Enlarge image

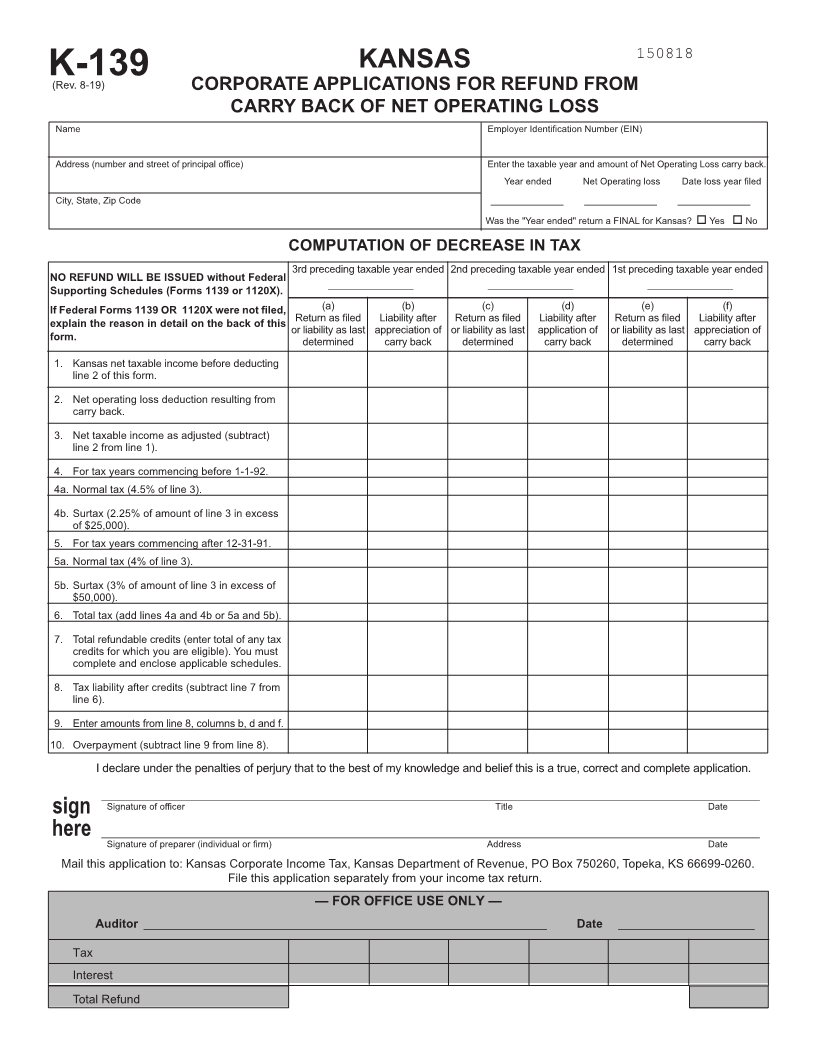

150818

KANSAS

K-139

(Rev. 8-19) CORPORATE APPLICATIONS FOR REFUND FROM

CARRY BACK OF NET OPERATING LOSS

Name Employer Identification Number (EIN)

Address (number and street of principal office) Enter the taxable year and amount of Net Operating Loss carry back.

Year ended Net Operating loss Date loss year filed

City, State, Zip Code ______________ ______________ ______________

Was the "Year ended" return a FINAL for Kansas? o Yes o No

COMPUTATION OF DECREASE IN TAX

3rd preceding taxable year ended 2nd preceding taxable year ended 1st preceding taxable year ended

NO REFUND WILL BE ISSUED without Federal _______________ _______________ _______________

Supporting Schedules (Forms 1139 or 1120X).

If Federal Forms 1139 OR 1120X were not filed, (a) (b) (c) (d) (e) (f)

explain the reason in detail on the back of this Return as filed Liability after Return as filed Liability after Return as filed Liability after

or liability as last appreciation of or liability as last application of or liability as last appreciation of

form. determined carry back determined carry back determined carry back

1. Kansas net taxable income before deducting

line 2 of this form.

2. Net operating loss deduction resulting from

carry back.

3. Net taxable income as adjusted (subtract)

line 2 from line 1).

4. For tax years commencing before 1-1-92.

4a. Normal tax (4.5% of line 3).

4b. Surtax (2.25% of amount of line 3 in excess

of $25,000).

5. For tax years commencing after 12-31-91.

5a. Normal tax (4% of line 3).

5b. Surtax (3% of amount of line 3 in excess of

$50,000).

6. Total tax (add lines 4a and 4b or 5a and 5b).

7. Total refundable credits (enter total of any tax

credits for which you are eligible). You must

complete and enclose applicable schedules.

8. Tax liability after credits (subtract line 7 from

line 6).

9. Enter amounts from line 8, columns b, d and f.

10. Overpayment (subtract line 9 from line 8).

I declare under the penalties of perjury that to the best of my knowledge and belief this is a true, correct and complete application.

_______________________________________________________________________________________________________________

Signature of officer Title Date

sign

here _______________________________________________________________________________________________________________

Signature of preparer (individual or firm) Address Date

Mail this application to: Kansas Corporate Income Tax, Kansas Department of Revenue, PO Box 750260, Topeka, KS 66699-0260.

File this application separately from your income tax return.

— FOR OFFICE USE ONLY —

Auditor ____________________________________________________________________ Date _______________________

Tax

Interest

Total Refund