Enlarge image

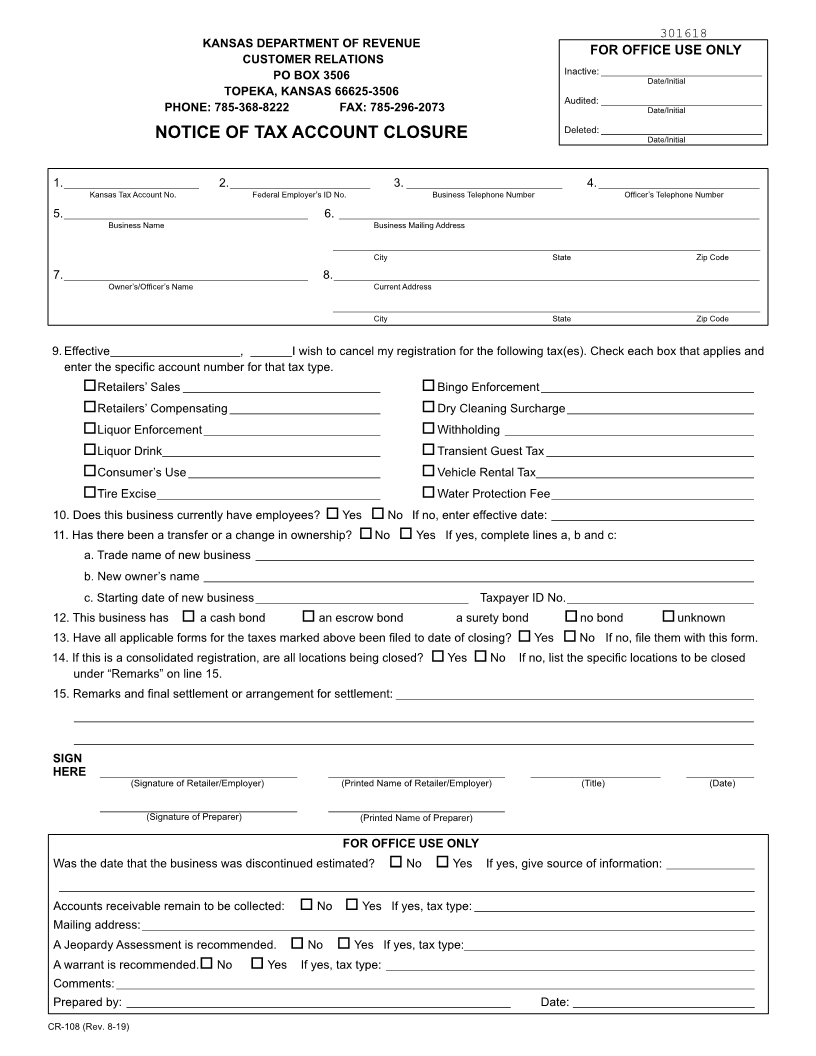

301618

KANSAS DEPARTMENT OF REVENUE

FOR OFFICE USE ONLY

CUSTOMER RELATIONS

PO BOX 3506 Inactive: _______________________________

Date/Initial

TOPEKA, KANSAS 66625-3506

Audited: _______________________________

PHONE: 785-368-8222 FAX: 785-296-2073 Date/Initial

Deleted: _______________________________

NOTICE OF TAX ACCOUNT CLOSURE Date/Initial

1.__________________________ 2.___________________________ 3. ______________________________ 4. _______________________________

Kansas Tax Account No. Federal Employer’s ID No. Business Telephone Number Officer’s Telephone Number

5._______________________________________________ 6. _________________________________________________________________________________

Business Name Business Mailing Address

________________________________________________________________________________________________

City State Zip Code

7._______________________________________________ 8. __________________________________________________________________________________

Owner’s/Officer’s Name Current Address

________________________________________________________________________________________________

City State Zip Code

9. Effective_________________________, ________ I wish to cancel my registration for the following tax(es). Check each box that applies and

enter the specific account number for that tax type.

Retailers’ Sales ______________________________________ Bingo Enforcement _________________________________________

Retailers’ Compensating _____________________________ Dry Cleaning Surcharge ____________________________________

Liquor Enforcement __________________________________ Withholding ________________________________________________

Liquor Drink__________________________________________ Transient Guest Tax ________________________________________

Consumer’s Use _____________________________________ Vehicle Rental Tax__________________________________________

Tire Excise___________________________________________ Water Protection Fee _______________________________________

10. Does this business currently have employees? Yes No If no, enter effective date: _______________________________________

11. Has there been a transfer or a change in ownership? No Yes If yes, complete lines a, b and c:

a. Trade name of new business ________________________________________________________________________________________________

b. New owner’s name __________________________________________________________________________________________________________

c. Starting date of new business _________________________________________ Taxpayer ID No.____________________________________

12. This business has a cash bond an escrow bond a surety bond no bond unknown

13. Have all applicable forms for the taxes marked above been filed to date of closing? Yes No If no, file them with this form.

14. If this is a consolidated registration, are all locations being closed? Yes No If no, list the specific locations to be closed

under “Remarks” on line 15.

15. Remarks and final settlement or arrangement for settlement: _____________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

SIGN

HERE ______________________________________ __________________________________ _________________________ _____________

(Signature of Retailer/Employer) (Printed Name of Retailer/Employer) (Title) (Date)

______________________________________ __________________________________

(Signature of Preparer) (Printed Name of Preparer)

FOR OFFICE USE ONLY

Was the date that the business was discontinued estimated? No Yes If yes, give source of information: _________________

______________________________________________________________________________________________________________________________________

Accounts receivable remain to be collected: No Yes If yes, tax type: ______________________________________________________

Mailing address: ______________________________________________________________________________________________________________________

A Jeopardy Assessment is recommended. No Yes If yes, tax type:________________________________________________________

A warrant is recommended. No Yes If yes, tax type: _______________________________________________________________________

Comments: ___________________________________________________________________________________________________________________________

Prepared by: __________________________________________________________________________ Date: ___________________________________

CR-108 (Rev. 8-1 )9