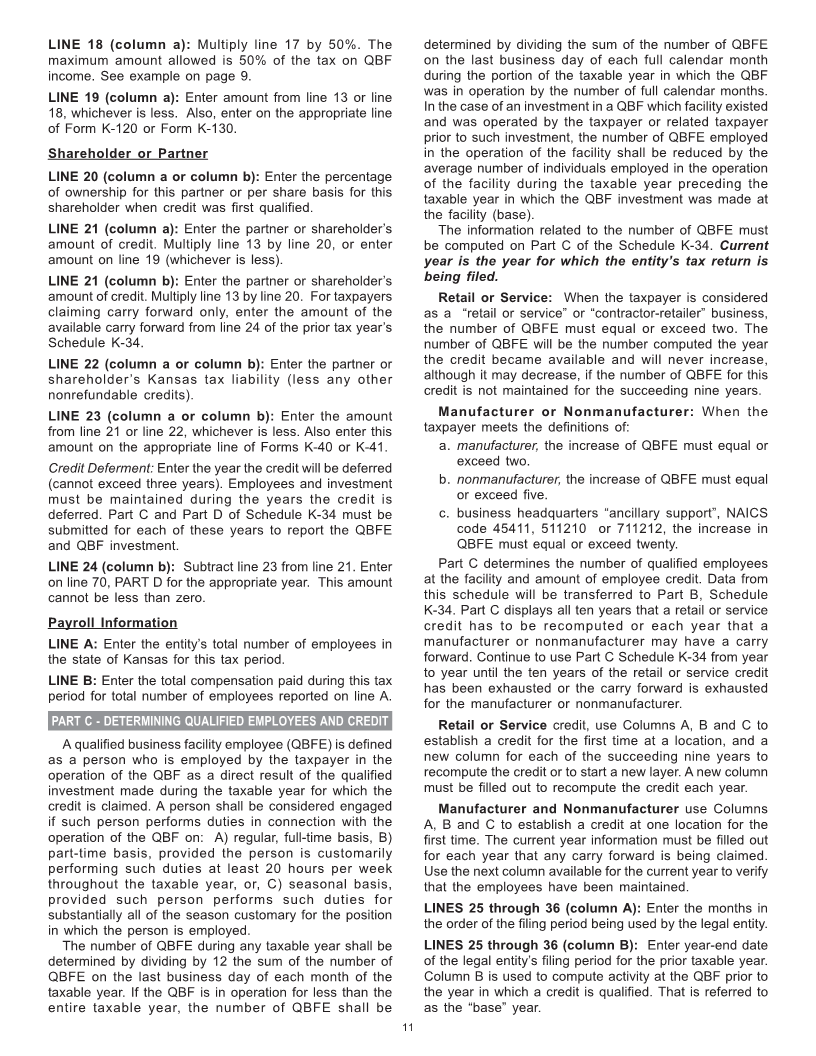

Enlarge image

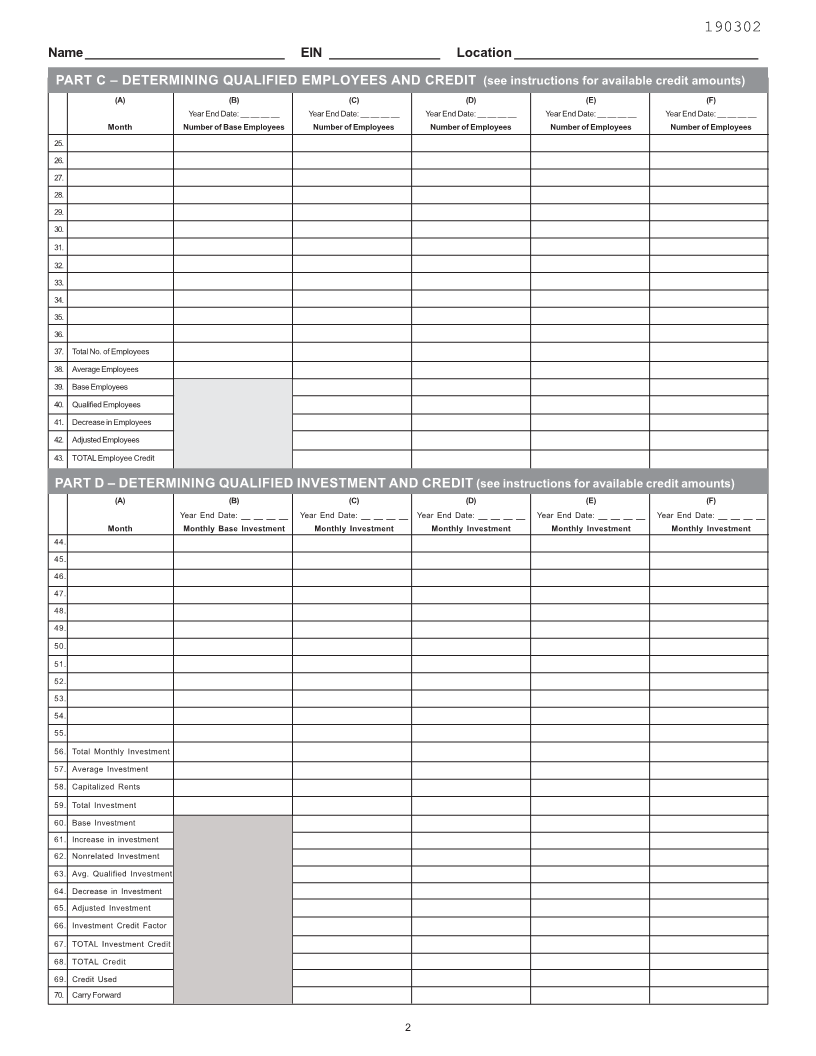

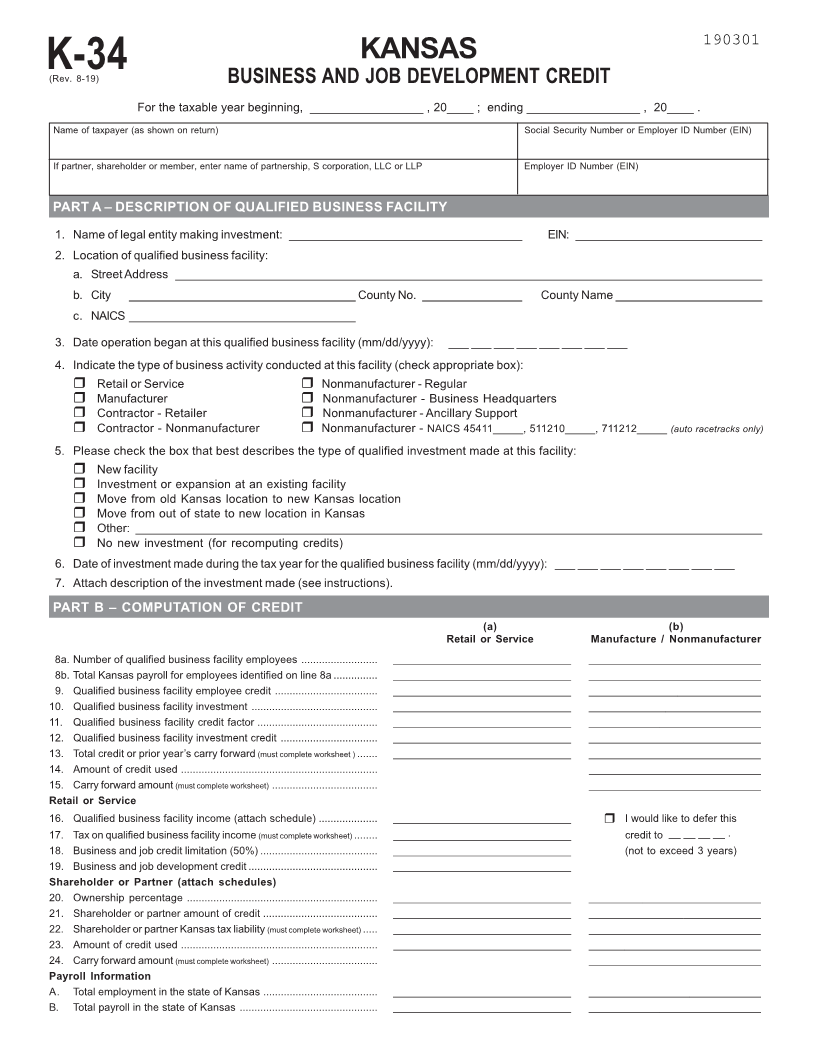

190301

KANSAS

K-34(Rev. 8 9-1 ) BUSINESS AND JOB DEVELOPMENT CREDIT

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return) Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP Employer ID Number (EIN)

