Enlarge image

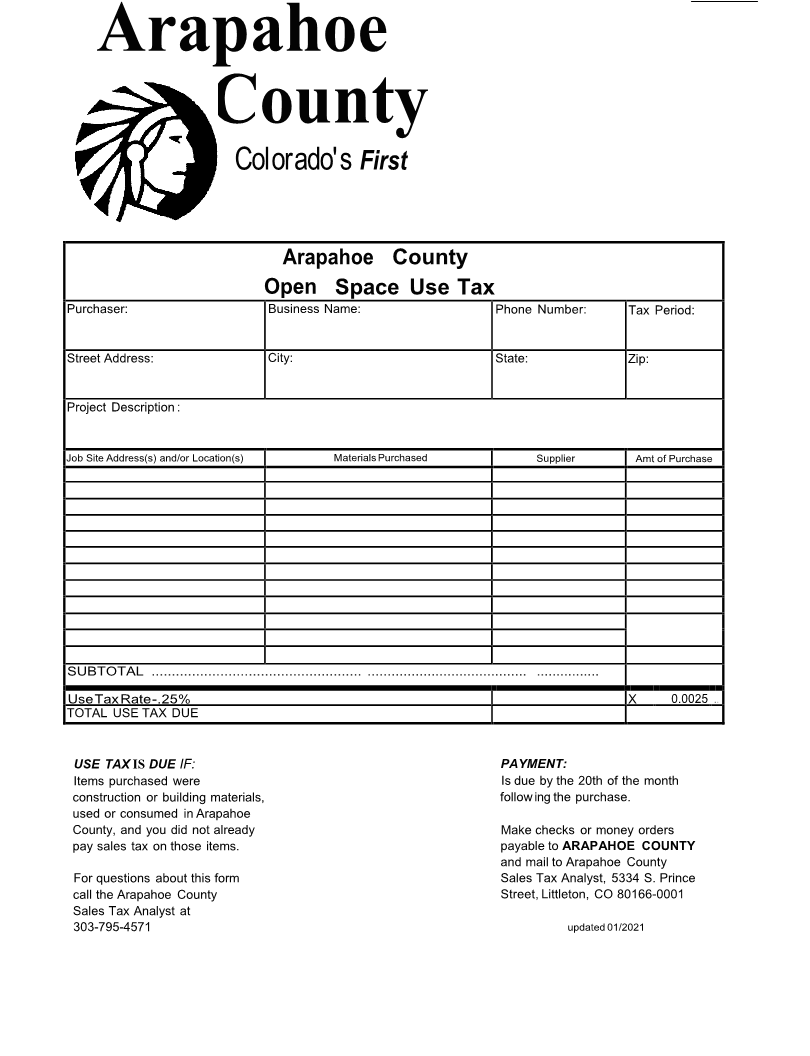

Arapahoe

County

Colorado's First

Arapahoe County

Open Space Use Tax

Purchaser: Business Name: Phone Number: Tax Period:

Street Address: City: State: Zip:

Project Description :

Job Site Address(s) and/or Location(s) Materials Purchased Supplier Amt of Purchase

SUBTOTAL ................ .................................... .... .................................. . . .. .... ........ . .

Use Tax Rate -.25% X 0.0025 ..

TOTAL USE TAX DUE

USE TAX IS DUE IF: PAYMENT:

Items purchased were Is due by the 20th of the month

construction or building materials, following the purchase.

used or consumed in Arapahoe

County, and you did not already Make checks or money orders

pay sales tax on those items. payable to ARAPAHOE COUNTY

and mail to Arapahoe County

For questions about this form Sales Tax Analyst, 5334 S. Prince

call the Arapahoe County Street,Littleton, CO 80166-0001

Sales Tax Analyst at

303-795-4571 updated 01/2021