Enlarge image

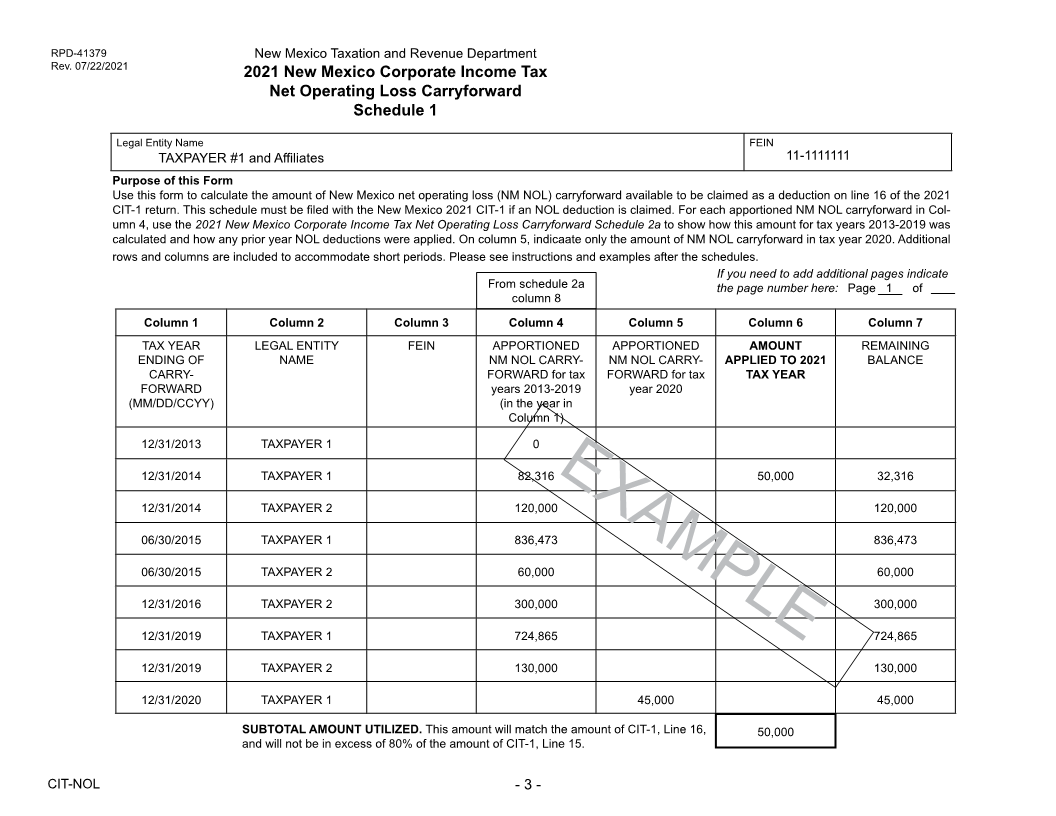

RPD-41379 New Mexico Taxation and Revenue Department

Rev. 07/22/2021

2021 New Mexico Corporate Income Tax

Net Operating Loss Carryforward

Schedule 1

*216160200*

Legal Entity Name FEIN

Purpose of this Form

Use this form to calculate the amount of New Mexico net operating loss (NM NOL) carryforward available to be claimed as a deduction on line 16 of the 2021 CIT-1 return. This sched-

ule must be filed with the New Mexico 2021 CIT-1 if an NOL deduction is claimed. For each apportioned NM NOL carryforward in Column 4, use the 2021 New Mexico Corporate

Income Tax Net Operating Loss Carryforward Schedule 2a to show how this amount for tax years 2013-2019 was calculated and how any prior year NOL deductions were applied.

On column 5, indicaate only the amount of NM NOL carryforward in tax year 2020. Additional rows and columns are included to accommodate short periods. Please see instructions

and examples after the schedules.

From schedule 2a If you need to add additional pages indicate

column 8 the page number here: Page 1 of

Column 1 Column 2 Column 3 Column 4 Column 5 Column 6 Column 7

TAX YEAR LEGAL ENTITY FEIN APPORTIONED APPORTIONED AMOUNT REMAINING

ENDING OF NAME NM NOL CARRY- NM NOL CARRY- APPLIED TO 2021 BALANCE

CARRY- FORWARD for tax FORWARD for tax TAX YEAR

FORWARD years 2013-2019 year 2020

(MM/DD/CCYY) (in the year in

Column 1)

SUBTOTAL AMOUNT UTILIZED. This amount will match the amount of CIT-1, Line 16,

and will not be in excess of 80% of the amount of CIT-1, Line 15.