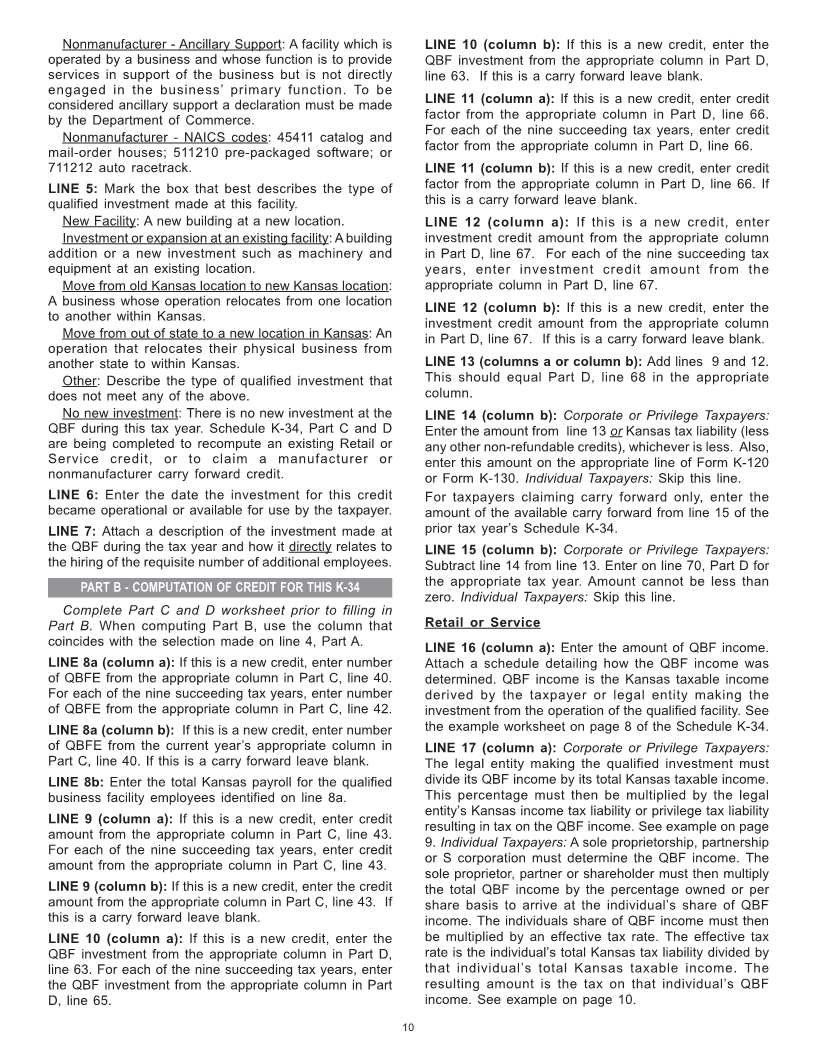

PART A – DESCRIPTION OF QUALIFIED BUSINESS FACILITY

1. Name of legal entity making investment: ___________________________________ EIN: ____________________________

2. Location of qualified business facility:

a. Street Address ________________________________________________________________________________________

b. City __________________________________ County No. _______________ County Name ______________________

