Enlarge image

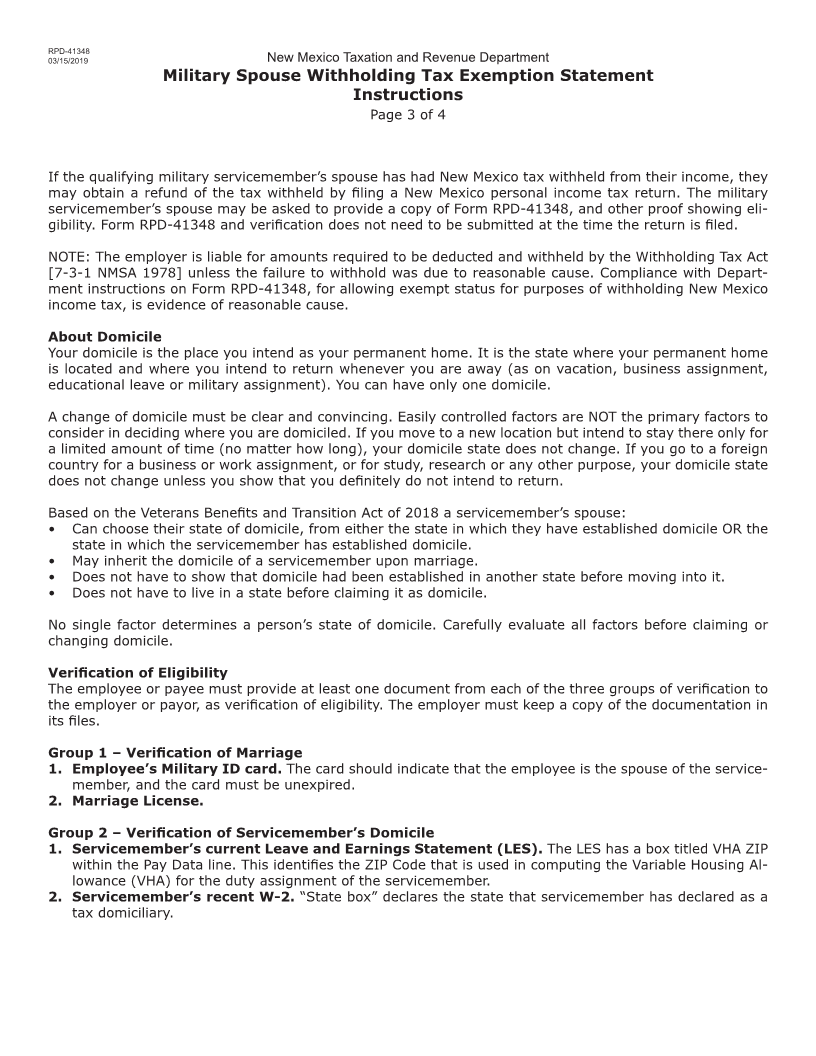

RPD-41348

03/15/2019 New Mexico Taxation and Revenue Department

Military Spouse Withholding Tax Exemption Statement

Effective date of this statement. __________________________________________________

A military servicemember’s non-resident spouse, eligible to claim an exempt New Mexico withholding status based on

the Veterans Benefits and Transition Act of 2018, must annually submit Form RPD-41348 to an employer or payor

responsible for withholding New Mexico tax. Complete a new statement if eligibility changes. All parties involved must

keep a copy of this statement in their records. The employer or payor accepting this form must mail a copy of the state-

ment and verification of eligibility to New Mexico Taxation and Revenue Department, P.O. Box 25128, Santa Fe, New

Mexico 87504-5128. For assistance, contact (505) 827-0832.

1. Taxable Year 2. Employer or payor’s name

3. Employee or payee’s name 4. Employee or payee’s social security number

5. Servicemember’s name 6. Servicemember’s social security number

7a. Street address where you reside (city, state, ZIP code) 7b. Check if you and your spouse

reside at the same address

8a. Name of military servicemember’s permanent duty station (city, state, ZIP code) 8b. Check if foreign

address

Statement of employee or payee.

9. The employee or payee’s, for tax purposes,

has declared domicile in the state of:

10. The servicemember, for tax purposes, has

declared domicile in the state of:

11. The servicemember is currently assigned Check one

military duty station in New Mexico.

YES NO

Review the eligibility requirements in the instructions and check the statement that applies.

I am eligible for the exemption from New Mexico Income Tax Withholding requirements be-

cause I meet the requirements set forth under the Servicemembers Civil Relief Act, as amended by

the Veterans Benefits and Transition Act of 2018 (P.L. 115-407).

I am NOT eligible for the exemption from New Mexico Income Tax Withholding requirements

because I do not or no longer meet the requirements set forth under the Servicemembers Civil

Relief Act, as amended by the Veterans Benefits and Transition Act of 2018 (P.L. 115-407).

Signature of employee or payee - Under penalty of perjury, I certify that I have examined this state-

ment, including accompanying attachments, and to the best of my knowledge and belief it is true, correct

and complete.

Signature of employee or payee Date Phone number

Signature of employer or payor - Under penalty of perjury, I certify that I have examined this state-

ment, including accompanying attachments, and to the best of my knowledge and belief it is true, correct

and complete.

Signature of employer or payor Date Phone number