Enlarge image

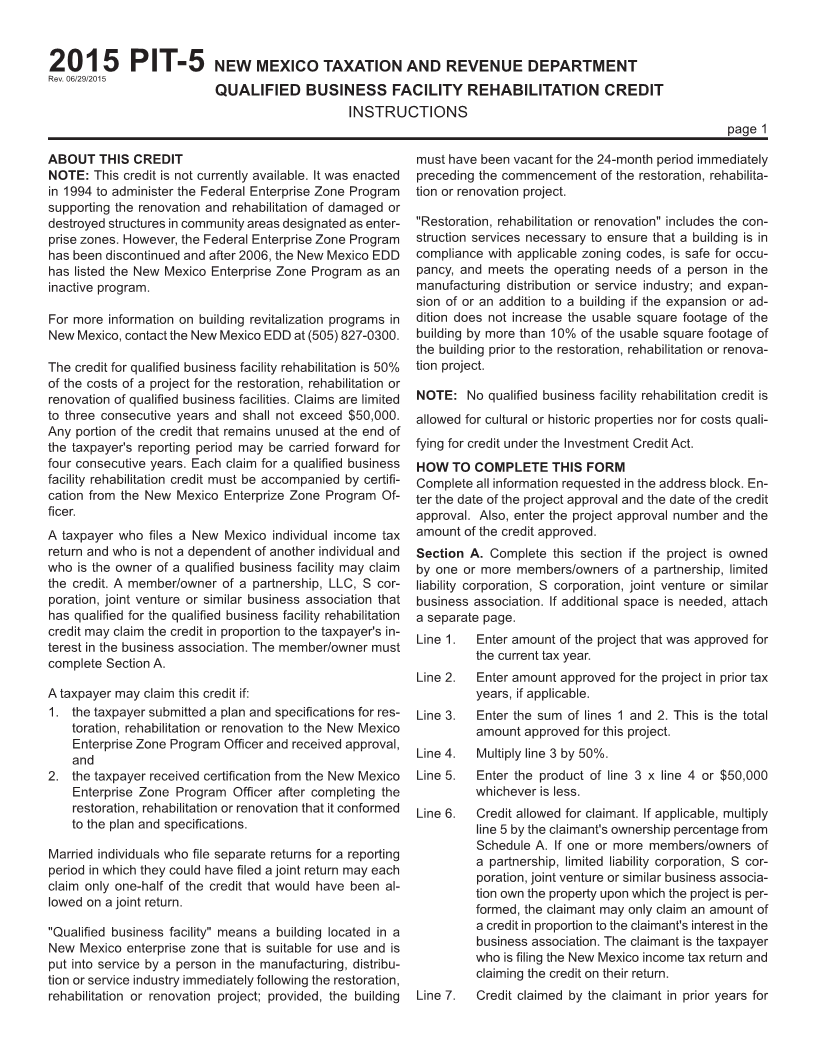

Rev.201506/29/2015 PIT-5 NEW MEXICO TAXATION AND REVENUE DEPARTMENT

QUALIFIED BUSINESS FACILITY REHABILITATION CREDIT

Name of owner Social Security Number

Physical address of property City / State / ZIP code

As provided by the New Mexico Economic Development Department, Enterprise Zone Program Officer:

Date of project approval: ___________________________ Project approval number: ________________________

Date of credit approval: ____________________________ Amount of credit approval: $ _____________________

If you are claiming the credit for more than one project, complete a separate Form PIT-5 for each.

Has credit for this project been claimed in any other taxable year? NO YES

If YES, indicate year(s) ______________________________

SCHEDULE A

If the property upon which the project is performed is a partnership, limited liability corporation, S corporation, joint venture

or similar business association, list each owner, the New Mexico CRS identification number or social security number, and

ownership percentage of each partner or member.

Name CRS I.D. Number Ownership Percentage

a. _____________________________________ _________________________ ______________________

b. _____________________________________ _________________________ ______________________

c. _____________________________________ _________________________ ______________________

d. _____________________________________ _________________________ ______________________

1. Project amount approved for the current tax year .................................................................. $ ___________________

2. Project amount approved in prior years ................................................................................. $ ___________________

3. Total amount approved for this project (The sum of lines 1 and 2) ........................................ $ ___________________

4. Multiply by .............................................................................................................................. 50%

5. Enter the product of line 3 x line 4 OR $50,000, whichever is less.

This is the Maximum Qualified Business Facility Rehabilitation Credit available.................... $ ___________________

6. Credit allowed for claimant. If applicable, multiply line 5 by the claimant's ownership

percentage from Schedule A above; otherwise, enter the amount from line 5 ..................... $

7. Credit claimed by claimant in prior years for this project ....................................................... $ ___________________

8. Credit available to the claimant during the current tax year (Subtract line 7 from line 6) ...... $ ___________________

9. Credit applied to the current return. The credit applied may not exceed the amount of

net New Mexico income tax (Form PIT-1, line 21) computed before applying this credit ...... $ ___________________

10. Credit available to the claimant for carryover (Subtract line 9 from line 8) ............................ $ ___________________

Unused credits may be carried forward for four consecutive years from the taxable year of the initial claim.

NOTE: Failure to attach this form and the approval from the New Mexico Enterprise Zone

Program Officer to your income tax return will result in denial of the credit claimed.