Enlarge image

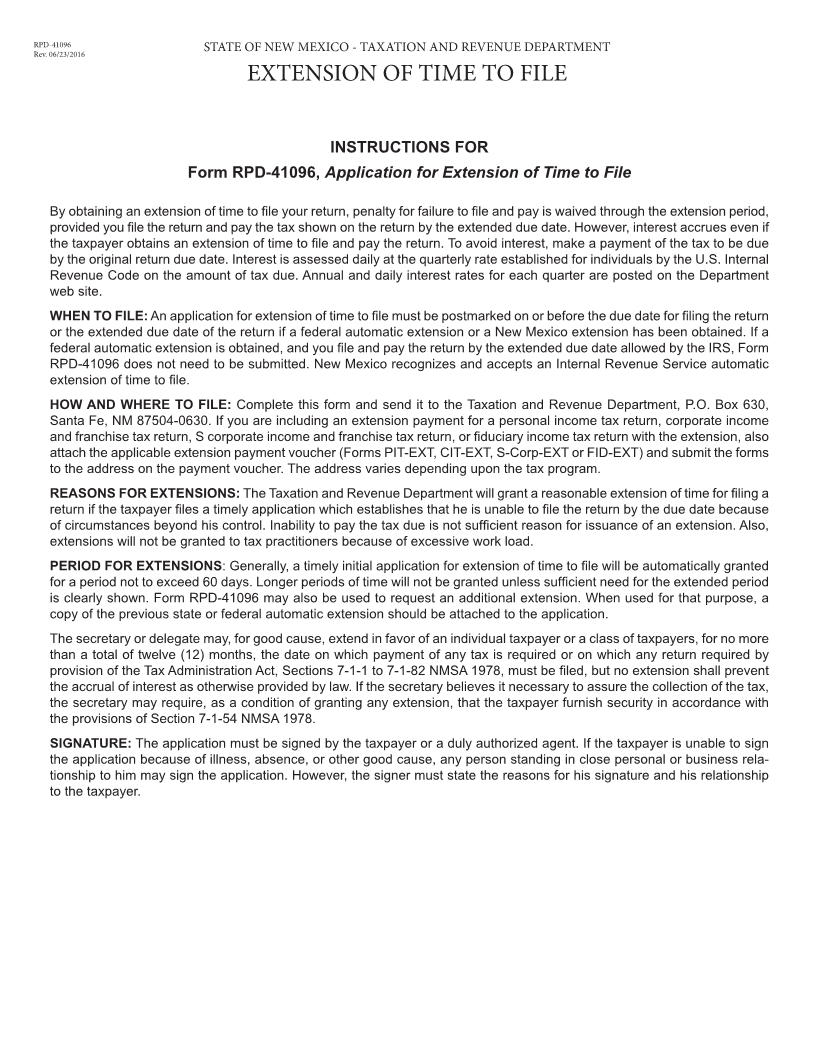

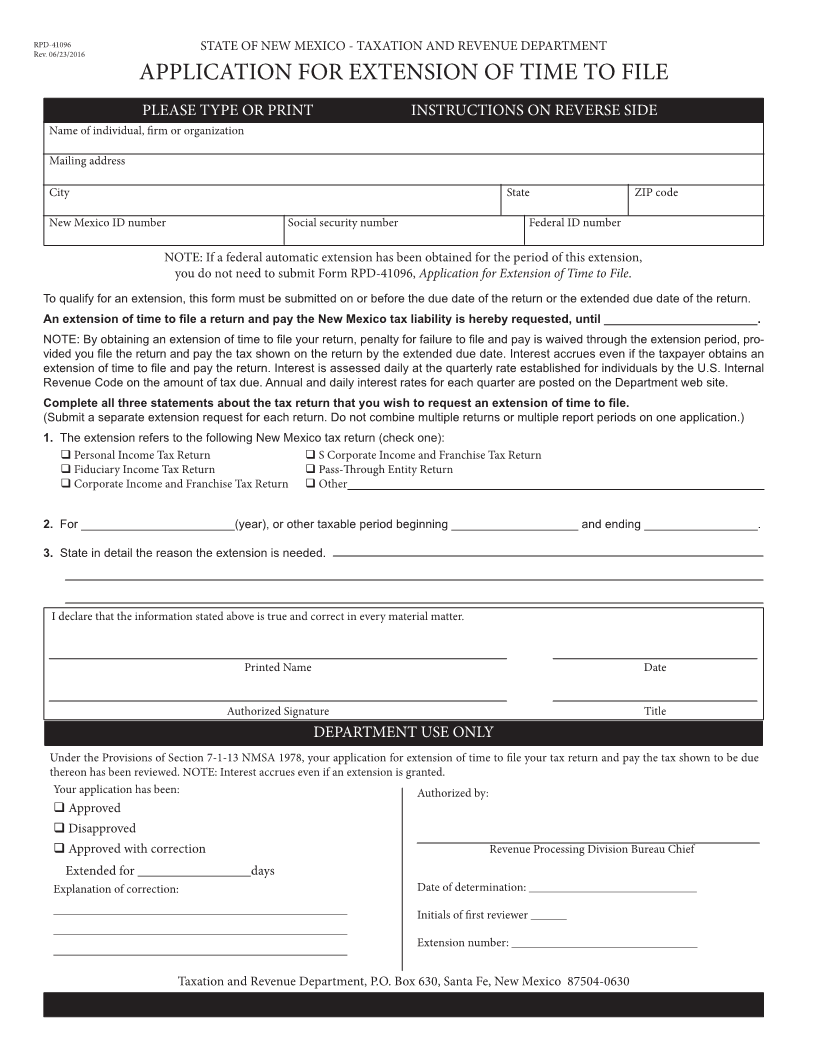

RPD-41096 STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 06/23/2016

APPLICATION FOR EXTENSION OF TIME TO FILE

PLEASE TYPE OR PRINT INSTRUCTIONS ON REVERSE SIDE

Name of individual, firm or organization

Mailing address

City State ZIP code

New Mexico ID number Social security number Federal ID number

NOTE: If a federal automatic extension has been obtained for the period of this extension,

you do not need to submit Form RPD-41096, Application for Extension of Time to File.

To qualify for an extension, this form must be submitted on or before the due date of the return or the extended due date of the return.

An extension of time to file a return and pay the New Mexico tax liability is hereby requested, until _______________________.

NOTE: By obtaining an extension of time to file your return, penalty for failure to file and pay is waived through the extension period, pro-

vided you file the return and pay the tax shown on the return by the extended due date. Interest accrues even if the taxpayer obtains an

extension of time to file and pay the return. Interest is assessed daily at the quarterly rate established for individuals by the U.S. Internal

Revenue Code on the amount of tax due. Annual and daily interest rates for each quarter are posted on the Department web site.

Complete all three statements about the tax return that you wish to request an extension of time to file.

(Submit a separate extension request for each return. Do not combine multiple returns or multiple report periods on one application.)

1. The extension refers to the following New Mexico tax return (check one):

Personal Income Tax Return S Corporate Income and Franchise Tax Return

Fiduciary Income Tax Return Pass-Through Entity Return

Corporate Income and Franchise Tax Return Other

2. For _______________________(year), or other taxable period beginning ___________________ and ending _________________.

3. State in detail the reason the extension is needed.

I declare that the information stated above is true and correct in every material matter.

Printed Name Date

Authorized Signature Title

DEPARTMENT USE ONLY

Under the Provisions of Section 7-1-13 NMSA 1978, your application for extension of time to file your tax return and pay the tax shown to be due

thereon has been reviewed. NOTE: Interest accrues even if an extension is granted.

Your application has been: Authorized by:

Approved

Disapproved

Approved with correction Revenue Processing Division Bureau Chief

Extended for _________________days

Explanation of correction: Date of determination: ____________________________

_________________________________________________ Initials of first reviewer ______

_________________________________________________

Extension number: _______________________________

_________________________________________________

Taxation and Revenue Department, P.O. Box 630, Santa Fe, New Mexico 87504-0630