Enlarge image

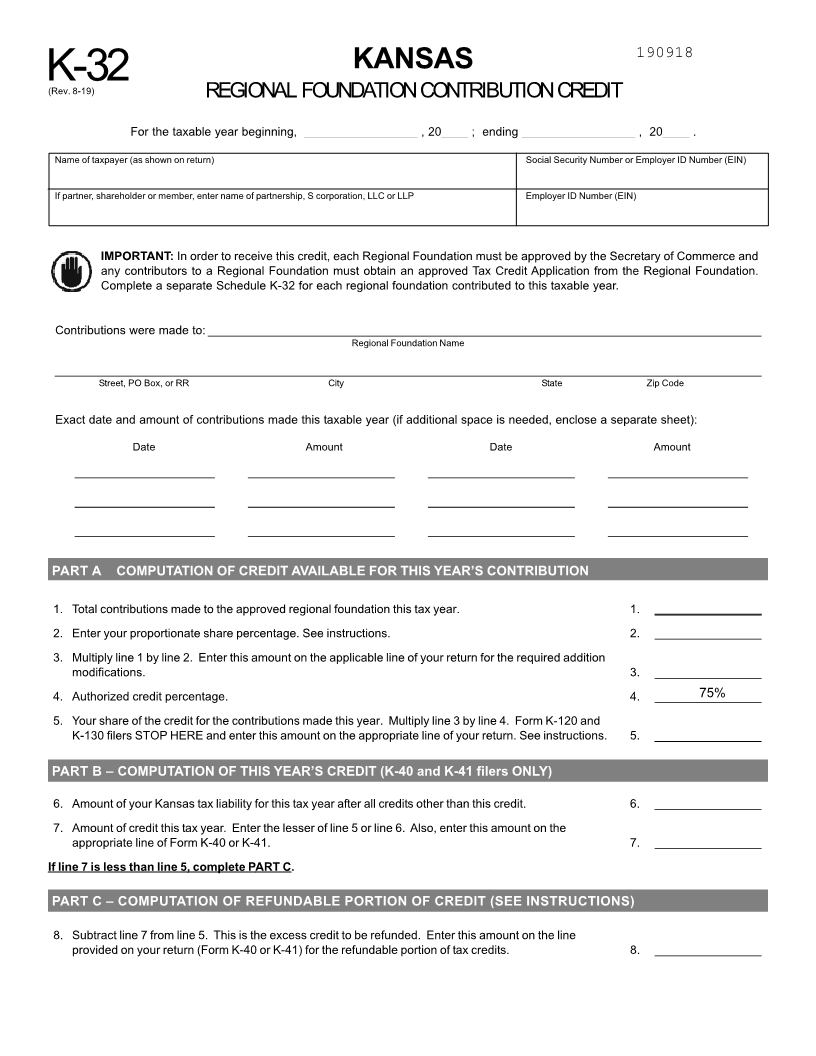

190918

KANSAS

K-32

(Rev. 8-19) REGIONAL FOUNDATION CONTRIBUTION CREDIT

For the taxable year beginning, _________________ , 20 ____ ; ending _________________ , 20 ____ .

Name of taxpayer (as shown on return) Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP Employer ID Number (EIN)

IMPORTANT: In order to receive this credit, each Regional Foundation must be approved by the Secretary of Commerce and

any contributors to a Regional Foundation must obtain an approved Tax Credit Application from the Regional Foundation.

Complete a separate Schedule K-32 for each regional foundation contributed to this taxable year.

Contributions were made to: ___________________________________________________________________________________

Regional Foundation Name

__________________________________________________________________________________________________________

Street, PO Box, or RR City State Zip Code

Exact date and amount of contributions made this taxable year (if additional space is needed, enclose a separate sheet):

Date Amount Date Amount

_____________________ ______________________ ______________________ _____________________

_____________________ ______________________ ______________________ _____________________

_____________________ ______________________ ______________________ _____________________

PART A – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S CONTRIBUTION

1. Total contributions made to the approved regional foundation this tax year. 1. ________________

2. Enter your proportionate share percentage. See instructions. 2. ________________

3. Multiply line 1 by line 2. Enter this amount on the applicable line of your return for the required addition

modifications. 3. ________________

4. Authorized credit percentage. 4. ________________75%

5. Your share of the credit for the contributions made this year. Multiply line 3 by line 4. Form K-120 and

K-130 filers STOP HERE and enter this amount on the appropriate line of your return. See instructions. 5. ________________

PART B – COMPUTATION OF THIS YEAR’S CREDIT (K-40 and K-41 filers ONLY)

6. Amount of your Kansas tax liability for this tax year after all credits other than this credit. 6. ________________

7. Amount of credit this tax year. Enter the lesser of line 5 or line 6. Also, enter this amount on the

appropriate line of Form K-40 or K-41. 7. ________________

If line 7 is less than line 5, complete PART C.

PART C – COMPUTATION OF REFUNDABLE PORTION OF CREDIT (SEE INSTRUCTIONS)

8. Subtract line 7 from line 5. This is the excess credit to be refunded. Enter this amount on the line

provided on your return (Form K-40 or K-41) for the refundable portion of tax credits. 8. ________________