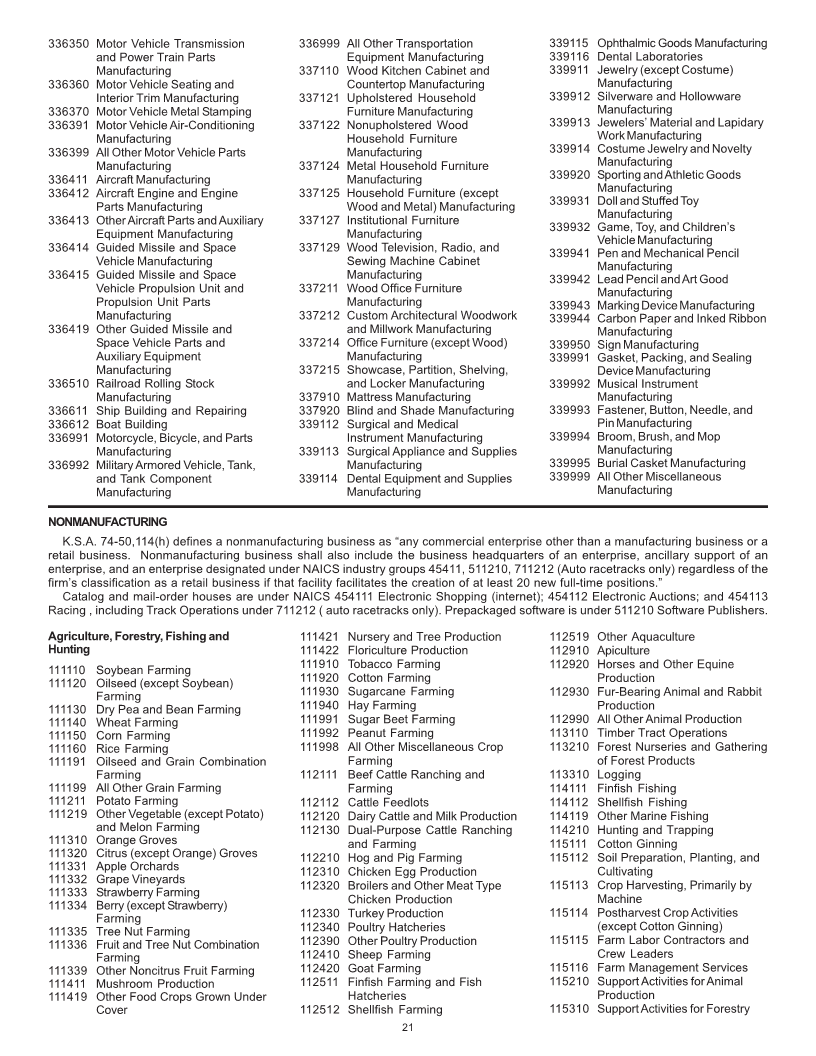

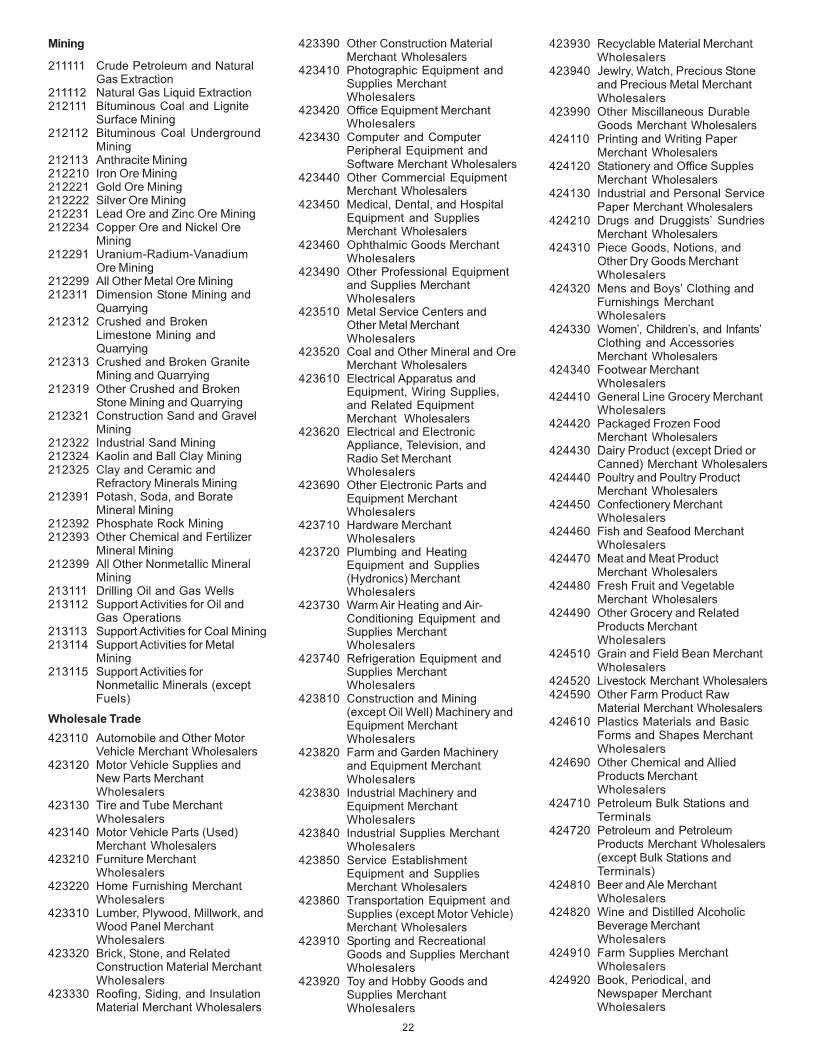

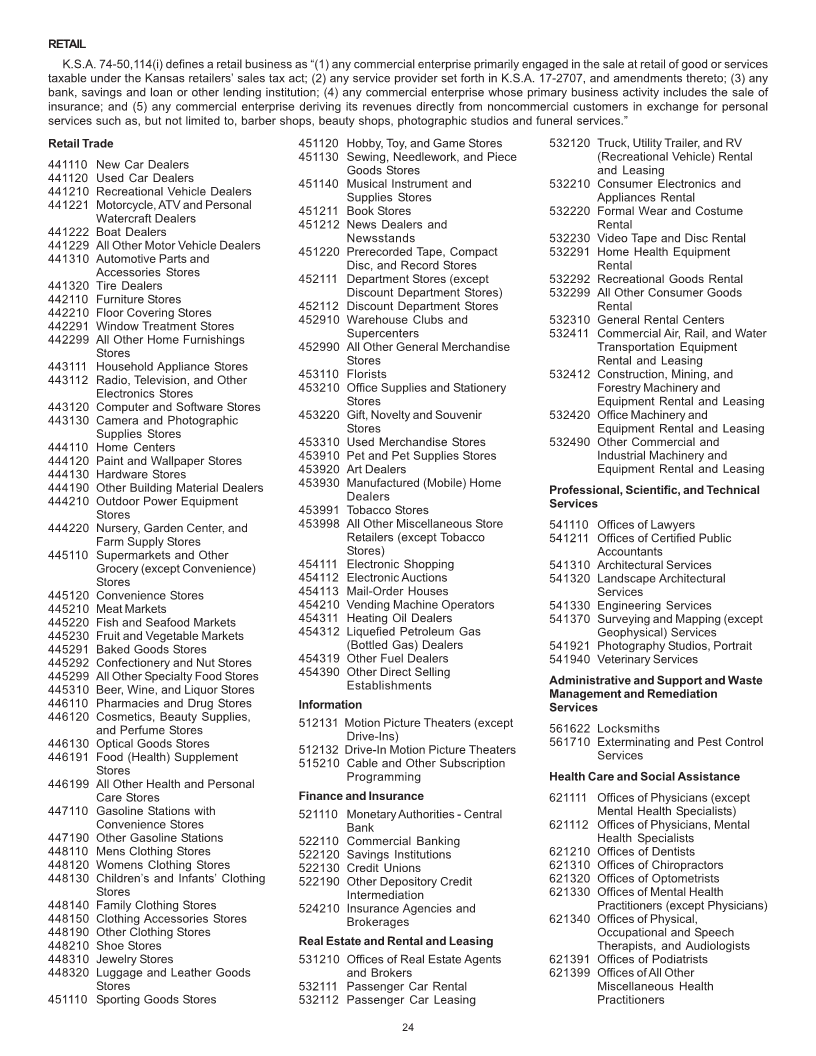

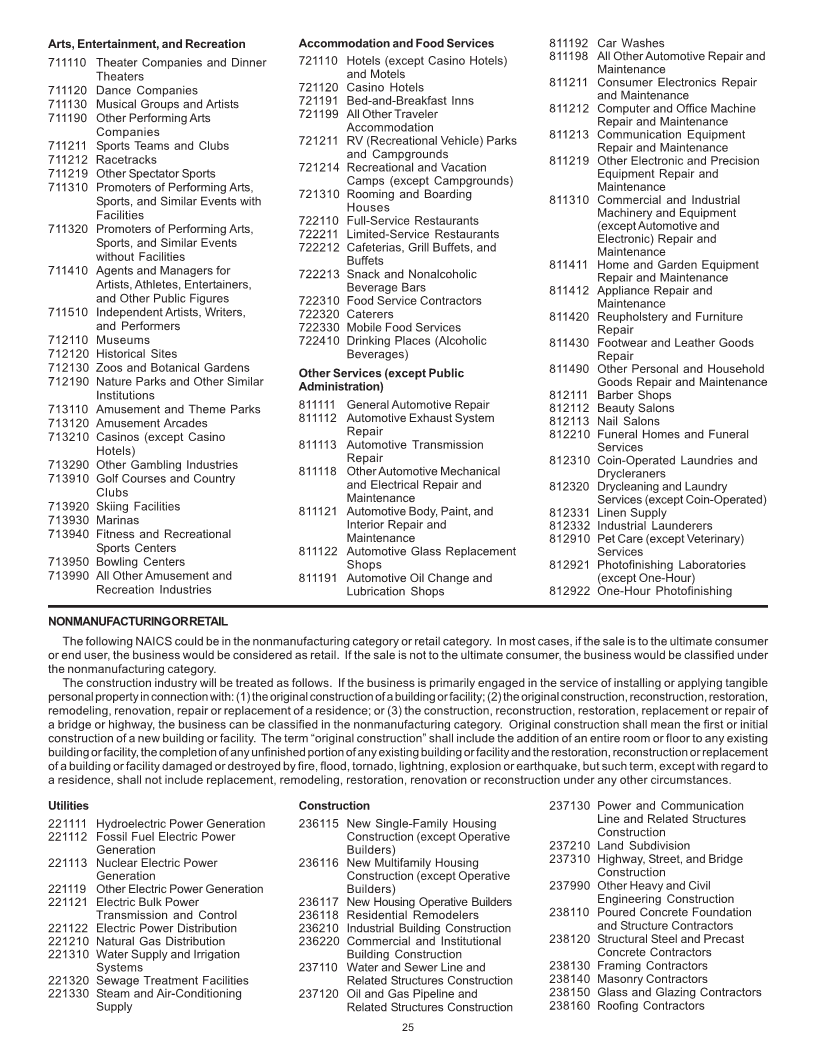

c. NAICS __________________________________

3. Date operation began at this qualified business facility (mm/dd/yyyy): ___ ___ ___ ___ ___ ___ ___ ___

4. Indicate the type of business activity conducted at this facility (check appropriate box):

Retail or Service Nonmanufacturer - Regular

Manufacturer Nonmanufacturer - Business Headquarters

Contractor - Retailer Nonmanufacturer - Ancillary Support

Contractor - Nonmanufacturer Nonmanufacturer - NAICS 45411_____, 511210_____, 711212_____ (auto racetracks only)

5. Please check the box that best describes the type of qualified investment made at this facility:

New facility

Investment or expansion at an existing facility

Move from old Kansas location to new Kansas location

Move from out of state to new location in Kansas

Other: ______________________________________________________________________________________________

No new investment (for recomputing credits)

6. Date of investment made during the tax year for the qualified business facility (mm/dd/yyyy): ___ ___ ___ ___ ___ ___ ___ ___

7. Attach description of the investment made (see instructions).

PART B – COMPUTATION OF CREDIT

(a) (b)

Retail or Service Manufacture / Nonmanufacturer

8a. Number of qualified business facility employees .......................... ______________________________ _____________________________

8b. Total Kansas payroll for employees identified on line 8a ............... ______________________________ _____________________________

9. Qualified business facility employee credit ................................... ______________________________ _____________________________

10. Qualified business facility investment ........................................... ______________________________ _____________________________

11. Qualified business facility credit factor ......................................... ______________________________ _____________________________

