- 2 -

Enlarge image

|

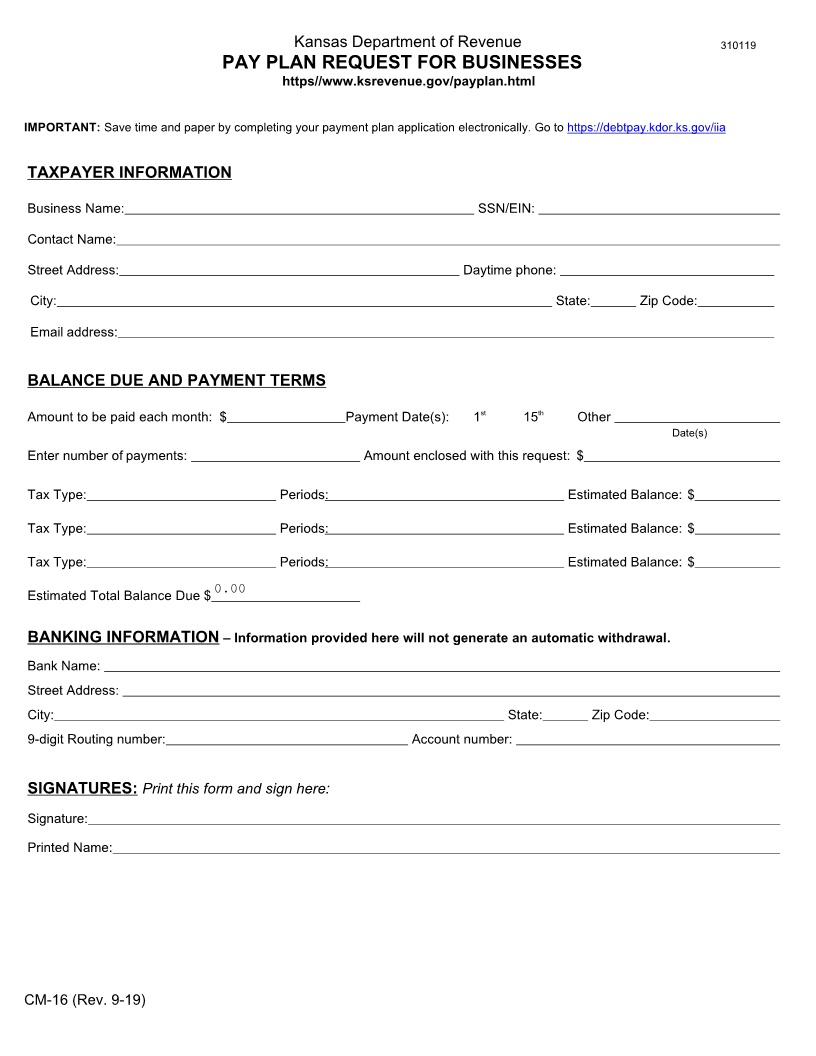

Instructions for completing and submitting form

Taxpayer Information: Enter the business name, contact name, phone and address information. Remember to enter

the area number when entering your phone number.

Balance Due and Payment Terms:

Amount to be paid each month- Enter the amount to be paid each month.

Payment Date(s) - Check the appropriate payment date. If “Other” is selected, enter the date in which the

payment will be due.

Enter number of payments – Based on the estimated balance due and the amount to be paid each month,

enter the number of payments that will be made.

Amount enclosed with this request – Enter the amount that you are enclosing with this request. If your pay

plan is approved, the first payment may include an additional $25.00 administration fee for plans exceeding 90

days. You will receive a pay plan confirmation by mail within 14 days once your request has been processed.

Tax Type, Periods and Estimated Balance- If you know what tax types, periods and estimated balances are

that make up your total balance due, enter the information. If unknown, enter an amount in the Estimated Total

Balance Due line. If you are sending a payment with the application, enter the amount on the appropriate line.

Banking Information: This information will not be used to generate an automatic withdrawal from your bank account.

Enter your bank name and address.

Routing Number – The 9-digit number is located on the bottom of your check and is the first set of numbers.

Account Number – The account number is located on the bottom of your check and is the last set of numbers.

Signature: Your application will not be accepted unless the document is signed.

Incomplete or missing information will result in delaying the processing of this request. This form can be faxed to (785)

291-3616 or emailed to kstaxpayplanrequest@kdor.ks.gov or mailed to the below address:

Compliance Enforcement

Kansas Department of Revenue

PO Box 3506

Topeka, KS 66601-3506

General Information

The Kansas Department of Revenue may consider a payment plan agreement for taxpayers to resolve their accounts if

certain criteria are met. Taxpayers who are granted a payment plan must file and pay all current and future taxes and

estimated payments when due. Any additional debts not included in the agreement or missed payments will be

considered default of the agreement and KDOR may take immediate enforcement action.

Penalty and interest will continue to accrue during the life of the agreement based upon any unpaid tax. Any refunds or other

monies due to the taxpayer will be applied to the liability, even if the taxpayer is/has made all of their installment payments on

time.

A tax warrant must be filed with the District Court for pay plans over 6 months. A tax warrant will also be filed if the Statute of

Limitations is due to expire during the term of the payment plan.

If your payment plan is denied, you will receive instructions from KDOR on how to proceed.

Once a payment plan is set, you may choose from one of the following three options offered by KDOR to pay your

tax:

Check or Money Order. If you choose this payment method, be sure to write your SSN or EIN on your check or money

order and make it payable to “Kansas Department of Revenue.”

Direct Payment. When you select Direct Payment, you are giving KDOR permission to initiate a payment

electronically from your bank account. This Direct Payment option is not recurring; you will need to authorize

each payment separately. For more information, visit our web site at: https://debtpay.kdor.ks.gov

Credit Card. To pay by credit card you must visit one of the service provider’s web sites. A convenience fee will be

charged by the service provider based on the amount of tax you are paying. You can find out what the fee is by visiting

their web site: www.officialpayments.com

Wage Assignment. To make payment arrangements utilizing a wage assignment(s) through your employer

please call (785) 296-6121 for information.

CM-16 (Rev. 06/17)

|