disability letter that shows you are receiving benefits based upon a total and permanent disability which prevented

you from being engaged in any substantial gainful activity during the entire calendar year of 2021. You may enclose a copy of

your original Veterans Disability Statement or request a letter from your regional Veterans Administration that includes your

disability date and percentage of permanent disability. Annual income derived from any substantial gainful activity during 2021

must not exceed the limits set by the Social Security Administration for 2021: $15,720 if the impairment is other than blindness;

$26,280 if the individual is blind.

NAME OF PERSON EXAMINED __________________________________________________________________________________________________________________________________________________

SOCIAL SECURITY NUMBER ______________________________________________________________________________________________________________________________________________________

ADDRESS _____________________________________________________________________________________________________________________________________________________________________________________

Street or RR (Include apartment number or lot number)

______________________________________________________________________________________________________________________________________________________________________________________________________

City State Zip Code

1. Does the individual qualify as having a disability preventing them from engaging in any substantial gainful activity by reason

of any medically determinable physical or mental impairment which can be expected to result in death and/or has lasted

for the entire year of 2021?

o YES o NO

2. Nature of disability __________________________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________________________________________________

3. When was the condition originally diagnosed? _______________________________________________________________________________________________________________________

CERTIFICATION OF PHYSICIAN

I, ______________________________________________________________________________________________________________ , certify that I have personally examined the physical

and mental condition of the above named individual.

I declare under the penalties of perjury that to the best of my knowledge and belief, this is a true, correct and complete statement.

SIGNATURE OF PHYSICIAN ______________________________________________________________________________________________________________________________________________________

PHYSICIAN’S NAME ____________________________________________________________________________________________________________________________________________________________________

Please type or print

BUSINESS ADDRESS _________________________________________________________________________________________________________________________________________________________________

Street or RR

______________________________________________________________________________________________________________________________________________________________________________________________________

City State Zip Code

PHONE __________________________________________________________________________________________ DATE _________________________________________________________________

Page 7

|

Enlarge image |

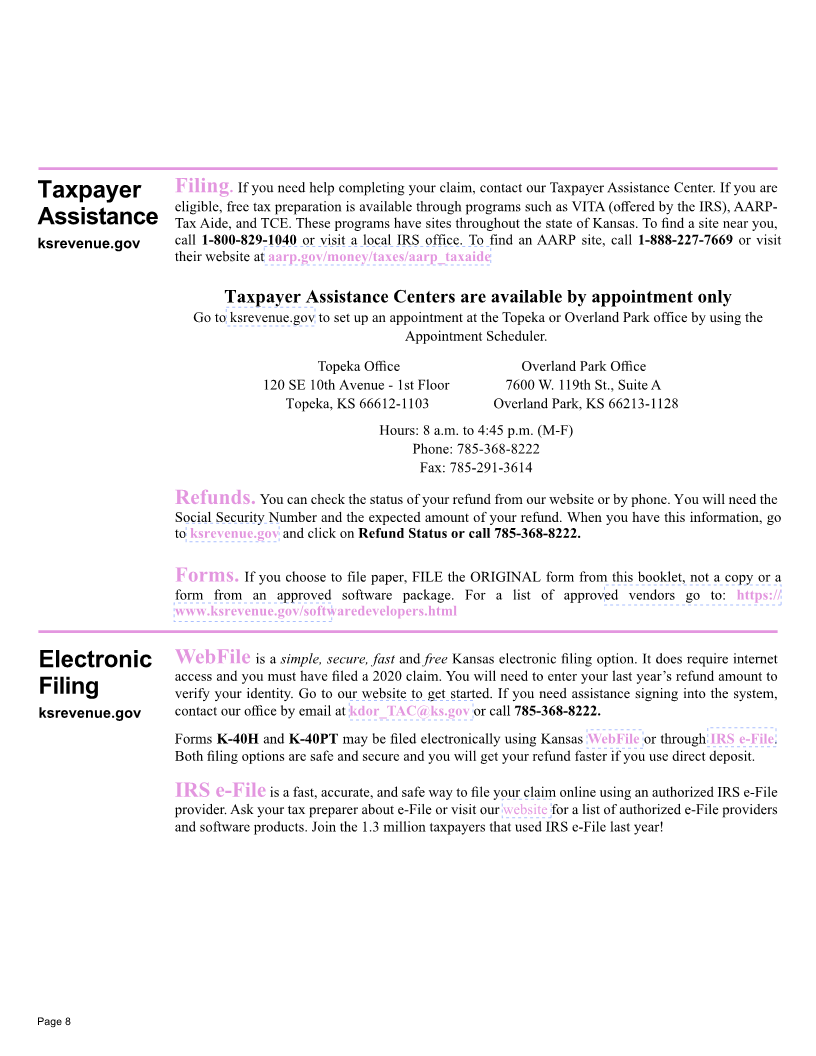

Filing. If you need help completing your claim, contact our Taxpayer Assistance Center. If you are

Taxpayer

eligible, free tax preparation is available through programs such as VITA (offered by the IRS), AARP-

Assistance Tax Aide, and TCE. These programs have sites throughout the state of Kansas. To find a site near you,

ksrevenue.gov call 1-800-829-1040 or visit a local IRS office. To find an AARP site, call 1-888-227-7669 or visit

their website at aarp.gov/money/taxes/aarp_taxaide

Taxpayer Assistance Centers are available by appointment only

Go to ksrevenue.gov to set up an appointment at the Topeka or Overland Park office by using the

Appointment Scheduler.

Topeka Office Overland Park Office

120 SE 10th Avenue - 1st Floor 7600 W. 119th St., Suite A

Topeka, KS 66612-1103 Overland Park, KS 66213-1128

Hours: 8 a.m. to 4:45 p.m. (M-F)

Phone: 785-368-8222

Fax: 785-291-3614

Refunds. You can check the status of your refund from our website or by phone. You will need the

Social Security Number and the expected amount of your refund. When you have this information, go

to ksrevenue.gov and click on Refund Status or call 785-368-8222.

Forms. If you choose to file paper, FILE the ORIGINAL form from this booklet, not a copy or a

form from an approved software package. For a list of approved vendors go to: https://

www.ksrevenue.gov/softwaredevelopers.html

WebFile is a simple, secure, fast and free Kansas electronic filing option. It does require internet

Electronic

access and you must have filed a 2020 claim. You will need to enter your last year’s refund amount to

Filing verify your identity. Go to our website to get started. If you need assistance signing into the system,

ksrevenue.gov contact our office by email at kdor_TAC@ks.gov or call 785-368-8222.

Forms K-40H and K-40PT may be filed electronically using Kansas WebFile or through IRS e-File.

Both filing options are safe and secure and you will get your refund faster if you use direct deposit.

IRS e-File is a fast, accurate, and safe way to file your claim online using an authorized IRS e-File

provider. Ask your tax preparer about e-File or visit our website for a list of authorized e-File providers

and software products. Join the 1.3 million taxpayers that used IRS e-File last year!

Page 8

|