Enlarge image

180018

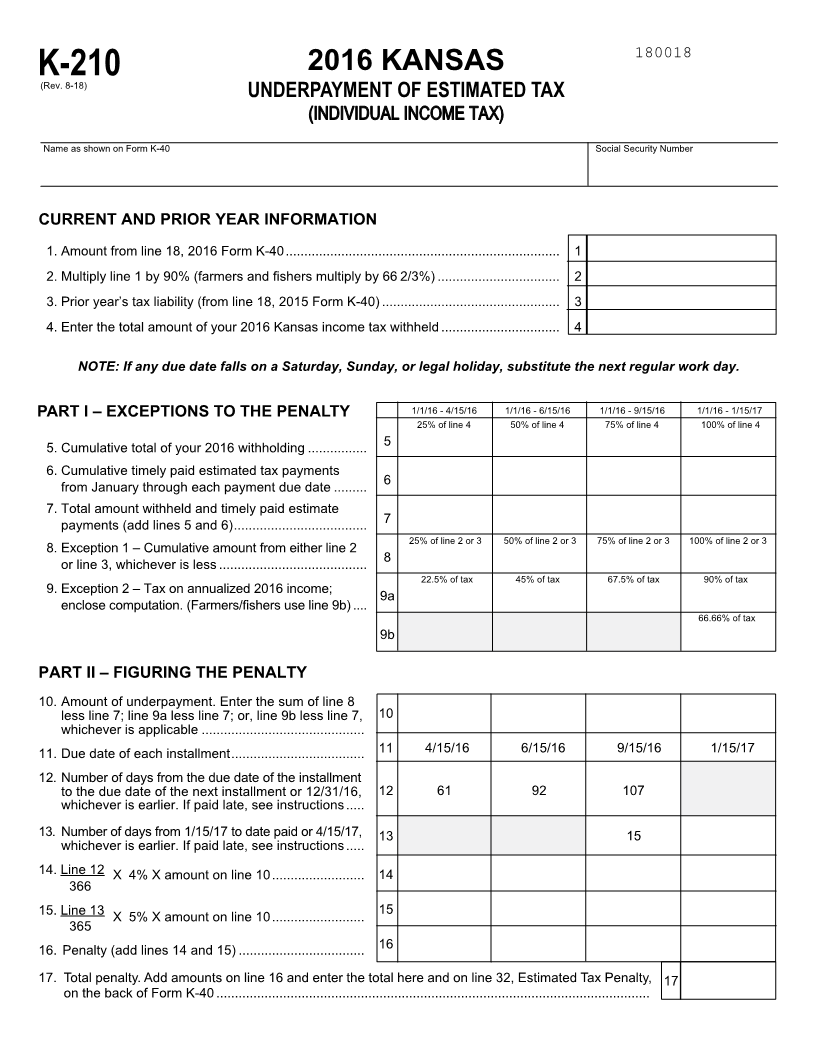

2016 KANSAS

K-210(Rev. 8-18)

UNDERPAYMENT OF ESTIMATED TAX

(INDIVIDUAL INCOME TAX)

Name as shown on Form K-40 Social Security Number

CURRENT AND PRIOR YEAR INFORMATION

1. Amount from line 18, 2016 Form K-40 .......................................................................... 1

2. Multiply line 1 by 90% (farmers and fishers multiply by 66 2/3%) ................................. 2

3. Prior year’s tax liability (from line 18, 2015 Form K-40) ................................................ 3

4. Enter the total amount of your 2016 Kansas income tax withheld ................................ 4

NOTE: If any due date falls on a Saturday, Sunday, or legal holiday, substitute the next regular work day.

PART I – EXCEPTIONS TO THE PENALTY 1/1/16 - 4/15/16 1/1/16 - 6/15/16 1/1/16 - 9/15/16 1/1/16 - 1/15/17

25% of line 4 50% of line 4 75% of line 4 100% of line 4

5. Cumulative total of your 2016 withholding ................ 5

6. Cumulative timely paid estimated tax payments

6

from January through each payment due date .........

7. Total amount withheld and timely paid estimate

payments (add lines 5 and 6) .................................... 7

25% of line 2 or 3 50% of line 2 or 3 75% of line 2 or 3 100% of line 2 or 3

8. Exception 1 – Cumulative amount from either line 2

8

or line 3, whichever is less ........................................

22.5% of tax 45% of tax 67.5% of tax 90% of tax

9. Exception 2 – Tax on annualized 2016 income;

9a

enclose computation. (Farmers/fishers use line 9b) ....

66.66% of tax

9b

PART II – FIGURING THE PENALTY

10. Amount of underpayment. Enter the sum of line 8

less line 7; line 9a less line 7; or, line 9b less line 7, 10

whichever is applicable ............................................

11. Due date of each installment.................................... 11 4/15/16 6/15/16 9/15/16 1/15/17

12. Number of days from the due date of the installment

to the due date of the next installment or 12/31/16, 12 61 92 107

whichever is earlier. If paid late, see instructions .....

13. Number of days from 1/15/17 to date paid or 4/15/17, 13 15

whichever is earlier. If paid late, see instructions .....

14. Line 12 X 4% X amount on line 10 ......................... 14

366

15. Line 13 15

X 5% X amount on line 10 .........................

365

16. Penalty (add lines 14 and 15) .................................. 16

17. Total penalty. Add amounts on line 16 and enter the total here and on line 32, Estimated Tax Penalty, 17

on the back of Form K-40 .....................................................................................................................