12. Qualified business facility investment credit ................................. ______________________________ _____________________________

13. Total credit or prior year’s carry forward (must complete worksheet ) ....... ______________________________ _____________________________

14. Amount of credit used ................................................................... _____________________________

15. Carry forward amount (must complete worksheet) .................................... _____________________________

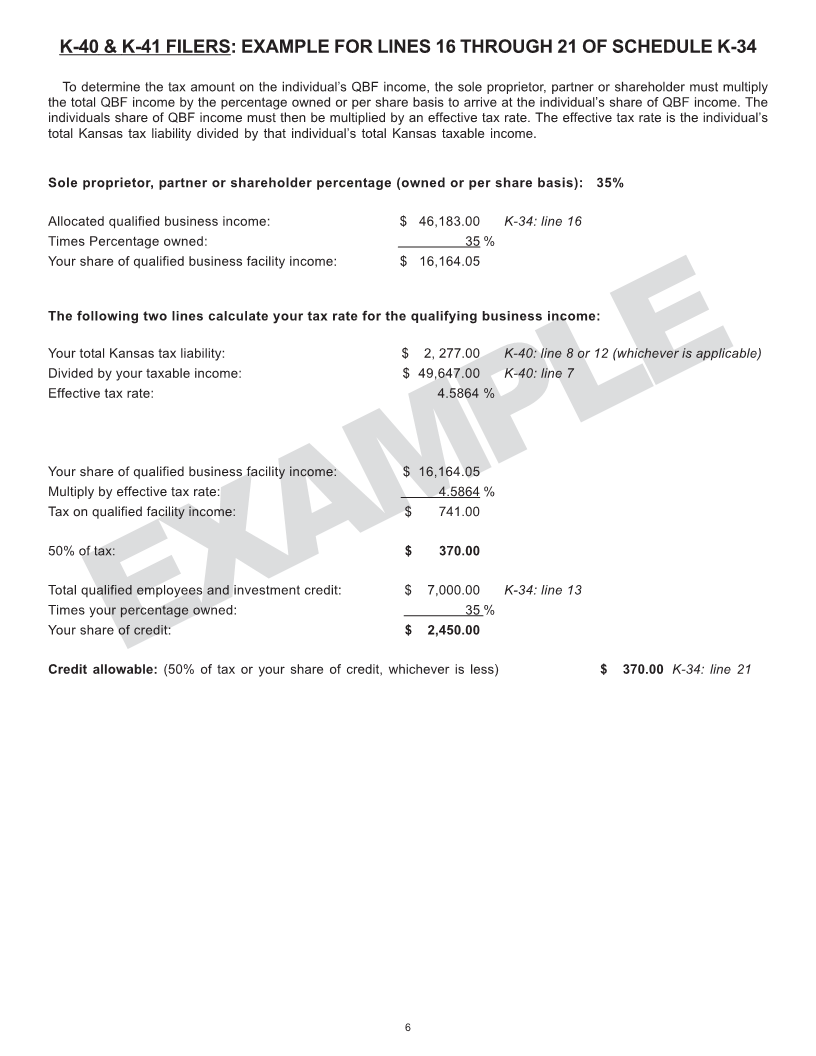

Retail or Service

16. Qualified business facility income (attach schedule) .................... ______________________________ I would like to defer this

17. Tax on qualified business facility income (must complete worksheet) ........ ______________________________ credit to __ __ __ __ .

18. Business and job credit limitation (50%) ........................................ ______________________________ (not to exceed 3 years)

19. Business and job development credit ............................................ ______________________________

Shareholder or Partner (attach schedules)

20. Ownership percentage ................................................................. ______________________________ _____________________________

21. Shareholder or partner amount of credit ....................................... ______________________________ _____________________________

22. Shareholder or partner Kansas tax liability (must complete worksheet) ..... ______________________________ _____________________________

23. Amount of credit used ................................................................... ______________________________ _____________________________

24. Carry forward amount (must complete worksheet) .................................... _____________________________

Payroll Information

A. Total employment in the state of Kansas ....................................... ______________________________ _____________________________

B. Total payroll in the state of Kansas ............................................... ______________________________ _____________________________