Enlarge image

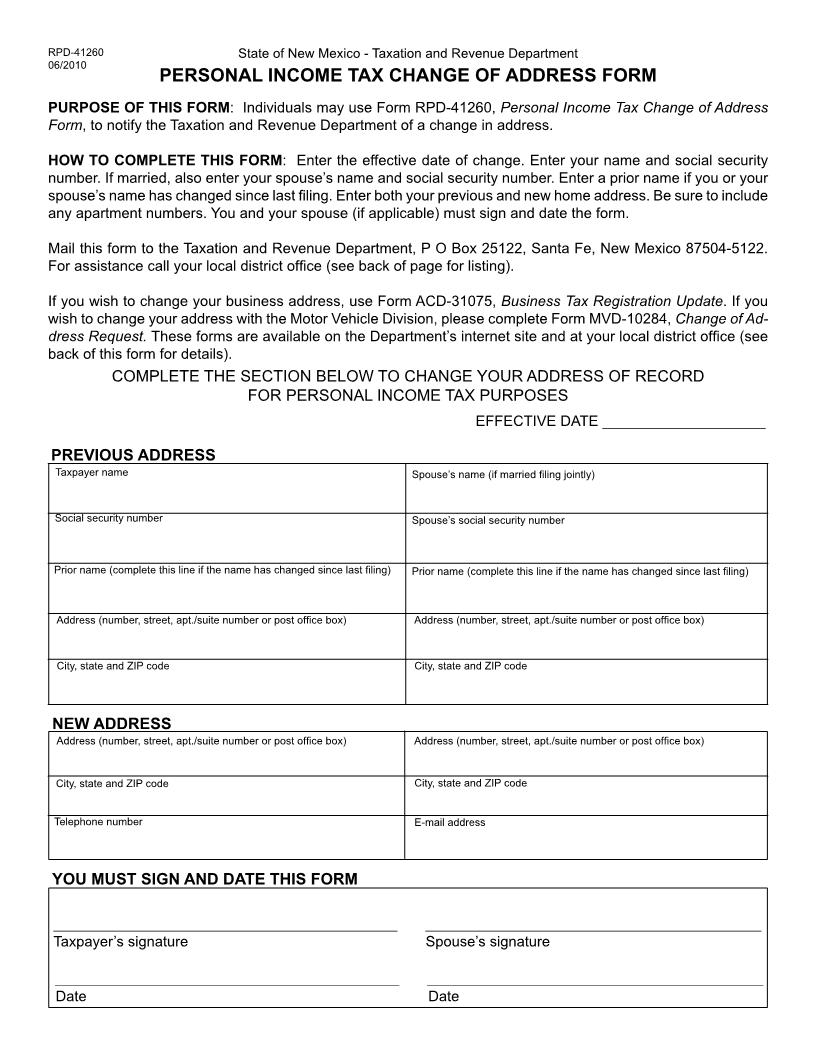

RPD-41260 State of New Mexico - Taxation and Revenue Department

06/2010

PERSONAL INCOME TAX CHANGE OF ADDRESS FORM

PURPOSE OF THIS FORM: Individuals may use Form RPD-41260, Personal Income Tax Change of Address

Form, to notify the Taxation and Revenue Department of a change in address.

HOW TO COMPLETE THIS FORM: Enter the effective date of change. Enter your name and social security

number. If married, also enter your spouse’s name and social security number. Enter a prior name if you or your

spouse’s name has changed since last ling. Enter both your previous and new home address. Be sure to include

any apartment numbers. You and your spouse (if applicable) must sign and date the form.

Mail this form to the Taxation and Revenue Department, P O Box 25122, Santa Fe, New Mexico 87504-5122.

For assistance call your local district ofce (see back of page for listing).

If you wish to change your business address, use Form ACD-31075, Business Tax Registration Update. If you

wish to change your address with the Motor Vehicle Division, please complete Form MVD-10284, Change of Ad-

dress Request. These forms are available on the Department’s internet site and at your local district ofce (see

back of this form for details).

COMPLETE THE SECTION BELOW TO CHANGE YOUR ADDRESS OF RECORD

FOR PERSONAL INCOME TAX PURPOSES

EFFECTIVE DATE ____________________

PREVIOUS ADDRESS

Taxpayer name S p o u s e ’ s n a m e ( i f m a r r i e d l i n g j o i n t l y )

Social security number Spouse’s social security number

Prior name (complete this line if the name has changed since last ling) Prior name (complete this line if the name has changed since last ling)

Address (number, street, apt./suite number or post ofce box) Address (number, street, apt./suite number or post ofce box)

City, state and ZIP code City, state and ZIP code

NEW ADDRESS

Address (number, street, apt./suite number or post ofce box) Address (number, street, apt./suite number or post ofce box)

City, state and ZIP code City, state and ZIP code

Telephone number E-mail address

YOU MUST SIGN AND DATE THIS FORM

___________________________________________ __________________________________________

Taxpayer’s signature Spouse’s signature

___________________________________________ __________________________________________

Date Date