Enlarge image

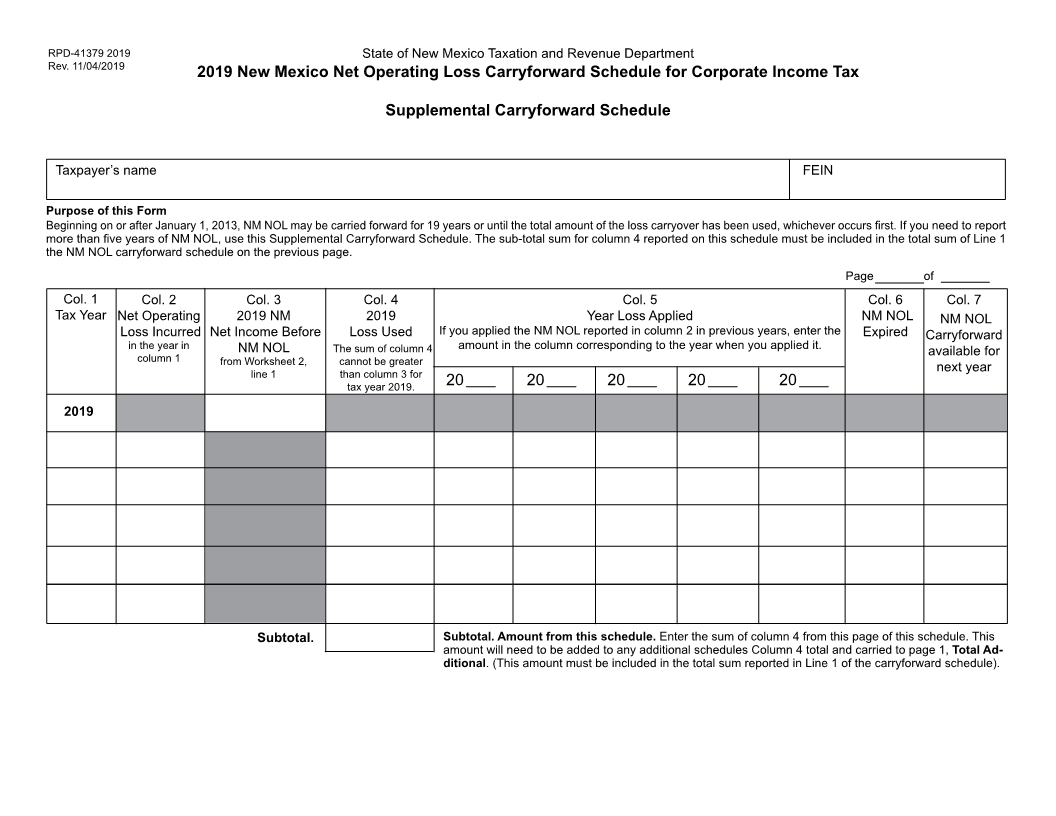

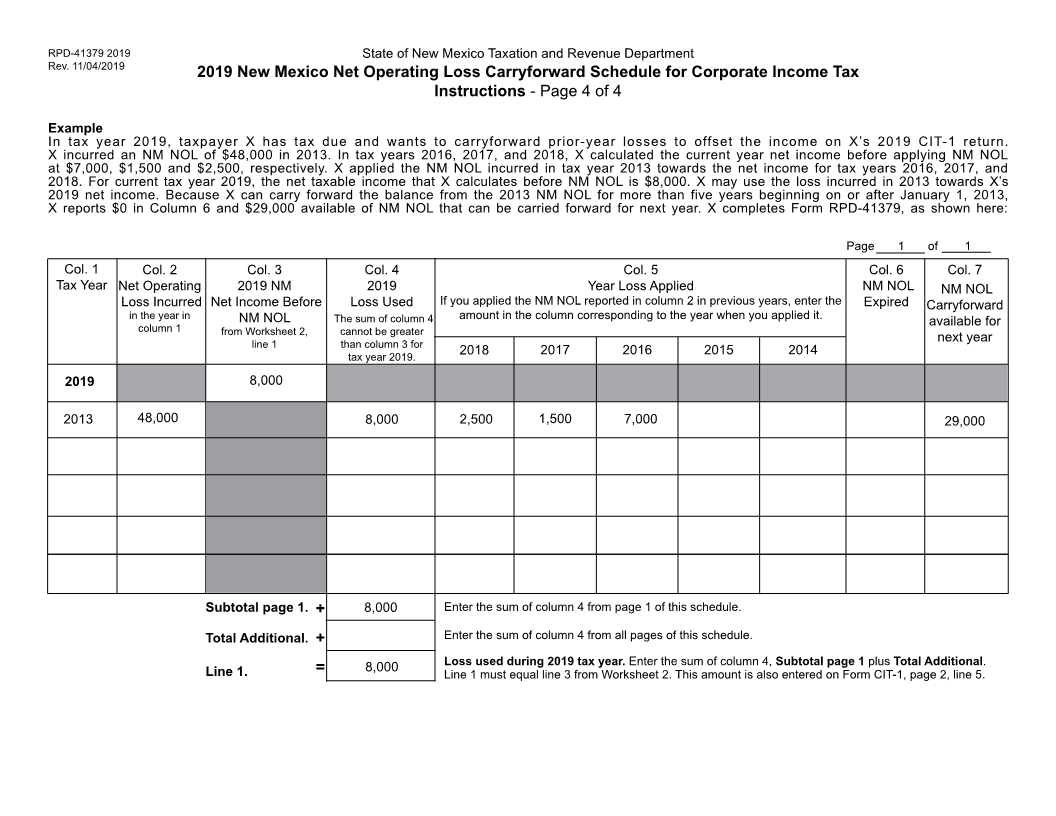

RPD-41379 2019 State of New Mexico Taxation and Revenue Department

Rev. 11/04/2019

2019 New Mexico Net Operating Loss Carryforward Schedule for Corporate Income Tax

Taxpayer’s name FEIN

Purpose of this Form

Use this form to calculate your excludable New Mexico net operating loss (NM NOL) carryforward deduction from the current year New Mexico Corporate income tax. For each prior-

year NM NOL carryforward, also show how you applied the credit in columns 4, 5, and 6. In column 7, show the balance of NM NOL carryforward available for the next tax year. If

you are reporting a NM NOL deduction from a carryforward on Form CIT-1, page 2, line 5, this schedule must be filed with the New Mexico 2019 Form CIT-1, Corporate Income and

Franchise Tax Return. Page 1 of

Col. 1 Col. 2 Col. 3 Col. 4 Col. 5 Col. 6 Col. 7

Tax Year Net Operating 2019 NM 2019 Year Loss Applied NM NOL NM NOL

Loss Incurred Net Income Before Loss Used If you applied the NM NOL reported in column 2 in previous years, enter the Expired Carryforward

in the year in NM NOL The sum of column 4 amount in the column corresponding to the year when you applied it.

available for

column 1 from Worksheet 2, cannot be greater

line 1 than column 3 for next year

tax year 2019. 2018 2017 2016 2015 2014

2019

Subtotal page 1. + Enter the sum of column 4 from page 1 of this schedule.

Total Additional. + Enter the sum of column 4 from all pages of this schedule.

= Loss used during 2019 tax year. Enter the sum of column 4, Subtotal page 1 plus Total Additional.

Line 1. Line 1 must equal line 3 from Worksheet 2. This amount is also entered on Form CIT-1, page 2, line 5.

Complete the Carryforward Schedule above using the instructions and Worksheets 1 and 2 on the next three pages. Do not submit Worksheets 1 and 2 to the Department. Use Work-

sheet 1 to calculate the NM NOL incurred in prior years. Use Worksheet 2 to calculate the 2019 NM net income before the current year NM NOL deduction is applied in column 3, row 1.

Line 1 of the schedule above (the total sum of column 4 from the NM NOL carryforward and supplemental schedules used) is the sum of the NM NOL carryforward loss used in the

2019 tax year. The amount in Line 1 is also entered on the 2019 Form CIT-1, page 2, line 5. For each row showing a prior-year NM NOL incurred, complete the row showing when the

NM NOL was incurred, how it has been applied, any expired amount, and the NM NOL carryforward balance available next year.